Walt Disney Co (NYSE: DIS) is reported

fiscal fourth-quarter earnings after Thursday's close.

Benzinga took a look back at Disney’s last six fourth-quarter earnings reports to look for any potential patterns in how the

stock reacts.

- Q4 2017: shares gained 2 percent the day following the report

- Q4 2016: up 2.8 percent

- Q4 2015: up 2.3 percent

- Q4 2014: down 2.1 percent

- Q4 2013: up 2.1 percent

- Q4 2012: down 5.9 percent

While most initial fourth-quarter earnings reactions have been relatively modest, Disney does have several instances of large

earnings moves following other quarterly earnings reports. The stock dropped 9.1 percent following its Q3 2015 earnings report

after gaining 7.6 percent following its Q1 earnings report earlier that year.

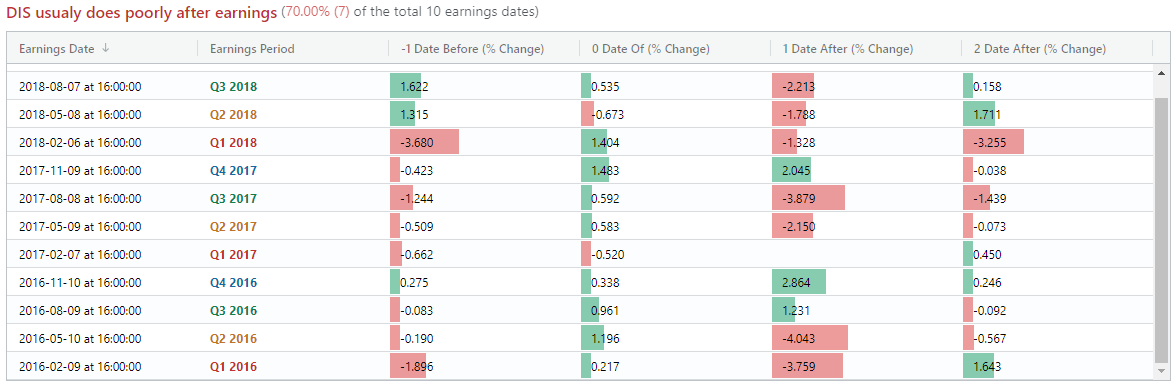

The chart below shows how Disney stock has reacted to its past three years of earnings reports:

Here are some potential takeaways from the information outlined above:

- Disney tends to have relatively modest earnings reactions of less than 4 percent.

- Disney stock has reacted mostly negatively to earnings reports, trading lower the following day more than 80 percent of the

time.

- Disney hasn’t had a positive reaction to earnings at all so far in 2018.

- Disney stock has averaged a one-day move of +/- 2.5 percent.

According to Optionslam.com, Disney’s seven-day implied

movement based on the weekly options market is 4.3 percent.

Disney's stock closed Wednesday at $117.05 per share. The stock is up 8.6 percent year-to-date.

Related Links:

Barclays

Upgrades Disney On Streaming Service Optimism

9

Streaming Services With The Best Original Content

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.