Geopolitical concerns once again appear in the forefront for investors as President Trump is set to announce his decision on

whether to reimpose sanctions on Iran.

If that happens, it will likely cut into the global supply of oil, providing upward pressure for crude prices. That

would bode well for energy producers, but it would raise costs for consuming companies such as manufacturers who would then

probably try to pass the costs along to their customers.

Given the high-level controversy of the Iran nuclear deal, the market may take it negatively whether Trump decides to

stay in the deal or not. Either way, some may be unhappy.

Inflation Fears Gain Energy

Inflation is already on the minds of investors as they hang on every word from the Fed and closely watch the yield on

the 10-year Treasury, which is below the psychological 3 percent mark this morning. Higher commodities prices, notably those

within the energy complex, are also being watched.

On Monday, rising crude prices seemed to help energy companies. Benchmark U.S. oil prices rose above $70 per barrel

for the first time since 2014 partly on worries about Iranian supply. But oil gave back some of those gains after President Trump

tweeted that he would make an announcement today about renewing sanctions against the OPEC nation. U.S. oil futures were lower this

morning but above the $70 mark.

Today, Walt Disney Co. (NYSE: DIS) is one of the stocks investors might be watching as the entertainment behemoth

reports earnings after the bell. Consider paying attention to the company’s ESPN segment results, as its dwindling subscriber

numbers have been a wild card for the company. Also, Reuters reported that Comcast Corporation (NASDAQ: CMCSA) is trying to put the money together for an all-cash bid for

assets Fox (FOX) has agreed to sell to Disney. Some insiders say Comcast is awaiting the outcome of the AT&T

Inc. (NYSE: T) Time-Warner merger deal, which is

currently tied up in court. If the government nixes that deal, Comcast may not proceed with a bid.

Info Tech Takes Charge

The information technology sector led the S&P 500 Index (SPX) higher Monday, while the other two main U.S. indices

were also in the green, continuing momentum from Friday’s rally.

Optimism about Apple Inc. (NASDAQ: AAPL), a big psychological driver for the market because it is widely held,

apparently helped momentum for the sector. NVIDIA Corporation (NASDAQ: NVDA) was the biggest gainer in that sector, rising more than 4 percent ahead of

its earnings report later in the week. Nvidia shares might have gotten some help from a Bank of America Merrill Lynch analyst note,

which according to CNBC was bullish.

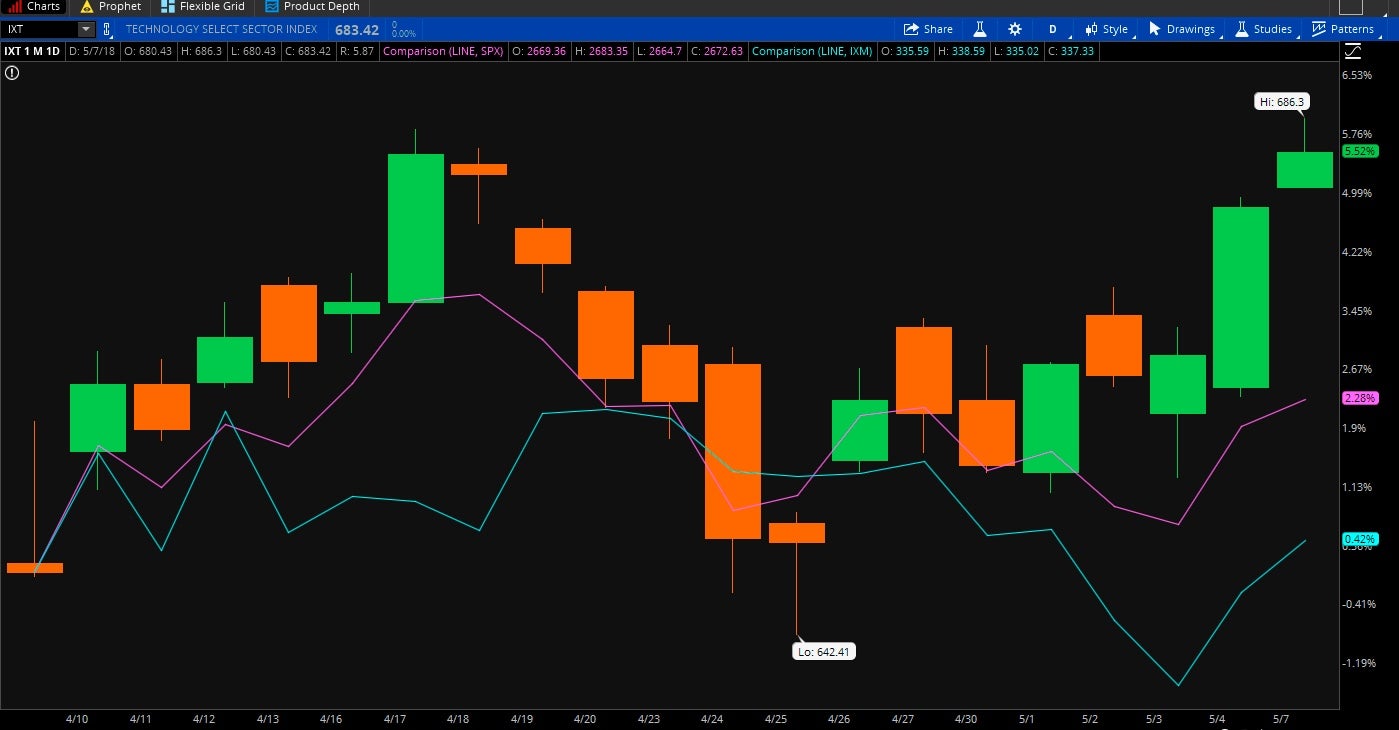

FIGURE 1: TECH ON A ROLL. Last year’s sector darling, info tech (candlestick), has been on a roll lately, gaining

at a pace well ahead of the broader S&P 500 Index (SPX, purple line). However, financials (blue line), another big gainer last

year, continues to struggle for direction. Data source: S&P Dow Jones Indices. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past

performance does not guarantee future results.

Poised for Producer Prices

Investors are likely to be watching Wednesday’s producer price index data closely for any signs it could cause the Fed

to adjust its course for interest rate hikes. If it shows too much inflation for producers, which could then try to pass that on to

consumers, that could become ammunition for the Fed to increase rates faster than what the market is currently thinking. Higher

inflation expectations could help push the yield on the 10-year Treasury above the psychologically important 3 percent mark again.

Higher yields could become a headwind to corporate borrowing. But keep in mind that Treasury yields can move higher because of

expectations that the economy might be stronger down the road. A consensus of economists shows both headline and core PPI rising by

0.2 percent in April, according to Briefing.com.

Volatility and the Market

Last month, some investors lessened exposure to the market as volatility apparently got too hot for them. Geopolitical

tensions, the 10-year-Treasury yield rising above 3 percent and tepid forecasts from some company executives helped keep the VIX at

elevated levels. And that apparently let TD Ameritrade clients to lower their overall exposure to equities, causing the

Investor Movement Index® to fall for a fourth consecutive month in April, slipping 8 percent from the prior month to 4.79. The

IMXSM is a proprietary, behavior-based index created by TD Ameritrade that aggregates Main Street investor

positions and activity to measure what TD Ameritrade clients actually have been doing and how they were positioned in the

markets.

What History Says

Much of this most recent earnings season is behind us, and we’ve seen some truly blockbuster results. According to

investment research firm CFRA, earnings-per-share growth for Q1 2018 is almost 600 basis points above end-of-quarter estimates.

It’s interesting to note that, according to CFRA, in more than 70 percent of observations since World War II, the S&P 500 rose

in price nine months after a peak in a certain measure of EPS growth. “History implies that a peak in EPS growth does not translate

to panic that this bull will soon come to a screeching halt,” CFRA said. Remember, however, that the past doesn't guarantee future

results.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of

any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved

with each strategy, including commission costs, before attempting to place any trade.

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.