DailyFX.com -

Talking Points:

- The Q1’19 New Zealand Consumer Price Index is due

on Tuesday, April 16

at 22:45 GMT.

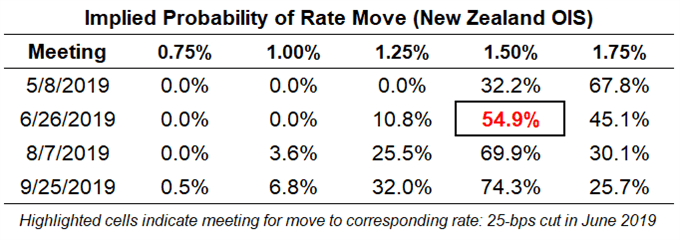

- The Reserve Bank of New Zealand has taken on a more dovish tone

in recent months, with rates markets leaning towards a 25-bps rate cut in June.

- Retail tradersare net-long NZDUSD but recent positioning changes point to more

losses.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we

discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

04/16 TUESDAY | 22:45 GMT | NZD Consumer Price Index (1Q)

Q1’19

New Zealand inflation data are due to underscore the Reserve Bank of New Zealand’s

recent concerns about a sluggish economy, according to Bloomberg News surveys. Following the collapse of both agricultural and

energy commodity prices in Q4’18, the prevailing trend of low

inflation across the developed economic world is expected spread to New

Zealand’s shore. Quarterly price pressures are expected in at +0.3%

after having gained +0.1% in Q4’18, while the yearly reading is due in at +1.7% from +1.9%.

Despite the expected decline in inflation readings, traders may want to be alert for

potentially better than expected price pressures. New Zealand Terms of Trade likely rebounded in Q1’19 because of a sharp rebound

in milk product prices. The New Zealand Global Dairy Trade (GDT) Price Index was up nearly 17% in the first quarter, which should

have helped inflation readings stabilize.

As such, even if inflation remains below the RBNZ’s medium-term target of +2%, a ‘beat’ on the data may see rates markets fail to become

any more dovish than they currently are priced. After all,

rates markets are pricing-in a 54.9% chance of a 25-bps rate cut by June 2019. Simply pushing back

the timing of the first expected hike to September 2019 could provoke a short-term rally by the New Zealand Dollar.

Pairs to Watch: AUDNZD, NZDJPY, NZDUSD

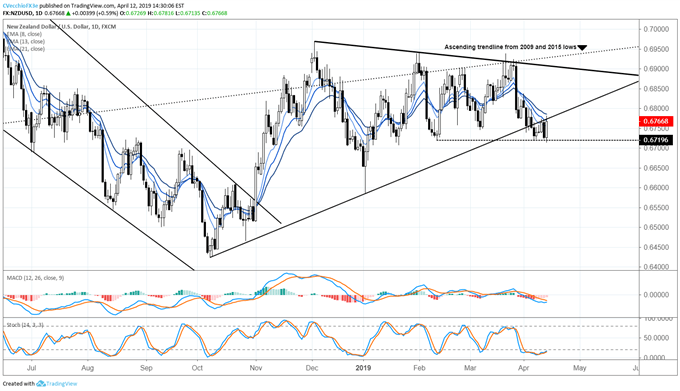

NZDUSD Technical Forecast: Daily Price Chart (June 2018 to April 2019) (Chart 1)

Since bottoming out of its 2018 downtrend in early-November, NZDUSD has spent most of 2019 consolidating in a symmetrical triangle. In April so far,

price has broken down through the March low at 0.6745 and temporarily broken

through the February low at 0.6720, culminating in a break of the uptrend from the October 2018 and January 2019 lows.

But as price action on Friday, April 12 drew to a close, the NZDUSD daily price candle was

working on a bullish outside engulfing bar, suggesting that the recent breakdown lower may indeed me a false breakout. In the

coming days, a return back within the symmetrical triangle would validate this point of view, and in turn suggest that the odds of

return back towards symmetrical triangle resistance (coming in near 0.6900) would increase materially; a better than expected Q1’19

New Zealand CPI report could be the catalyst required.

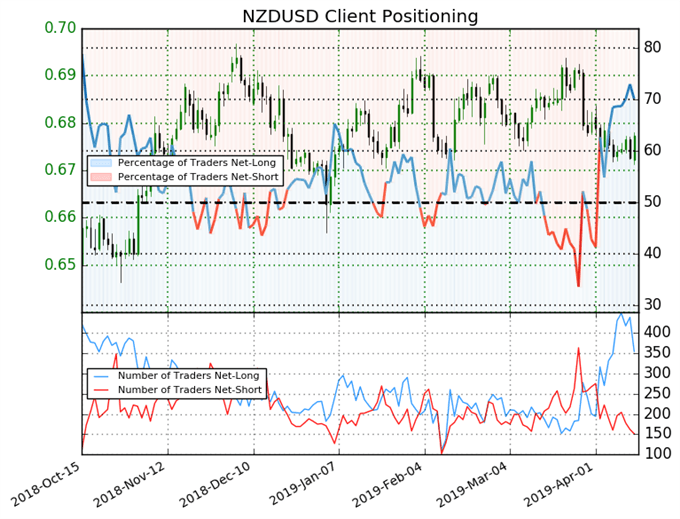

IG Client Sentiment Index: NZDUSD (April 12, 2019) (Chart 2)

Retail trader data shows 70.1% of traders are net-long with the ratio of traders long to short

at 2.34 to 1. In fact, traders have remained net-long since April 2 when NZDUSD traded near 0.67513; price has moved 0.3% higher

since then. The number of traders net-long is 11.9% lower than yesterday and 2.6% higher from last week, while the number of

traders net-short is 17.5% lower than yesterday and 17.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long

suggests NZDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of

current sentiment and recent changes gives us a stronger NZDUSD-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to

help you: an indicator for monitoring trader sentiment; quarterly trading

forecasts; analytical and educational webinars held

daily; trading guides to help you improve trading

performance, and even one for those who are new to FX

trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX

original source

DailyFX provides forex news and

technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.