Walmart Inc. (NYSE: WMT) became the latest

major store to exceed earnings estimates Wednesday, and shares of the company climbed in pre-market trading. The WMT news might

help give the rest of the market a lift, but Brexit worries have the dollar on the rise again.

Walmart earnings of $1.08 per share beat third-party consensus of $1.01, while revenue of $124.9 billion came in just shy of

estimates. WMT also raised fiscal 2019 guidance, and said ecommerce sales—a closely-watched area—rose 43 percent. That was well

above estimates of 35 to 40 percent, and came as U.S. same-store sales also rose more sharply than analysts had anticipated. It

looks like shoppers are clicking the keys and walking through the doors.

WMT’s strength follows solid results earlier this week from Home Depot Inc. (NYSE: HD) and Macy’s Inc. (NYSE: M). However, a positive earnings report isn’t necessarily the prescription for a rally,

as Macy’s investors discovered yesterday. What WMT’s results suggest, when combined with results from the other retailers reporting

so far, is that consumers continue to step up heading into holiday season. That might be a good omen for the shopping days

ahead.

Brexit negotiations continue, leaving investors to watch the resulting mayhem in the mother country. UK Prime Minister Theresa

May had won her cabinet’s support for a Brexit plan yesterday, but May and her team still have to get the plan through Parliament.

That’s a whole new challenge as the deadline nears for the UK to leave the EU. Challenges already arose Thursday when the UK’s

“Brexit secretary” resigned, which raises questions about the agreement and even about May’s political future. The pound got kicked

on the resignation news, and the dollar index climbed slightly to 97.21, not far from recent 16-month highs.

The rising dollar is one factor weighing on U.S. stocks lately, so the Brexit resignation news might not be the best tidings for

the market. We’ll have to wait and see.

In other earnings news early Thursday, Cisco Systems, Inc. (NASDAQ: CSCO) shares rose in pre-market trading after the company surpassed Wall Street

analysts’ estimates. Nvidia Corporation (NASDAQ: NVDA) reports after the close (see more below). J.C. Penney Company

Inc. (NYSE: JCP) shares fell after the struggling

retailer cut its earnings outlook after missing Wall Street analysts’ estimates for same-store sales.

Meanwhile, there was more good news on the consumer front this morning as October retail sales rose 0.8 percent, beating

consensus estimates of 0.5 percent.

Rally Hats Still On Shelf

The steep losses earlier this week haven’t repeated, but there hasn’t been a comeback rally, either. The S&P 500 (SPX)

enters today down five-straight sessions, and hovering just above what some analysts see as psychological support at the 2700

level. One question is whether the SPX might once again test its lows from last month down near 2600. Such a dip wouldn’t be

unprecedented. Remember, stocks originally got slammed last February, recovered a bit, and then made new lows in April.

The SPX is barely up for the year, and the small-cap Russell 2000 (RUT) index is in the red year-to-date. Nasdaq (COMP) still

holds some 2018 gains, but they’ve been clipped a lot over the last few weeks.

There hasn’t been any break from the volatility, either, with the VIX back above 21. That’s still well below highs above 26 last

month, but also up from near 16 earlier this month. As long as this volatility persists, we could continue to see big market

swings. Keep in mind that volatility is simply back at historic levels, and this has been an incredibly orderly downward move. What

seems to be happening is a repricing of assets, and news out of China could continue to drive the market one way or the other.

Wednesday saw growth and cyclical stocks like financials and technology continue getting smacked around amid the volatility.

However, these are two of the very sectors that might have the most to gain if some of the geopolitical factors—particularly trade

with China—start to ease. If we get some good news around tariffs, momentum stocks might be a possible beneficiary.

Semiconductors Take Center Stage

There wasn’t much momentum in the market’s performance Wednesday, but it wasn’t a complete washout. Apple Inc. (NASDAQ:

AAPL) shares continue to cast a big negative shadow as they

moved into bear territory, but tech also had some names in the green. The semiconductors looked a bit better, with Advanced

Micro Devices, Inc. (NASDAQ: AMD) making big gains

ahead of rival Nvidia’s (NVDA) earnings today. AMD’s better performance came after the stock got crushed earlier this week, which

raises the possibility that Wednesday’s action might have been bargain hunting, to some extent. The semiconductors have been one of

the most volatile areas of the market lately.

NVDA’s earnings this afternoon

could be the next big catalyst for the sector, one way or the other. The company is expected to report EPS of $1.71, up from $1.33

in the prior-year quarter, on revenue of $3.24 billion, according to third-party consensus analyst estimates. Revenue is projected

to grow 22.8 percent year over year.

Washington Weighs In

The midterm results earlier this month might be starting to have an impact. On Wednesday, financial stocks fell after Rep.

Maxine Waters—incoming Democratic chair of the House Financial Services Committee—said in a committee meeting that there will be no

more easing of banking regulations once she takes control in January. Financials fell more than 1 percent, making the sector one of

the day’s worst performers, though not all the losses were necessarily related to her comments. This isn’t a political column, but

you can’t overlook the possible impact of new leadership in Congress, especially when there’s been so much de-regulatory emphasis

out of Washington the last two years.

While financials lagged, crude oil broke its 12-day losing streak Wednesday amid talk that OPEC might cut production at its

meeting next month. The moribund energy sector, however, still lost a little ground.

One positive factor that might have gotten a little overlooked this week is Home Depot (HD) raising its guidance. That sort of

optimistic outlook was one that was generally lacking from a lot of reporting companies lately. Many CEOs have been

conservative—and who could blame them—because no one is really sure where things might land come Jan. 1, especially on geopolitical

issues like China.

Powell Talk

Fed Chair Jerome Powell spoke in a Q&A session at a Fed event in Dallas last night, once again putting the economy in a

positive light. However, he added that the Fed is at a point where it has to take risks from moving either too quickly or too

slowly on policy “seriously,” and he did identify risks to the economic outlook, according to MarketWatch. Twice he noted that the

global economy was slowing, which Powell called “concerning.”

Waning fiscal stimulus and the lagged effect of the Fed’s previous rate hikes are also concerns for Powell, the media outlet

said. Powell is also worried about the slowdown in housing and the fact that many potential home buyers have never lived in a high

mortgage rate environment. He didn’t specifically discuss rate policy, according to media reports.

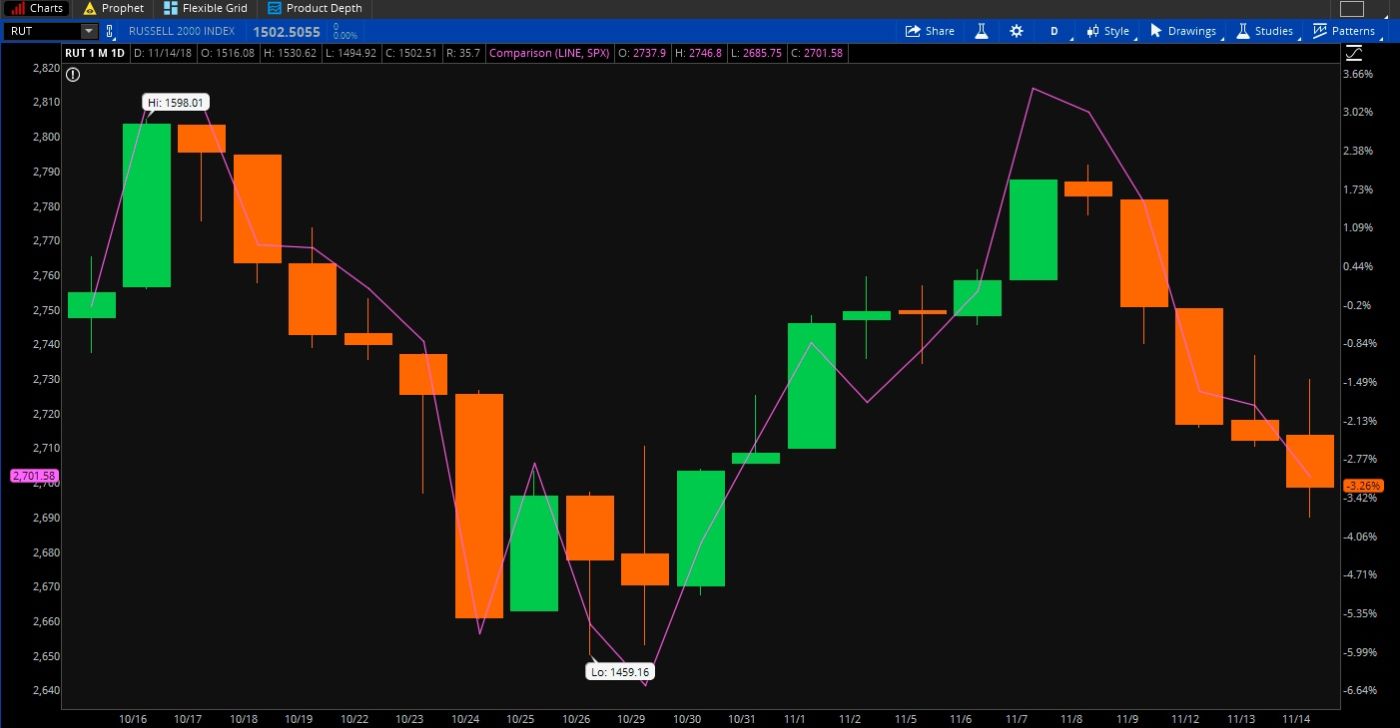

Figure 1: No Escape For Big or Small: Over the last month, neither the Russell 2000 (RUT) index of small caps

(candlestick) or the S&P 500 (purple line) have been able to get much traction. It doesn’t look like investors are favoring

small caps over large, at least from a high-level perspective. Data Sources: S&P Dow Jones Indices, FTSE Russell. Chart

source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not

guarantee future results.

Ignition Sequence Starts

Though company buybacks seem to dominate the financial news cycle, another interesting development so far this year is the

growing initial public offering (IPO) market. According to The Wall Street Journal, it's been the busiest year for U.S.-listed IPOs

by number of deals and proceeds since 2014, with 212 companies raising $57 billion. That includes 50 technology companies that

raised $19.7 billion. Next year could be even bigger, the paper reported, as some of the largest startups that have been waiting in

the wings, like ride-hailing service Uber Technologies Inc. and data-mining specialist Palantir Technologies Inc., prepare for

their debuts.

Investors have been snapping up newly minted shares, especially in tech. Through the end of October, technology shares that

debuted on U.S. exchanges this year were up 22 percent on average, The Wall Street Journal said. That compared with a 1.4

percent rise in the S&P 500 through Oct. 31 and a 9.9 percent gain for tech shares in the index through Oct. 31. Does this mean

investors should hop on the IPO wagon? Consider taking the time to understand what you¹re investing in. An IPO can seem

exciting, but that excitement sometimes gets investors into a mode where they leap before they look. For every hot tech IPO,

there¹s often a flop. It just might not get as much attention.

Welcome to Winter—Here’s Your Bill

You may get a break at the gas station this holiday season but lose some of that extra pocket money when you pay to heat your

home. Natural gas futures flared pretty sharply over the last few weeks, in part because we’re going into the highest demand season

with supplies at 15-year lows. Also, November brought colder than normal temperatures to much of the U.S., raising demand. Natural

gas inventories stood at 3,143 billion cubic feet (Bcf) for the week ending on Oct. 26, or about 623 Bcf lower than at the same

point last year and 638 Bcf below the five-year average. Considering all this, perhaps it’s not too surprising to see natural gas

futures spike double digits at times Wednesday, and up 35 percent since the start of the month.

The tight inventory situation might actually reflect industry progress, ironically. Forbes reports that U.S. natural gas exports

have surged in the last two years as new terminals have come online. The price spike might prove temporary if milder weather comes

back, Forbes added. Current prices probably aren’t enough to put too much of a dent in consumer wallets. On the other hand, a

prolonged period of high heating costs, like the one during the “polar vortex” of 2014, would potentially weigh on consumer demand

for other products, so investors might want to keep an eye on natural gas in the weeks ahead.

Keeping Emotions Out

Some investors may wonder why there’s so much focus on volatility. It’s certainly a more obscure concept than some other

fundamental market metrics like price-to-earnings or GDP. Where volatility can have a big impact is at times like these, when the

VIX is above 20 and the market becomes prone to sharp gains and losses. Nerves often fray as investors see sharp drops like the one

on Monday, and lose their long-term focus. Sometimes this sentiment builds on itself and becomes kind of a self-fulfilling

prophecy.

While there are appropriate times to sell stocks, especially if your long-term plans have changed or if your portfolio becomes

over-exposed to stocks vs. fixed income, simply jumping out due to frayed nerves in a volatile market arguably doesn’t make much

sense. Being a successful long-term

investor takes discipline, patience, and the ability to weather tough times like the ones we’re in. Discipline can be hard.

That’s why there’s a multi-billion dollar diet industry. All joking aside, it might help to ignore emotion as much as possible and

develop a thoughtful, objective relationship with the market and your holdings, especially on money earmarked for long-term

objectives like retirement.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any

particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with

each strategy, including commission costs, before attempting to place any trade.

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.