Capri Holdings Limited Completes Acquisition of Versace

Capri Holdings Limited, a global fashion luxury group, announced today that it has changed its name from Michael Kors Holdings

Limited (NYSE: KORS), and beginning on January 2, 2019, its New York Stock Exchange ticker symbol will be CPRI. The company is also

pleased to announce that it has completed its acquisition of Versace.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181231005037/en/

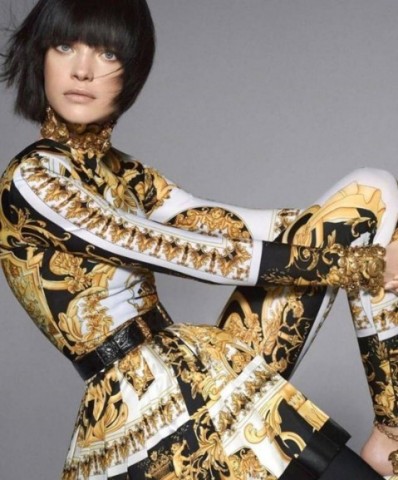

VERSACE (Photo: Business Wire

John D. Idol, Chairman and Chief Executive Officer of Capri Holdings said, “With the acquisition of Versace, we have now created

one of the leading global fashion luxury groups in the world. The new name for our group, Capri Holdings, is inspired by the fabled

island which has long been recognized as an iconic, glamorous and luxury destination. The island’s spectacular three rock

formation, formed over 200 million years ago, is symbolic of the timeless heritage and strong foundation that is at the core of

each of the three founder-led brands.”

Mr. Idol continued, “Versace has long been recognized as one of the world’s leading fashion luxury houses, and is synonymous

with Italian glamour and style. We are thrilled that the house of Versace is now part of the Capri Holdings family of luxury

brands. We look forward to working with Chief Creative Officer Donatella Versace, Chief Executive Officer Jonathan Akeroyd, and

their incredibly talented team to continue to drive Versace’s growth and success globally.”

Strategic Rationale

The acquisition of Versace is expected to deliver a number of benefits for Capri Holdings, including:

- Expand global group to include three iconic founder-led brands defined by fashion luxury products

with a reputation for world-class design and innovation

- Opportunity to help grow the group’s revenues to US$8.0 billion in the long-term

- Grow Versace to US$2.0 billion in revenues

- Grow Jimmy Choo to US$1.0 billion in revenues

- Grow Michael Kors to US$5.0 billion in revenues

- Diversify geographic revenues, increasing exposure to growing Asia region:

- 66% Americas to 57% Americas

- 23% Europe to 24% Europe

- 11% Asia to 19% Asia

- Potential to create long-term operational synergies

Transaction Details

As previously announced, Capri Holdings acquired Versace for a total enterprise value of Euro 1.83 billion (or approximately

US$2.12 billion on the date of announcement). The cash portion of the purchase price was funded by a combination of cash on hand,

drawings under its revolving credit facility, and bank term loans. Concurrently with the closing, the Versace family reinvested an

aggregate of Euro 150 million of the cash received for their interests in Versace in exchange for 2,395,170 ordinary shares of

Capri Holdings.

Additional Information

For additional information concerning Capri Holdings Limited and the Versace acquisition, please see the investor presentation

available on the Capri Holdings Limited website at www.capriholdings.com. For

the avoidance of doubt, the contents of this website are not incorporated into and do not form part of this press release.

About Capri Holdings Limited

Capri Holdings Limited is a global fashion luxury group, consisting of iconic brands that are industry leaders in design, style

and craftsmanship. Its brands cover the full spectrum of fashion luxury categories including women’s and men’s accessories,

footwear and ready-to-wear as well as wearable technology, watches, jewelry, eyewear and a full line of fragrance products. The

company’s goal is to continue to extend the global reach of its brands while ensuring that they maintain their independence and

exclusive DNA. Capri Holdings Limited is publicly listed on the New York Stock Exchange, and commencing January 2, 2019, its ticker

will be CPRI.

Forward-Looking Statements

This press release contains statements which are, or may be deemed to be, “forward-looking statements.” Forward-looking

statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of

the management of Capri Holdings Limited (the “Company”) about future events, and are therefore subject to risks and uncertainties

which could cause actual results to differ materially from the future results expressed or implied by the forward-looking

statements. All statements other than statements of historical facts included in this press release may be forward-looking

statements. Without limitation, any statements preceded or followed by or that include the words “targets”, “plans”, “believes”,

“expects”, “aims”, “intends”, “will”, “should”, “could”, “would”, “may”, “anticipates”, “estimates”, “synergy”, “cost-saving”,

“projects”, “goal”, “strategy”, “budget”, “forecast” or “might” or, words or terms of similar substance or the negative thereof,

are forward-looking statements. Forward-looking statements include statements relating to the following: (i) the expected effects

of the Versace acquisition on the Company; (ii) future capital expenditures, expenses, revenues, earnings, economic performance,

indebtedness, financial condition, share buybacks, dividend policy, losses and future prospects; (iii) business and management

strategies and the expansion and growth of the Company’s operations and benefits from the acquisition; and (iv) the effects of

government regulation on the Company’s business. These forward-looking statements are not guarantees of future financial

performance. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect

expected results and are based on certain key assumptions. Many risks, uncertainties and other factors could cause actual results

to differ materially from those projected or implied in any forward-looking statements. These risks, uncertainties and other

factors include the Company’s ability to integrate the Versace businesses successfully and to achieve anticipated benefits of the

Versace acquisition; the risk of disruptions to the Company’s businesses; the negative effects of the consummation of the

acquisition on the market price of the Company’s ordinary shares and its operating results; significant transaction costs; unknown

liabilities; the risk of litigation and/or regulatory actions related to the Versace acquisition; fluctuations in demand for the

Company’s products; levels of indebtedness (including the indebtedness incurred in connection with the Versace acquisition); future

availability of credit; the timing and scope of future share buybacks, which may be suspended at any time due to market conditions

and the level of other investing activities and uses of cash; changes in consumer traffic and retail trends; loss of market share

and industry competition; fluctuations in the capital markets; fluctuations in interest and exchange rates; the occurrence of

unforeseen disasters or catastrophes; political or economic instability in principal markets; adverse outcomes in litigation; and

general, local and global economic, political, business and market conditions, as well as those risks set forth in the reports that

the Company files from time to time with the U.S. Securities and Exchange Commission, including the Company’s Annual Report on Form

10-K for the fiscal year ended March 31, 2018 (File No. 001-35368). Other unknown or unpredictable factors could cause actual

results to differ materially from those in the forward-looking statements. Such forward-looking statements should therefore be

construed in the light of such factors. Unless otherwise required by applicable law, the Company does not provide any

representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in

this press release will actually occur. Due to such uncertainties and risks, readers are cautioned not to place undue reliance on

such forward-looking statements. All subsequent oral or written forward-looking statements attributable to the Company are

expressly qualified in their entirety by the cautionary statement above. The Company disclaims any obligation to update or revise

any forward-looking or other statements contained herein other than in accordance with legal and regulatory obligations.

Capri Holdings Limited

Katina Metzidakis

(201) 514-8234

InvestorRelations@capriholdings.com

Media:

Capri Holdings Limited

Francesca Leoni

Press@capriholdings.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20181231005037/en/