Exelon Reports Third Quarter 2018 Results

Earnings Release Highlights

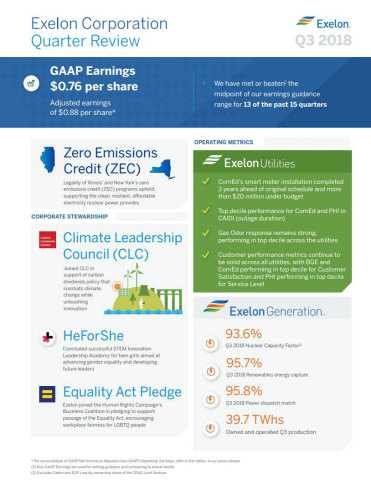

- GAAP Net Income of $0.76 per share and Adjusted (non-GAAP) Operating Earnings of $0.88 per share for

the third quarter of 2018

- Raising the lower end of our guidance range for full year 2018 Adjusted (non-GAAP) Operating Earnings

from $2.90 - $3.20 per share to $3.05 - $3.20 per share

- Announcing additional annual cost savings of $200 million gross, and $150 million net, reflecting

ongoing initiatives leveraging process efficiency and technology; full run-rate savings to be achieved in 2021

- All Exelon Utilities achieved top quartile reliability performance in outage frequency and outage

duration

- PECO, along with interested parties, filed a partial settlement agreement for its distribution rate

case on Aug. 28, 2018

Exelon Corporation (NYSE: EXC) today reported its financial results for the third quarter of 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181101005324/en/

Exelon third-quarter highlights (Graphic: Business Wire)

“Exelon had a strong third quarter as our utility and power businesses reported earnings at the upper end of our guidance range.

Our strategy to invest in advanced technology and infrastructure continues to drive improved customer satisfaction across our

utilities, and has allowed ComEd to complete its $920 million smart meter installation program three years ahead of its

original schedule,” said Christopher M. Crane, Exelon’s President and CEO. “At the utilities, we continue to make progress with

solid earned ROEs and strong key customer satisfaction and operating metrics. On the generation front, the Federal Circuit Courts

in Illinois and New York strongly affirmed the legality of the ZEC programs, which will help preserve these states’ emissions-free

nuclear power plants and the economic and environmental benefits they provide. Coupled with our pledge to join the Human Rights

Campaign’s Business Coalition in support of passing the Equality Act and the successful completion of our first round of HeForShe

STEM Innovation Leadership Academies, we are delivering on our commitment to be a positive force in our communities.”

“In the third quarter of 2018, Exelon also delivered financially with Adjusted (non-GAAP) operating earnings of $0.88 per share,

which is near the top of our guidance range,” said Joseph Nigro, Exelon’s Senior Executive Vice President and CFO. “Exelon is

raising the lower end of the full-year 2018 guidance from $2.90 - $3.20 to $3.05 - $3.20 per share as a result of the operational

results across our family of businesses. As part of our ongoing efforts to improve operations, we are announcing another $200

million of annual cost savings by 2021. Together with previously announced cost savings, Exelon has identified total savings of

over $900 million since 2015.”

Third Quarter 2018

Exelon's GAAP Net Income for the third quarter of 2018 decreased to $0.76 per share from $0.85 per share in the third quarter of

2017. Adjusted (non-GAAP) Operating Earnings increased to $0.88 per share in the third quarter of 2018 from $0.85 per share in the

third quarter of 2017. For the reconciliations of GAAP Net Income to Adjusted (non-GAAP) Operating Earnings, refer to the tables

beginning on page 6.

Adjusted (non-GAAP) Operating Earnings in the third quarter of 2018 primarily reflect higher electric distribution and energy

efficiency earnings at ComEd, regulatory rate increases at PHI, favorable weather conditions at PECO and PHI, increased capacity

prices, the favorable impacts of the Illinois Zero Emission Standard (ZES) and tax savings related to the Tax Cuts & Jobs Act

(TCJA) at Generation, partially offset by the absence of ExGen Texas Power, LLC (EGTP) earnings resulting from its deconsolidation

in the fourth quarter of 2017, lower realized energy prices and increased nuclear outage days at Generation.

Operating Company Results1

ComEd

ComEd's third quarter of 2018 GAAP Net Income increased to $193 million from $189 million in the third quarter of 2017. ComEd’s

Adjusted (non-GAAP) Operating Earnings increased to $193 million for the third quarter of 2018 from $186 million in the third

quarter of 2017, primarily reflecting higher electric distribution and energy efficiency earnings. Due to revenue decoupling,

ComEd's distribution earnings are not affected by actual weather or customer usage patterns.

PECO

PECO’s third quarter of 2018 GAAP Net Income increased to $126 million from $112 million in the third quarter of 2017. PECO’s

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2018 increased to $127 million from $114 million in the third

quarter of 2017, primarily due to favorable weather conditions and volumes.

Cooling degree days were up 13.7 percent relative to the same period in 2017 and were 12.5 percent above normal. Total retail

electric deliveries were up 7.8 percent compared with the third quarter of 2017. Natural gas deliveries (including both retail and

transportation segments) in the third quarter of 2018 were down 1.0 percent compared with the same period in 2017.

BGE

BGE’s third quarter of 2018 GAAP Net Income increased to $63 million from $62 million in the third quarter of 2017. BGE’s

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2018 remained consistent at $64 million compared with the third

quarter of 2017. Due to revenue decoupling, BGE's distribution earnings are not affected by actual weather or customer usage

patterns.

___________

1Exelon’s five business units include ComEd, which consists of electricity transmission and distribution operations

in northern Illinois; PECO, which consists of electricity transmission and distribution operations and retail natural gas

distribution operations in southeastern Pennsylvania; BGE, which consists of electricity transmission and distribution operations

and retail natural gas distribution operations in central Maryland; PHI, which consists of electricity transmission and

distribution operations in the District of Columbia and portions of Maryland, Delaware, and New Jersey and retail natural gas

distribution operations in northern Delaware; and Generation, which consists of owned and contracted electric generating facilities

and wholesale and retail customer supply of electric and natural gas products and services, including renewable energy products and

risk management services.

PHI

PHI’s third quarter of 2018 GAAP Net Income increased to $187 million from $153 million in the third quarter of 2017. PHI’s

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2018 increased to $195 million from $146 million in the third

quarter of 2017, primarily reflecting regulatory rate increases and favorable weather conditions and volumes in Delaware and New

Jersey. Due to revenue decoupling, PHI's distribution earnings related to Pepco Maryland, DPL Maryland and Pepco District of

Columbia are not affected by actual weather or customer usage patterns.

Generation

Generation's third quarter of 2018 GAAP Net Income decreased to $234 million from $304 million in the third quarter of 2017.

Generation’s Adjusted (non-GAAP) Operating Earnings for the third quarter of 2018 decreased to $318 million from $346 million in

the third quarter of 2017, primarily reflecting the absence of EGTP earnings resulting from its deconsolidation in the fourth

quarter 2017, lower realized energy prices and increased nuclear outage days, partially offset by, the favorable impacts of the

Illinois ZES, increased capacity prices and tax savings related to the TCJA.

The proportion of expected generation hedged as of Sept. 30, 2018, was 98 percent to 101 percent for 2018, 82 percent to 85

percent for 2019 and 48 percent to 51 percent for 2020.

Third Quarter and Recent Highlights

- Cost Management Program: In Nov. 2018, Exelon announced the elimination of approximately $200

million in annual ongoing costs, through initiatives primarily at Generation and BSC, by 2021. Approximately $150 million is

expected to be related to Generation, with the remaining amount related to the Utility Registrants. This announcement is a

result of Exelon’s continuous focus on improving its cost profile through enhanced efficiency and productivity. The targeted cost

savings are incremental to the expected savings from previous cost management initiatives.

- Illinois and New York ZEC Programs: In Sept. 2018, the U.S. Court of Appeals for the Seventh

Circuit and the Second Circuit affirmed dismissal of the complaints against Illinois’ and New York’s Zero Emissions Credit (ZEC)

programs, respectively, which will allow them to continue supporting the clean, resilient electricity that nuclear power provides

to each state’s residents. On Sept. 27, 2018, the plaintiffs filed a request for a panel rehearing with the U.S. Circuit Court of

Appeals for the Seventh Circuit. On Oct. 9, 2018, the U.S. Circuit Court of Appeals for the Seventh Circuit panel denied the

request for rehearing.

- PECO Electric Distribution Base Rate Case: On Aug. 28, 2018, PECO and interested parties filed

with the Pennsylvania Public Utility Commission (PAPUC) a petition for partial settlement for an increase of $25 million in

annual electric distribution service revenues, which includes annual ongoing TCJA tax savings. No overall ROE was specified in

the partial settlement. The requested ROE was 10.95 percent in the filing with the PAPUC on March 29, 2018. On Oct. 18, 2018, the

Administrative Law Judges issued a Recommended Decision to the PAPUC that the partial settlement be approved without

modification. A final ruling from the PAPUC is expected before Dec. 31, 2018, and if approved, the new electric distribution base

rates will become effective on Jan. 1, 2019.

- Pepco District of Columbia Electric Distribution Base Rate Case: On Aug. 9, 2018, the District

of Columbia Public Service Commission approved a settlement agreement with an effective date of Aug. 13, 2018 that provides for a

net decrease to Pepco's annual electric distribution rates of $24 million, which includes annual ongoing TCJA tax savings, and

reflects a ROE of 9.525 percent. On Sept. 7, 2018, Pepco submitted an updated filing for a one-time bill credit to customers of

approximately $20 million, and an increase of $4 million to the customer base rate credit established in connection with the

merger between Exelon and PHI for residential customers, representing the TCJA benefits for the period Jan. 1, 2018 through Aug.

12, 2018. Following the expiration of the comment period with no objections filed, Pepco issued the $20 million to customers in

Sept. 2018.

- DPL Delaware Electric Distribution Base Rate Case: On Aug. 21, 2018, the Delaware Public

Service Commission (DPSC) approved the settlement agreement, which provides for a net decrease to annual electric distribution

base rates of $7 million, which includes annual ongoing TCJA tax savings, and reflects a ROE of 9.7 percent. In addition, the

settlement agreement separately provides for a one-time bill credit to customers of approximately $3 million representing the

TCJA benefits for the period Feb. 1, 2018 through March 17, 2018, when full interim rates were put into effect. DPL expects to

issue the $3 million to customers in the fourth quarter of 2018.

- DPL Delaware Gas Distribution Base Rate Case: On Sept. 7, 2018 (as amended and restated on

Oct. 2, 2018), DPL entered into a partial settlement agreement with several parties in its pending gas distribution base rate

case proceeding that provides for a net decrease to annual gas distribution base rates of $4 million, which includes annual

ongoing TCJA tax savings, and reflects a ROE of 9.7 percent. In addition, the settlement agreement separately provides a one-time

bill credit to customers of approximately $1 million representing the TCJA tax savings for the period Feb. 1, 2018 through March

17, 2018, when full interim rates were put into effect. DPL expects a decision on the settlement agreement in the fourth quarter

of 2018 but cannot predict if the DPSC will approve the settlement agreement as filed.

- ACE New Jersey Electric Distribution Base Rate Case: On Aug. 21, 2018, ACE refiled its

application with the New Jersey Board of Public Utilities (NJBPU), requesting an increase to its electric distribution rates of

$109 million (before New Jersey sales and use tax), reflecting a requested ROE of 10.1 percent. Included in the $109 million

request is $40 million of higher depreciation expense related to ACE's updated depreciation study. ACE currently expects a

decision in this matter in the third quarter of 2019 but cannot predict if the NJBPU will approve the application as filed.

- Acquisition of Distrigas Liquefied Natural Gas Terminal: On Oct. 1, 2018, Generation acquired

the Distrigas liquefied natural gas import terminal to ensure the continued reliable supply of fuel to Mystic Units 8 and 9 while

they remain operating.

- Nuclear Operations: Generation’s nuclear fleet, including its owned output from the Salem

Generating Station and 100 percent of the CENG units, produced 46,549 gigawatt-hours (GWhs) in the third quarter of 2018,

compared with 47,747 GWhs in the third quarter of 2017. Excluding Salem, the Exelon-operated nuclear plants at ownership achieved

a 93.6 percent capacity factor for the third quarter of 2018, compared with 96.1 percent for the third quarter of 2017. The

number of planned refueling outage days in the third quarter of 2018 totaled 36, compared with 13 in the third quarter of 2017.

There were 12 non-refueling outage days in the third quarter of 2018, compared with 15 in the third quarter of 2017.

- Fossil and Renewables Operations: The Dispatch Match rate for Generation’s gas and hydro fleet

was 95.8 percent in the third quarter of 2018, compared with 98.4 percent in the third quarter of 2017. The lower performance was

primarily due to outages at combined cycle gas units in Alabama and Texas.

Energy Capture for the wind and solar fleet was 95.7 percent in the third quarter of 2018, compared with 95.9 percent in the

third quarter of 2017.

-

Financing Activities:

- On Aug. 14, 2018, ComEd issued $550 million aggregate principal amount of its First Mortgage

Bonds, 3.70 percent Series 125, due Aug. 15, 2028. ComEd used the proceeds to repay a portion of its outstanding commercial

paper obligations and for general corporate purposes.

- On Sept. 11, 2018, PECO issued $325 million aggregate principal amount of its First and Refunding

Mortgage Bonds, 3.90 percent due March 1, 2048. PECO used the proceeds to satisfy short-term borrowings from the Exelon

intercompany money pool and for general corporate purposes.

- On Sept. 20, 2018, BGE issued $300 million aggregate principal amount of its 4.25 percent senior

notes due Sept. 15, 2048. BGE used the proceeds to repay commercial paper obligations and for general corporate

purposes.

- On Oct. 16, 2018, ACE issued $350 million aggregate principal amount of its First Mortgage

Bonds, 4.00 percent due Oct. 15, 2028. ACE will use the proceeds to refinance its maturing 7.75 percent First Mortgage

Bonds, repay outstanding commercial paper and for general corporate purposes.

GAAP/Adjusted (non-GAAP) Operating Earnings Reconciliation

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2018 do not include the following items (after tax) that were

included in reported GAAP Net Income:

|

|

Exelon |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Share |

|

Exelon |

|

ComEd |

|

PECO |

|

BGE |

|

PHI |

|

Generation |

| 2018 GAAP Net Income |

|

$ |

0.76 |

|

|

$ |

733 |

|

|

$ |

193 |

|

|

$ |

126 |

|

|

$ |

63 |

|

|

$ |

187 |

|

|

$ |

234 |

|

| Mark-to-Market Impact of Economic Hedging Activities (net of taxes of $20 and

$22) |

|

(0.06 |

) |

|

(55 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(65 |

) |

| Unrealized Gains Related to Nuclear Decommissioning Trust (NDT) Fund Investments (net

of taxes of $4) |

|

(0.06 |

) |

|

(53 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(53 |

) |

| Long-Lived Asset Impairments (net of taxes of $2) |

|

0.01 |

|

|

6 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

6 |

|

| Plant Retirements and Divestitures (net of taxes of $70 and $68) |

|

0.21 |

|

|

202 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

204 |

|

| Cost Management Program (net of taxes of $4, $0, $0, $1 and $3, respectively) |

|

0.01 |

|

|

13 |

|

|

— |

|

|

1 |

|

|

1 |

|

|

1 |

|

|

10 |

|

| Asset Retirement Obligation (net of taxes of $6) |

|

0.02 |

|

|

16 |

|

|

— |

|

|

— |

|

|

— |

|

|

16 |

|

|

— |

|

| Change in Environmental Liabilities (net of taxes of $3) |

|

(0.01 |

) |

|

(9 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(9 |

) |

| Reassessment of Deferred Income Taxes (entire amount represents tax expense) |

|

(0.02 |

) |

|

(18 |

) |

|

— |

|

|

— |

|

|

— |

|

|

(9 |

) |

|

(30 |

) |

| Noncontrolling Interests (net of taxes of $4) |

|

0.02 |

|

|

21 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

21 |

|

| 2018 Adjusted (non-GAAP) Operating Earnings |

|

$ |

0.88 |

|

|

$ |

856 |

|

|

$ |

193 |

|

|

$ |

127 |

|

|

$ |

64 |

|

|

$ |

195 |

|

|

$ |

318 |

|

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2017 do not include the following items (after tax) that were

included in reported GAAP Net Income:

|

|

Exelon |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Share |

|

Exelon |

|

ComEd |

|

PECO |

|

BGE |

|

PHI |

|

Generation |

| 2017 GAAP Net Income1 |

|

$ |

0.85 |

|

|

$ |

823 |

|

|

$ |

189 |

|

|

$ |

112 |

|

|

$ |

62 |

|

|

$ |

153 |

|

|

$ |

304 |

|

| Mark-to-Market Impact of Economic Hedging Activities (net of taxes of $29) |

|

(0.05 |

) |

|

(45 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(46 |

) |

| Unrealized Gains Related to NDT Fund Investments (net of taxes of $51) |

|

(0.07 |

) |

|

(67 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(67 |

) |

| Amortization of Commodity Contract Intangibles (net of taxes of $8) |

|

0.01 |

|

|

12 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

12 |

|

| Merger and Integrations Costs (net of taxes of $1, $6 and $5, respectively) |

|

— |

|

|

(1 |

) |

|

— |

|

|

— |

|

|

— |

|

|

(9 |

) |

|

7 |

|

| Long-Lived Asset Impairments (net of taxes of $16) |

|

0.03 |

|

|

24 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

25 |

|

| Plant Retirements and Divestitures (net of taxes of $47 and $46, respectively) |

|

0.08 |

|

|

71 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

72 |

|

| Cost Management Program (net of taxes of $8, $1, $1 and $6, respectively) |

|

0.01 |

|

|

13 |

|

|

— |

|

|

2 |

|

|

2 |

|

|

— |

|

|

10 |

|

| Bargain Purchase Gain (net of taxes of $0) |

|

(0.01 |

) |

|

(7 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(7 |

) |

| Asset Retirement Obligation (net of taxes of $1) |

|

— |

|

|

(2 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2 |

) |

| Reassessment of Deferred Income Taxes (entire amount represents tax expense) |

|

(0.02 |

) |

|

(21 |

) |

|

(3 |

) |

|

— |

|

|

— |

|

|

2 |

|

|

18 |

|

| Noncontrolling Interests (net of taxes of $4) |

|

0.02 |

|

|

20 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

20 |

|

| 2017 Adjusted (non-GAAP) Operating Earnings |

|

$ |

0.85 |

|

|

$ |

820 |

|

|

$ |

186 |

|

|

$ |

114 |

|

|

$ |

64 |

|

|

$ |

146 |

|

|

$ |

346 |

|

(1) Certain immaterial prior year amounts in the Registrants' Consolidated Statements of Operations and Comprehensive

Income have been recasted to reflect new accounting standards issued by the FASB and adopted as of Jan. 1, 2018.

Note:

Unless otherwise noted, the income tax impact of each reconciling item between GAAP Net Income and Adjusted (non-GAAP) Operating

Earnings is based on the marginal statutory federal and state income tax rates for each Registrant, taking into account whether the

income or expense item is taxable or deductible, respectively, in whole or in part. For all items except the unrealized gains

and losses related to NDT fund investments, the marginal statutory income tax rates for 2018 and 2017 ranged from 26.0 percent to

29.0 percent and 39.0 percent to 41.0 percent, respectively. Under IRS regulations, NDT fund investment returns are taxed at

different rates for investments if they are in qualified or non-qualified funds. The effective tax rates for the unrealized gains

and losses related to NDT fund investments were 7.7 percent and 43.2 percent for the three months ended Sept. 30, 2018 and 2017,

respectively.

Webcast Information

Exelon will discuss third quarter 2018 earnings in a one-hour conference call scheduled for today at 9 a.m. Central Time (10

a.m. Eastern Time). The webcast and associated materials can be accessed at

www.exeloncorp.com/investor-relations.

About Exelon

Exelon Corporation (NYSE: EXC) is a Fortune 100 energy company with the largest number of electricity and natural gas customers

in the U.S. Exelon does business in 48 states, the District of Columbia and Canada and had 2017 revenue of $33.5 billion. Exelon

serves approximately 10 million customers in Delaware, the District of Columbia, Illinois, Maryland, New Jersey and Pennsylvania

through its Atlantic City Electric, BGE, ComEd, Delmarva Power, PECO and Pepco subsidiaries. Exelon is one of the largest

competitive U.S. power generators, with more than 32,000 megawatts of nuclear, gas, wind, solar and hydroelectric generating

capacity comprising one of the nation’s cleanest and lowest-cost power generation fleets. The company’s Constellation business unit

provides energy products and services to approximately 2 million residential, public sector and business customers, including more

than two-thirds of the Fortune 100. Follow Exelon on Twitter @Exelon.

Non-GAAP Financial Measures

In addition to net income as determined under generally accepted accounting principles in the United States (GAAP), Exelon

evaluates its operating performance using the measure of Adjusted (non-GAAP) Operating Earnings because management believes it

represents earnings directly related to the ongoing operations of the business. Adjusted (non-GAAP) Operating Earnings exclude

certain costs, expenses, gains and losses and other specified items. This measure is intended to enhance an investor’s overall

understanding of period over period operating results and provide an indication of Exelon’s baseline operating performance

excluding items that are considered by management to be not directly related to the ongoing operations of the business. In

addition, this measure is among the primary indicators management uses as a basis for evaluating performance, allocating resources,

setting incentive compensation targets and planning and forecasting of future periods. Adjusted (non-GAAP) Operating Earnings

is not a presentation defined under GAAP and may not be comparable to other companies’ presentation. The Company has provided

the non-GAAP financial measure as supplemental information and in addition to the financial measures that are calculated and

presented in accordance with GAAP. Adjusted (non-GAAP) Operating Earnings should not be deemed more useful than, a substitute

for, or an alternative to the most comparable GAAP Net Income measures provided in this earnings release and attachments. This

press release and earnings release attachments provide reconciliations of adjusted (non-GAAP) Operating Earnings to the most

directly comparable financial measures calculated and presented in accordance with GAAP, are posted on Exelon’s website:

www.exeloncorp.com, and have been furnished to the Securities and Exchange Commission on Form 8-K

on Nov. 1, 2018.

Cautionary Statements Regarding Forward-Looking Information

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995 that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the

forward-looking statements made by the Registrants include those factors discussed herein, as well as the items discussed in (1)

the Registrants' 2017 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 23, Commitments and

Contingencies; (2) the Registrants' Third Quarter 2018 Quarterly Report on Form 10-Q (to be filed on Nov. 1, 2018) in (a) Part II,

Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 17,

Commitments and Contingencies; and (3) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned

not to place undue reliance on these forward-looking statements, which apply only as of the date of this press release. None of the

Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or

circumstances after the date of this press release.

|

|

|

|

|

| EXELON CORPORATION |

| GAAP Consolidated Statements of Operations and |

| Adjusted (non-GAAP) Operating Earnings Reconciling Adjustments |

|

(unaudited)

|

|

(in millions, except per share data)

|

|

|

|

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

|

June 30, 2018 |

|

June 30, 2017 (a) |

|

|

|

|

Non-GAAP |

|

|

|

|

|

Non-GAAP |

|

|

|

|

GAAP (b) |

|

Adjustments |

|

|

|

GAAP (b) |

|

Adjustments |

|

|

| Operating revenues |

|

$ |

8,076 |

|

|

$ |

5 |

|

|

(c) |

|

$ |

7,665 |

|

|

$ |

158 |

|

|

(c),(e) |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased power and fuel |

|

3,315 |

|

|

76 |

|

|

(c),(i) |

|

3,086 |

|

|

(48 |

) |

|

(c),(e) |

| Operating and maintenance |

|

2,307 |

|

|

(68 |

) |

|

(f),(h),(i),(j),(k) |

|

2,945 |

|

|

(524 |

) |

|

(f),(g),(h),(i),(j) |

| Depreciation and amortization |

|

1,088 |

|

|

(152 |

) |

|

(i) |

|

915 |

|

|

(35 |

) |

|

(i) |

| Taxes other than income |

|

428 |

|

|

— |

|

|

|

|

420 |

|

|

— |

|

|

|

| Total operating expenses |

|

7,138 |

|

|

|

|

|

|

7,366 |

|

|

|

|

|

| Gain on sales of assets and businesses |

|

4 |

|

|

(1 |

) |

|

(i) |

|

1 |

|

|

— |

|

|

|

| Operating income |

|

942 |

|

|

|

|

|

|

300 |

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(373 |

) |

|

— |

|

|

|

|

(436 |

) |

|

63 |

|

|

(h),(m) |

| Other, net |

|

44 |

|

|

158 |

|

|

(d) |

|

177 |

|

|

(66 |

) |

|

(d),(m) |

| Total other income and (deductions) |

|

(329 |

) |

|

|

|

|

|

(259 |

) |

|

|

|

|

| Income before income taxes |

|

613 |

|

|

|

|

|

|

41 |

|

|

|

|

|

| Income taxes |

|

66 |

|

|

126 |

|

|

(c),(d),(h),(i),(j),(k),(l) |

|

(62 |

) |

|

353 |

|

|

(c),(d),(e),(f),(g),(h),(i),(j),(m) |

| Equity in losses of unconsolidated affiliates |

|

(5 |

) |

|

— |

|

|

|

|

(9 |

) |

|

— |

|

|

|

| Net income |

|

542 |

|

|

|

|

|

|

94 |

|

|

|

|

|

| Net income (loss) attributable to noncontrolling interests |

|

3 |

|

|

33 |

|

|

(n) |

|

(1 |

) |

|

(20 |

) |

|

(n) |

| Net income attributable to common shareholders |

|

$ |

539 |

|

|

|

|

|

|

$ |

95 |

|

|

|

|

|

| Effective tax rate(o) |

|

10.8 |

% |

|

|

|

|

|

(151.2 |

)% |

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.56 |

|

|

|

|

|

|

$ |

0.10 |

|

|

|

|

|

| Diluted |

|

$ |

0.56 |

|

|

|

|

|

|

$ |

0.10 |

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

967 |

|

|

|

|

|

|

934 |

|

|

|

|

|

| Diluted |

|

969 |

|

|

|

|

|

|

936 |

|

|

|

|

|

| Effect of adjustments on earnings per average diluted common share

recorded in accordance with GAAP: |

| Mark-to-market impact of economic hedging activities (c) |

|

$ |

(0.07 |

) |

|

|

|

|

|

$ |

0.12 |

|

|

|

| Unrealized gains (losses) related to NDT fund investments (d) |

|

0.08 |

|

|

|

|

|

|

(0.05 |

) |

|

|

| Amortization of commodity contract intangibles (e) |

|

— |

|

|

|

|

|

|

0.01 |

|

|

|

| Merger and integration costs (f) |

|

— |

|

|

|

|

|

|

0.02 |

|

|

|

| Merger commitments (g) |

|

— |

|

|

|

|

|

|

— |

|

|

|

| Long-lived asset impairments (h) |

|

0.03 |

|

|

|

|

|

|

0.29 |

|

|

|

| Plant retirements and divestitures (i) |

|

0.14 |

|

|

|

|

|

|

0.07 |

|

|

|

| Cost management program (j) |

|

0.01 |

|

|

|

|

|

|

0.01 |

|

|

|

| Change in environmental liabilities (k) |

|

0.01 |

|

|

|

|

|

|

— |

|

|

|

| Reassessment of deferred income taxes (l) |

|

(0.01 |

) |

|

|

|

|

|

— |

|

|

|

| Like-kind exchange tax position (m) |

|

— |

|

|

|

|

|

|

(0.03 |

) |

|

|

| Noncontrolling interests (n) |

|

(0.04 |

) |

|

|

|

|

|

0.02 |

|

|

|

| Total adjustments |

|

$ |

0.15 |

|

|

|

|

|

|

$ |

0.46 |

|

|

|

(a) Certain immaterial prior year amounts in the Registrants' Consolidated Statements of Operations and Comprehensive Income

have been recasted to reflect new accounting standards issued by the FASB and adopted as of January 1, 2018.

(b) Results reported in accordance with accounting principles generally accepted in the United States (GAAP).

(c) Adjustment to exclude the mark-to-market impact of Exelon’s economic hedging activities, net of intercompany

eliminations.

(d) Adjustment to exclude the impact of net unrealized gains and losses on Generation’s NDT fund investments for Non-Regulatory

and Regulatory Agreement Units. The impacts of the Regulatory Agreement Units, including the associated income taxes, are

contractually eliminated, resulting in no earnings impact.

(e) Adjustment to exclude the non-cash amortization of intangible assets, net, primarily related to commodity contracts recorded

at fair value related to the ConEdison Solutions and FitzPatrick acquisitions.

(f) Adjustment to exclude certain costs associated with mergers and acquisitions, including, if and when applicable,

professional fees, employee-related expenses and integration activities. In 2017, reflects costs related to the PHI and FitzPatrick

acquisitions, and in 2018, reflects costs related to the PHI acquisition.

(g) Adjustment to exclude costs incurred as part of the settlement orders approving the PHI acquisition.

(h) Adjustment to exclude charges to earnings related to the impairment of the ExGen Texas Power, LLC (EGTP) assets held for

sale in 2017, and in 2018 the impairment of certain wind projects at Generation.

(i) Adjustment to exclude, in 2017, primarily reflects accelerated depreciation and amortization expenses and one-time charges

associated with Generation's decision to early retire the Three Mile Island nuclear facility. In 2018, primarily reflects

accelerated depreciation and amortization expense associated with Generation's decision to early retire the Oyster Creek and Three

Mile Island nuclear facilities and a loss associated with Generation's sale of Residential Solar Holding, LLC, partially offset by

a gain associated with Generation's sale of its electrical contracting business.

(j) Adjustment to exclude severance and reorganization costs related to a cost management program.

(k) Adjustment to exclude charges to adjust the environmental reserve associated with Cotter.

(l) Adjustment to exclude an adjustment to the remeasurement of deferred income taxes as a result of the Tax Cuts and Jobs Act

(TCJA).

(m) Adjustment to exclude adjustments to income tax, penalties and interest expenses in the second quarter of 2017 as a result

of the finalization of the IRS tax computation related to Exelon's like-kind exchange tax position.

(n) Adjustment to exclude elimination from Generation’s results of the noncontrolling interest related to certain exclusion

items, primarily related to the impact of unrealized gains and losses on NDT fund investments at CENG.

(o) The effective tax rate related to Adjusted (non-GAAP) Operating Earnings is 20.9% and 36.2% for the three months ended June

30, 2018 and June 30, 2017, respectively.

|

|

|

|

|

| EXELON CORPORATION |

| GAAP Consolidated Statements of Operations and |

| Adjusted (non-GAAP) Operating Earnings Reconciling Adjustments |

|

(unaudited)

|

|

(in millions, except per share data)

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2018 |

|

Six Months Ended June 30, 2017

(a) |

|

|

|

|

Non-GAAP |

|

|

|

|

|

Non-GAAP |

|

|

|

|

GAAP (b) |

|

Adjustments |

|

|

|

GAAP (b) |

|

Adjustments |

|

|

| Operating revenues |

|

$ |

17,769 |

|

|

$ |

102 |

|

|

(c) |

|

$ |

16,413 |

|

|

$ |

116 |

|

|

(c),(e) |

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased power and fuel |

|

8,042 |

|

|

(107 |

) |

|

(c),(i) |

|

6,985 |

|

|

(141 |

) |

|

(c),(e),(i) |

| Operating and maintenance |

|

4,691 |

|

|

(104 |

) |

|

(f),(h),(i),(j),(l) |

|

5,383 |

|

|

(572 |

) |

|

(f),(g),(h),(i),(j) |

| Depreciation and amortization |

|

2,179 |

|

|

(289 |

) |

|

(i) |

|

1,811 |

|

|

(37 |

) |

|

(e),(i) |

| Taxes other than income |

|

874 |

|

|

— |

|

|

|

|

857 |

|

|

— |

|

|

|

| Total operating expenses |

|

15,786 |

|

|

|

|

|

|

15,036 |

|

|

|

|

|

| Gain on sales of assets and businesses |

|

60 |

|

|

(54 |

) |

|

(i) |

|

5 |

|

|

(1 |

) |

|

(i) |

| Bargain purchase gain |

|

— |

|

|

— |

|

|

|

|

226 |

|

|

(226 |

) |

|

(k) |

| Operating income |

|

2,043 |

|

|

|

|

|

|

1,608 |

|

|

|

|

|

| Other income and (deductions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(745 |

) |

|

— |

|

|

|

|

(809 |

) |

|

59 |

|

|

(h),(o),(m) |

| Other, net |

|

17 |

|

|

269 |

|

|

(d) |

|

434 |

|

|

(274 |

) |

|

(d),(m) |

| Total other income and (deductions) |

|

(728 |

) |

|

|

|

|

|

(375 |

) |

|

|

|

|

| Income before income taxes |

|

1,315 |

|

|

|

|

|

|

1,233 |

|

|

|

|

|

| Income taxes |

|

125 |

|

|

274 |

|

|

(c),(d),(f),(h),(i),(j),

(l),(n)

|

|

149 |

|

|

441 |

|

|

(c),(d),(e),(f),(g),(h),(i),(j),(m),(n),(o) |

| Equity in losses of unconsolidated affiliates |

|

(11 |

) |

|

— |

|

|

|

|

(18 |

) |

|

— |

|

|

|

| Net income |

|

1,179 |

|

|

|

|

|

|

1,066 |

|

|

|

|

|

| Net income (loss) attributable to noncontrolling interests |

|

54 |

|

|

57 |

|

|

(p) |

|

(20 |

) |

|

(55 |

) |

|

(p) |

| Net income attributable to common shareholders |

|

$ |

1,125 |

|

|

|

|

|

|

$ |

1,086 |

|

|

|

|

|

| Effective tax rate(q) |

|

9.5 |

% |

|

|

|

|

|

12.1 |

% |

|

|

|

|

| Earnings per average common share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.16 |

|

|

|

|

|

|

$ |

1.17 |

|

|

|

|

|

| Diluted |

|

$ |

1.16 |

|

|

|

|

|

|

$ |

1.17 |

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

967 |

|

|

|

|

|

|

931 |

|

|

|

|

|

| Diluted |

|

968 |

|

|

|

|

|

|

932 |

|

|

|

|

|

| Effect of adjustments on earnings per average diluted common share

recorded in accordance with GAAP: |

| Mark-to-market impact of economic hedging activities (c) |

|

$ |

0.13 |

|

|

|

|

|

|

$ |

0.15 |

|

|

|

| Unrealized gains (losses) related to NDT fund investments (d) |

|

0.15 |

|

|

|

|

|

|

(0.15 |

) |

|

|

| Amortization of commodity contract intangibles (e) |

|

— |

|

|

|

|

|

|

0.02 |

|

|

|

| Merger and integration costs (f) |

|

— |

|

|

|

|

|

|

0.04 |

|

|

|

| Merger commitments (g) |

|

— |

|

|

|

|

|

|

(0.15 |

) |

|

|

| Long-lived asset impairments (h) |

|

0.03 |

|

|

|

|

|

|

0.29 |

|

|

|

| Plant retirements and divestitures (i) |

|

0.23 |

|

|

|

|

|

|

0.07 |

|

|

|

| Cost management program (j) |

|

0.02 |

|

|

|

|

|

|

0.01 |

|

|

|

| Bargain purchase gain (k) |

|

— |

|

|

|

|

|

|

(0.24 |

) |

|

|

| Change in environmental liabilities (l) |

|

0.01 |

|

|

|

|

|

|

— |

|

|

|

| Like-kind exchange tax position (m) |

|

— |

|

|

|

|

|

|

(0.03 |

) |

|

|

| Reassessment of deferred income taxes (n) |

|

(0.01 |

) |

|

|

|

|

|

(0.02 |

) |

|

|

| Tax settlements (o) |

|

— |

|

|

|

|

|

|

(0.01 |

) |

|

|

| Noncontrolling interests (p) |

|

(0.06 |

) |

|

|

|

|

|

0.06 |

|

|

|

| Total adjustments |

|

$ |

0.50 |

|

|

|

|

|

|

$ |

0.04 |

|

|

|

(a) Certain immaterial prior year amounts in the Registrants' Consolidated Statements of Operations and Comprehensive Income

have been recasted to reflect new accounting standards issued by the FASB and adopted as of January 1, 2018.

(b) Results reported in accordance with accounting principles generally accepted in the United States (GAAP).

(c) Adjustment to exclude the mark-to-market impact of Exelon’s economic hedging activities, net of intercompany

eliminations.

(d) Adjustment to exclude the impact of net unrealized gains and losses on Generation’s NDT fund investments for Non-Regulatory

and Regulatory Agreement Units. The impacts of the Regulatory Agreement Units, including the associated income taxes, are

contractually eliminated, resulting in no earnings impact.

(e) Adjustment to exclude the non-cash amortization of intangible assets, net, primarily related to commodity contracts recorded

at fair value related to the ConEdison Solutions and FitzPatrick acquisitions.

(f) Adjustment to exclude certain costs associated with mergers and acquisitions, including, if and when applicable,

professional fees, employee-related expenses and integration activities. In 2017, reflects costs related to the PHI and FitzPatrick

acquisitions, offset at PHI by the anticipated recovery of previously incurred PHI acquisition costs, and in 2018, reflects costs

related to the PHI acquisition.

(g) Adjustment to exclude a decrease in reserves for uncertain tax positions related to the deductibility of certain merger

commitments associated with the 2012 CEG and 2016 PHI acquisitions.

(h) Adjustment to exclude charges to earnings related to the impairment of the ExGen Texas Power, LLC (EGTP) assets held for

sale in 2017, and in 2018 the impairment of certain wind projects at Generation.

(i) Adjustment to exclude accelerated depreciation and amortization expenses and one-time charges associated with Generation's

decision to early retire the Three Mile Island nuclear facility in 2017. In 2018, primarily reflects accelerated depreciation and

amortization expenses and one-time charges associated with Generation's decision to early retire the Oyster Creek nuclear facility,

as well as accelerated depreciation and amortization expenses associated with the 2017 decision to early retire the Three Mile

Island nuclear facility and a loss associated with Generation's sale of Residential Solar Holding, LLC, partially offset by a gain

associated with Generation's sale of its electrical contracting business.

(j) Adjustment to exclude severance and reorganization costs related to a cost management program.

(k) Adjustment to exclude the excess of the fair value of assets and liabilities acquired over the purchase price for the

FitzPatrick acquisition.

(l) Adjustment to exclude charges to adjust the environmental reserve associated with Cotter.

(m) Adjustment to exclude adjustments to income tax, penalties and interest expenses in the second quarter of 2017 as a result

of the finalization of the IRS tax computation related to Exelon’s like-kind exchange tax position.

(n) Adjustment to exclude the change in the District of Columbia statutory tax rate in 2017, and in 2018, an adjustment to the

remeasurement of deferred income taxes as a result of the Tax Cuts and Jobs Act (TCJA).

(o) Adjustment to exclude benefits related to the favorable settlement in 2017 of certain income tax positions related to PHI's

unregulated business interests.

(p) Adjustment to exclude elimination from Generation’s results of the noncontrolling interest related to certain exclusion

items, primarily related to the impact of unrealized gains and losses on NDT fund investments at CENG.

(q) The effective tax rate related to Adjusted (non-GAAP) Operating Earnings is 18.7% and 35.6% for the six months ended June

30, 2018 and June 30, 2017, respectively.

Exelon Corporation

Emily Duncan

Investor Relations

312-394-2345

or

Paul Adams

Corporate Communications

410-470-4167

View source version on businesswire.com: https://www.businesswire.com/news/home/20181101005324/en/