Even as the 2019 market attempts to shake off last year’s volatility, the incoming earnings season stands to disrupt traders

attempts to restore normalcy. Earnings tend to be a trailing indicator, and reflect a company’s health and financial strategy

anywhere from 3-6 month prior. If you’ve been paying attention, a lot happened in the last six months of 2018.

By taking a look at company financial data provided by stock research platform Finscreener — and contextualizing a few of the major unresolved economic questions from last

year — a picture emerges of what factors are driving buying into the Q4 2018 postmortem.

The Global Perspective

It’s difficult to assess anything about the market without first reckoning with the ongoing issues regarding international trade

and growth. Fears of a gradually slowing global economy started

emerging mid-2018, alongside U.S. tariffs on goods from Canada, Mexico, the EU and, of course, China.

More recent concerns about anemic oil and commodity prices and rapidly contracting productivity in China have only added to the

uncertainty. Recall, January’s batch of reports are coming on the tail of what turned out to be a devastating announcement from

Apple Inc. (NASDAQ: AAPL) about the

sluggishness of its emerging market sales, particularly in China.

What It Means For Earnings

These lingering events, as well as the prospect of a widely forecasted slowdown in the U.S. economy, are among the biggest macro

considerations the market is carrying into the reporting season. One useful tool for getting an idea of a company's ability to

weather the fallout of events like this is debt to capital ratios against its valuation and cash flow statistics.

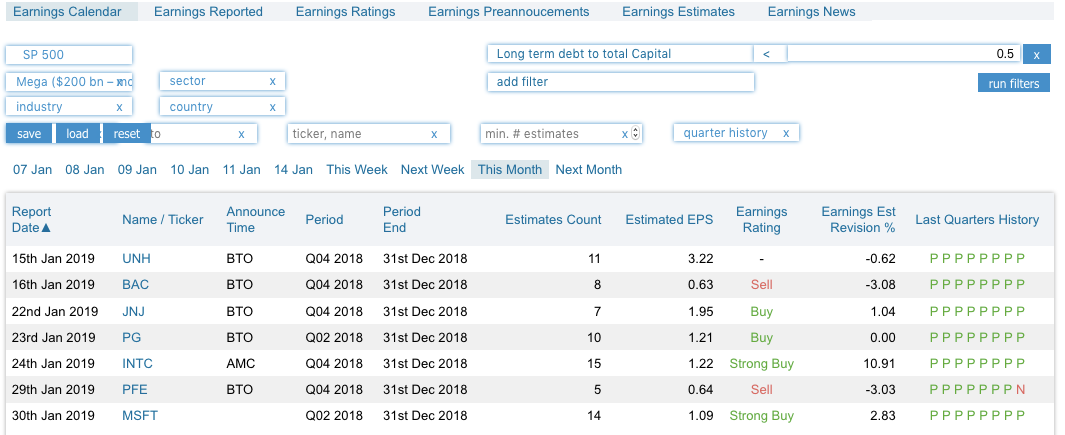

By using Finscreener’s earnings calendar to first sort companies scheduled to report this month, then screening for those with a

long term debt to capital ratio below 0.4, an interesting picture emerges of January’s first batch of reports. Keep in mind that

this survey is limited to mega-cap (>$200 billion) companies on the S&P 500.

As you might expect, safety names like UnitedHealth Group Inc. (NYSE: UNH) Procter & Gamble Co. (NYSE: PG) and Johnson & Johnson (NYSE: JNJ) make appearances. However, more interesting are names with greater international

exposure like Intel Corporation (NASDAQ: INTC), Microsoft Corporation (NASDAQ: MSFT) and Pfizer Inc. (NYSE: PFE), which are all set to report at the end of the month.

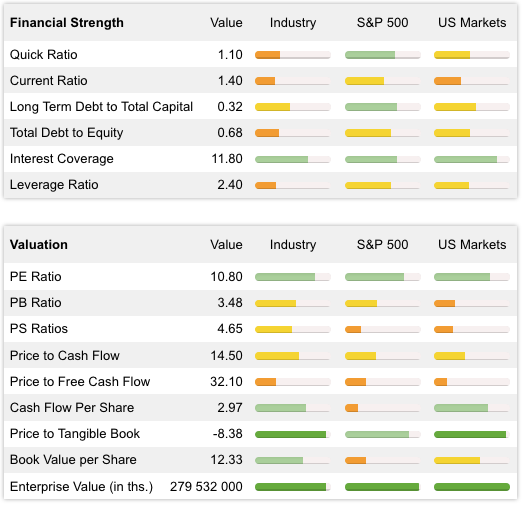

Keying in on Pfizer first, its strong performance in the past month seemingly runs counter to the company’s focus on continuing

to invest its second largest market in China, which the company’s new CEO

singled out as a priority upon beginning his tenure. Its average leverage statistics and relatively low valuation make its

popularity a little less surprising.

Should the Jan. 29th report reflect more evidence of a slowing Chinese economy, expect investors to hit the stock hard. However,

Pfizer’s overall financial health will likely carry it past any headwinds that might appear in its quarterly report.

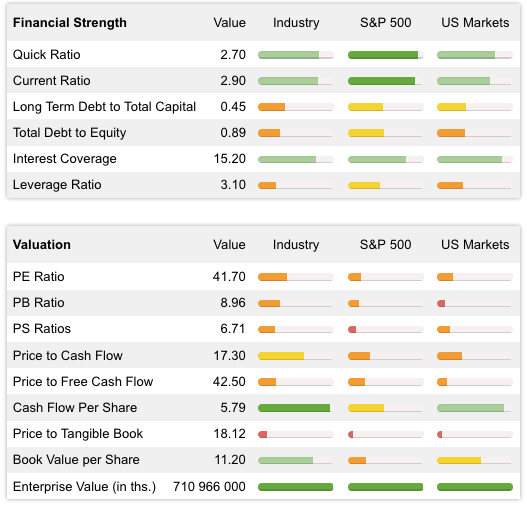

Turning to the two tech concerns, given the trouble with Apple and the ongoing U.S. tariff on semiconductor components Microsoft

(reporting Jan. 30) and Intel (reporting Jan. 24) might have more persistent troubles crop up on their financials this time

around.

Relative to its price, Microsoft’s financials are uniformly low, which says a lot even as the stock is about 10 percent below

its 52-week high. What’s more informative is Microsoft’s low cash flow statistics, which are even lower than those of the heavily

leveraged Apple.

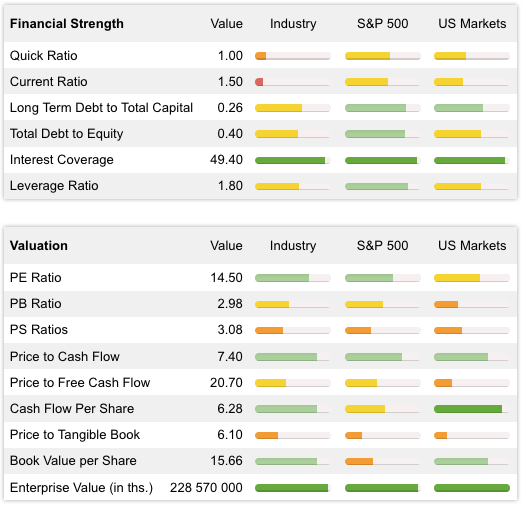

Alternatively, Intel, which is down more than 16 percent from its 2018 high, is in a much stronger valuation position to either

weather a disappointing report or benefit from exceeding estimates.

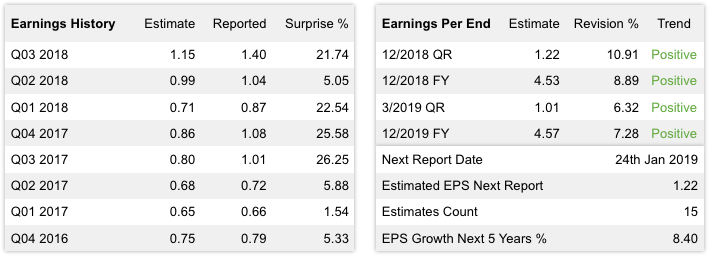

Further benefiting Intel is its earnings track record, which reveals a long string of positive surprises and upward

revisions.

It’s critical to remember that Intel, like Microsoft and Apple, has a big stake in China as both a supplier and buyer of their

products, so a disappointing report is possible on all fronts.

Given the state of the market heading into this season, traders would benefit from researching the full financial picture of a

company or industry to anticipate any surprises before they happen.

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.