Stocks around the world are swimming in a sea of green Wednesday morning as optimism continues to grow about possible

resolutions to some of the major geopolitical issues haunting the markets. The S&P 500 Index (SPX) starts the day above its

200-day moving average for the first time in more than two months.

A double-dose of good news got the U.S. market back on a positive track Tuesday after several days of malaise, and the U.S.

gains spread overseas to Europe and Asia early Wednesday. Stocks are reacting to hopes for a deal to potentially avoid a government

shutdown this weekend, along with the potential for a looser deadline for China trade negotiations. President Trump said Tuesday he

might let the early March deadline slip if progress is being made. Talks between the two countries resume this week, and there were

media reports early Wednesday that China’s President Xi might meet with U.S. negotiators.

Early Wednesday, The Wall Street Journal reported that the president is expected to sign a congressional deal on border

security, which would keep the government open after Friday’s deadline.

The SPX is now at its highest level since early December, and boasts a three-day winning streak, while the Dow Jones Industrial

Average ($DJI) and Nasdaq (COMP) ride seven-week win streaks of their own.

As investors digested the new developments affecting two of the major global storylines, volatility eased. However, other risk

meters remained slightly elevated, as gold rose on Tuesday and U.S. Treasuries barely moved off of recent highs. From those

indications, it might appear that at least some investors are keeping a little powder dry for now, perhaps because geopolitical

events tend to change so quickly. The 10-year Treasury note yield remains under its year-ago level despite the recent strong stock

rally, though a dovish Fed might explain some of that.

Fresh data landed on investors’ desks early Wednesday when the U.S. government reported consumer price data for January. The

headline consumer price index (CPI) reading was flat, while core CPI—which strips out food and energy—rose 0.2%, in line with

expectations.

Declining energy prices were offset by rises in food and shelter costs, the Labor Department said. Headline inflation rose just

1.6% year over year, the lowest since June 2017. Core inflation rose 2.2%, the same reading as November and December.

At first glance, the data didn’t seem to show much, if anything, for inflation hawks to get excited over. The consensus

projections heading into the report had been for an overall reading of 0.1% and a core rise of 0.2%, according to Briefing.com.

Headline Risk Hasn’t Gone Away

Investors might want to consider that there’s also the potential for things to turn on a dime with any of the geopolitical

stories. Yesterday, the news was good. Today or perhaps tomorrow, a headline could change the market’s positive tone. It really

becomes about the story of the day. Any rumor on how China-U.S. negotiations are doing has the potential to color the entire tone

of any given session.

Another factor to potentially keep an eye on is the sector standings. Yesterday saw a lot of strength in “risk-on” areas like

financials and industrials. If investors remain generally optimistic about the global stage, it wouldn’t be too surprising to see

this sort of sector emphasis continue. One way to possibly measure the market’s degree of concern, especially about the China

situation, is to watch the performance of so-called “defensive” sectors like utilities, health care and staples, as well as

volatility and the dollar. Any strength in these areas might reflect renewed worries.

Early Wednesday, the dollar index resumed its recent climb and rose back above 96.80. Recent dollar strength appears to reflect

weakness in Asian and European economies, as well as worries about Brexit. The greenback rally, if it continues, could potentially

begin to weigh on U.S. stocks. However, the SPX and the dollar have been marching upward in sync over the last month or so.

Activision Blizzard, Cisco Among Earnings Highlights

Earnings season is still humming along as well, and Activision Blizzard, Inc. (NASDAQ: ATVI) reported late yesterday. Shares of the video game company rose more

than 3% in pre-market trading despite the fact that it missed analysts’ revenue estimates and put out lower than expected guidance.

It’s possible that the stock is reacting to word that ATVI plans a stock buyback and cost cuts, analysts said.

Earnings season continues after the close today with Cisco Systems, Inc. (NASDAQ: CSCO). Investors might want to listen to CSCO executives for any hint at how Asian

sales are going, and for any discussion of how the company might be affected if the U.S. and China resume their tariff battle.

Deere & Company (NYSE: DE) is another

big multinational stock reporting earnings later this week. Walmart, Inc (NYSE: WMT) steps to the plate early next week.

Back Above 200 For SPX

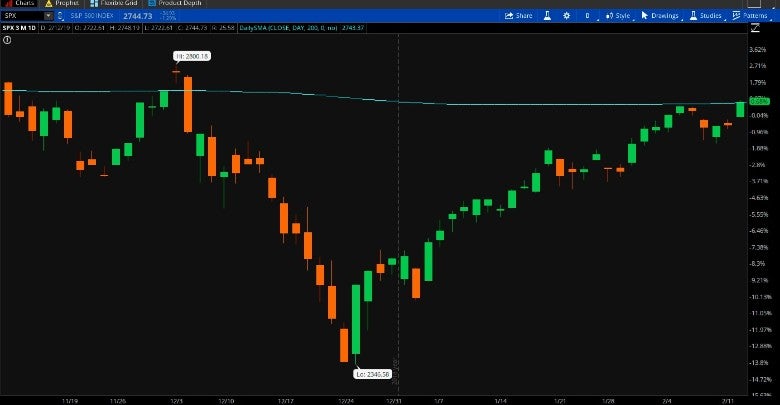

It might be interesting to watch over the next day or two whether the SPX can hold these gains above the 200-day average, which

now stands at around 2743. It’s topped that technical level a few times in recent months, but never for long. An extended string of

closes above the 200-day could potentially be another positive sign.

With the SPX closing just a point above the 200-day on Tuesday, perhaps we’re at an inflection point. Last week, the SPX

challenged the technical resistance here and then pulled back. Today and the rest of the week have the potential to show if

investors are ready to push the SPX into higher ground above that mark.

Figure 1: ECLIPSING 200: The S&P 500 Index (candlestick) finally eclipsed its 200-day moving average

(blue line) again Tuesday, by one point, closing above that level for the first time in two months. Some analysts might see this as

a positive development from a technical perspective. Data Source: S&P Dow Jones Indices. Chart source: The thinkorswim®

platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

What’s Driving Transports?: One metric that’s been galloping higher lately is the Dow Jones Transportation

Average ($DJT), which motored its way to 1.25% gains Monday and 1.3% gains Tuesday. The rails contributed to Monday’s strength,

especially Norfolk Southern Corp. (NYSE: NSC). Shares of NSC rose more than 3% after the company outlined cost-cutting and

operational efficiency plans at an investor conference.

We just saw airlines post a great earnings season with many companies saying the cost of energy isn’t slowing them down. Rails

conceivably get the same benefit, and are seeing great traffic. They’re also benefiting from a positive price environment where

they’ve seen the ability to charge more. If you ask anyone who’s been around the markets for a long time, they’ll likely tell you

that when transports do well, the market does well. That’s not always the case, but transports tend to do best when the economy

thrives, and this could be another sign of economic strength. The low price of crude is something the transportation sector has

really been eating up.

Additional Financial Sector M&A Seen Challenging: Earlier this week, we mentioned additional bank merger

and acquisition activity as a possible spark for the sector following last week’s merger between SunTrust Banks,

Inc. (NYSE: STI) and BB&T

Corporation (NYSE: BBT). However, some argue it

would be a change of pace if M&A does pick up among financials. As Barron’s pointed out recently, the environment in some ways

just doesn’t favor M&A, despite competition among banks and rising technology costs that might have you think mergers could

make sense. For one thing, Barron’s said, suitable partners are rare, and top banks are so big that regulators might cast a fish

eye on anything that potentially makes them bigger. Also, pickings just seem kind of slim. In 1984, there were 14,450 commercial

banks, and that’s fallen to 4,746. Today, Barron’s notes, roughly 56% of assets in the U.S. are controlled by the top five

banks.

Name Your Price: A year ago, it seemed like every new data point had the potential to cause a mini-panic over

how the Fed might react. Remember, for instance, how volatility spiked and stock prices crashed early last year after annual wage

growth came in higher than expected in the January jobs report, sparking concerns that the Fed might get more hawkish. Now, with

the Fed seemingly on pause for a while, it’s perhaps a little easier for some investors to sit back and watch the numbers roll in

without having to keep a nervous eye on the VIX.

Tomorrow sees release of producer prices for January ahead of the open. According to the Briefing.com consensus, analysts expect

the headline number to rise 0.1% and core PPI to be up 0.2%, compared to negative numbers in December. A lot of the softness then

was driven by falling energy prices, which weren’t so big a factor in January. However, processed and finished goods for

intermediate demand also fell in the final month of 2018, maybe a sign that producer inflation might be moderating in

general—meaning not just an energy story. Meanwhile, the Fed needle isn’t budging much, with futures trading predicting less than

4% chances for a March rate hike and about 7% for a June hike.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any

particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with

each strategy, including commission costs, before attempting to place any trade.

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.