Working in retirement may be the new norm according to PGIM Investments study

Few current retirees take a new job in their golden years—but more than half of future retirees expect to continue working

during retirement, driven by uncertainty about Social Security and their own financial preparedness, a new study from PGIM Investments reveals. PGIM Investments is the global manufacturer and fund distributor of PGIM, Inc., the $1 trillion global investment management business of Prudential Financial, Inc. (NYSE: PRU).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180710005020/en/

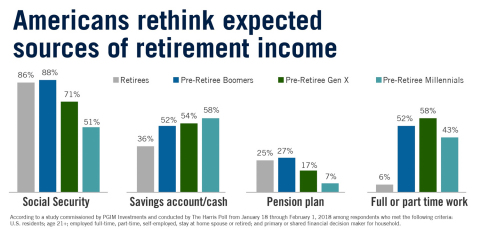

Expected sources of income in retirement. (Graphic: Business Wire)

The study, the 2018 Retirement Preparedness Study: A Generational Challenge, commissioned by PGIM Investments and conducted by

The Harris Poll, found that while only 6 percent of today’s retirees work, 52 percent of pre-retiree Baby Boomers, 58 percent

of pre-retiree Gen Xers, and 43 percent of pre-retiree Millennials expect to take on a full- or part-time job during retirement.

These expectations may be linked to pre-retirees’ decreased reliance on Social Security—for example, only 51 percent of Millennials

expect to receive these benefits at all.

“While changes in retirement expectations are often driven by pure economics, these study results also suggest a mind shift in

how people are thinking about retirement. However, pre-retirees’ actions don’t always back up their goals,” said Stuart Parker, president and CEO of PGIM Investments. “To help them bridge this gap, the asset management

industry will need to rethink the way that it does business and bring products and services in line with changing customer

needs.”

According to PGIM Investments’ study:

The “dream retirement” is changing

- Pre-retirees are more likely to base their decision about when to retire on their wealth rather

than their age with half of Gen Xers and 62 percent of Millennials saying they will retire when they have saved enough

money. Current retirees decided when to retire largely based on their age and eligibility for Social Security and

pensions.

- Millennials are more likely to start a business in retirement (20 percent) than Gen Xers

(9 percent) or Boomers (four percent). Nearly four in 10 pre-retirees (39 percent) say they want to volunteer after they

retire.

- More than half (51 percent) of current retirees say they’re “living the dream.”

On average, these individuals started saving six years earlier than other retirees. Compared with those who aren’t living

their dream retirement, these individuals are more likely to have pensions and diversified sources of income. They also are more

likely to have been able to retire at their planned retirement age.

Pre-retirees need to evolve their saving habits

Recently, trustees for Social Security announced that the program is operating at a deficit and will need to pull money

from its reserves for the first time since 1982. Pre-retirees may not be prepared to fill the gap, PGIM Investments’ study

finds:

- Social Security benefits are the most critical source of income for 61 percent of

retirees. By comparison, only 70 percent of Gen Xers and 51 percent of Millennials expect Social Security benefits when

they retire.

- Millennials are least likely to rely on Social Security for retirement income and are more heavily

invested in cash and less invested in equities; nearly one in three aren’t saving for retirement at all.

- More than half (53 percent) of pre-retirees are unsure how much they need for retirement. Gen

Xers have the highest estimates of the savings they need, but almost one in five aren’t saving for retirement at all.

- Pre-retirees need to expect the unexpected—51 percent of retirees say they retired earlier than

expected. Of that group, half say they retired more than five years earlier than planned. In many cases, the reasons were

involuntary, including health problems (29% of the early retirees), layoffs or restructurings (14%), the need to care for a loved

one (13%), and the inability to find a new job (10%).

To address growing consumer need for retirement income planning, Prudential Financial, along with 23 other leading financial

services organizations, established the Alliance for Lifetime Income to help educate Americans about the value of having protected income in

retirement.

For more study results, download the report: 2018 Retirement Preparedness Study: A Generational Challenge.

About the study

A total of 1,514 interviews were conducted online by The Harris Poll from Jan. 18 through Feb. 1, 2018, among U.S. residents age

21 and over, employed full-time, part-time, self-employed, a stay-at-home spouse or retired, and a primary or shared financial

decision maker for their household. Results were weighted separately to bring them in line with their actual proportions in the

population.

About PGIM Investments

PGIM Investments offers more than 100 funds globally across a broad spectrum of asset classes and investment styles. Clients can

also choose from a variety of investment vehicles including closed-end funds and target date funds such as the Prudential Day One

Mutual Fund series. All products draw on PGIM’s globally diversified investment platform that encompasses the expertise of managers

across fixed income, equities and real estate.

About PGIM and Prudential Financial Inc.

With 15 consecutive years of positive third-party institutional net flows, PGIM is the global investment management business of

Prudential Financial, Inc. (NYSE: PRU)— a top-10 investment manager globally according to Pensions & Investments’ 2018 Top Money

Managers List, with more than $1 trillion in assets under management as of March 31, 2018. PGIM’s businesses offer a range of

investment solutions for retail and institutional investors around the world across a broad range of asset classes, including

fundamental equity, quantitative equity, public fixed income, private fixed income, real estate and commercial mortgages. Its

businesses have offices in 16 countries across four continents. For more information, please visit pgim.com.

Prudential’s additional businesses offer a variety of products and services, including life insurance, annuities and

retirement-related services. For more information about Prudential, please visit news.prudential.com.

This material is being provided for informational or educational purposes only and does not take into account the investment

objectives or financial situation of any client or prospective clients. The information is not intended as investment advice and is

not a recommendation about managing or investing your retirement savings. Clients seeking information regarding their particular

investment needs should contact a financial professional.

The target date is the approximate date when investors plan to retire and may begin withdrawing their money. The asset

allocation of the target date funds will become more conservative until the date which is ten years prior to the target date by

lessening the equity exposure and increasing the exposure in fixed income investments. The principal value of an investment in a

target date fund is not guaranteed at any time, including the target date. There is no guarantee that the fund will provide

adequate retirement income. A target date fund should not be selected solely based on age or retirement date. Before investing,

participants should carefully consider the fund's investment objectives, risks, charges and expenses, as well as their age,

anticipated retirement date, risk tolerance, other investments owned, and planned withdrawals.

The Prudential Day One Funds may be offered as mutual funds. You should consider the investment objectives, risks, charges

and expenses of each fund carefully before investing. The prospectus and summary prospectus contain this and other information

about the fund. Contact your financial professional for a prospectus and summary prospectus. Read them carefully before

investing.

Shares of the registered mutual funds are offered through Prudential Investment Management Services LLC (PIMS), Newark, NJ, a

Prudential Financial company.

Investing involves risks. Some investments have more risk than others. The investment return and principal value will fluctuate

and the investment, when sold, may be worth more or less than the original cost and it is possible to lose money.

© 2018 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, the Rock symbol, Prudential Day

One, PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many

jurisdictions worldwide.

MEDIA:

Kristin Meza, 973-367-4104

kristin.meza@prudential.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20180710005020/en/