The waiting game continues as trade negotiations with China remain front and center on Wall Street. Tariff talks still rule the

day.

Media outlets reported progress in the talks Thursday, but U.S. stock indices didn’t seem inclined to move too much in either

direction early on. Overnight trading in Europe and Asia had a mixed tone, and the first weak Eurozone manufacturing number in a

while appeared to provide a bit of a weight that crept into U.S. pre-market prices. Chip makers, however, moved higher before the

opening bell, which could be viewed as a positive sign for trade talks. The sector tends to be a good barometer for how the trade

talks are going since these companies have a lot at stake.

Meanwhile, consider keeping an eye on crude, which crossed the $57 a barrel mark to approach new highs for the year. If crude

keeps climbing, it might be interesting to see if there’s an impact on some of the transport stocks, which rely more on oil to run

their businesses.

Outside of the China negotiations, which continue in Washington this week, there’s a bunch of new data due today and an earnings

report from one of China’s biggest tech companies (see more below).

Your Patience Is Appreciated

The Fed’s favorite new word seems to be “patient,” and we saw it again in the Fed minutes released Wednesday from last month’s

meeting. In fact, it appeared 14 times in the minutes, according to a count by The Wall Street Journal. The patience

applies mainly to additional rate hikes, but almost all participants also argued in favor of a near-term conclusion of the balance

sheet unwinding that’s gone on for the past year. It looks like the balance sheet reduction could halt by the end of the year,

according to the minutes.

Keeping rates where they are and stopping the balance sheet unwinding are both factors that could improve liquidity, potentially

a bullish development for the stock market. Remember that markets tend to like liquidity.

Wednesday’s minutes brought the same kind of dovish language from the Fed that investors have gotten used to hearing in 2019,

and a reversal compared with what they heard as recently as late December. The sharp turn from hawk to dove continues, and might be

one of the things giving the market a tailwind. Nothing in the minutes would appear to fly in the face of Fed’s overall recent

tone, and major stock indices mostly moved higher Wednesday afternoon following the meeting and stand near four-month highs.

Fed Seems Focused on Slower Growth

The flip side of this dovishness is what it’s in response to. The Fed seems to think the global economy is slowing, and that was

evident in the minutes. Fed participants noted softer consumer and business sentiment, along with weak foreign economies. Recent

data on U.S. industrial production and retail sales that came out after the Fed’s meeting could be dual signs of struggle, though

no one month or one data point can ever be seen as a trend. The follow-up is arguably what matters more, meaning will the same

reports next month show continued signs of weakness? Another point potentially worth noting is the quickening pace of layoffs

across much of the country. Jobless claims have been perking up.

The Fed might also be taking a more deliberate approach due in part to slowing growth abroad. Some economists warn that Germany

could be on the brink of recession, and China’s economy has been slowing down for awhile, though its stock market has been

galloping higher (see more below). The German Bund yield is fluttering around 0.1%, and U.S. 10-year Treasury notes seem stuck in

the 60s, meaning between 2.6% and 2.7%. Attempts to move above that range over the last few weeks have stalled, a possible sign of

investor worries over economic growth. Investors are scheduled to get a first look next week at the government’s Q4 GDP

estimate.

Still, despite the “patience” the Fed keeps talking about, the minutes showed some members still think a rate hike might be

warranted at some point this year if the economy keeps growing strongly. Some analysts see muted Q1 growth due in part to the

government shutdown, trade jitters, and bad weather. Also The Conference Board, in its forecast earlier this month, said it expects

the economy to “slow to 2.2 percent growth by the second half of this year compared to more than three percent during the first

three quarters of 2018.” If that turns out to be the case, the Fed might need other elements of the economy, like inflation, to

flash some signals in order to justify a rate hike.

Early Thursday, St. Louis Fed President James Bullard told CNBC he thinks interest rate hikes and the reduction of bond holdings

are near an end, and that rates are actually too high now. However, he said he’s in the minority on the policymaking Federal Open

Market Committee (FOMC) in thinking rates have risen too much.

No Joy in the Joystick Sector

Meanwhile, remember that word we used last week, “dichotomy?” It showed up again Wednesday as the Nasdaq (COMP) lagged against

the Dow Jones Industrial Average ($DJI) and the S&P 500 Index (SPX). The COMP did manage a slight gain for the eighth day in a

row, but felt some burden from weakness in the video game and social media spaces. Electronic Arts Inc (NASDAQ:

EA), fell 4% and Activision Blizzard, Inc.

(NASDAQ: ATVI) dropped nearly 4%. This came after a market

research firm reported that U.S. video game sales fell 19% in January from a year earlier.

That doesn’t mean kids aren’t vegging in front of their games any less than they were last year. It probably is more reflective

of giveaways, especially of Fortnite, one of the most popular games around.

So far this year, industrials have led the market rally, up more than 17%. That’s while the sectors that previously provided

lots of momentum, including info tech, are solidly higher but not leading the market. The FAANGs have also bounced back from the

pounding they took in Q4, but aren’t really providing the kind of momentum they did a year ago. What’s a bit unclear is whether the

market can continue grinding higher without tech and communication services leadership, or if those are going to get a fire lit

under them and step back into the vanguard anytime soon.

In other corporate news, ride-sharing company Lyft might list shares on the Nasdaq Stock Market by the end of next month,

according to The Wall Street Journal. However, the company declined to verify that report. Also, both Wendy’s

Co (NASDAQ: WEN) and Domino’s Pizza,

Inc. (NYSE: DPZ) missed analysts’ estimates for

same-store sales.

Earnings Bulletin From China

There’s a new batch of economic data today, with existing home sales on deck. The homebuilder stocks have been on a bit of a

roll lately as mortgage rates stepped back, so we’ll potentially see if the data bears out any of this positive sentiment. There’s

also some earnings news due this afternoon from Baidu.com (BIDU) that could provide more insight into China’s economic performance.

BIDU is a big player in the artificial intelligence and cloud-computing markets. Earnings next week bring tidings from some of the

major U.S. department and big box stores, so stay tuned.

Also, durable goods orders rose 1.2% in December, the government reported early Thursday. That doesn’t look like a weak number,

but it’s slightly below the average analyst expectation.

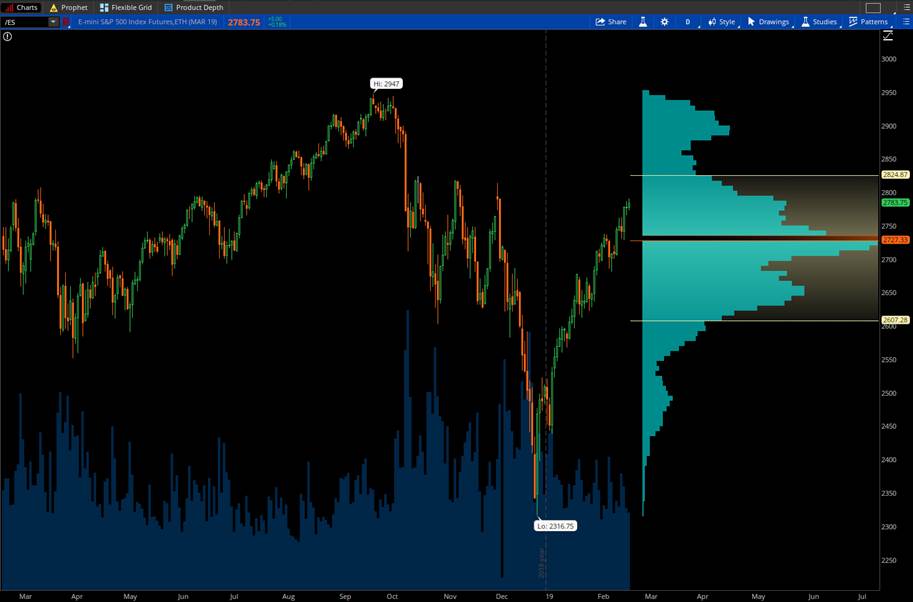

We’re at what might be described as an inflection point if you look at the SPX. As of late Wednesday, the index was trading just

below 2790, which puts it on the high end of the range at which the biggest part of average trading volume has occurred over the

last year. That range is roughly between 2605 and 2825, and the SPX has failed a couple of times—first last February and then last

fall—to spend much time above 2815. That means if the market does rally from here, it will be in territory it’s only ventured into

once, which was last summer when it posted its all-time high.

Just because it’s a road less trodden doesn’t mean it’s like driving off a cliff. Still, at these levels investors might be

looking for new positive catalysts to take things higher. With earnings season basically over, it might take a geopolitical

development like trade progress with China or a Brexit solution to keep the fizz bubbling.

FIGURE

1: CONCENTRATION GAME: Over the past 12 months, the average trading volume in futures on the S&P 500 Index (/ES)

has been most concentrated in an area roughly between 2605 and 2825. Wednesday's rally put /ES into the high end of that range.

Data Source: CME Group. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past

performance does not guarantee future results.

FIGURE

1: CONCENTRATION GAME: Over the past 12 months, the average trading volume in futures on the S&P 500 Index (/ES)

has been most concentrated in an area roughly between 2605 and 2825. Wednesday's rally put /ES into the high end of that range.

Data Source: CME Group. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past

performance does not guarantee future results.

London Bridge: British stocks tracked on the The Financial Times Stock Exchange 100 Index (FTSE 100 Index) are

up more than 7% so far this year, but that trails the wider European averages and the S&P 500 (SPX). As the March 29 Brexit

deadline comes closer, it might be interesting to see how the FTSE performs, as well as how the broader European market reacts. A

dive into uncertainty can sometimes initiate what analysts call a “flight to safety,” meaning investors fleeing toward what they

might see as safer investments in gold, the dollar, and U.S. Treasuries. Until the last couple of days, the dollar index had been

on the rise much of February, which could possibly reflect some of this financial uncertainty already taking shape. However, the

euro has been relatively flat.

One sector to potentially watch as the Brexit parley plays out over the coming weeks is financials. A lot of big banks do major

business in London, which is one of the financial capitals of the world. A messy Brexit might potentially be a boon for U.S. banks,

which might attract more international business if London looks less stable.

Is China Rally For Real?: As long as we’re overseas, let’s take a side trip to Asia, where the Shanghai

Composite has had a rip-roaring start to the year, up nearly 11%. Large-cap stocks in China are performing particularly well. In

fact, after being the world’s poster child for weak markets for much of 2018, the Shanghai index has outpaced the SPX over the last

six months, raising some chatter on Wall Street about the possibility that China’s rebound might signal a rebound of emerging

market stocks in general. We’ll have to wait and see if that’s the case, but to keep things in perspective, Chinese stocks aren’t

exactly running away. They’re up 1% over the last six months, which is a little better than the slight loss recorded by the SPX

over the same time period.

A rising dollar could mean continued tough times for emerging markets, if history is any guide. Also, if the U.S. economy is

truly slowing, that often can bring declining demand for imports from the world’s largest economy. Don’t forget, too, that a lot of

recent data from China has been less than encouraging, and the trade war with the U.S. remains far from resolved. So the jury is

arguably still out on whether the Chinese market recovery is a true sign of things to come or simply a reflection of an oversold

market getting some attention from bargain hunters.

Headwinds Remain: Though U.S. stocks have rebounded nicely from their late December lows, we’re far from out of

the woods as long as issues like China trade and Brexit continue to provide an overhang. A resolution on trade would remove a major

headwind for the market, and would also potentially remove a major source of uncertainty from companies, perhaps, enabling them to

make decisions on spending with more clarity. Earnings season is pretty much over and we’re weeks away from the next one. If

there’s still no resolution on China by the time Q1 earnings begin in April, companies might not be able to provide any new

information to investors about their spending plans. This could mean more uncertainty about U.S. economic growth, which many

analysts already see faltering in Q1 due in part to the government shutdown and rough winter weather. In the short term, however,

it’s arguably all about trade.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any

particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with

each strategy, including commission costs, before attempting to place any trade.

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.