Maven Reports Rapid Growth in Monthly Organic Users and Reports Q3 Results

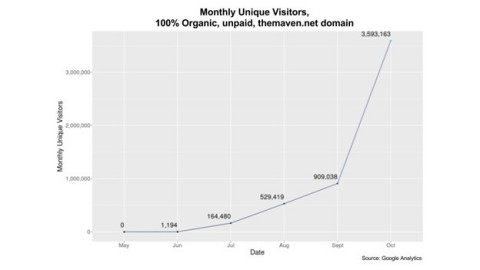

Maven (ticker symbol:MVEN) today announced that its monthly traffic is climbing at an accelerated rate – from 900,000 unique

users in September to 3.6 million in October, with the trend line continuing in November. In addition, third quarter expenses

tracked with internal forecasts as the company transitions from the research and development phase to the operational phase.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20171117005205/en/

Monthly Unique Visitors (Graphic: Business Wire)

“For more than a year, we’ve been focused on platform development and securing our founding Mavens,” said CEO James Heckman.

“September’s launch out of beta certainly was encouraging at every level, from the quality of our content partners, the instant

uplift in engagement from our platform, and the significant growth – all organic traffic.”

Heckman cited four key drivers for Maven’s success:

- More than 80 signed and 30 live channel partners with more coming weekly

- Significant increase in audience engagement (71% increase, post migration)

- Launch of version 1.0 of the technology platform, featuring tightly integrated publishing, video,

mobile, social, paid membership and advertising features

- Organic growth from 164,000 to 529,000 to 900,000 monthly unique visitors during the three months of

Q3, which then quadrupled to 3.6 million during October, utilizing no paid traffic acquisition

“I can’t emphasize this point enough,” said Heckman. “Most ‘traffic’ press releases by Internet companies are meaningless, if

not misleading, as they generally buy their traffic through referral from major social platforms. We believe a digital media

company is best valued by the number of organic (unpaid) monthly unique visitors, because that metric is what drives profitable

content transactions.”

“As our authentic scale continues to grow, we look forward to bringing our elite network of Mavens to the advertising

community,” Heckman added. “We think the combination of high engagement, consistent professionalism and our efficient platform with

be an attractive environment for quality brands and marketers.”

Key performance indicators for assessing Maven’s progress going forward include:

- Number of channels signed – currently 82, with goal of 1,000

- Number of channels live on Maven – currently at 30 with 40+ expected by EOY

- Average Monthly Users per live channel – currently 124,000, beating goal of 100k

- Total organic unique users (UU) – 3.6 million in October

- Total revenue (per channel and network)

- Audience engagement

Q3 2017 Strategic Initiatives

Maven, during the third quarter of 2017, focused on three key strategic initiatives: (1) developing our technology platform, (2)

business development to sign new Mavens to our network and (3) launching operations with certain Mavens.

Since the company’s founding, July 2016, the primary focus of its software engineering team has been building the world-class

publishing and social media technology platform. Since inception, Maven has invested over $2.6 million in the technology platform.

We expect that we will continue to invest over $800,000 each quarter as we continue to deploy features and functions for all three

form factors: mobile devices, tablets and desktop computers.

Q3 Financial Results

In the third quarter of 2017, the company moved the first 25 channel partners out of beta stage. In beta we had very limited

monetization activities since we were testing content systems and ad serving integration; as such, we generated no material revenue

in the third quarter. In October, our monthly unique users (UU) grew to 3.6 million and we expect to be above 6 million at the end

of November. However, we do not expect to generate significant revenue until early 2018. We need to first aggregate the audience

base of users and we believe effective monetization of that audience base will begin in early 2018.

The company incurred a net loss of $1,778,000, or $0.11 per share for the three months ending September 30, 2017. For the nine

months ending September 30, 2017, we incurred a net loss of $4,371,000 or $0.33 per share. Traffic was 100% unpaid, organic traffic

with zero expense for traffic acquisition costs.

As presented in the Statement of Cash Flows, for the nine months ending September 30, 2017, net cash used in operating

activities was $2,655,000. Third quarter expenses tracked with internal forecast as the company transitions from the research and

development phase to the operational phase. These expenditures were primarily used to build initial network of channels and for

administrative functions. In addition, Maven invested $1,513,000 of cash in website development and fixed assets. During 2017, the

company completed two private placements of common stock: one that closed in April raising $3.5 million in net proceeds, and one

that closed in October raising $2.7 million in net proceeds, of which $1.75 million was received prior to September 30, 2017. Cash

balance at the end of September was approximately $1.7 million.

Maven’s complete third quarter financial statements (Statement of Operations; Balance Sheet; Statement of Cash Flow) on

Form 10-Q Quarterly Report can be found HERE: https://www.themaven.net/the-maven/investors/sec-filings-e6Tq9qeDGESem_9IuDqTzQ

|

|

|

|

|

|

|

|

| theMaven, Inc. and Subsidiary |

| Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

September 30,

2017

|

|

|

|

December 31,

2016

|

|

|

|

(Unaudited) |

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

| Cash |

|

$ |

1,699,061 |

|

|

|

$ |

598,294 |

|

| Accounts receivable |

|

|

3,482 |

|

|

|

|

- |

|

| Deferred contract costs |

|

|

15,986 |

|

|

|

|

- |

|

| Prepayments and other current assets |

|

|

102,265 |

|

|

|

|

121,587 |

|

| Total current assets |

|

|

1,820,794 |

|

|

|

|

719,881 |

|

|

|

|

|

|

|

|

|

|

|

| Fixed assets, net |

|

|

2,515,930 |

|

|

|

|

547,804 |

|

| Intangible assets |

|

|

20,000 |

|

|

|

|

20,000 |

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

4,356,724 |

|

|

|

$ |

1,287,685 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

51,568 |

|

|

|

$ |

154,361 |

|

| Accrued expenses |

|

|

442,061 |

|

|

|

|

54,789 |

|

| Deferred revenue |

|

|

31,634 |

|

|

|

|

- |

|

| Conversion feature liability |

|

|

130,238 |

|

|

|

|

137,177 |

|

| Total current liabilities |

|

|

655,501 |

|

|

|

|

346,327 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Redeemable convertible preferred stock, $0.01 par value, 1,000,000 shares

authorized; 168 shares issued and outstanding ($168,496 aggregate liquidation value) |

|

|

168,496 |

|

|

|

|

168,496 |

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

| Common stock, $0.01 par value, 100,000,000 shares authorized; 26,005,140 and

22,047,531 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively |

|

|

260,051 |

|

|

|

|

220,475 |

|

| Common stock to be issued in private placement |

|

|

1,566,000 |

|

|

|

|

9,375 |

|

| Additional paid-in capital |

|

|

8,265,925 |

|

|

|

|

2,730,770 |

|

| Accumulated deficit |

|

|

(6,559,249 |

) |

|

|

|

(2,187,758 |

) |

| Total stockholders’ equity |

|

|

3,532,727 |

|

|

|

|

772,862 |

|

| Total liabilities and stockholders’ equity |

|

$ |

4,356,724 |

|

|

|

$ |

1,287,685 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| theMaven, Inc. and Subsidiary |

| Consolidated Statements of Operations |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Nine Months Ended |

|

|

|

September 30,

2017

|

|

|

September 30,

2016

|

|

|

|

September 30,

2017

|

|

|

September 30,

2016

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Revenue |

|

$ |

6,064 |

|

|

$ |

- |

|

|

|

$ |

6,064 |

|

|

$ |

- |

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service Costs |

|

|

449,567 |

|

|

|

- |

|

|

|

|

641,606 |

|

|

|

- |

|

| Research and development |

|

|

30,776 |

|

|

|

374,944 |

|

|

|

|

104,095 |

|

|

|

374,944 |

|

| General and administrative |

|

|

1,300,767 |

|

|

|

1,110,461 |

|

|

|

|

3,639,204 |

|

|

|

1,110,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(1,775,046 |

) |

|

|

(1,485,405 |

) |

|

|

|

(4,378,841 |

) |

|

|

(1,485,405 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and dividend income, net |

|

|

61 |

|

|

|

- |

|

|

|

|

411 |

|

|

|

- |

|

| Interest expense |

|

|

- |

|

|

|

(4,044 |

) |

|

|

|

- |

|

|

|

(4,044 |

) |

| Change in fair value of conversion feature |

|

|

(3,311 |

) |

|

|

- |

|

|

|

|

6,939 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income (expense) |

|

|

(3,250 |

) |

|

|

(4,044 |

) |

|

|

|

7,350 |

|

|

|

(4,044 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,778,296 |

) |

|

$ |

(1,489,449 |

) |

|

|

|

(4,371,491 |

) |

|

|

(1,489,449 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per common share |

|

$ |

(0.11 |

) |

|

$ |

(0.35 |

) |

|

|

$ |

(0.33 |

) |

|

$ |

(0.35 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding – basic and diluted |

|

|

16,367,424 |

|

|

|

4,243,607 |

|

|

|

|

13,091,231 |

|

|

|

4,243,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| theMaven, Inc. and Subsidiary |

| Consolidated Statement of Stockholders’ Equity (Unaudited) |

| Nine Months Ended September 30, 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

To Be Issued |

|

|

Paid-in |

|

|

Accumulated |

|

|

Stockholders' |

|

|

|

Shares |

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 1, 2017 |

|

22,047,531 |

|

$ |

220,475 |

|

|

8,929 |

|

|

$ |

9,375 |

|

|

$ |

2,730,770 |

|

|

$ |

(2,187,758 |

) |

|

$ |

772,862 |

|

| Common stock to be issued in private placement, net of issuance costs |

|

- |

|

|

- |

|

|

1,521,739 |

|

|

$ |

1,566,000 |

|

|

|

- |

|

|

|

- |

|

|

$ |

1,566,000 |

|

| Common stock to be issued |

|

8,929 |

|

|

89 |

|

|

(8,929 |

) |

|

|

(9,375 |

) |

|

|

9,286 |

|

|

|

- |

|

|

|

- |

|

| Issuance of common stock, net of offering costs |

|

3,765,000 |

|

|

37,650 |

|

|

- |

|

|

|

- |

|

|

|

3,281,014 |

|

|

|

- |

|

|

|

3,318,664 |

|

| Shares issued for investment banking fees |

|

162,000 |

|

|

1,620 |

|

|

- |

|

|

|

- |

|

|

|

199,260 |

|

|

|

- |

|

|

|

200,880 |

|

| Exercise of stock options |

|

21.680 |

|

|

217 |

|

|

|

|

|

|

|

|

|

|

(217

|

)

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

- |

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

2,045,812 |

|

|

|

- |

|

|

|

2,045,812 |

|

| Net loss |

|

- |

|

|

- |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

(4,371,491 |

) |

|

|

(4,371,491 |

) |

| Balance at September 30, 2017 |

|

26,005,140 |

|

$ |

260,051 |

|

|

1,521,739 |

|

|

$ |

1,566,000 |

|

|

$ |

8,265,925 |

|

|

$ |

(6,559,249 |

) |

|

$ |

3,532,727 |

|

|

|

|

|

| theMaven, Inc. and Subsidiary |

| Consolidated Statement of Cash Flows |

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30,

2017

|

|

|

September 30,

2016

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(4,371,491 |

) |

|

$ |

(1,489,449 |

) |

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Change in fair value of conversion feature |

|

|

(6,939 |

) |

|

|

- |

|

| Stock based compensation |

|

|

1,357,510 |

|

|

|

935,058 |

|

| Depreciation and amortization |

|

|

233,990 |

|

|

|

- |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Prepayments and other current assets |

|

|

19,322 |

|

|

|

(5,222 |

) |

| Accounts receivable |

|

|

(3,482 |

) |

|

|

- |

|

| Deferred costs |

|

|

(15,986 |

) |

|

|

- |

|

| Accounts payable |

|

|

(102,793 |

) |

|

|

30,600 |

|

| Deferred revenue |

|

|

31,634 |

|

|

|

- |

|

| Accrued expenses |

|

|

203,271 |

|

|

|

36,992 |

|

| Net cash used in operating activities |

|

|

(2,654,964 |

) |

|

|

(492,021 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Website development costs and fixed assets |

|

|

(1,513,813 |

) |

|

|

- |

|

| Net cash used in investing activities |

|

|

(1,513,813 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from common stock to be issued in private placement |

|

|

1,750,000 |

|

|

|

- |

|

| Proceeds from notes payable |

|

|

- |

|

|

|

638,351 |

|

| Net proceeds from issuance of common stock |

|

|

3,519,544 |

|

|

|

2,952 |

|

| Net cash provided by financing activities |

|

|

5,269,544 |

|

|

|

641,303 |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash |

|

|

1,100,767 |

|

|

|

149,282 |

|

|

|

|

|

|

|

|

|

|

| Cash at beginning of period |

|

|

598,294 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

| Cash at end of period |

|

$ |

1,699,061 |

|

|

$ |

149,282 |

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of noncash investing and financing activities: |

|

|

|

|

|

|

|

|

| Reclassification of stock-based compensation to website development costs |

|

|

688,302 |

|

|

|

- |

|

| Accrual of stock issuance costs |

|

|

184,000 |

|

|

|

- |

|

| Shares issued for investment banking fees |

|

|

200,880 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

ABOUT MAVEN

Maven is an expert-driven, group media network, whose innovative platform serves, by invitation only, a coalition of

professional, independent channel partners. By providing broader distribution, greater community engagement and efficient

advertising and membership programs, Maven enables partners to focus on the key drivers of their business: creating, informing,

sharing, discovering, leading and interacting with the communities and constituencies they serve.

Based in Seattle, Maven is publicly traded under the ticker symbol MVEN. The executive team and operational board members include digital media pioneers James Heckman and Josh

Jacobs, and technology innovators Bill Sornsin and Ben Joldersma. For more insight, head to themaven.net.

FORWARD-LOOKING STATEMENTS:

This press release by theMaven, Inc. (“company”) contains “forward-looking statements.” Forward-looking statements relate to

future events or future performance and include, without limitation, statements concerning the company’s business strategy, future

revenues, market growth, capital requirements, product introductions and expansion plans, and the adequacy of the company’s

funding. Other statements contained in this press release that are not historical facts are also forward-looking statements. The

company has tried, wherever possible, to identify forward-looking statements by terminology such as “may,” “will,” “could,”

“should,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and other comparable terminology.

The company cautions investors that any forward-looking statements presented in this report, or that the company may make orally

or in writing from time to time, are based on the beliefs of, assumptions made by, and information currently available to, the

company. Such statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends,

uncertainties and factors that are beyond the company’s control or ability to predict. Although the company believes that its

assumptions are reasonable, they are not guarantees of future performance, and some will inevitably prove to be incorrect. As a

result, the company’s actual future results can be expected to differ from its expectations, and those differences may be material.

Accordingly, investors should use caution in relying on forward-looking statements, which are based only on known results and

trends at the time they are made, to anticipate future results or trends.

This press release and all subsequent written and oral forward-looking statements attributable to the company or any person

acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this

section. The company does not undertake any obligation to release publicly any revisions to its forward-looking statements to

reflect events or circumstances after the date of this press release. The information on the websites referenced in this press

release are not incorporated herein by reference for any purpose.

theMaven Inc.

Investor Inquiries:

Martin Heimbigner, 206-947-2472

Chief Financial Officer

Marty@themaven.net

or

Media Inquiries:

Gretchen Bakamis, 206-715-6660

View source version on businesswire.com: http://www.businesswire.com/news/home/20171117005205/en/