CHARLOTTE, N.C., March 13, 2019 /PRNewswire/ -- LendingTree®, the nation's leading online loan marketplace, today released its monthly Mortgage Offers Report, which analyzes data from actual loan terms offered to borrowers on LendingTree.com by

lenders on LendingTree's network. The purpose of the report is to empower consumers by providing additional information on how

their credit profile affects their loan prospects.

- February's best mortgage offers for borrowers with the best profiles had an average APR of 4.09 percent for conforming

30-year, fixed-rate purchase loans, down from 4.19 percent in January. The APR on refinance loan offers is also decreased from

4.14 percent in January to 4.04 percent. We consider people with the best credit profiles to be those in the 95th percentile of

borrowers who received the best mortgage offers through the LendingTree marketplace, which allows users to compare offers from

multiple mortgage lenders.

- Mortgage rates vary depending upon parameters including credit score, loan-to-value ratio, income and property type.

- For the average borrower, the purchase APR for conforming 30-year, fixed-rate purchase loans offered on LendingTree's

platform was 4.87 percent in February, down 11 basis points from January. The loan note rate of 4.75 percent was also down 11

basis points from January. We prefer to emphasize the APR as lenders often make changes to other fees in response to changing

interest rates.

- Consumers with excellent credit scores (760+, representing the 65th percentile of borrowers) received an average APR of

4.68 percent, versus 5.02% for consumers with scores of 680 to 719. The APR spread of 34 basis points between these score

ranges is down from 37 in January. For the average purchase loan amount of $229,615, the spread

represents slightly more than $17,000 in additional costs for borrowers with lower credit scores

in the span of 30 years. The additional costs result from higher interest rates, larger fees or a combination of the two.

- For the average borrower, the APR for conforming 30-year, fixed-rate refinance loans decreased 13 basis points from January

to 4.81 percent. At 4.62 percent and 4.95 percent, respectively, the spread between credit score brackets (760+ and 680-719)

was 33 basis points. That amounts to about $17,600 in extra costs over the life of the loan for

borrowers with lower credit scores, given an average refinance loan of $245,323.

- Average proposed purchase down payments rose nearly $1,700 from January to February — to

$55,026.

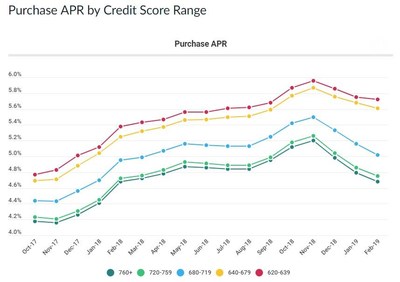

"Of note, since rates started falling in December, lenders are passing through those benefits to higher credit borrowers, but

not so much to lower credit borrowers," said Tendayi Kapfidze, Chief Economist at LendingTree. "You can see in the chart that

tracks APR by credit score, the top two lines representing lower credit scores have not moved down much. Borrowers with scores

760+ have seen a decline of 52 bps, but those with scores of 620 to 639 just 24 bps from November to February. This tightening of

lending at the lower end may have implications for home sales as the two lower buckets are about 10% of sales."

|

Purchase Mortgage Offers by Credit Score

|

|

FICO Range

|

Average

APR

|

Average Down

Payment

|

Average Loan

Amount

|

Average

LTV

|

Lifetime Interest

Paid*

|

|

All Loans

|

4.87%

|

$55,026

|

$229,615

|

83%

|

$207,585

|

|

760+

|

4.68%

|

$73,526

|

$254,757

|

80%

|

$198,105

|

|

720-759

|

4.75%

|

$50,224

|

$226,855

|

84%

|

$201,586

|

|

680-719

|

5.02%

|

$35,637

|

$211,007

|

87%

|

$215,140

|

|

640-679

|

5.61%

|

$65,134

|

$196,858

|

76%

|

$245,448

|

|

620-639

|

5.72%

|

$56,394

|

$187,833

|

76%

|

$251,200

|

*Lifetime interest paid is calculated based on the overall average loan amount to enable comparison.

|

Refinance Mortgage Offers by Credit Score

|

|

FICO Range

|

Average

APR

|

Average Down

Payment

|

Average Loan

Amount

|

Average

LTV

|

Lifetime Interest

Paid*

|

|

All Loans

|

4.81%

|

$299

|

$245,323

|

62%

|

$218,576

|

|

760+

|

4.62%

|

$453

|

$258,065

|

59%

|

$208,482

|

|

720-759

|

4.69%

|

$378

|

$249,120

|

64%

|

$212,188

|

|

680-719

|

4.95%

|

$167

|

$237,713

|

64%

|

$226,083

|

|

640-679

|

5.23%

|

$0

|

$225,112

|

60%

|

$241,270

|

|

620-639

|

5.48%

|

$0

|

$210,589

|

61%

|

$255,020

|

*Lifetime interest paid is calculated based on the overall average loan amount to enable comparison.

To view the Mortgage Offers Report, visit: https://www.lendingtree.com/home/mortgage-offers-report-february-2019/.

About the Report

The LendingTree Mortgage Offers Report contains data from actual loan terms offered to borrowers on

LendingTree.com by lenders. We believe it is an important addition to standard industry surveys and reports on mortgage rates.

Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment. Most borrowers do not

fit this profile. Our report includes the average quoted APR by credit score, together with the average down payment and other

metrics described below. We stratify by credit score, so borrowers have added information on how their credit profile affects

their loan prospects. The report covers conforming 30-yr fixed loans for both purchase and refinance.

- APR: Actual APR offers to borrowers on our platform

- Down Payment: Though analogous to the LTV, we find that borrowers identify more closely with the down payment.

Academic studies have also found that the down payment is the primary concern for homebuyers and one of the main impediments to

entering the homebuying market.

- Loan Amount: The average loan amount borrowers are offered

- LTV: Actual LTV offered to borrowers on our platform

- Lifetime Interest Paid: This is the total cost a borrower incurs for the loan, inclusive of fees.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online marketplace that connects consumers with the choices

they need to be confident in their financial decisions. LendingTree empowers consumers to shop for financial services the same

way they would shop for airline tickets or hotel stays, comparing multiple offers from a nationwide network of over 500 partners

in one simple search, and can choose the option that best fits their financial needs. Services include mortgage loans, mortgage

refinances, auto loans, personal loans, business loans, student refinances, credit cards and more. Through the My LendingTree platform, consumers receive free credit scores, credit monitoring and recommendations to

improve credit health. My LendingTree proactively compares consumers' credit accounts against offers on our network, and notifies

consumers when there is an opportunity to save money. In short, LendingTree's purpose is to help simplify financial decisions for

life's meaningful moments through choice, education and support. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more

information, go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

704-943-8208

Megan.greuling@lendingtree.com

View original content to download multimedia:http://www.prnewswire.com/news-releases/lendingtree-releases-monthly-mortgage-offer-report-for-february-300811859.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/lendingtree-releases-monthly-mortgage-offer-report-for-february-300811859.html

SOURCE LendingTree