Uncovers Possible Ride-sharing Effect: Auto Businesses Slump in First

Quarter of 2019

Yelp Inc. (NYSE: YELP), the company that connects people with great

local businesses, today released the Yelp Economic Average (YEA), a

benchmark of local economic strength in the U.S.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190424006180/en/

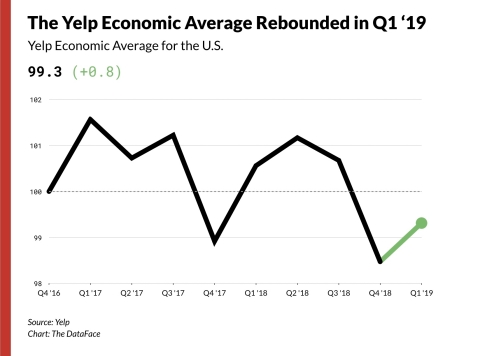

Yelp Economic Average (Graphic: Business Wire)

“Many of today’s data resources for measuring economic health generally

either focus on giant corporations or move at a glacial pace,” said Carl

Bialik, Yelp’s data science editor. “Yelp has information on millions of

U.S. brick-and-mortar businesses and the interests and needs of the

millions of consumers who use Yelp every day, which researchers

have found makes us well positioned to quickly measure a huge swath

of the economy that is missed by many major indicators.”

The Yelp Economic Average rose by eight tenths of a point in the first

quarter of 2019 after a tough end to 2018. In the last quarter of that

year, the YEA—a measure of the health of important sectors across the

economy, based on Yelp’s unique data set—fell

by 2.2 points. The YEA measures success using two signals: business

survival and consumer interest. The opening of new businesses and an

increase in consumer engagement both boost the YEA.

Local and professional services businesses drove the increase, but two

major sectors bucked the trend by falling in the first quarter. Retail

businesses continue to struggle. And automotive businesses extended

their slump. In most major metros around the country, businesses

associated with the auto industry have experienced a steady decline over

the past two and a half years.

Why Auto is Slumping

One question that emerged from the Yelp Economic Average is whether the

declining health of the auto sector is a side-effect of the growing

popularity in ride-sharing. Far

more people are getting around by Uber and Lyft today, and many of

those rides may replace individual driving trips and even contribute

to a decline in car ownership. That’s one of several challenges

facing local auto businesses around the country. Yelp charted the

fortune of auto businesses in 50 major metros around the nation, looking

at the overall Yelp Economic Average score as well as the performance of

its two constituents: auto repair and gas stations. While the picture

for gas stations is mixed, the major slump in auto repair across the

board is weighing on the automotive sector in every corner of the

country.

Auto businesses are facing other challenges. Increasing

fuel efficiency may mean more miles between fill-ups while auto-repair

shops struggle to find qualified workers.

The Marie Kondo and Trump Tax Effects

Beyond the auto sector’s slump, the surge in junk removal and hauling

businesses suggests that Marie

Kondo is on to something. The number of Americans hiring

professionals to cart their stuff away is rising enough to significantly

move the needle on junk haulers’ YEA score, up 7.2 points.

Americans also are increasingly turning to lawyers. Whether they

specialize in real estate, divorce and family, or personal injury,

lawyers had a strong start to 2019. Their professional-services peers,

accountants, also had a strong quarter, with the tax overhaul likely

fueling demand months

before the filing deadline.

A rebound in these core business sectors, such as local services,

professional services, and restaurants, may be early signs of an

economic turnaround. A third successive first-quarter rise isn’t a

result of seasonality; Yelp normalized the data so that it is seasonally

adjusted.

Methodology

The Yelp Economic Average (YEA) is a composite measure of the economy,

reflecting both business health and consumer demand among businesses in

30 sectors.

The eight root categories

The 30 business sectors, or categories — the “Yelp 30” — are drawn from

eight umbrella business categories

on Yelp: restaurants, food, nightlife, local services, automotive,

professional services, home services, and shopping.

Root categories’ share of the 30 components

The share of YEA components from each of these eight categories is based

on each one’s share of the economy, as estimated from County

Business Patterns reports.

Choosing the Yelp 30

Each of the Yelp 30 is chosen based on maximizing four criteria,

relative to other candidates within its family of categories, as

measured in the first quarter of 2016:

-

Number of businesses on Yelp in the category;

-

Consumer interest on Yelp for businesses in the category;

-

Number of the 50 metro areas — whose economic health Yelp has been

measuring for a year and a half, originally as part of the company’s Local

Economic Outlook — in which the category is present;

-

Uniform spread across the

four Census Bureau-defined regions of the country.

Choosing baseline categories

Yelp’s data science team then chose baseline categories against which to

compare the fortunes of the Yelp 30. This step helps remove changes due

to seasonality and Yelp’s internal growth; what remains is a reflection

of real economic patterns. The team selected all other root categories

not represented by YEA components as baselines because they provided the

most robust controls against seasonality and activity on Yelp.

Calculating YEA scores

For each of the Yelp 30 in each quarter, its two scores — one for

business population and one for consumer interest — are calculated as

follows:

-

Count the component’s total for the quarter;

-

For consumer interest only: Count the baseline’s total for the quarter;

-

For consumer interest only: Divide the component’s total by the

baseline total to get the component’s score;

-

Divide the component’s score for the quarter of interest by the

component’s score in the equivalent quarter in 2016 — comparing, for

instance, the fourth quarter of 2018 to the fourth quarter of 2016, to

adjust for seasonality;

-

Multiply by 100 to make 100 a typical score.

Then the two scores are normalized to have the same variance, so that

each contributes equally across components.

To reduce the effect of outliers, the overall score for both consumer

engagement and business count is the median of each component’s score.

YEA is the mean of the overall consumer engagement score and

business-count score.

Yelp calculated equivalent scores at the regional and metro level to

provide a local look at the state of the local economy.

About Yelp Inc.

Yelp Inc. (www.yelp.com)

connects people with great local businesses. With unmatched local

business information, photos and review content, Yelp provides a

platform for consumers to discover, interact and transact with local

businesses of all sizes. Yelp was founded in San Francisco in July 2004.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190424006180/en/

Copyright Business Wire 2019