Vancouver, British Columbia--(Newsfile Corp. - July 19, 2018) - Cabral Gold Inc. (TSXV: CBR) (OTC Pink: CBGZF)

("Cabral" or the "Company") is pleased to announce initial sampling and exploration results

from an ongoing program assessing the potential of newly discovered high-grade veins at the Machichie Prospect, within the Cuiú

Cuiú Project, Pará State, northern Brazil.

Initial results have highlighted a newly recognized mineralized trend with no previous drilling that is located only 500m north

of the Cabral's MG deposit (Figure 1). MG is one of four deposits with defined resources at Cuiú Cuiú.

The newly discovered Machichie mineralized structures extend at least 300m and lie along an easterly trend, roughly parallel to

MG. The discovery is highlighted by a line of recently sunk artisanal shafts that are exploiting high-grade gold-bearing quartz

veins hosted in soft, shallow weathered bedrock. The structure is defined as a subtle magnetic low that corresponds to a coincident

gold-in-soil geochemical anomaly (100-315ppb Au). Both the veins and wall-rock alteration are sulphide rich, which appears to

correlate to a pronounced off-grid IP chargeability response interpreted from a 2006 IP test survey covering part of the MG deposit

to the south.

Highlights

- A composite grab sample of mineralized rock returned 336 g/t Au from a 1m wide quartz-pyrite vein in an artisanal shaft at

Machichie.

- Channel sample results include 54.6 g/t Au over 0.80m, 13.2 g/t Au over 0.75m, 13.8 g/t Au over 1.5m and 5.8 g/t Au over

1.75m

Figure 1: Location of the Machichie target relative to the other gold deposits and targets in the central part of the

Cuiú Cuiú property.

To view an enhanced version of Figure 1, please visit:

http://orders.newsfilecorp.com/files/3900/36078_a1531969804946_19.jpg

Background

The Cuiú Cuiú Project covers the largest of the historical placer gold camps in the Tapajós region of northern Brazil, having

yielded an estimated 2MMoz of gold from the overall 20-30MMoz gold produced during the Tapajós gold rush1 from the

late-1970's though the mid-1990's. Placer workings cover over 850ha on the property but are largely exhausted. The few remaining

artisanal workers now process gold from palaeo-valley placer deposits and in places exploit high-grade gold mineralization from

quartz veins in saprolite (shallow highly weathered bedrock).

Exploration work from 2006 through 2012 successfully identified multiple bedrock sources for a number of the placer workings,

largely discovered by following up pronounced surface gold-in-soil geochemical anomalies. Many potential source areas remain

untested, and recent work by artisanal workers is uncovering additional new targets.

Earlier this year, Cabral reported an updated NI 43-101 Mineral Resource Estimate2 totalling 5.9MM tonnes grading 0.9

g/t Au (Indicated) and 19.5MM tonnes grading 1.2 g/t Au (Inferred), or 0.2MM ounces and 0.8MM ounces of gold, respectively. That

estimate was based on four deposits drilled prior to the cessation of drilling in 2012.

The Company's current program is designed to improve understanding and expand existing prospects, evaluate newly identified

discoveries, prioritize drill targets, and to build upon the existing resource inventory.

One focus is on the definition of gold targets that are strategically close to existing resources. The Machichie area is one

such target, as it lies within 500m of the MG deposit (Figure 1).

Currently MG is assigned an Inferred Resource of 8.6MMt @ 1.45g/t Au (0.4MMoz of gold) 3. To date, drilling at MG is

wide-spaced. The deposit remains open at depth. The resource is quite sensitive to top-end cuts, with 73% more gold reporting to an

estimate provided without top-end cuts. Additional strategic drilling this fall will be targeted to better define high-grade shoots

at MG in order to improve the gold grade, and thereby the size of the gold resource.

Any nearby resources outlined at Machichie would be expected to improve the economic prospects of MG.

Machichie Target Area

Placer deposits were mined for gold in the Machichie area during the main phase of the Tapajós gold rush. Principal placer

workings extended over 1km along a valley system to the north of Cabral's MG deposit.

Artisanal workers later found multiple northeast trending gold-bearing vein systems in weathered bedrock immediately to the

northwest of the east-trending MG deposits. There, several substantial artisanal pits were eventually developed ranging up to 120m

in strike length that exploited the saprolite-hosted gold mineralization. These pits are now flooded, and are no longer accessible

to sampling, having been worked to the water table. A channel sample taken during whilst one of these pits was active returned

16.0 g/t Au over 5.8m. While the MG deposit was being drilled in 2009, a single historical hole (CC-52-09)

tested below these pits, returning 7.4g/t Au over 3.3m, approximately 50m along strike from the channel

sample. Despite these initial strong results, emphasis at the time was on MG and no further work was done at Machichie.

In early March 2018, Cabral's first field visit to Machichie identified extensive new artisanal workings on a previously unknown

easterly trend that is roughly parallel to MG (Figure 2). These include a key area where artisanal gold mining and processing is

being conducted on quartz veins hosted in saprolite that were recently exposed following a renewed phase of colluvial mining of

overburden-covered placer mineralization.

Cabral commenced a review of the new Machichie discovery area in April 2018. There are currently at least ten active shafts,

four of which are in active production and are developed on vein-hosted gold mineralization. These shafts are all developed along

an east -trending structural corridor, which cuts across the previously discovered northeast-trending vein set. The majority of

these shafts have only been developed in the last six months. The western extension of the vein system remains concealed by a soil

profile typically 6-8 m thick. The eastern extension, identified with the more recent advancement of colluvial mining, remains

partly covered by tailings and stockpiles.

Cabral's initial work has included: detail drone aerial photography to map the artisanal workings, rock-chip sampling and

channel sampling of veins exposed in shafts, stockpile and grab sampling of material extracted from shafts, and trenching and

channel sampling between the workings where topography and overburden thickness allows access. The geophysical and geochemical work

completed by the previous operator has also been reassessed.

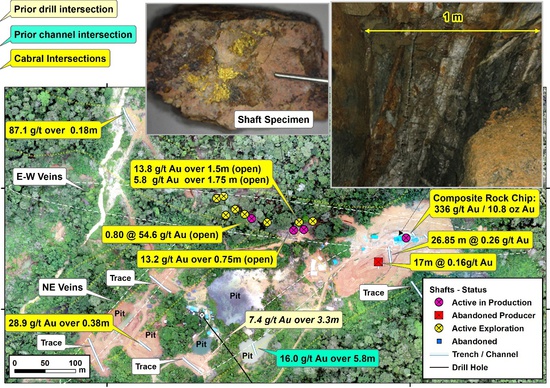

Figure 2: Drone orthophoto of the MG-Machichie Area showing the new discovery trend and historic drilling and

sampling and the outline of the MG mineralisation trend.

To view an enhanced version of Figure 2, please visit:

http://orders.newsfilecorp.com/files/3900/36078_a1531969805290_93.jpg

Reprocessed ground magnetic data clearly shows a subtle easterly trending magnetic low along which the shafts align (Figure 3).

Additional magnetic lows are evident that have not yet been evaluated.

A strong gold-in-soil anomaly directly correlates to the area of the new discovery (Figure 3), and there are several other

untested anomalies that have yet to be evaluated, including:

- A soil anomaly at a 100ppb Au threshold extending ~400m WNE of the western-most shaft.

- The 100ppb Au geochemical anomaly persists 300m ESE from the easternmost shaft, and untested satellite anomalies are present

extending over distances between 200 and 800m

- A smaller satellite soil anomaly further to the west converges towards the Jerimum Baixo area.

Figure 3: Geochemical anomalies associated with trends in reprocessed ground magnetics. The shafts at Machichie align

with an easterly trend along which untested gold in soil geochemical anomalies are distributed. Additional targets are represented

by magnetic lows, which need to be tested for indications of alteration related to the mineralization event.

To view an enhanced version of Figure 3, please visit:

http://orders.newsfilecorp.com/files/3900/36078_a1531969805602_85.jpg

Figure 4: Detailed drone orthophoto view of the new Machichie discovery area with sample results pit, trench and

shaft locations, along with photos of samples and workings.

To view an enhanced version of Figure 4, please visit:

http://orders.newsfilecorp.com/files/3900/36078_a1531969805884_44.jpg

Figure 4 shows a more detailed view of the new Machichie discovery area. The eastern-most shaft has been developed to the top of

fresh bedrock at the water table, exposing a 1m wide quartz-pyrite vein. A composite sample of from the run-of-mine material

excavated from the working face returned an assay result of 336 g/t Au. The artisanal workers pass the crushed vein material

through a sluice box four times. Sampling of rejects from the first, second and third stages of washing returned grades of 25.7,

14.2, and 12.9 g/t Au respectively.

The vein was observed to be 1m wide in the working, and is enveloped by a strongly silicified wall rock with disseminated

pyrite. Grab samples of the pyrite-altered wall rock returned grades of 1.0 to 4.4 g/t Au. This material is not targeted for

processing and exposure is limited, such that the width of this zone around the vein has yet to be established.

Four of the new shafts to the west have been accessed for sampling. Results of channel samples across the face of these western

shafts were:

- 54.6 g/t Au over 0.80m

- 13.8 g/t Au over 1.5m

- 13.2 g/t Au over 0.75m

- 5.8 g/t Au over 1.75m

These channel samples are all open across strike, as all were constrained to the available width of the narrow working face. A

deep soil profile and topography prevents trenching in the immediate vicinity of these E-W veins. The potential for additional

cross-strike mineralization will be tested with drilling as will the unmined wall-rock alteration.

Figure 5: -100m Chargeability grid from a 2006 IP test survey superimposed on the 2018 MG-Machichie area drone

orthophoto. Geophysical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral

deposit.

To view an enhanced version of Figure 5, please visit:

http://orders.newsfilecorp.com/files/3900/36078_a1531969806212_70.jpg

Higher grade mineralization in the east-trending MG deposit exhibited considerably more sulphide in veins and wall-rock

alteration than the other known deposits on the property. Higher grade mineralization examined from the new Machichie discovery

appears to have even stronger sulphide alteration. Furthermore, that strong pyrite wall-rock alteration is coupled with large

accessory molybdenite grains, and traces of chalcopyrite. Fluorite is also present in the vein and alteration halo. Given this

strong sulphide content, results from a test IP (induced polarisation) geophysical survey completed in 2006 were re-examined. The

results, interpreted at that time, indicated a strong chargeability anomaly trending towards the new Machichie discovery area

(Figure 5).

The new Machichie discovery area is shaping up to be a primary drill target area for Cabral's initial drill program planned

later this year. In the meantime, additional multi-element geochemistry will also be conducted in the area, focusing initially on

stream sediments to assess whether the copper- molybdenum signature can be traced over a broader area. Auger lines are planned to

further define the lateral extensions of the zone. And; finally, an expanded IP survey over the MG-Machichie area is being

considered as an option for defining the extensions of the structure under-cover, and to target rocks with chargeability response

consistent with heavier sulphide contents, that in the Cuiu Cuiu setting generally correlate with higher grade lode positions.

Alan Carter, President & CEO commented "The Machichie results are redefining our ideas of the variety of target styles that are

yet to be drilled at Cuiú Cuiú. Past exploration has focussed on the lower-grade stockwork-style vein systems. These new results

highlight the potential of more discrete vein structures with exceptionally high-grades. The new processing and review of our

geophysical database has added valuable context of interpreted structures correlative with geochemical anomalies which can now be

seen to extend from this trend. Our next steps are to further screen these targets using auger drilling, and potentially geophysics

to complete the definition of drill targets along this newly recognized corridor. We look forward to drill-testing the new

Machichie discovery later this year".

About Cabral Gold Inc.

The Company is a junior resource company and is engaged in the identification, exploration and development of mineral

properties, with a primary focus on gold properties located in Brazil. The Company owns the Cuiú Cuiú gold project located in the

Tapajos Region within the state of Para in northern Brazil.

FOR FURTHER INFORMATION PLEASE CONTACT:

Alan Carter

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Dr. Adrian McArthur, B.Sc. Hons, PhD. FAusIMM., a consultant to the Company as well

as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this

news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable

securities legislation (collectively "forward-looking statements"). The use of the words "will", "expected" and similar expressions

are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

Such forward-looking statements should not be unduly relied upon. This news release contains forward-looking statements and

assumptions pertaining to the following: strategic plans and future operations, and results of exploration. Actual results achieved

may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given

that these expectations will prove to be correct.

Notes

Gold analysis has been conducted by SGS method FAA505 (fire assay of 50g charge),

with higher grade samples checked by FAA525 or screen fire assay. Analytical quality is

monitored by certified references and blanks. Until dispatch, samples are stored under the supervision the

Company's exploration office. The samples are couriered to the assay laboratory using a commercial contractor. Pulps are

returned to the Company and archived. Channel sampling is conducted using a hand-trenching tool over exposed faces to

maintain a consistent sample. The high-grade Machichie sample was collected from the 2mm crushed run-of-mine feed

stream of an artisanal processing operation. Under the agreement with the Cuiu Cuiu condominium, local artisanal operators can

process mineralization to a depth of 30m, unless otherwise negotiated. Shafts generally stop at or above the depth at

the depth around the water-table. Historical drilling results are reports as down-hole length weighted

intersections unless otherwise stated.

1 DNPM (National Department of Mining Production)

2 Micon NI 43-101 resource estimate reported June 7 2018.

3 Micon NI 43-101 resource estimate reported June 7 2018.