iAnthus' Multistate Operations Expands to 11 States Forming Super-Regional Footprints

NEW YORK and TORONTO, Feb. 5,

2019 /CNW/ - iAnthus Capital Holdings, Inc. ("iAnthus" or the "Company") (CSE: IAN, OTCQX: ITHUF) and

MPX Bioceutical Corporation ("MPX") (CSE: MPX; OTC: MPXEF) are pleased to announce the closing of the previously announced

plan of arrangement (the "Arrangement") under the Business Corporations Act (British Columbia) pursuant to which iAnthus acquired all of the issued and outstanding common shares of MPX

(the "MPX Shares") pursuant to the terms of an arrangement agreement, as amended, among, inter alia, iAnthus and MPX dated

October 18, 2018 (the "Arrangement Agreement").

Pursuant to the terms of the Arrangement Agreement, holders of MPX Shares received 0.1673 common shares of iAnthus for each

MPX Share held, representing a premium of 30.6% based on the closing price of iAnthus and MPX Shares on October 17, 2018. In addition, each MPX shareholder received common shares of newly formed MPX International

Corporation ("MPX International"), which holds all of the non-U.S. cannabis businesses of MPX. MPX International has

received conditional approval to list its securities on the Canadian Securities Exchange (the "CSE") and MPX International

expects that the common shares of MPX International will commence trading on or around February 6,

2019.

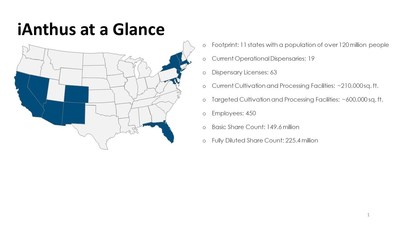

The combined company (iAnthus and MPX), now has operations in 11 states that will permit iAnthus to operate 63 retail

locations and 15 cultivation/processing facilities. As a result of the business combination, iAnthus has added retail and/or

production capabilities in Arizona, Maryland, Nevada, California, Massachusetts and

New Jersey. These additional licenses complement iAnthus' existing assets in New York, Florida, Massachusetts,

Vermont, Colorado, and New

Mexico, forming super-regional footprints in both the eastern and western United States

reaching over 121 million potential customers.

iAnthus has submitted applications to the CSE and the Ontario Securities Commission to delist the MPX Shares and for MPX to

cease to be a reporting issuer.

Management Commentary

"2019 will be a transformative year for iAnthus, with the closing of our business combination with MPX being a crucial step

forward. As the U.S. cannabis market continues to expand with increasing consumer and regulatory acceptance, iAnthus will

continue to execute and provide the quality products and brands that our customers demand. As demonstrated with our 2018

acquisitions in Florida and New York, and now with the closing

of our MPX transaction, the iAnthus team continues to demonstrate its focus on growing its platform and operations." said

Hadley Ford, CEO of iAnthus.

"As early pioneers in the licensed cannabis sector in Arizona, Nevada and Maryland, MPX is extremely excited to join forces with iAnthus

as we create the multi-state operator that will define this burgeoning industry. We plan to add the power of our market leading

product, retail and wholesale experience to the iAnthus platform." said Beth Stavola, Chief

Operating Officer of MPX.

"With iAnthus' operation increasing in size from six to 11 states, we plan to take advantage of this opportunity by unveiling

unified national retail and product brands across the organization," said Mr. Ford. "We realize that as the cannabis market

continues to grow, the need for strong national brands only increases. With our ambitions to be the leader in the U.S. cannabis

market, that is our logical next step. Stay tuned, as we plan to unveil further details around this in the coming weeks."

Management and Board Changes

Immediately prior to the closing of the Arrangement, all directors and officers of MPX resigned and MPX is now a wholly-owned

subsidiary of iAnthus. iAnthus will expand its board of directors to seven members. Current board members Hadley Ford, Randy Maslow, Julius Kalcevich and

Paul Rosen will be joined by MPX's nominees Robert Petch,

Elizabeth Stavola, and Robert Galvin. Dr. Richard Boxer has resigned from the board of directors of iAnthus to make way for one of MPX's nominees and

will remain with iAnthus in the role of Chief Medical Officer. Mr. Ford added, "On behalf of iAnthus and MPX, I'd like to thank

Robert Petch and MPX's special committee for their support of this transaction."

Further information about the closing of the Arrangement is available on the SEDAR profile of iAnthus on SEDAR at www.sedar.com.

About iAnthus Capital Holdings, Inc.

iAnthus Capital Holdings, Inc. owns and operates best-in-class licensed cannabis cultivation, processing and dispensary

facilities throughout the United States, providing investors diversified exposure to the U.S.

regulated cannabis industry. Founded by entrepreneurs with decades of experience in operations, investment banking, corporate

finance, law and health care services, iAnthus provides a unique combination of capital and hands-on operating and management

expertise. The Company uses these skills to support operations across six states. For more information, visit www.iAnthusCapital.com.

Forward Looking Statements

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning

the specific factors disclosed here and elsewhere in iAnthus' periodic filings with Canadian securities regulators. When used in

this news release, words such as "will, could, plan, estimate, expect, intend, may, potential, believe, should, our vision" and

similar expressions, are forward-looking statements.

Forward-looking statements may include, without limitation, anticipated benefits associated with the business combination with

MPX, the delisting of the MPX Shares, the cessation of MPX as a reporting issuer, the listing of MPX International on the CSE,

the size of iAnthus' retail footprint, iAnthus' national retail strategy, and other statements of fact.

Readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are

made as of the date of this release. iAnthus disclaims any intention or obligation to update or revise such information, except

as required by applicable law, and iAnthus does not assume any liability for disclosure relating to any other company mentioned

herein.

The Canadian Securities Exchange has not reviewed, approved or disapproved the content of this news

release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in

the United States. The securities have not been and will not be registered under the United

States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered

or sold within the United States or to U.S. Persons unless registered under the U.S. Securities

Act and applicable state securities laws or an exemption from such registration is available.

View original content to download multimedia:http://www.prnewswire.com/news-releases/ianthus-and-mpx-bioceutical-announce-closing-of-transformational-1-6-billion-business-combination-300790408.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/ianthus-and-mpx-bioceutical-announce-closing-of-transformational-1-6-billion-business-combination-300790408.html

SOURCE iAnthus Capital Holdings, Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/05/c6822.html