(TheNewswire)

Toronto, Canada / TheNewswire / November 1, 2017 – Savary Gold Corp. (TSX-V: SCA) (“Savary” or the

“Company”) is pleased to announce an updated and increased Inferred Mineral Resource Estimate for its Karankasso JV

Project in Burkina Faso totalling 12.3 million tonnes (Mt) grading 2.03 g/t gold for 805,000 ounces.

The majority of the estimated Inferred Mineral Resources is comprised of open pit constrained Mineral Resources in six

different zones using a 0.5 g/t cut-off grade and a small amount of underground Mineral Resources using a cut-off of 2.0 g/t that

are situated beneath two of the open pit zones.

Highlights of the Inferred Mineral Resources Estimate:

-Pit constrained of 11.9 Mt grading 1.97 g/t gold for 757,000 ounces*

-Underground of 0.42 Mt grading 3.57 g/t gold 48,000 ounces*

-All mineralized zones remain open in at least two directions with modelled mineralization extending beyond the pit

constrained Mineral Resources at all zones .

- 70% of the pit constrained Mineral Resources occur within a 6.5 km radius where potential

still remains for the discovery of additional Mineral Resources

* See Notes on Open Pit Mineral Resource Estimation on pages 3 and 4

Don Dudek, Savary’s President and CEO commented: “The program focused on expanding three of the six zones with the largest

of the three, Diosso, returning 74% more pit constrained Inferred Mineral Resources compared to the 2015 Estimate. Mineralization

continues to extend beyond pit-constrained limits at all zones. The new higher-grade underground Mineral Resource warrants further

testing and expansion and are indicative of the upside potential of the project. Even with the increase in Mineral Resources, the

methodology used to estimate the Mineral Resources was more conservative utilizing tighter mineralized envelopes and in estimating

the potential Mineral Resource losses related to artisanal mining. We plan to continue to systematically expand the new and

existing mineralized zones while exploring the remainder of the extensive mineralized corridor that transects the

Project.”

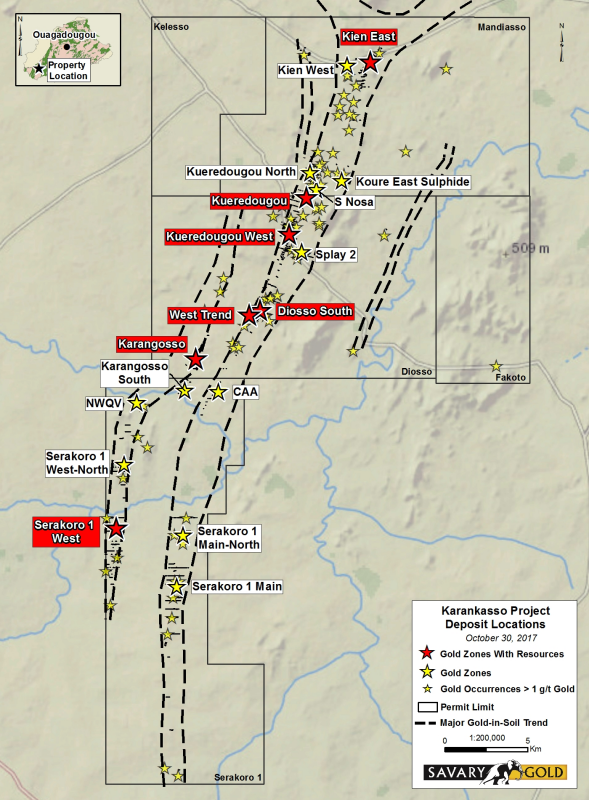

The Karankasso Property (the “Property”) is located approximately 300 kilometres southwest of Ouagadougou, Burkina Faso’s

capital city (see Figure), and 60 kilometres east of Bobo Dioulasso, the second largest city in Burkina Faso. The Property

can be accessed by a paved highway with both rail and grid power coming within approximately 50 kilometres.

During the period from May 6, 2016 to July 4, 2017, 183 reverse circulation drill holes and 14 diamond drill core holes

were completed on the Property for a total of approximately 23,170 metres of drilling. Approximately 72% of the holes were drilled

to extend known zones with the remaining, testing and discovering new targets. For the current Mineral Resource, Savary compiled

and interpreted the drill data to create an updated set of wireframes which where provided to P&E Mining Consultants Inc. for

validation, refining and subsequent Mineral Resource estimation.

Mineral Resources have been estimated for six areas: Kien East, Kueredougou, Kueredougou West, Diosso (includes Diosso,

Kueredougou West Trend and WTN zones), Karangosso and Serakoro 1 West, with all but one of the zones, in the northern half of the

property (see Figure 1). Approximately 27% of the pit constrained Inferred Mineral Resources are oxidized saprolite and sap rock

with the remainder of the Mineral Resources in fresh rock. The Kien East Zone is the largest of the six deposits containing

approximately 3.8 million tonnes of pit constrained Inferred Mineral Resources grading 1.68 g/t totalling 204,000 ounces (see

Figure 2). The Diosso South Zone area, is the second largest zone with estimated pit constrained Inferred Mineral

Resources of 2.5 million tonnes grading 2.18 g/t gold totalling approximately 176,000 ounces. The Kueredougou Main Zone is the

highest grade containing 0.6 million tonnes of estimated pit constrained Inferred Mineral Resources grading 2.51 g/t gold totalling

55,000 ounces (see Figure 3). The above Mineral Resources are at reported at a 0.5 g/t gold cut-off.

Resource Estimation utilized 3D constraining wireframes, capped 1m composites (capped between no capping and 20 g/t gold)

and inverse distance cubed (1D3) grade interpolation.

Mineral Resource depletion, due to artisanal mining activity, was estimated for all zones using the following

parameters:

-

-- Kueredougou Main Zone – artisanal shafts were measured with a new depletion wire frame created

resulting in an additional loss of approximately 30,000 ozs of gold compared to the 2015 Mineral Resource

Estimate

-

-- Diosso South Area - Saprolite - 50% removed

-

-- Kien East: Northwest trending vertical lenses - Saprolite - 50% removed; Kien East shallow dipping

lenses - no significant artisanal mining

-

-- Karangosso - no artisanal mining

-

-- Serakoro 1 West zone area – no artisanal mining

-

-- Kueredougou West Zone - no significant artisanal mining

Updated preliminary metallurgical test work indicates a range in estimated gold recoveries of 92 to 97% for oxide, 90 to

95% for sap rock and 80 to 91% for fresh rock (see Table 1). A summary of average and assumed recoveries is presented in Table 1.

This summary represents only preliminary metallurgical data derived from a combination of timed bottle roll analyses of assay

pulp composites over 72 hours to more rigorous grind and controlled gold extraction from both a bottle roll and CIL over a 48 hour

period. Initial samples utilized assay pulps that were ground to 80% passing 75 microns. The latest tests utilized historic

core and reverse circulation chips that were ground to 86% passing 80 microns. Six samples were ground to +94% passing 38

microns and demonstrated that gold recoveries can be improved by 2 to 7% with finer grinding. Some samples were noted to contain

carbon but are considered anomalous or erroneous as the host rocks are dominantly intrusions and altered volcanics that should not

contain any such carbon material. Additional metallurgical work, using fresh drill core samples will be utilized in the future

studies.

Table 1 – Metallurgical Summary – Assumed Percentage Gold Recoveries by Zone

|

Zone

|

Saprolite

|

Sap Rock

|

Fresh

|

|

Kien

|

92

|

90

|

82

|

|

Kueredougou

|

92

|

90

|

84

|

|

Kueredougou West

|

92

|

90

|

81

|

|

Diosso

|

94

|

90

|

80

|

|

Diosso (WTN Zone)

|

92

|

90

|

80

|

|

Diosso (West Trend Zone)

|

92

|

90

|

80

|

|

Karangosso

|

97

|

95

|

90

|

|

Serakoro 1 West

|

97

|

95

|

91

|

The mineralized zones are structurally-controlled and hosted by a variety of sediment, intermediate volcanic, potassic

granite and diorite porphyry. Hydrothermal alteration minerals comprise a mixture of quartz vein, sericite, carbonate and pyrite

with local fuchsite, arsenopyrite and tourmaline.

A summary of the of the pit constrained Inferred Mineral Resource Estimates, within a constraining pit shell, is presented

in Table 2 with Mineral Resource Estimate details for each deposit, presented in Table 4. Cut-off grades at both, 0.5 g/t and 1.0

g/t, are presented with the Mineral Resource at a 0.5 g/t cut-off grade chosen as the base case. Optimized pit depths range from

less than 90 metres for the Serakoro 1 West Zone to approximately 195 metres depth at the Karangosso Zone where locally higher

grades have drawn the pit deeper with the rest of the pits dominantly being less than 100 metres deep.

Table 2 – Pit Constrained Inferred Mineral Resource Estimate and Sensitivity Summary*

|

Zone

|

Gold Cut-Off

|

Mineralization Type

|

Tonnes

|

Au g/t

|

Au oz

|

|

Summary

|

0.5 g/t

|

Saprolite

|

1,768,000

|

1.69

|

95,800

|

|

Sap Rock

|

1,546,000

|

1.75

|

87,200

|

|

Fresh

|

8,610,000

|

2.07

|

573,900

|

|

Total

|

11,924,000

|

1.97

|

756,900

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

1,249,000

|

2.08

|

83,400

|

|

Sap Rock

|

1,141,000

|

2.11

|

77,300

|

|

Fresh

|

6,840,000

|

2.41

|

529,900

|

|

Total

|

9,230,000

|

2.33

|

690,600

|

*Notes on Open Pit Mineral Resource Estimation :

-

1. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation,

sociopolitical, marketing, or other relevant issues.

-

2. 2. The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to

an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of

the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

-

3. The Karankasso Property Mineral Resource Estimates were prepared by Eugene Puritch, P. Eng., Yungang

Wu, P.Geo. and Antoine Yassa, P. Geo. from P&E Mining Consultants Inc., Qualified Persons under NI 43-101 who are

independent of the Company

-

4. The Mineral Resources in this press release were estimated using the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM

Standing Committee on Reserve Definitions and adopted by CIM Council

-

5. The gold price used in this Mineral Resource Estimate was the Sep 30/17 approximate two-year trailing

average of US$1,250/oz. Gold recovery ranges from 80% to 97% with an average of 85% and mining costs were US$2.00/tonne for

waste and $3.00 per tonne for mineralized material. Processing and G&A costs combined were US$18.50/tonne. Pit

optimization slopes were 50 degrees. Bulk densities used for the Mineral Resource Estimate varied by deposit with ranges as

follows; Saprolite 1.75 to 1.98 t/m3, Sap Rock 2.20 to 2.45 t/m3 and Fresh Rock 2.70 to 2.80 t/m3.

-

6. The effective date of the Mineral Resource Estimate is October 5, 2017.

Underground Inferred Mineral Resources totalling 47,900 ounces grading 3.59 g/t contained within 415,000

tonnes were determined for two zones (see Table 3). Both zones have returned multiple intercepts of higher than

average grade. At Kueredougou, intercepts containing from 48.00 g/t to 83.35 g/t gold intercepts over 4 metres occur

in a structural intersection. At Karangosso, an intercept below the pit limits returned 6.73 g/t over 7 metres and 3.82 g/t over 13

metres.

Table 3 Underground Inferred Mineral Resource Estimate*

|

Zone

|

Cut-off

Au g/t

|

Tonnes

|

Au g/t

|

Au Ounces

|

|

Karangosso

|

2.0

|

246,000

|

3.95

|

31,200

|

|

Kueredougou

|

2.0

|

173,000

|

3.02

|

16,800

|

|

TOTAL

|

|

419,000

|

3.57

|

48,000

|

*Notes on Underground Mineral Resource Estimation:

-

1. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation,

sociopolitical, marketing, or other relevant issues.

-

2. The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an

Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the

Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

-

3. The Karankasso Property Mineral Resource Estimates were prepared by Eugene Puritch, P. Eng., Yungang

Wu, P.Geo. and Antoine Yassa, P. Geo. from P&E Mining Consultants Inc., Qualified Persons under NI 43-101 who are

independent of the Company

-

4. The Mineral Resources in this press release were estimated using the Canadian Institute of Mining,

Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM

Standing Committee on Reserve Definitions and adopted by CIM Council.

-

5. The gold price used in this Mineral Resource Estimate was the Sep 30/17 approximate two-year trailing

average of US$1,250/oz. Gold recovery ranges from 80% to 97% with an average of 85% and mining costs were US$50/tonne

Processing and G&A costs combined were US$18.50/tonne. Bulk densities used for the Mineral Resource Estimate varied by

deposit with ranges as follows; Saprolite 1.75 to 1.98 t/m3, Sap Rock 2.20 to 2.45 t/m3 and Fresh Rock 2.70 to 2.80

t/m3.

-

6. The effective date of the Mineral Resource Estimate is October 5, 2017.

Click Image To View Full Size

Figure 1 – Location of Mineral Resource Zones

Table 4 – Pit Constrained Inferred Mineral Resource Estimate and Sensitivity Details by Zone*

|

Zone

|

Au Cut-Off

|

Mineralization Type

|

Tonnes

|

Aug/t

|

Au oz

|

|

Karangosso

|

0.5 g/t

|

Saprolite

|

317,000

|

1.75

|

17,900

|

|

Sap Rock

|

195,000

|

2.04

|

12,800

|

|

Fresh

|

1,604,000

|

2.35

|

121,100

|

|

Total

|

2,116,000

|

2.23

|

151,800

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

235,000

|

2.12

|

16,000

|

|

Sap Rock

|

141,000

|

2.55

|

11,500

|

|

Fresh

|

1,246,000

|

2.81

|

112,500

|

|

Total

|

1,622,000

|

2.68

|

140,000

|

|

Diosso South Area

|

0.5 g/t

|

Saprolite

|

424,000

|

1.75

|

23,800

|

|

Sap Rock

|

378,000

|

2.05

|

25,000

|

|

Fresh

|

1,706,000

|

2.31

|

126,900

|

|

Total

|

2,508,000

|

2.18

|

175,700

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

292,000

|

2.20

|

20,600

|

|

Sap Rock

|

284,000

|

2.48

|

22,600

|

|

Fresh

|

1,286,000

|

2.82

|

116,500

|

|

Total

|

1,862,000

|

2.67

|

159,700

|

|

Serakoro 1 West

|

0.5 g/t

|

Saprolite

|

208,000

|

1.66

|

11,100

|

|

Sap Rock

|

83,000

|

1.38

|

3,700

|

|

Fresh

|

110,000

|

1.28

|

4,500

|

|

Total

|

401,000

|

1.50

|

19,300

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

160,000

|

1.93

|

9,900

|

|

Sap Rock

|

69,000

|

1.50

|

3,300

|

|

Fresh

|

97,000

|

1.34

|

4,200

|

|

Total

|

326,000

|

1.66

|

17,400

|

|

Kueredougou West

|

0.5 g/t

|

Saprolite

|

430,000

|

1.89

|

26,100

|

|

Sap Rock

|

507,000

|

1.76

|

28,700

|

|

Fresh

|

1,516,000

|

1.99

|

97,000

|

|

Total

|

2,453,000

|

1.92

|

151,800

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

342,000

|

2.18

|

24,000

|

|

Sap Rock

|

405,000

|

2.02

|

26,300

|

|

Fresh

|

1,264,000

|

2.24

|

90,900

|

|

Total

|

2,011,000

|

2.18

|

141,200

|

|

Kueredougou

Main

|

0.5 g/t

|

Saprolite

|

16,000

|

1.90

|

1,000

|

|

Sap Rock

|

19,000

|

2.10

|

1,300

|

|

Fresh

|

641,000

|

2.54

|

52,200

|

|

Total

|

676,000

|

2.51

|

54,500

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

12,000

|

2.30

|

900

|

|

Sap Rock

|

15,000

|

2.52

|

1,200

|

|

Fresh

|

492,000

|

3.06

|

48,500

|

|

Total

|

519,000

|

3.03

|

50,600

|

|

Kien East

|

0.5 g/t

|

Saprolite

|

372,000

|

1.33

|

16,000

|

|

Sap Rock

|

364,000

|

1.35

|

15,800

|

|

Fresh

|

3,033,000

|

1.77

|

172,100

|

|

Total

|

3,769,000

|

1.68

|

203,900

|

|

1.0 g/t

Sensitivity

|

Saprolite

|

208,000

|

1.79

|

12,000

|

|

Sap Rock

|

228,000

|

1.69

|

12,400

|

|

Fresh

|

2,455,000

|

2.00

|

157,400

|

|

Total

|

2,891,000

|

1.96

|

181,800

|

* See Notes on Open Pit Mineral Resource Estimation on pages 3 and 4

QA/QC Comments

Savary’s procedure for handling reverse circulation drill chips comprises initial riffle splitting of the rock chips from one

metre drill length samples into approximately 2.5-kilogram samples, as well as description and logging into a database. A duplicate

2.5-kilogram sample, prepared at the same time as the assay sample, is kept as a reference for each sample. NQ-size core

assay samples are first logged into a database and then are sawn in half with half of the core submitted for analysis; the length

of the core samples depends on logged geological controls with samples varying from 0.3 metres to 2.0 metres in length.

A sample duplicate and assay blank was inserted sequentially every 5 to 14 samples and an assay standard was inserted every

29 to 34 samples. This results in 8% of the assayed samples being reference/blank/control samples. Blanks and duplicates were

preferentially inserted in visually mineralized zones to better test the assay results. This sampling procedure was periodically

reviewed by Savary’s President and CEO, and the Company QP, Don Dudek, P. Geo. All assay samples were collected at site by staff

from SGS Burkina Faso SA (‘SGS’) from Ouagadougou, Burkina Faso where sample preparation and analysis were performed.

Each sample was dried, crushed to 75% passing 2 mm and then split to 1.5 kg by rotary splitter. This split was pulverized to 85%

passing 75 microns. Fifty grams of the pulverized material was analysed for gold via fire assay with an atomic absorption

spectroscopy (AAS) finish. SGS operates according to ISO 17025 standards and institutes a full Quality Assurance/Quality Control

(QA/QC) program consisting of insertion of internal blanks, standard reference material, repeats and reject splits which in total

account for up to 25% of all determinations conducted. All standards and blank control samples returned results within expected

ranges.

Closure of JV Agreement

The Company also announces that on September 29, 2017 it formally closed its previously announced (see September 11, 2014

news release) Karankasso JV Project with Sarama Resources Ltd. pursuant to which the JV company now controls a 688 square kilometre

property in the highly prospective Houndé belt. The Property is 69.5% owned by Savary and 30.5% owned by Sarama, with Savary acting

as the operator.

About Savary Gold

Savary is a Canadian exploration company is focused on exploring and developing the Karankasso Gold Project in Burkina

Faso. The Company holds a 69.5% joint venture ownership and is the operator of the project with Sarama Resources Limited. The

Project is located within the Houndé Greenstone Belt, which hosts Semafo’s Mana mine, Roxgold’s Yaramoko Mine, Endeavor’s Houndé

Mine (under construction). The Project contains an Inferred mineral resource estimate of 12.3 million tonnes

(Mt) grading 2.03 g/t gold for 805,000 ounces . For additional information please visit our website at www.savarygold.com .

Qualified Persons

The Mineral Resource Estimates in this press release were prepared by Eugene Puritch, P.Eng., Yungang Wu, P.Geo. and

Antoine Yassa, P.Geo., of P&E Mining Consultants Inc., each an independent Qualified Person, as defined by National Instrument

43-101 (“NI 43-101”). Mr. Puritch has reviewed and approved the contents of this news release.

Don Dudek, P.Geo., President and CEO of the Company and a qualified person under National Instrument 43-101, has reviewed

and approved the scientific and technical information in this press release.

SAVARY GOLD CORP.

On behalf of the Board

“Don Dudek”

President & Chief Executive Officer

For more information, please contact:

Don Dudek

T: 647-259-2097

E: info@savarygold.com

www.savarygold.com

Cautionary Notes

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all

or any part of Mineral Resources will be converted to Mineral Reserves. Inferred Mineral Resources have a lower level of

confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is

reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with

continued exploration.. Quantity and grades are estimates and are rounded to reflect the fact that the Mineral Resource Estimate is

an approximation.

This news release may contain forward-looking statements. These statements include statements regarding the

Company's intention with the Karankassso JV project, access to capital, regulatory approvals, exploration and development drilling,

exploration, exploitation and development activities and successes, continuity of mineralization, uncertainties related to the

ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies

regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing,. details

of the potential value growth of the JV, the upside of the property, the drill program, the company’s exploration plans and the

timing of results, the focus on existing drill targets and new targets and general economic, market or business

conditions. These statements are based on current expectations and assumptions that are subject to risks and

uncertainties Actual results could differ materially because of factors discussed in the management discussion and

analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture

Exchange and applicable Canadian securities regulations. Readers are cautioned not to place undue reliance on this

forward-looking information, which is given as of the date it is expressed in this press release, and the Company undertakes no

obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or

otherwise, except as required by applicable securities laws. For more information on the Company, investors should review the

Company's continuous disclosure filings that are available at www.sedar.com.

Copyright (c) 2017 TheNewswire - All rights reserved.