Vancouver, British Columbia--(Newsfile Corp. - January 17, 2018) - Bravada Gold Corporation (TSXV: BVA) (OTCQB: BGAVF)

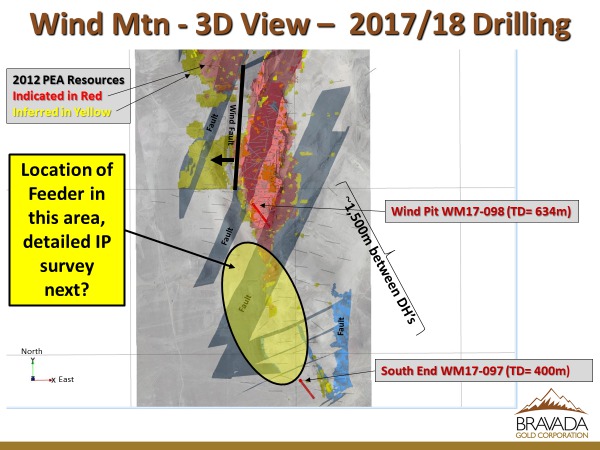

(FSE: BRTN) (the "Company" or "Bravada") reports that two proof-of-concept holes were completed in December and early January at

the Company's 100% owned low-sulfidation Wind Mountain project, a past-producing gold/silver property in northwestern

Nevada. The reverse-circulation holes were drilled approximately 1,500m apart. Alteration and geochemistry indicate that the

southerly hole intersected mineralization with characteristics of being up-dip from a feeder zone and the northerly hole

intersected characteristics of being down-dip from a feeder zone, indicating the feeder lies between these holes (see figure

below). Each hole intersected a low-angle fault that separates the Tertiary volcanic and sedimentary host rocks from Mesozoic

metamorphosed basement rocks.

Wind Mtn - 3D View - 2017/18 Drilling

Cannot view this image?

Please visit http://orders.newsfilecorp.com/files/5343/32049_a1516130366769_100.jpg

to view this image

Hole WM17-097 (-75, 135 degrees, TD= 401m) was drilled close to the South End Inferred Resource and intersected strongly

clay-altered sediments and tuffs within the lower Pyramid volcanic sequence. Anomalous gold (50-699ppb) and mercury (+1ppm) occur

in this rock sequence before passing into unaltered Mesozoic basement rocks at 279m depth (see cross section below).

Wind Mtn - South End Target - WM17-097

Cannot view this image?

Please visit http://orders.newsfilecorp.com/files/5343/32049_a1516130366832_7.jpg

to view this image

Hole WM17-098 (-75, 135 degrees, TD=634m) was drilled from the bottom of the Wind Mountain open pit and drilled through a

portion of the previously defined resource, where assays in hole -098 returned 0-40m averaging 0.343g/t Au (0.510g/t Au-eq using a

70Ag:1Au ratio) as expected. Alteration, gold and pathfinder elements decreased to background levels and continued at these low

levels down hole to 524m, below which assays are not expected until mid-February. Unaltered Mesozoic basement was intersected at

617m depth. Pyramid sediments are much less altered than similar sediments intersected in hole -097 (see cross section below, note

change in scale from WM17-097 section).

Wind Mtn - Wind Pit Target - WM17-098

Cannot view this image?

Please visit http://orders.newsfilecorp.com/files/5343/32049_a1516130366972_61.jpg

to view this image

President Joe Kizis commented, "The two proof-of-concept holes in combination with existing data provide us with clear

vectors to the likely feeder zone, also called the upwelling zone in low-sulfidation gold deposits. Evidence is overwhelming for

large-scale lateral movement of the gold-depositing fluids that formed the known gold/silver deposit,

which makes zeroing in on the suspected high-grade feeder difficult. However, the difference in alteration is striking within

similar volcanic-sediments above basement rocks; those in hole -098 appear to be essentially unaltered, even though they underlie

the thickest portion of the shallow mineralization, whereas those volcanic-sediments in hole -097 have alteration and

mineralization that is typical of being distal from an upwelling zone. The challenge now is to determine where the feeder zone(s)

lies within this area of approximately 1km by 0.5km. IP or another geophysical technique should assist in refining drill targets to

be drilled in the second quarter 2018, subject to rig availability."

About Wind Mountain

The Wind Mountain Property is in northwestern Nevada approximately 160km northeast of Reno in a sparsely populated region with

excellent logistics, including county-maintained road access and a power line to the property. It is an historic past-producing,

bulk-tonnage gold-silver mine. An independent resource estimate and Preliminary Economic Evaluation for Wind Mountain commissioned

by Bravada in 2012 reported:

- 570,000 ounces of gold and 14.7 million ounces of silver in the Indicated category, and

- 354,000 ounces of gold and 10.1 million ounces of silver in the Inferred category.

See the table below and news release NR-06-12 dated April 11, 2012 for details of the resource update. Mineral resources that

are not mineral reserves do not have demonstrated economic viability. Inferred resources are considered too speculative

geologically to have economic considerations applied to them that would enable them to be classified as mineral reserves. There is

no assurance that any part of the resources will ultimately be converted to mineral reserves.

Mine Development Associates compiled the Technical Report and PEA. Thomas Dyer, P.E. is a Senior Engineer for MDA and is

responsible for sections of the Technical Report involving mine designs and the economic evaluation, and Steven Ristorcelli,

C.P.G., is a Principal Geologist for MDA and is responsible for the sections involving the Mineral Resource estimate. These are the

Qualified Persons of the technical report for the purpose of Canadian NI 43-101, Standards of Disclosure for Economic Analyses of

Mineral Projects. Details of the PEA produced by Mine Development Associates (MDA) of Reno can be found on SEDAR, as previously

reported (see NR-07-12 dated May 1, 2012). Note that although the PEA was encouraging, it is preliminary in nature, it includes

Inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that

would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized.

| |

Tons |

oz Au/T |

oz Ag/T |

Tonnes |

gms Au/T |

gms Ag/T |

oz Au |

oz Ag |

| Indicated resource |

| Oxide at 0.005 oz Au/ton cut off |

| |

58,816,000 |

0.010 |

0.25 |

53,372,051 |

0.343 |

8.6 |

564,600 |

14,539,000 |

| Mixed/Sulfide at 0.01 oz Au/ton cut off |

| |

498,000 |

0.012 |

0.40 |

451,906 |

0.411 |

13.7 |

5,900 |

197,000 |

| Total |

59,314,000 |

|

|

53,823,956 |

|

|

570,500 |

14,736,000 |

| |

| Inferred resource |

| Oxide at 0.005 oz Au/ton cut off |

| |

19,866,000 |

0.006 |

0.17 |

18,027,223 |

0.206 |

5.8 |

125,200 |

3,443,000 |

| Mixed/Sulfide at 0.01 oz Au/ton cut off |

| |

14,595,000 |

0.016 |

0.46 |

13,244,102 |

0.549 |

15.8 |

229,100 |

6,672,000 |

| Total |

34,461,000 |

|

|

31,271,325 |

|

|

354,300 |

10,115,000 |

About Bravada

Bravada is an exploration company with a portfolio of 11 high-quality properties in Nevada, one of the best mining jurisdictions

in the world. During the past 12 years the Company has successfully identified and advanced properties that have the potential to

host high-margin deposits while successfully attracting partners to fund later stages of project development. Currently,

exploration expenses on three of its Nevada properties are being funded by partners. Seven of the Company's properties have been

developed through exploration by Bravada and are drill-ready or close to being so with exploration to continue throughout 2018

subject to funding availability.

Joseph Anthony Kizis, Jr. (AIPG CPG-11513, Wyoming PG-2576) is the Qualified Person responsible for reviewing and preparing the

technical data presented in this release and has approved its disclosure.

On behalf of the Board of Directors of Bravada Gold Corporation

Joseph A. Kizis, Jr., Director, President, Bravada Gold Corporation

For further information, please visit Bravada Gold Corporation's website at bravadagold.com.

Contact Information:

Jay Oness

VP Investor Corporate Development

Tel: 604-641-2759

Email: joness@mnxltd.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and

content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes,

etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual

results may differ materially from those currently anticipated in such statements. These statements are based on a number of

assumptions, including, but not limited to, assumptions regarding general economic conditions, interest rates, commodity markets,

regulatory and governmental approvals for the company's projects, and the availability of financing for the company's development

projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements

include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, and

continued availability of capital and financing and general economic, market or business conditions. Bravada Gold Corporation does

not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events

or otherwise, except to the extent required by applicable law.