Wideband semiconductors poised to grow at a 60% CAGR through 2026

Strategy Analytics predicts that as HEV/EV (hybrid electric vehicle/electric vehicle) platforms become a greater proportion of the global vehicle manufacturing mix, the demand for power electronic components will account for over 55% of the total semiconductor demand from HEV/EV powertrain by 2026. The Strategy Analytics Powertrain Body Chassis & Safety (PBCS) service report, “HEV-EV Semiconductor Technology Outlook: What Role will SiC and GaN Play? (https://www.strategyanalytics.com/access-services/automotive/powertrain-body-chassis-and-safety/reports/report-detail/hev-ev-semiconductor-technology-outlook),” finds the emphasis on improving system efficiencies will dictate a move towards the use of higher value SiC and GaN-based components, creating a window of opportunity for the automotive semiconductor industry for higher margins and greater profitability.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190716005175/en/

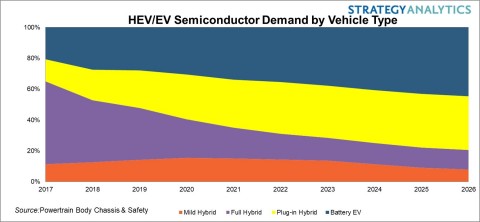

HEV-EV Semiconductor Outlook 2017-2026 (Graphic: Business Wire)

While the power electronics market for wideband semiconductors is at an early stage, it offers significant upside potential for companies that are able to leverage the growing opportunity from the HEV/EV sector. Silicon-based IGBTs, MOSFETs and SBDs will continue to dominate the power electronics landscape, but SiC and GaN are starting to make in-roads, and will collectively account for almost 20% of the HEV/EV automotive power semiconductor market in 2026.

“SiC is the more mature of the two technologies with 650V and 1200V parts starting to compete with Si-based components for the main inverter as well as getting some traction into the DC-DC converter and the OBC (on-board charger)”, noted Chris Webber, Senior VP of the Global Automotive Practice at Strategy Analytics. “However, we remain concerned that surety of material supply constraints as well as associated costs and yield issues could slow the implementation of SiC-based systems in the volume segments of the HEV/EV market.”

“Efficiency is key in choosing the future power semiconductor architectures for HEV/EV platforms, and SiC and GaN technologies certainly offer significant advantages,” observed Asif Anwar, report author and Associate Director of the PBCS service. “However, Si technology still has some performance overhead that it can tap into to improve switching losses and efficiencies, and this can be coupled with advances in packaging technology. We believe that companies able to offer the full suite of technologies will be best positioned to take advantage of this growing power electronics semiconductor opportunity.”

The report concludes that the power electronics market for wideband semiconductors is at an early stage but offers significant upside potential for companies that are able to leverage the growing opportunity from the HEV/EV sector. However, industry players should also consider other factors that may influence future growth including:

-

What is the tipping point for consumer acceptance of HEV/EV use, and how will this be influenced by factors such as “range anxiety” and availability of a robust charging infrastructure?

-

Merge or acquire – what strategies should companies be adopting to ensure access to the technologies that will further disrupt the power semiconductor electronics market?

-

How do you manage an incumbent technology portfolio as the shift towards emerging technologies dictates more of your R&D and production dollar spend?

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20190716005175/en/

Copyright Business Wire 2019