VANCOUVER, Feb. 6, 2019 /CNW/ - Trilogy Metals Inc.

(TSX/NYSE American: TMQ) ("Trilogy Metals", "Trilogy" or the "Company") is pleased to announce a new regional

exploration budget of $2 million that is in addition to the previously announced 2019 programs and

budgets of $16.2 million, increasing the exploration budget at the Company's Upper Kobuk Mineral

Projects ("UKMP") located in the Ambler Mining District of Northwest Alaska for 2019 to

$18.2 million. All amounts are in US dollars.

Exploration Budget

Last December the Company's technical team held meetings in Perth, Australia with

representatives of South32 Limited (ASX, LSE, JSE: S32; ADR: SOUHY) ("South32"). Subsequent to these meetings, additional

discussions took place in Vancouver resulting in both Companies agreeing to increase exploration

expenditures at the UKMP by $2 million. The additional $2.0 million

has been approved for regional or district exploration focused on identifying and testing new drill targets within the Ambler

Volcanogenic Massive Sulphide ("VMS") Belt. The Company will contribute $1 million to the UKMP

regional program and South32 will contribute the remaining $1 million.

The $1 million that South32 is contributing is in excess of the $30

million in option payments that South32 has already contributed to maintain the option to form a 50/50 joint venture on

the UKMP (see the press release dated January 31, 2019 for more information on the option agreement

between Trilogy and South32).

Rick Van Nieuwenhuyse, President and CEO of Trilogy Metals commented, "As an exploration

geologist, I am very excited that the Technical Committee and South32 have agreed to equally fund a $2

million exploration program along the Ambler VMS belt. The program will include a VTEM airborne geophysical survey

along the entire belt. Follow-up ZTEM may be flown in certain areas. High priority targets will be evaluated with

follow-up drilling. There are dozens of known VMS prospects along the 75 mile-long Ambler Belt including many with historic

resources. It is exciting to be drilling new exploration targets again. We are confident that we can find additional

high-grade polymetallic resources along this prolific mineral belt."

Ambler VMS Belt

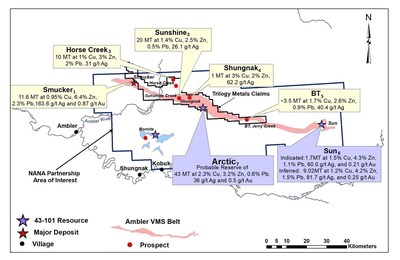

The Ambler mining district is located on the southern margin of the Brooks Range. Within this VMS belt, several deposits and

prospects (including the Arctic Deposit) are hosted in the Ambler Sequence, a group of Middle Devonian to Early Mississippian,

metamorphosed, bimodal volcanic and volcaniclastic rocks with interbedded siliceousclastic, graphitic, and calcareous

metasediments. The Ambler sequence occurs in the upper part of the regional Anirak Schist. VMS-style mineralization is found

along the entire 110 km strike length of the district. In addition to the Arctic Deposit, numerous other VMS-like occurrences are

present on the Trilogy Metals land package. The most notable of these occurrences are the Dead Creek (also known as Shungnak), Sunshine, Cliff, Horse, and the Snow prospects to the west of the Arctic Deposit and the Red,

Nora, Tom-Tom and BT prospects to the east (Figures 1 and 2).

|

1.

|

Source: Anaconda Copper Mining Company ("ACM"), ACM Internal Report,

1981

|

|

2.

|

Source: Kennecott Mines Company ("KMC"), KCM Internal Report,

1985

|

|

3.

|

Source: Kennecott Mines Company ("KMC"), KCM Internal Report,

1997

|

|

4.

|

Source: Bear Creek Mining Company ("BCM"), BCM Progress Report,

1983

|

|

5.

|

Source: Kennecott Mines Company ("KMC"), KCM Internal Report,

1997

|

|

6.

|

Source: North of 60 Mining News, September 7, 2018. The Sun project is

100%-owned by Valhalla Metals Inc. Inferred resources have a great amount of uncertainty as to their existence and as to

whether they can be mined legally or economically. It cannot be assumed that all or any part of inferred resources will

ever be upgraded to a higher category. See "Cautionary Note to United States Investors."

|

|

7.

|

"Arctic Project, Northwest Alaska, USA, NI 43-101 Technical Report on

Pre-Feasibility Study". See the news release at https://Trilogy PR February 20, 2018 and the technical report which is available

on the Company's website at https://trilogymetals.com/assets/docs/2018-04-06-Arctic-NI-43-101-TechReport.pdf or on the Company's

profiles at www.sedar.com and

www.sec.gov.

|

A Qualified Person has not done sufficient work to classify the above historical estimates (Smucker, Horse Creek, Sunshine,

Shungnak and BT) as current mineral resources or mineral reserves. Trilogy is not treating these

historical estimates as current mineral resources or mineral reserves, has not verified the above historical resource estimates

and is not relying on them. The historical estimates were prepared prior to the adoption and implementation of National

Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and do not use categories that conform to the

current Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral

Reserves. Additional work, including drilling, would need to be carried out on these historical resources to make them

complaint with NI 43-101.

Generally, VMS belts host clusters of deposits that can range from 1 million tonnes to over 100 million tonnes, and can

contain high-grade copper, zinc, lead and precious metals. Some of the most prolific base-metal mineral belts in the world are

within VMS districts such as the Flin Flon Belt of northern Manitoba, the Iberian Pyrite Belt in

Spain and Portugal and the Noranda area of Quebec (Figure 3).

The Company is well financed to complete these programs. With cash and cash equivalents at its fiscal year-end over

$20.0 million and the funding from South32 of $10.2 million, the

Company has over $30.0 million to advance the UKMP Projects. Trilogy also has 6.5 million

warrants held by large shareholders expiring on July 2, 2019, at an exercise price of $1.52 which is below the Company's current trading price. Trilogy would receive an additional

$10 million with the full exercise of the warrants.

|

*See the Company's technical reports entitled "Arctic Project, Northwest

Alaska, USA, NI 43-101 Technical Report on the Pre-Feasibility Study" with an effective date of February 20, 2018 and

filed on April 6, 2018 and "NI 43-101 Technical Report on the Bornite Project, Northwest Alaska, USA" with an effective

date of June 5, 2018 and filed on July 20, 2018.

|

|

Inferred resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of

inferred resources will ever be upgraded to a higher category. See "Cautionary Note to United States

Investors."

|

Qualified Persons

Andrew W. West, Certified Professional Geologist, Exploration Manager for Trilogy Metals Inc.,

is a Qualified Person as defined by National Instrument 43-101. Mr. West has reviewed the technical information in this news

release and approves the disclosure contained herein.

About Trilogy Metals

Trilogy Metals Inc. is a metals exploration and development company focused on exploring and developing the Ambler mining

district located in northwestern Alaska. It is one of the richest and most-prospective known

copper-dominant districts located in one of the safest geopolitical jurisdictions in the world. It hosts world-class polymetallic

volcanogenic massive sulphide ("VMS") deposits that contain copper, zinc, lead, gold and silver, and carbonate replacement

deposits which have been found to host high-grade copper and cobalt mineralization. Exploration efforts have been focused on two

deposits in the Ambler mining district - the Arctic VMS deposit and the Bornite carbonate replacement deposit. Both deposits are

located within the Company's land package that spans approximately 143,000 hectares. The Company has an agreement with NANA

Regional Corporation, Inc., a Regional Alaska Native Corporation that provides a framework for the exploration and potential

development of the Ambler mining district in cooperation with local communities. Our vision is to develop the Ambler mining

district into a premier North American copper producer.

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain "forward-looking information" and "forward-looking statements" (collectively

"forward-looking statements") within the meaning of applicable Canadian and United States

securities legislation including the United States Private Securities Litigation Reform Act of 1995. All statements, other than

statements of historical fact, included herein, including, without limitation, further drilling and exploration activity, the

potential advancement of the AMDIAP, the Company's ability to find additional resources at the UKMP and mining generally in

Alaska, the timing and the filing of updated reports on the Company's projects, the future price

of copper, the estimation of mineral reserves and mineral resources, the realization of mineral reserve and mineral resource

estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of

the development of projects, the likelihood and timing of the AMDIAP, the potential future development of Bornite, the future

operating or financial performance of the Company, planned expenditures and the anticipated activity at the UKMP Projects, are

forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects",

"anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events,

conditions, or results "will", "may", "could", or "should" occur or be achieved. These forward-looking statements may include

statements regarding perceived merit of properties; exploration plans and budgets; mineral reserves and resource estimates; work

programs; capital expenditures; timelines; strategic plans; market prices for precious and base metals; or other statements that

are not statements of fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that

such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in

such statements. Important factors that could cause actual results to differ materially from the Company's expectations include

the uncertainties involving success of exploration, development and mining activities, permitting timelines, requirements for

additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses; mineral

reserve and resource estimates and the assumptions upon which they are based; assumptions and discount rates being appropriately

applied to the pre-feasibility study; our assumptions with respect to the likelihood and timing of the AMDIAP; capital estimates;

prices for energy inputs, labour, materials, supplies and services the interpretation of drill results, the need for additional

financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved

in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for

cooperation of government agencies and native groups in the development and operation of properties as well as the construction

of the access road; the need to obtain permits and governmental approvals; risks of construction and mining projects such as

accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements, unanticipated variation

in geological structures, metal grades or recovery rates; unexpected cost increases, which could include significant increases in

estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; and other risks and

uncertainties disclosed in the Company's Annual Report on Form 10-K for the year ended November 30,

2017 filed with Canadian securities regulatory authorities and with the United States Securities and Exchange Commission

and in other Company reports and documents filed with applicable securities regulatory authorities from time to time. The

Company's forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made. The

Company assumes no obligation to update the forward-looking statements or beliefs, opinions, projections, or other factors,

should they change, except as required by law.

Cautionary Note to United States Investors

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource

and reserve estimates included in this press release have been prepared in accordance with Canadian National Instrument 43-101

Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy and Petroleum

(CIM)—CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended ("CIM Definition

Standards"). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public

disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI

43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (SEC), and resource

and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular,

and without limiting the generality of the foregoing, the term "resource" does not equate to the term "reserves". Under U.S.

standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization

could be economically and legally produced or extracted at the time the reserve determination is made. The SEC's disclosure

standards normally do not permit the inclusion of information concerning "measured mineral resources", "indicated mineral

resources" or "inferred mineral resources" or other descriptions of the amount of mineralization in mineral deposits that do not

constitute "reserves" by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that all or any

part of "measured" or "indicated resources" will ever be converted into "reserves". Investors should also understand that

"inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic

and legal feasibility. Under Canadian rules, estimated "inferred mineral resources" may not form the basis of feasibility or

pre-feasibility studies except in rare cases. Disclosure of "contained ounces" in a resource is permitted disclosure under

Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves"

by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for

identification of "reserves" are also not the same as those of the SEC, and reserves reported by Trilogy Metals in compliance

with NI 43-101 may not qualify as "reserves" under SEC standards. Arctic does not have known reserves, as defined under SEC

Industry Guide 7. Accordingly, information concerning mineral deposits set forth herein may not be comparable with

information made public by companies that report in accordance with U.S. standards.

View original content to download multimedia:http://www.prnewswire.com/news-releases/trilogy-metals-announces-increase-in-2019-exploration-budget-at-the-upper-kobuk-mineral-projects-300790491.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/trilogy-metals-announces-increase-in-2019-exploration-budget-at-the-upper-kobuk-mineral-projects-300790491.html

SOURCE Trilogy Metals Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/06/c3865.html