TORONTO, Feb. 11, 2019 /CNW/ - Roxgold Inc. ("Roxgold" or "the

Company") (TSX: ROXG) (OTC: ROGFF) is pleased to announce that it has entered into an agreement with Newcrest West Africa

Holdings Pty Ltd ("Newcrest") to acquire a portfolio of 11 exploration permits in Côte d'Ivoire (the "Tenements"), which includes

the Séguéla gold project ("Séguéla"), for total upfront consideration of US$20 million (the

"Transaction"). All amounts in this news release are expressed in US dollars.

Highlights of the Transaction

- Highly prospective exploration permits covering 3,298 km2 in the attractive mining jurisdiction of Côte d'Ivoire

with significant scope to build upon existing data and high-quality exploration work completed to date

- Near-term development potential at the flagship Séguéla project, which hosts the Antenna deposit and a number of satellite

opportunities

- Séguéla's Antenna deposit hosts a mineral resource containing an inferred resource of 5.8Mt at 2.3 g/t Au for 430koz

Au1

- Acquisition cost of $20 million upon closing with a further payment of $10 million upon first gold production from the subject land package

- Addition to management team with the return of Paul Criddle to a full time executive

position

John Dorward, President and Chief Executive Officer of Roxgold commented, "Roxgold is excited

to acquire Séguéla and the related permits from Newcrest. This acquisition represents a meaningful addition to our growth

pipeline, providing a key second asset, immediate additional resource upside and a large prospective land package all in an

accretive transaction for Roxgold shareholders. Rarely does such a large and carefully assembled land package become

available from one of the world's leading gold producers and Séguéla is expected to materially increase Roxgold's overall

resource inventory, particularly after we bring the deposit up to National Instrument 43-101 standards later this year. We

also believe there is substantial near-term exploration upside at this deposit, and regionally, with the opportunity to

significantly advance Séguéla in the near term."

Paul Weedon, Vice President, Exploration added, "This acquisition provides Roxgold with a very

attractive exploration portfolio that includes highly prospective early stage opportunities as well as an advanced stage

exploration asset in Séguéla. Acquiring these assets from Newcrest allows us to build upon the high quality exploration work they

have completed to date. We are eager to get to work on this portfolio to fully explore the potential upside we see at these

assets."

Terms of the Agreement

Roxgold is acquiring the Tenements from Newcrest for upfront consideration of $20 million.

Roxgold is also committing to a further payment of $10 million in cash upon production of the first

gold from any of the areas covered by the Tenements. Closing of the Transaction is dependent upon, amongst other things, the

renewal of certain tenements and the approval from the Minister of Mines of Côte d'Ivoire and other required regulatory

approvals.

About the Tenements

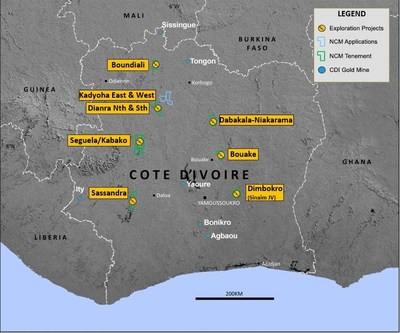

The Tenements are located across prospective Birimian greenstone belts in the established mining jurisdiction of Côte d'Ivoire

and includes highly prospective early stage projects as well as advanced stage projects throughout Côte d'Ivoire (See Figure 1).

To date, approximately $21 million dollars has been invested in exploration and approximately

117,000 metres of drilling has been completed on the Tenements, allowing for significant scope to build upon existing data and

exploration work completed to date.

Included in the portfolio is the advanced exploration Séguéla gold project that hosts the near surface Antenna gold deposit.

Séguéla is located approximately 240 kilometres north-west of Yamoussoukro, the political

capital of Côte d'Ivoire, and approximately 480 kilometres north-west of Abidjan, the commercial

capital of the country. The Antenna gold deposit consists of near-surface, potentially open pittable mineralization and is

ideally located near existing infrastructure including grid power, transport and water resources.

Newcrest has been operating in Côte d'Ivoire since 2010 and discovered the Antenna deposit in 2016. Roxgold intends to keep

key infrastructure and personnel in place to ensure a smooth transition of activities at site. A maiden mineral resource was

declared at Séguéla's Antenna deposit in December 2017 in accordance with JORC

20121.

Mineral Resources – Antenna Deposit*1

|

Mineral Resources

Antenna Deposit

|

Tonnes (Mt)

|

Grade (g/t Au)

|

Ounces (koz)

|

|

Inferred

|

5.8

|

2.3

|

430

|

|

(*) The mineral resources presented are as defined under the JORC Code,

which is materially consistent with National Instrument 43-101.

|

The Company is currently undertaking work to support a conversion from JORC reporting standards to National Instrument 43-101

reporting which is expected to be completed in the first half of 2019.

Furthermore, Séguéla presents a significant opportunity to further assess multiple priority exploration targets within 15

kilometres of the Antenna deposit. These targets have the potential to increase the resource base and enhance the potential

economics of the Séguéla project by adding low-cost near surface ounces (see Figure 2). In addition to Antenna, early

stage drilling by Newcrest has produced results ranging from trace to 14 metres at 58.1 g/t Au from 0 metres, and including

several high-grade intercepts from the nearby Agouti, Boulder, Kwenko and Ancien prospects, all of which support the potential to

add additional ounces to the project.

Additional notable results from the satellite targets include2:

Boulder:

- 9 metres at 16.9 g/t Au in SGRD162 from 145 metres; and

- 7 metres at 9.1 g/t Au in SGRC161 from 18 metres.

Agouti:

- 14 metres at 58.1 g/t Au in SGAC5021 from 0 metres;

- 5 metres at 20.4 g/t Au in SGRC152 from 44 metres;

- 4 metres at 16.5 g/t Au in SGRC185 from 125 metres; and

- 11 metres at 5.1 g/t Au in SGRC187 from 21 metres.

Ancien:

- 16 metres at 9.3 g/t Au in SGRC172 from 37 metres.

Roxgold intends to elaborate on its near-term exploration plans for Séguéla prior to the end of the current quarter.

In addition, significant exploration potential exists across the balance of the Tenements with large total holdings covering

3,298 km2. These early stage, prospective regional opportunities exist on the Dimbokro, Dianra North and South,

Boundiali and Bouake Permits (see Figure 1).

Raymond James Ltd. has acted as financial advisor and Norton Rose Fulbright has acted as legal

advisor to Roxgold.

Management Addition

Roxgold is also pleased to announce that Mr. Paul Criddle will be returning to the Company in a

full-time executive capacity as Chief Development Officer. John Dorward, President and Chief

Executive Officer of Roxgold commented, "We are very pleased to have Paul returning to Roxgold in an executive function. Paul was

the prime mover for the definition and development of Yaramoko which has been one of the most successful projects developed by a

junior in recent years. In terms of its current stage, Séguéla is of nearly identical scale to when we started with Yaramoko so I

am very pleased to have Paul back in an executive capacity to lead the efforts on our second growth project."

As part of his transition to an executive function, Mr. Criddle will step down from his current role as a non-executive

director of Roxgold.

Qualified Person

Paul Weedon, MAIG, Vice President, Exploration for Roxgold Inc., is a Qualified Person within

the meaning of National Instrument 43-101, having verified and approved the technical data disclosed in this press release. This

includes the sampling, analytical and test data underlying the information.

About Roxgold

Roxgold is a gold mining company with its key asset, the high grade Yaramoko Gold Mine, located in the Houndé greenstone

region of Burkina Faso, West Africa. Roxgold trades on the TSX

under the symbol ROXG and as ROGFF on OTC.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities laws

("forward-looking statements"). Such forward-looking statements include, without limitation: statements with respect to closing

of the proposed Transaction, Mineral Resource estimates (including proposals for the potential conversion thereof from JORC to

National Instrument 43-101 standards, and the anticipated timing thereof), anticipated receipt and maintenance of permits and

licenses and renewal of the Tenements proposed to be acquired, future potential production, satellite opportunities and

exploration and development potential of the Tenements, retention of personnel and existing infrastructure following the

Transaction, future expansion and development plans, proposed exploration plans and the timing and costs thereof, the anticipated

costs, timing and sufficiency of future funding. These statements are based on information currently available to the Company and

the Company provides no assurance that actual results will meet management's expectations. In certain cases, forward-looking

information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Forward-looking information contained in this news release is based on certain factors and assumptions

regarding, among other things, satisfaction of all closing conditions to the completion of the Transaction, the estimation of

Mineral Resources, the realization of resource estimates, the timing and amount of future exploration and development

expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the

availability of necessary financing and materials to continue to explore and develop the Tenements, the progress of exploration

and development activities as currently proposed and anticipated, the receipt of necessary regulatory approvals and permits

including renewals of the Tenements, and assumptions with respect to currency fluctuations, environmental risks, title disputes

or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information

currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially

from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in

forward-looking statements include: failure to satisfy all closing conditions to the completion of the Transaction, changes in

market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses,

changes in the costs and timing of the development, inaccurate resource estimates, changes in the price of gold, unanticipated

changes in key management personnel, failure to obtain permits or renewal of the Tenements as anticipated or at all, failure of

exploration and/or development activities to progress as currently anticipated or at all, and general economic conditions. Mining

exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those

projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company's

forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on

the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made

from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

___________________________________

1 Newcrest declared an inferred mineral resource of 5.8Mt at 2.3 g/t Au for 430koz Au for the Antenna Deposit in their

Annual Mineral Resources and Ore Reserves Statement – 31 December 2017 in accordance with JORC

2012, released to the ASX on 15 February 2018.

2 Potential quantity and grade is conceptual in nature. There has been insufficient exploration to define a National

Instrument 43-101 compliant mineral resource on the Tenements and it is uncertain if further exploration will result in the

Tenements being delineated as such a mineral resource.

View original content to download multimedia:http://www.prnewswire.com/news-releases/roxgold-to-acquire-the-seguela-gold-project-in-cote-divoire-and-announces-addition-to-management-team-300793497.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/roxgold-to-acquire-the-seguela-gold-project-in-cote-divoire-and-announces-addition-to-management-team-300793497.html

SOURCE Roxgold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/11/c9045.html