Glu Reports First Quarter 2018 Financial Results

- Revenue increased to $81.4 million from $56.8 million year-over-year

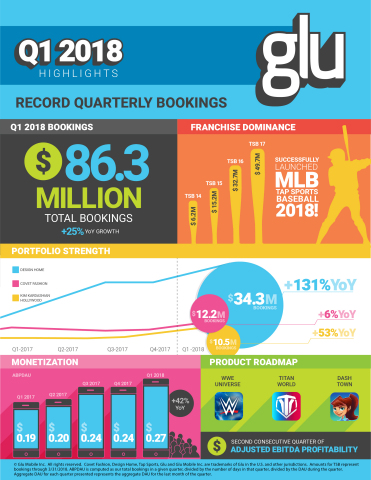

- Record bookings increased 25.1% year-over-year and increased sequentially to $86.3 million exceeding

guidance

- Company raises 2018 full year bookings guidance by $35.0 million to a range of $360.0 million to

$370.0 million

- Design Home peaks at #8 top grossing game on U.S. App Store for iPhone

Glu Mobile Inc. (NASDAQ: GLUU), a leading global developer and publisher of free-to-play mobile games, today announced financial

results for its first quarter ended March 31, 2018. The company also provided an outlook for its financial performance in the

second quarter and increased its outlook for the full year 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180501006672/en/

(Graphic: Business Wire)

Nick Earl, Chief Executive Officer, stated, “Momentum from our significantly improved results last year carried into 2018 and we

are off to a great start for the year. Glu’s strong first quarter financial results were driven by an outperformance from Design

Home and another quarter of growth from both Covet Fashion and Kim Kardashian: Hollywood. These better than expected results

demonstrate the quality of our current Growth and Evergreen titles and the successful execution of initiatives we’ve implemented to

improve game performance as part of our live ops strategy. We also made steady progress in further developing our product roadmap

and are well positioned to execute on our overall growth strategy.”

“As a result of our strong top and bottom line first quarter results we have raised our bookings outlook for the full year 2018

to account for the quarter’s outperformance. We continue to expect sequentially growing bottom line profitability on an adjusted

EBITDA basis throughout the year.”

First Quarter 2018 Financial Highlights:

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

March 31, |

| in millions, except per share data |

|

|

|

2018 |

|

|

2017 |

|

|

|

|

| Revenue |

|

|

|

$81.4 |

|

|

$56.8 |

| Bookings |

|

|

|

$86.3 |

|

|

$69.0 |

| Gross margin |

|

|

|

62.3% |

|

|

56.1% |

| Net loss |

|

|

|

($7.2) |

|

|

($22.8) |

| Net loss per share – basic and diluted |

|

|

|

($0.05) |

|

|

($0.17) |

| Weighted-average common shares outstanding – basic and diluted |

|

|

|

139,108 |

|

|

134,336 |

| Cash and cash equivalents |

|

|

|

$48.3 |

|

|

$73.2 |

| Cash (used in) / generated from operations excluding royalty advances |

|

|

|

($12.4) |

|

|

($14.8) |

| Cash paid for royalty advances that are included in cash (used in) / generated from

operations |

|

|

|

($4.1) |

|

|

($14.2) |

|

|

|

|

|

|

|

|

Eric R. Ludwig, Chief Operating Officer and Chief Financial Officer, said, “We are pleased to report another quarter of

outperformance as bookings reached $86.3 million, a new quarterly record. The record bookings coupled with the initiatives we

started last year to consolidate studios led to improved operating efficiency and drove adjusted EBITDA profitability. We have

raised our full year financial guidance to reflect our confidence in our outlook."

Recent Developments and Strategic Initiatives:

- Launched MLB Tap Sports Baseball 2018: Announced the launch of the latest franchise

installment of Tap Sports Baseball, which contains several updates including a new Create-A-Player feature that allows

users to customize a player of their own and compete against MLB’s best, and a Pick’em feature that allows users to predict real

game results to win in-game prizes. Real baseball strategy and console-quality graphics bring the Major League Baseball

experience to life!

Financial Outlook as of May 1, 2018:

Glu is providing its financial outlook for the second quarter of 2018 and updating guidance for the full year 2018 as

follows:

Second Quarter 2018 Guidance:

|

|

|

|

|

|

|

|

| In millions |

|

|

|

Low |

|

|

High |

| Bookings |

|

|

|

$90.0 |

|

|

$92.0 |

| Platform commissions, excluding any impact of deferred platform commissions |

|

|

|

$23.9 |

|

|

$24.5 |

| Royalties, excluding any impact of deferred royalties |

|

|

|

$6.8 |

|

|

$6.9 |

| Hosting and other costs |

|

|

|

$1.7 |

|

|

$1.7 |

| User acquisition and marketing expenses |

|

|

|

$21.6 |

|

|

$21.9 |

| Adjusted other operating expenses |

|

|

|

$29.5 |

|

|

$29.5 |

| Depreciation |

|

|

|

$1.0 |

|

|

$1.0 |

| Income tax |

|

|

|

$0.1 |

|

|

$0.1 |

| Stock-based compensation |

|

|

|

$5.7 |

|

|

$5.7 |

| Amortization of intangible assets |

|

|

|

$1.5 |

|

|

$1.5 |

| Weighted-average common shares outstanding – basic |

|

|

|

140.1 |

|

|

140.1 |

| Weighted-average common shares outstanding –diluted |

|

|

|

147.5 |

|

|

147.5 |

|

|

|

|

|

|

|

|

Full Year 2018 Guidance:

|

|

|

|

|

|

|

|

| In millions |

|

|

|

Low |

|

|

High |

| Bookings |

|

|

|

$360.0 |

|

|

$370.0 |

| Platform commissions, excluding any impact of deferred platform commissions |

|

|

|

$95.4 |

|

|

$98.1 |

| Royalties, excluding any impact of deferred platform royalties |

|

|

|

$27.0 |

|

|

$27.8 |

| Hosting and other costs |

|

|

|

$6.8 |

|

|

$7.0 |

| User acquisition and other marketing expenses |

|

|

|

$84.6 |

|

|

$87.1 |

| Adjusted other operating expenses |

|

|

|

$118.2

|

|

|

$120.0

|

| Depreciation |

|

|

|

$4.0 |

|

|

$4.0 |

| Income tax |

|

|

|

$0.6 |

|

|

$0.6 |

| Stock-based compensation |

|

|

|

$25.9 |

|

|

$25.9 |

| Transitional costs |

|

|

|

$1.4 |

|

|

$1.4 |

| Restructuring costs |

|

|

|

$0.1 |

|

|

$0.1 |

| Amortization of intangible assets |

|

|

|

$6.4 |

|

|

$6.4 |

| Weighted-average common shares outstanding – basic |

|

|

|

140.5 |

|

|

140.5 |

| Weighted-average common shares outstanding –diluted |

|

|

|

147.5 |

|

|

147.5 |

| Cash and short-term investments |

|

|

|

$85.0 |

|

|

|

|

|

Glu does not provide guidance on a GAAP basis primarily due to the fact that Glu is unable to predict, with reasonable accuracy,

future changes in its deferred revenue and corresponding cost of revenue. The amount of Glu’s deferred revenue and cost of revenue

for any given period is difficult to predict due to differing estimated useful lives of paying users across games, variability of

monthly revenue, platform commissions and royalties by game and unpredictability of revenue from new game releases. Future changes

in deferred revenue and deferred cost of revenue are uncertain and could be material to Glu’s results computed in accordance with

GAAP. Accordingly, Glu is unable to provide a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP

measure without unreasonable effort.

Quarterly Conference Call Information:

Glu will discuss its quarterly results via teleconference today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time). Please dial

(866) 582-8907 (domestic), or (760) 298-5046 (international), with conference ID # 7169305 to access the conference call at least

five minutes prior to the 2:00 p.m. Pacific Time start time. A live webcast and replay of the call will also be available on the

investor relations portion of the company's website at www.glu.com/investors. An audio replay will be available between 5:00 p.m. Pacific Time, May 1, 2018, and 8:59

p.m. Pacific Time, May 8, 2018, by calling (855) 859-2056, or (404) 537-3406, with conference ID # 7169305.

Disclosure Using Social Media Channels

Glu currently announces material information to its investors using SEC filings, press releases, public conference calls and

webcasts. Glu uses these channels as well as social media channels to announce information about the company, games, employees

and other issues. Given SEC guidance regarding the use of social media channels to announce material information to investors,

Glu is notifying investors, the media, its players and others interested in the company that in the future, it might choose to

communicate material information via social media channels or, it is possible that information it discloses through social media

channels may be deemed to be material. Therefore, Glu encourages investors, the media, players and others interested in Glu to

review the information posted on the company forum (http://ggnbb.glu.com/forum.php) and the company Facebook site (https://www.facebook.com/glumobile) and the company twitter account (https://twitter.com/glumobile). Investors, the media, players or other interested parties can subscribe to

the company blog and twitter feed at the addresses listed above. Any updates to the list of social media channels Glu will use

to announce material information will be posted on the Investor Relations page of the company's website at www.glu.com/investors.

Use of Non-GAAP Financial Measures

To supplement Glu's unaudited condensed consolidated financial data presented in accordance with GAAP, Glu uses certain non-GAAP

measures of financial performance. The presentation of these non-GAAP financial measures is not intended to be considered in

isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and

may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in

that they do not reflect all of the amounts associated with Glu's results of operations as determined in accordance with GAAP. The

non-GAAP financial measures used by Glu include historical and estimated bookings, platform commissions, excluding any impact of

deferred platform commissions, royalties, excluding any impact of deferred royalties, and adjusted operating expenses. These

non-GAAP financial measures exclude the following items from Glu's unaudited consolidated statements of operations:

- Change in deferred platform commissions;

- Change in deferred royalties;

- Non-cash warrant benefit/(expense)

- Impairment and amortization of intangible assets;

- Stock-based compensation expense;

- Restructuring charges; and

- Transitional costs.

Bookings do not reflect the deferral of certain game revenue that Glu recognizes over the estimated useful lives of paying users

of Glu’s games and excludes changes in deferred revenue and litigation settlement proceeds.

Glu may consider whether significant items that arise in the future should also be excluded in calculating the non-GAAP

financial measures it uses.

Glu believes that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide

meaningful supplemental information regarding Glu's performance by excluding certain items that may not be indicative of Glu's core

business, operating results or future outlook. Glu's management uses, and believes that investors benefit from referring to, these

non-GAAP financial measures in assessing Glu's operating results, as well as when planning, forecasting and analyzing future

periods. These non-GAAP financial measures also facilitate comparisons of Glu's performance to prior periods.

Cautions Regarding Forward-Looking Statements

This news release contains forward-looking statements, including those regarding our “Financial Outlook as of May 1, 2018”

(“Second Quarter 2018 Guidance” and “Full Year 2018 Guidance”), and the statements that we are well positioned to execute on our

overall growth strategy; we continue to expect sequentially growing bottom line profitability on an adjusted EBITDA basis

throughout the year; and we have raised our full year financial guidance to reflect our confidence in our outlook. These

forward-looking statements are subject to material risks and uncertainties that could cause actual results to differ materially

from those in the forward-looking statements. Investors should consider important risk factors, which include: the risk that

consumer demand for smartphones, tablets and next-generation platforms does not grow as significantly as we anticipate or that we

will be unable to capitalize on any such growth; the risk that we do not realize a sufficient return on our investment with respect

to our efforts to develop free-to-play games for smartphones, tablets and next-generation platforms, the risk that we will be

unable build successful Growth titles that provide predictable bookings and year over year growth; the risk that we will not be

able to maintain our good relationships with Apple and Google; the risk that our development expenses for games for smartphones,

tablets and next-generation platforms are greater than we anticipate; the risk that our recently and newly launched games are less

popular than anticipated or decline in popularity and monetization rate more quickly than we anticipate; the risk that our newly

released games will be of a quality less than desired by reviewers and consumers; the risk that the mobile games market,

particularly with respect to free-to-play gaming, is smaller than anticipated; the risk that we may lose a key intellectual

property license; the risk that we are unable to recruit and retain qualified personnel for developing and maintaining the games in

our product pipeline resulting in reduced monetization of a game, product launch delays or games being eliminated from our pipeline

altogether; and other risks detailed under the caption "Risk Factors" in our Form 10-K filed with the Securities and Exchange

Commission on March 9, 2018 and our other SEC filings. You can locate these reports through our website at http://www.glu.com/investors. We are under no obligation, and expressly disclaim any obligation, to update or

alter our forward-looking statements whether as a result of new information, future events or otherwise.

About Glu Mobile

Glu Mobile (NASDAQ: GLUU) is a leading creator of mobile games. Founded in 2001, Glu is headquartered in San Francisco with Bay

Area studios in Burlingame and San Mateo, and international locations in Toronto and Hyderabad. With a history spanning over a

decade, Glu’s culture is rooted in taking smart risks and fostering creativity to deliver world-class interactive experiences for

our players. Glu’s diverse portfolio features top-grossing and award-winning original and licensed IP titles including, Cooking

DASH, Covet Fashion, Deer Hunter, Design Home, MLB Tap Sports Baseball and Kim Kardashian:

Hollywood available worldwide on various platforms including the App Store and Google Play. For more information, visit

www.glu.com or follow Glu on Twitter, Facebook and Instagram.

COOKING DASH, COVET FASHION, DEER HUNTER, DESIGN HOME, TAP SPORTS, GLU, GLU MOBILE, and the 'g' character logo are trademarks of

Glu Mobile Inc.

|

|

|

|

|

|

|

| Glu Mobile Inc. |

|

|

|

|

|

|

| Consolidated Statements of Operations |

|

|

|

|

|

|

| (in thousands, except per share data) |

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended |

|

|

|

|

|

March 31, |

|

March 31, |

|

|

|

|

|

2018 |

|

2017 |

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

$ |

81,443 |

|

|

$ |

56,788 |

|

|

|

|

|

|

|

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

Platform commissions, royalties and other |

|

|

|

|

29,167 |

|

|

|

20,860 |

|

|

Impairment of prepaid royalties and minimum guarantees |

|

|

|

|

99 |

|

|

|

792 |

|

|

Impairment and amortization of intangible assets |

|

|

|

|

1,467 |

|

|

|

3,262 |

|

|

Total cost of revenue |

|

|

|

|

30,733 |

|

|

|

24,914 |

|

| Gross profit |

|

|

|

|

50,710 |

|

|

|

31,874 |

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

|

|

|

22,710 |

|

|

|

25,032 |

|

|

Sales and marketing |

|

|

|

|

26,810 |

|

|

|

17,287 |

|

|

General and administrative |

|

|

|

|

7,890 |

|

|

|

8,497 |

|

|

Restructuring charge |

|

|

|

|

80 |

|

|

|

3,712 |

|

| Total operating expenses |

|

|

|

|

57,490 |

|

|

|

54,528 |

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

|

|

(6,780 |

) |

|

|

(22,654 |

) |

|

Interest and other expense, net |

|

|

|

|

(251 |

) |

|

|

(122 |

) |

| Loss before income taxes |

|

|

|

|

(7,031 |

) |

|

|

(22,776 |

) |

|

Income tax benefit/(provision) |

|

|

|

|

(175 |

) |

|

|

12 |

|

| Net loss |

|

|

|

$ |

(7,206 |

) |

|

$ |

(22,764 |

) |

|

|

|

|

|

|

|

|

| Net loss per common share - basic and diluted |

|

|

|

$ |

(0.05 |

) |

|

$ |

(0.17 |

) |

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic and diluted |

|

|

|

|

139,108 |

|

|

|

134,336 |

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense included in: |

|

|

|

|

|

|

|

Research and development |

|

|

|

$ |

3,199 |

|

|

$ |

1,441 |

|

|

Sales and marketing |

|

|

|

|

653 |

|

|

|

362 |

|

|

General and administrative |

|

|

|

|

2,456 |

|

|

|

1,738 |

|

|

Total stock-based compensation expense |

|

|

|

$ |

6,308 |

|

|

$ |

3,541 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Glu Mobile Inc. |

|

|

|

|

|

|

|

Consolidated Balance Sheets |

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

|

2018 |

|

2017 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

$ |

48,306 |

|

|

$ |

63,764 |

|

|

Accounts receivable, net |

|

|

|

|

34,421 |

|

|

|

34,673 |

|

|

Prepaid royalties |

|

|

|

|

3,457 |

|

|

|

2,994 |

|

|

Restricted Cash |

|

|

|

|

602 |

|

|

|

602 |

|

|

Prepaid expenses and other current assets |

|

|

|

|

32,715 |

|

|

|

35,543 |

|

|

Total current assets |

|

|

|

|

119,501 |

|

|

|

137,576 |

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

14,073 |

|

|

|

14,630 |

|

|

Long-term prepaid royalties |

|

|

|

|

8,861 |

|

|

|

9,302 |

|

|

Other long-term assets |

|

|

|

|

3,373 |

|

|

|

3,299 |

|

|

Intangible assets, net |

|

|

|

|

16,797 |

|

|

|

18,264 |

|

|

Goodwill |

|

|

|

|

116,227 |

|

|

|

116,227 |

|

|

Total assets |

|

|

|

$ |

278,832 |

|

|

$ |

299,298 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

Accounts payable |

|

|

|

$ |

14,600 |

|

|

$ |

21,203 |

|

|

Accrued liabilities |

|

|

|

|

1,172 |

|

|

|

1,154 |

|

|

Accrued compensation |

|

|

|

|

6,835 |

|

|

|

20,603 |

|

|

Accrued royalties |

|

|

|

|

8,503 |

|

|

|

11,782 |

|

|

Accrued restructuring |

|

|

|

|

516 |

|

|

|

759 |

|

|

Deferred revenue |

|

|

|

|

72,648 |

|

|

|

77,403 |

|

|

Total current liabilities |

|

|

|

|

104,274 |

|

|

|

132,904 |

|

|

Long-term accrued royalties |

|

|

|

|

6,868 |

|

|

|

7,300 |

|

|

Other long-term liabilities |

|

|

|

|

5,280 |

|

|

|

5,234 |

|

|

Total liabilities |

|

|

|

|

116,422 |

|

|

|

145,438 |

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

|

|

14 |

|

|

|

14 |

|

|

Additional paid-in capital |

|

|

|

|

596,866 |

|

|

|

589,962 |

|

|

Accumulated other comprehensive (loss)/income |

|

|

|

|

20 |

|

|

|

(6 |

) |

|

Accumulated deficit |

|

|

|

|

(434,490 |

) |

|

|

(436,110 |

) |

|

Stockholders' equity |

|

|

|

|

162,410 |

|

|

|

153,860 |

|

|

Total liabilities and stockholders' equity |

|

|

|

$ |

278,832 |

|

|

$ |

299,298 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Glu Mobile Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

March 31, |

|

June 30, |

|

September 30, |

|

December 31, |

|

March 31, |

|

|

|

2016 |

|

2017 |

|

2017 |

|

2017 |

|

2017 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP gross profit |

|

$ |

25,907 |

|

|

$ |

31,874 |

|

|

$ |

40,747 |

|

|

$ |

49,423 |

|

|

$ |

23,630 |

|

|

$ |

50,710 |

|

|

Impairment and amortization of intangible assets |

|

|

2,811 |

|

|

|

3,262 |

|

|

|

3,171 |

|

|

|

2,363 |

|

|

|

1,535 |

|

|

|

1,467 |

|

|

Non-cash warrant (benefit)/expense |

|

|

(26 |

) |

|

|

62 |

|

|

|

- |

|

|

|

- |

|

|

|

569 |

|

|

|

248 |

|

|

Change in deferred revenue |

|

|

11,464 |

|

|

|

12,248 |

|

|

|

13,863 |

|

|

|

4,533 |

|

|

|

2,986 |

|

|

|

4,905 |

|

|

Change in deferred platform commissions |

|

|

(3,126 |

) |

|

|

(3,479 |

) |

|

|

(3,583 |

) |

|

|

(1,107 |

) |

|

|

(707 |

) |

|

|

(1,477 |

) |

|

Change in deferred royalties |

|

|

(200 |

) |

|

|

145 |

|

|

|

(1,032 |

) |

|

|

153 |

|

|

|

(355 |

) |

|

|

(15 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating expense |

|

$ |

43,287 |

|

|

$ |

54,528 |

|

|

$ |

64,545 |

|

|

$ |

61,880 |

|

|

$ |

56,267 |

|

|

$ |

57,490 |

|

|

Stock-based compensation |

|

|

(3,667 |

) |

|

|

(3,541 |

) |

|

|

(3,523 |

) |

|

|

(3,575 |

) |

|

|

(4,424 |

) |

|

|

(6,308 |

) |

|

Transitional costs |

|

|

(802 |

) |

|

|

(1,582 |

) |

|

|

(1,924 |

) |

|

|

(506 |

) |

|

|

(336 |

) |

|

|

(919 |

) |

|

Restructuring charge |

|

|

- |

|

|

|

(3,712 |

) |

|

|

(926 |

) |

|

|

(1,402 |

) |

|

|

21 |

|

|

|

(80 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP research and development expense |

|

$ |

20,766 |

|

|

$ |

25,032 |

|

|

$ |

23,989 |

|

|

$ |

22,004 |

|

|

$ |

21,395 |

|

|

$ |

22,710 |

|

|

Transitional costs |

|

|

(83 |

) |

|

|

(1,115 |

) |

|

|

(1,821 |

) |

|

|

(90 |

) |

|

|

(179 |

) |

|

|

(860 |

) |

|

Stock-based compensation |

|

|

(1,401 |

) |

|

|

(1,441 |

) |

|

|

(1,558 |

) |

|

|

(1,521 |

) |

|

|

(1,940 |

) |

|

|

(3,199 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP sales and marketing expense |

|

$ |

14,387 |

|

|

$ |

17,287 |

|

|

$ |

30,952 |

|

|

$ |

29,776 |

|

|

$ |

26,341 |

|

|

$ |

26,810 |

|

|

Transitional costs |

|

|

(39 |

) |

|

|

(53 |

) |

|

|

53 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Stock-based compensation |

|

|

(344 |

) |

|

|

(362 |

) |

|

|

(178 |

) |

|

|

(283 |

) |

|

|

(466 |

) |

|

|

(653 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP general & administrative expense |

|

$ |

8,134 |

|

|

$ |

8,497 |

|

|

$ |

8,678 |

|

|

$ |

8,698 |

|

|

$ |

8,552 |

|

|

$ |

7,890 |

|

|

Transitional costs |

|

|

(680 |

) |

|

|

(414 |

) |

|

|

(156 |

) |

|

|

(417 |

) |

|

|

(157 |

) |

|

|

(59 |

) |

|

Stock-based compensation |

|

|

(1,922 |

) |

|

|

(1,738 |

) |

|

|

(1,787 |

) |

|

|

(1,771 |

) |

|

|

(2,018 |

) |

|

|

(2,456 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other supplemental financial information |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

$ |

804 |

|

|

$ |

790 |

|

|

$ |

830 |

|

|

$ |

827 |

|

|

$ |

748 |

|

|

$ |

976 |

|

|

Foreign currency exchange (gain)/loss |

|

|

294 |

|

|

|

129 |

|

|

|

(48 |

) |

|

|

(78 |

) |

|

|

17 |

|

|

|

86 |

|

|

Income from change in fair value of strategic investments |

|

|

(255 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Income tax provision/(benefit) |

|

|

(280 |

) |

|

|

(12 |

) |

|

|

(177 |

) |

|

|

(1,057 |

) |

|

|

420 |

|

|

|

175 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition to the reasons stated above, which are generally applicable to each of the items Glu excludes from its non-GAAP

financial measures, Glu believes it is appropriate to exclude certain items for the following reasons:

Change in Deferred Platform Commissions and Deferred Royalties. At the date we sell certain premium games and

micro-transactions, Glu has an obligation to provide additional services and incremental unspecified digital content in the future

without an additional fee. In these cases, we recognize any associated cost of revenue, including platform commissions and

royalties, on a straight-line basis over the estimated life of the paying user. Internally, Glu’s management excludes the impact of

the changes in deferred platform commissions and deferred royalties related to its premium and free-to-play games in its non-GAAP

financial measures when evaluating the company’s operating performance, when planning, forecasting and analyzing future periods,

and when assessing the performance of its management team. Glu believes that excluding the impact of the changes in deferred

platform commissions and deferred royalties from its operating results is important to facilitate comparisons to prior periods and

to understand Glu’s operations.

Non-cash Warrant (benefit)/expense. Glu recorded non-cash charges related to the warrants to purchase shares of common

stock issued to certain brand holders as part of third party licensing, development and publishing arrangements. These charges were

recorded in cost of revenue. When evaluating the performance of its consolidated results, Glu does not consider non-cash warrant

charges as it places a greater emphasis on overall stockholder dilution rather than the accounting charges associated with any

warrants. As the non-cash warrant expense impacts comparability from period to period Glu believes that investors benefit from a

supplemental non-GAAP financial measure that excludes these charges.

Impairment and amortization of Intangible Assets. When analyzing the operating performance of an acquired entity or

intangible asset, Glu's management focuses on the total return provided by the investment (i.e., operating profit generated from

the acquired entity as compared to the purchase price paid) without taking into consideration any allocations made for accounting

purposes. Because the purchase price for an acquisition necessarily reflects the accounting value assigned to intangible assets

(including acquired in-process technology and goodwill), when analyzing the operating performance of an acquisition in subsequent

periods, Glu's management excludes the GAAP impact of acquired intangible assets to its financial results. Glu believes that such

an approach is useful in understanding the long-term return provided by an acquisition and that investors benefit from a

supplemental non-GAAP financial measure that excludes the accounting expense associated with acquired intangible assets.

Stock-Based Compensation Expense. Glu applies the fair value provisions of Accounting Standard Codification Topic 718,

Compensation-Stock Compensation (“ASC 718”). ASC 718 requires the recognition of compensation expense, using a fair-value based

method, for costs related to all share-based payments. Glu's management team excludes stock-based compensation expense from its

short and long-term operating plans. In contrast, Glu's management team is held accountable for cash-based compensation and such

amounts are included in its operating plans. Further, when considering the impact of equity award grants, Glu places a greater

emphasis on overall stockholder dilution rather than the accounting charges associated with such grants. Glu believes it is useful

to provide a non-GAAP financial measure that excludes stock-based compensation in order to better understand the long-term

performance of its business.

Restructuring Charges. Glu undertook restructuring activities in the first, second and third quarters of 2017 and

recorded cash restructuring charges due to the termination of certain employees in Asia and certain U.S. offices. Glu recorded the

severance costs as an operating expense when it communicated the benefit arrangement to the employee and no significant future

services, other than a minimum retention period, were required of the employee to earn the termination benefits. Additionally, Glu

recorded restructuring charges upon exiting portions of certain facilities in Asia and the US in 2017 and the first quarter of

2018. Glu believes that these restructuring charges do not reflect its ongoing operations and that investors benefit from a

supplemental non-GAAP financial measure that excludes these charges.

Transitional Costs. GAAP requires expenses to be recognized for various types of events associated with a business

acquisition such as legal, accounting and other deal related expenses. Glu incurred various costs related to the divestiture of

Moscow Studio, acquisition and integration of Crowdstar, and Dairy Free Games into Glu’s operations. Glu recorded these acquisition

and transitional costs as operating expenses when they were incurred. Glu believes that these acquisition and transitional costs

affect comparability from period to period and that investors benefit from a supplemental non-GAAP financial measure that excludes

these expenses.

Investor Relations:

Ellipsis

Bob Jones / Taylor Krafchik

646-776-0886

IR@glu.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20180501006672/en/