Earnings Release Highlights

-

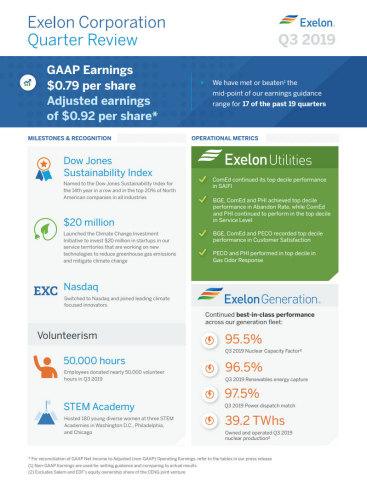

GAAP Net Income of $0.79 per share and Adjusted (non-GAAP) Operating Earnings of $0.92 per share for the third quarter of 2019

-

Narrowing guidance range for full year 2019 Adjusted (non-GAAP) Operating Earnings from $3.00- $3.30 per share to $3.05 - $3.20 per share

-

Announcing additional annual cost savings of $100 million; savings of $75 million of operating and maintenance expenses and $25 million of other expenses; full run-rate savings to be achieved in 2022

-

New York’s Supreme Court rejected challenges to New York’s Zero Emissions Credit (ZEC) Program

-

Strong utility customer operations performance - every utility achieved top quartile in Service Level and Abandon Rate

Exelon Corporation (Nasdaq: EXC) today reported its financial results for the third quarter of 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20191031005232/en/

Exelon Third-quarter Earnings Highlights (Graphic: Business Wire)

“Ongoing infrastructure investment at our electric and gas companies is delivering solid financial and customer satisfaction results, while our clean generation fleet continues to achieve best-in-class reliability and operational efficiency,” said Christopher M. Crane, Exelon president and CEO. “Exelon was named to the Dow Jones Sustainability Index for the 14th consecutive year, ranking in the top 20 percent of North American companies in all industries. We continue to look for ways to meet customer expectations for a cleaner and more resilient energy grid, teaming with the Exelon Foundation to launch a new Climate Change Investment Initiative to fund startups focused on technologies to reduce emissions and advocating for state policies that will properly value nuclear and other clean energy resources.”

"Our third-quarter performance remained strong, with adjusted (non-GAAP) earnings of $0.92 cents per share exceeding our guidance range of $0.80 to $0.90 per share,” said Joseph Nigro, Exelon’s senior vice president and CFO. “We are on track to invest more than $5.4 billion at our electric and gas companies by year end to enhance reliability and resiliency. We are also announcing an additional $100 million in annual cost savings at Exelon Generation beginning in 2022, adding to the more than $900 million in companywide cost savings already announced between 2015 and 2018. We are narrowing our guidance range for full-year 2019 adjusted (non-GAAP) operating earnings from $3.00-$3.30 per share to $3.05-$3.20 per share.”

Third Quarter 2019

Exelon's GAAP Net Income for the third quarter of 2019 increased to $0.79 per share from $0.76 per share in the third quarter of 2018. Adjusted (non-GAAP) Operating Earnings increased to $0.92 per share in the third quarter of 2019 from $0.88 per share in the third quarter of 2018. For the reconciliations of GAAP Net Income to Adjusted (non-GAAP) Operating Earnings, refer to the tables beginning on page 4.

The Adjusted (non-GAAP) Operating Earnings in the third quarter of 2019 primarily reflect higher utility earnings due to regulatory rate increases at PECO, BGE and PHI; and, at Generation, decreased nuclear outage days, increased revenue from ZECs in New York and New Jersey, and lower operating and maintenance expense, partially offset by decreased capacity prices and lower realized energy prices.

Operating Company Results1

ComEd

ComEd's third quarter of 2019 GAAP Net Income and Adjusted (non-GAAP) Operating Earnings remained relatively consistent with the third quarter of 2018. Due to revenue decoupling, ComEd's distribution earnings are not affected by actual weather or customer usage patterns.

PECO

PECO’s third quarter of 2019 GAAP Net Income increased to $140 million from $126 million in the third quarter of 2018. PECO’s Adjusted (non-GAAP) Operating Earnings for the third quarter of 2019 increased to $141 million from $127 million in the third quarter of 2018, primarily due to regulatory rate increases partially offset by unfavorable weather conditions and volume.

BGE

BGE’s third quarter of 2019 GAAP Net Income decreased to $55 million from $63 million in the third quarter of 2018. BGE’s Adjusted (non-GAAP) Operating Earnings for the third quarter of 2019 decreased to $56 million from $64 million compared with the third quarter of 2018, primarily due to an increase in various expenses, partially offset by regulatory rate increases. Due to revenue decoupling, BGE's distribution earnings are not affected by actual weather or customer usage patterns.

PHI

PHI’s third quarter of 2019 GAAP Net Income increased to $189 million from $187 million in the third quarter of 2018. PHI’s Adjusted (non-GAAP) Operating Earnings for the third quarter of 2019 increased to $209 million from $195 million in the third quarter of 2018, primarily due to regulatory rate increases (not reflecting the impact of TCJA). Due to revenue decoupling, PHI's distribution earnings related to Pepco Maryland, DPL Maryland and Pepco District of Columbia are not affected by actual weather or customer usage patterns.

Generation

Generation's third quarter of 2019 GAAP Net Income increased to $257 million from $234 million in the third quarter of 2018. Generation’s Adjusted (non-GAAP) Operating Earnings for the third quarter of 2019 increased to $352 million from $318 million in the third quarter of 2018, primarily due to increased revenue from ZECs in New York and New Jersey, decreased nuclear outage days, and lower operating and maintenance expense, partially offset by decreased capacity prices and lower realized energy prices.

As of Sept. 30, 2019, the percentage of expected generation hedged is 96%-99%, 84%-87% and 54%-57% for 2019, 2020 and 2021, respectively.

___________

1Exelon’s five business units include ComEd, which consists of electricity transmission and distribution operations in northern Illinois; PECO, which consists of electricity transmission and distribution operations and retail natural gas distribution operations in southeastern Pennsylvania; BGE, which consists of electricity transmission and distribution operations and retail natural gas distribution operations in central Maryland; PHI, which consists of electricity transmission and distribution operations in the District of Columbia and portions of Maryland, Delaware, and New Jersey and retail natural gas distribution operations in northern Delaware; and Generation, which consists of owned and contracted electric generating facilities and wholesale and retail customer supply of electric and natural gas products and services, including renewable energy products and risk management services.

Recent Developments and Third Quarter Highlights

-

Cost Management Programs: Exelon continues to be committed to managing its costs. On Oct. 31 2019, Exelon announced additional annual cost savings of approximately $100 million, at Generation, to be achieved by 2022. These actions are in response to the continuing economic challenges confronting Generation’s business, necessitating continued focus on cost management through enhanced efficiency and productivity.

-

Conowingo Hydroelectric Project: In connection with Generation’s pursuit of a new Federal Energy Regulatory Commission (FERC) license for the Conowingo Hydroelectric Project, on Oct. 29, 2019, Generation and Maryland Department of the Environment (MDE) entered into a settlement agreement that would resolve all outstanding issues between the parties, effective upon and subject to approval by FERC and incorporation of the terms into the new license when issued. The financial impact of this settlement, along with other anticipated and prior license commitments, would be recognized over the term of the new 50-year license and is estimated to be, on average, $11 million to $14 million per year, including capital and operating costs. The actual timing and amount of a majority of these costs are not currently fixed and will vary from year to year throughout the life of the new license. Generation cannot currently predict when FERC will issue the new license.

-

New York State Court Upholds New York ZECs: On Oct. 8, 2019, the New York State Court dismissed all remaining claims of plaintiffs' petition seeking to invalidate the ZEC program. The petitioners have until Nov. 11, 2019 to file a notice of appeal.

-

BGE Electric and Natural Gas Distribution Base Rate Case: On May 24, 2019 (as amended Oct. 4, 2019), BGE filed an application with the Maryland Public Service Commission (MDPSC) to increase its annual electric and natural gas distribution base rates by $74 million and $59 million, respectively, reflecting a requested ROE of 10.3%. On Oct. 25, 2019, BGE filed a settlement agreement with the MDPSC. The settlement provides for an increase to BGE’s annual electric and natural gas distribution rates of $18 million and $45 million, respectively. A final order from the MDPSC is expected by Dec. 2019.

-

Pepco Maryland Electric Distribution Base Rate Case: On Aug. 12, 2019, the MDPSC approved a settlement agreement with an effective date of Aug. 13, 2019 that provides for a net increase to Pepco's annual electric distribution rates of $10 million and reflects a ROE of 9.6%.

-

Nuclear Operations: Generation’s nuclear fleet, including its owned output from the Salem Generating Station and 100% of the CENG units, produced 46,215 gigawatt-hours (GWhs) in the third quarter of 2019, compared with 46,549 GWhs in the third quarter of 2018. Excluding Salem, the Exelon-operated nuclear plants at ownership achieved a 95.5% capacity factor for the third quarter of 2019, compared with 93.6% for the third quarter of 2018. The number of planned refueling outage days in the third quarter of 2019 totaled 15, compared with 36 in the third quarter of 2018. There were 15 non-refueling outage days in the third quarter of 2019, compared with 12 in the third quarter of 2018.

-

Fossil and Renewables Operations: The Dispatch Match rate for Generation’s fossil and hydro fleet was 97.5% in the third quarter of 2019, compared with 95.8% in the third quarter of 2018. Energy Capture for the wind and solar fleet was 96.5% in the third quarter of 2019, compared with 95.7% in the third quarter of 2018.

-

Financing Activities:

-

On Sept. 10, 2019, PECO issued $325 million aggregate principal amount of its First and Refunding Mortgage Bonds, 3.00% Series due Sept. 15, 2049. PECO used the proceeds to satisfy short-term borrowings and for general corporate purposes.

-

On Sept. 12, 2019, BGE issued $400 million aggregate principal amount of its 3.20% senior notes due Sept. 15, 2049. BGE used the proceeds to repay outstanding commercial paper obligations and for general corporate purposes.

GAAP/Adjusted (non-GAAP) Operating Earnings Reconciliation

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2019 do not include the following items (after tax) that were included in reported GAAP Net Income:

(in millions)

|

Exelon

Earnings per

Diluted

Share

|

Exelon

|

ComEd

|

PECO

|

BGE

|

PHI

|

Generation

|

2019 GAAP Net Income

|

$

|

0.79

|

|

$

|

772

|

|

$

|

200

|

|

$

|

140

|

|

$

|

55

|

|

$

|

189

|

|

$

|

257

|

|

Mark-to-Market Impact of Economic Hedging Activities (net of taxes of $2 and $4, respectively)

|

—

|

|

(2

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(10

|

)

|

Unrealized Gains Related to Nuclear Decommissioning Trust (NDT) Fund Investments (net of taxes of $34)

|

(0.04

|

)

|

(39

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(39

|

)

|

Asset Impairments (net of taxes of $53)

|

0.12

|

|

113

|

|

—

|

|

—

|

|

—

|

|

—

|

|

113

|

|

Plant Retirements and Divestitures (net of taxes of $40)

|

0.12

|

|

119

|

|

—

|

|

—

|

|

—

|

|

—

|

|

119

|

|

Cost Management Program (net of taxes of $3, $0, $0, $0 and $3, respectively)

|

0.01

|

|

14

|

|

—

|

|

1

|

|

1

|

|

2

|

|

10

|

|

Asset Retirement Obligation (net of taxes of $9)

|

(0.09

|

)

|

(84

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(84

|

)

|

Change in Environmental Liabilities (net of taxes of $5, $5 and $0)

|

0.02

|

|

18

|

|

—

|

|

—

|

|

—

|

|

17

|

|

1

|

|

Income Tax-Related Adjustments (entire amount represents tax expense)

|

0.01

|

|

13

|

|

—

|

|

—

|

|

—

|

|

1

|

|

9

|

|

Noncontrolling Interests (net of taxes of $3)

|

(0.02

|

)

|

(24

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(24

|

)

|

2019 Adjusted (non-GAAP) Operating Earnings

|

$

|

0.92

|

|

$

|

900

|

|

$

|

200

|

|

$

|

141

|

|

$

|

56

|

|

$

|

209

|

|

$

|

352

|

|

Adjusted (non-GAAP) Operating Earnings for the third quarter of 2018 do not include the following items (after tax) that were included in reported GAAP Net Income:

(in millions)

|

Exelon

Earnings per

Diluted

Share

|

Exelon

|

ComEd

|

PECO

|

BGE

|

PHI

|

Generation

|

2018 GAAP Net Income

|

$

|

0.76

|

|

$

|

733

|

|

$

|

193

|

|

$

|

126

|

|

$

|

63

|

|

$

|

187

|

|

$

|

234

|

|

Mark-to-Market Impact of Economic Hedging Activities (net of taxes of $20 and $22)

|

(0.06

|

)

|

(55

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(65

|

)

|

Unrealized Gains Related to NDT Fund Investments (net of taxes of $4)

|

(0.06

|

)

|

(53

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(53

|

)

|

Asset Impairments (net of taxes of $2)

|

0.01

|

|

6

|

|

—

|

|

—

|

|

—

|

|

—

|

|

6

|

|

Plant Retirements and Divestitures (net of taxes of $70 and $68, respectively)

|

0.21

|

|

202

|

|

—

|

|

—

|

|

—

|

|

—

|

|

204

|

|

Cost Management Program (net of taxes of $4, $0, $0, $1 and $3, respectively)

|

0.01

|

|

13

|

|

—

|

|

1

|

|

1

|

|

1

|

|

10

|

|

Asset Retirement Obligation (net of taxes of $6)

|

0.02

|

|

16

|

|

—

|

|

—

|

|

—

|

|

16

|

|

—

|

|

Change in Environmental Liabilities (net of taxes of $3)

|

(0.01

|

)

|

(9

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

(9

|

)

|

Income Tax-Related Adjustments (entire amount represents tax expense)

|

(0.02

|

)

|

(18

|

)

|

—

|

|

—

|

|

—

|

|

(9

|

)

|

(30

|

)

|

Noncontrolling Interests (net of taxes of $4)

|

0.02

|

|

21

|

|

—

|

|

—

|

|

—

|

|

—

|

|

21

|

|

2018 Adjusted (non-GAAP) Operating Earnings

|

$

|

0.88

|

|

$

|

856

|

|

$

|

193

|

|

$

|

127

|

|

$

|

64

|

|

$

|

195

|

|

$

|

318

|

|

Note:

Amounts may not sum due to rounding.

Unless otherwise noted, the income tax impact of each reconciling item between GAAP Net Income and Adjusted (non-GAAP) Operating Earnings is based on the marginal statutory federal and state income tax rates for each Registrant, taking into account whether the income or expense item is taxable or deductible, respectively, in whole or in part. For all items except the unrealized gains and losses related to NDT fund investments, the marginal statutory income tax rates for 2019 and 2018 ranged from 26.0% to 29.0%. Under IRS regulations, NDT fund investment returns are taxed at different rates for investments if they are in qualified or non-qualified funds. The effective tax rates for the unrealized gains and losses related to NDT fund investments were 47.1% and 7.7% for the three months ended Sept. 30, 2019 and 2018, respectively.

Webcast Information

Exelon will discuss third quarter 2019 earnings in a one-hour conference call scheduled for today at 9 a.m. Central Time (10 a.m. Eastern Time). The webcast and associated materials can be accessed at www.exeloncorp.com/investor-relations.

About Exelon

Exelon Corporation (Nasdaq: EXC) is a Fortune 100 energy company with the largest number of electricity and natural gas customers in the U.S. Exelon does business in 48 states, the District of Columbia and Canada and had 2018 revenue of $36 billion. Exelon serves approximately 10 million customers in Delaware, the District of Columbia, Illinois, Maryland, New Jersey and Pennsylvania through its Atlantic City Electric, BGE, ComEd, Delmarva Power, PECO and Pepco subsidiaries. Exelon is one of the largest competitive U.S. power generators, with more than 31,000 megawatts of nuclear, gas, wind, solar and hydroelectric generating capacity comprising one of the nation’s cleanest and lowest-cost power generation fleets. The company’s Constellation business unit provides energy products and services to approximately 2 million residential, public sector and business customers, including more than two-thirds of the Fortune 100. Follow Exelon on Twitter @Exelon.

Non-GAAP Financial Measures

In addition to net income as determined under generally accepted accounting principles in the United States (GAAP), Exelon evaluates its operating performance using the measure of Adjusted (non-GAAP) Operating Earnings because management believes it represents earnings directly related to the ongoing operations of the business. Adjusted (non-GAAP) Operating Earnings exclude certain costs, expenses, gains and losses and other specified items. This measure is intended to enhance an investor’s overall understanding of period over period operating results and provide an indication of Exelon’s baseline operating performance excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this measure is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets and planning and forecasting of future periods. Adjusted (non-GAAP) Operating Earnings is not a presentation defined under GAAP and may not be comparable to other companies’ presentation. The Company has provided the non-GAAP financial measure as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. Adjusted (non-GAAP) Operating Earnings should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP Net Income measures provided in this earnings release and attachments. This press release and earnings release attachments provide reconciliations of Adjusted (non-GAAP) Operating Earnings to the most directly comparable financial measures calculated and presented in accordance with GAAP, are posted on Exelon’s website: www.exeloncorp.com, and have been furnished to the Securities and Exchange Commission on Form 8-K on Oct. 31, 2019.

Cautionary Statements Regarding Forward-Looking Information

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by the Registrants include those factors discussed herein, as well as the items discussed in (1) the Registrants' 2018 Annual Report on Form 10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 22, Commitments and Contingencies; (2) the Registrants' Third Quarter 2019 Quarterly Report on Form 10-Q (to be filed on Oct. 31, 2019) in (a) Part II, ITEM 1A. Risk Factors; (b) Part I, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, ITEM 1. Financial Statements: Note 16, Commitments and Contingencies; and (3) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this press release. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this press release.

Exelon

|

GAAP Consolidated Statements of Operations and

|

Adjusted (non-GAAP) Operating Earnings Reconciling Adjustments

|

(unaudited)

|

(in millions, except per share data)

|

|

|

|

Three Months Ended

September 30, 2019

|

|

Three Months Ended

September 30, 2018

|

|

|

GAAP (a)

|

|

Non-GAAP Adjustments

|

|

|

|

GAAP (a)

|

|

Non-GAAP Adjustments

|

|

|

Operating revenues

|

|

$

|

8,929

|

|

|

$

|

(77

|

)

|

|

(b)

|

|

$

|

9,403

|

|

|

$

|

(6

|

)

|

|

(b)

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased power and fuel

|

|

3,952

|

|

|

(63

|

)

|

|

(b),(d)

|

|

4,332

|

|

|

46

|

|

|

(b),(d)

|

Operating and maintenance

|

|

2,072

|

|

|

18

|

|

|

(c),(d),(e),

(f),(h)

|

|

2,346

|

|

|

(130

|

)

|

|

(c),(d),(e),(h)

|

Depreciation and amortization

|

|

1,083

|

|

|

(96

|

)

|

|

(d)

|

|

1,105

|

|

|

(152

|

)

|

|

(d)

|

Taxes other than income

|

|

452

|

|

|

—

|

|

|

|

|

469

|

|

|

—

|

|

|

|

Total operating expenses

|

|

7,559

|

|

|

|

|

|

|

8,252

|

|

|

|

|

|

Gain on sales of assets and businesses

|

|

(17

|

)

|

|

18

|

|

|

(d)

|

|

(5

|

)

|

|

6

|

|

|

(d)

|

Operating income

|

|

1,353

|

|

|

|

|

|

|

1,146

|

|

|

|

|

|

Other income and (deductions)

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

(409

|

)

|

|

14

|

|

|

(b)

|

|

(393

|

)

|

|

8

|

|

|

(b)

|

Other, net

|

|

158

|

|

|

(75

|

)

|

|

(i)

|

|

194

|

|

|

(69

|

)

|

|

(b),(i)

|

Total other income and (deductions)

|

|

(251

|

)

|

|

|

|

|

|

(199

|

)

|

|

|

|

|

Income before income taxes

|

|

1,102

|

|

|

|

|

|

|

947

|

|

|

|

|

|

Income taxes

|

|

172

|

|

|

33

|

|

|

(b),(c),(d), (e),(f),(h),(i),(j),(k)

|

|

137

|

|

|

73

|

|

|

(b),(d),(c), (e),(h),(i),(j),(k)

|

Equity in losses of unconsolidated affiliates

|

|

(170

|

)

|

|

164

|

|

|

(f)

|

|

(10

|

)

|

|

—

|

|

|

|

Net income

|

|

760

|

|

|

|

|

|

|

800

|

|

|

|

|

|

Net income attributable to noncontrolling interests

|

|

(12

|

)

|

|

24

|

|

|

(d),(e),(f), (g),(h),(i)

|

|

67

|

|

|

(21

|

)

|

|

(g)

|

Net income attributable to common shareholders

|

|

$

|

772

|

|

|

|

|

|

|

$

|

733

|

|

|

|

|

|

Effective tax rate(n)

|

|

15.6

|

%

|

|

|

|

|

|

14.5

|

%

|

|

|

|

|

Earnings per average common share

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.79

|

|

|

|

|

|

|

$

|

0.76

|

|

|

|

|

|

Diluted

|

|

$

|

0.79

|

|

|

|

|

|

|

$

|

0.76

|

|

|

|

|

|

Average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

973

|

|

|

|

|

|

|

968

|

|

|

|

|

|

Diluted

|

|

974

|

|

|

|

|

|

|

970

|

|

|

|

|

|

(a)

|

|

Results reported in accordance with accounting principles generally accepted in the United States (GAAP).

|

(b)

|

|

Adjustment to exclude the mark-to-market impact of Exelon’s economic hedging activities, net of intercompany eliminations.

|

(c)

|

|

Adjustment to exclude a change in environmental liabilities.

|

(d)

|

|

In 2018, adjustment to exclude accelerated depreciation and amortization expense associated with Generation's decision to early retire the Oyster Creek and Three Mile Island nuclear facilities and a charge associated with a remeasurement of the Oyster Creek ARO. In 2019, adjustment to exclude accelerated depreciation and amortization expenses associated with the early retirement of the TMI nuclear facility and certain fossil sites, a charge associated with the remeasurement of the TMI ARO and the loss on sale of Oyster Creek to Holtec.

|

(e)

|

|

Adjustment to exclude reorganization costs related to cost management programs.

|

(f)

|

|

In 2019, adjustment to exclude impairment of equity investments in certain distributed energy companies.

|

(g)

|

|

Adjustment to exclude elimination from Generation’s results of the noncontrolling interest related to certain exclusion items, primarily related to the impact of unrealized gains and losses on NDT fund investments at CENG.

|

(h)

|

|

In 2018, adjustment to exclude an increase at Pepco related primarily to asbestos identified at its Buzzard Point property. In 2019, adjustment to exclude a benefit related to Generation's annual nuclear ARO update for non-regulatory units.

|

(i)

|

|

Adjustment to exclude the impact of net unrealized gains and losses on Generation’s NDT fund investments for Non-Regulatory and Regulatory Agreement Units. The impacts of the Regulatory Agreement Units, including the associated income taxes, are contractually eliminated, resulting in no earnings impact.

|

(j)

|

|

The effective tax rate related to Adjusted (non-GAAP) Operating Earnings is 18.3% and 18.7% for the three months ended September 30, 2019 and September 30, 2018, respectively.

|

(k)

|

|

In 2018, adjustment to exclude the remeasurement of deferred income taxes as a result of the TCJA. In 2019, adjustment to exclude primarily deferred income taxes due to changes in forecasted apportionment.

|

Exelon

|

GAAP Consolidated Statements of Operations and

|

Adjusted (non-GAAP) Operating Earnings Reconciling Adjustments

|

(unaudited)

|

(in millions, except per share data)

|

|

|

|

Nine Months Ended

September 30, 2019

|

|

Nine Months Ended

September 30, 2018

|

|

|

GAAP (a)

|

|

Non-GAAP Adjustments

|

|

|

|

GAAP (a)

|

|

Non-GAAP Adjustments

|

|

|

Operating revenues

|

|

$

|

26,096

|

|

|

$

|

(64

|

)

|

|

(b)

|

|

$

|

27,170

|

|

|

$

|

96

|

|

|

(b)

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased power and fuel

|

|

11,731

|

|

|

(160

|

)

|

|

(b),(c)

|

|

12,374

|

|

|

(61

|

)

|

|

(b),(c)

|

Operating and maintenance

|

|

6,419

|

|

|

70

|

|

|

(c),(d),(e),

(f),(h),(i)

|

|

7,036

|

|

|

(234

|

)

|

|

(c),(d),(e),

(g),(h),(i)

|

Depreciation and amortization

|

|

3,237

|

|

|

(294

|

)

|

|

(c)

|

|

3,284

|

|

|

(441

|

)

|

|

(c)

|

Taxes other than income

|

|

1,316

|

|

|

—

|

|

|

|

|

1,342

|

|

|

—

|

|

|

|

Total operating expenses

|

|

22,703

|

|

|

|

|

|

|

24,036

|

|

|

|

|

|

Gain on sales of assets and businesses

|

|

19

|

|

|

(15

|

)

|

|

(c)

|

|

55

|

|

|

(48

|

)

|

|

(c)

|

Operating income

|

|

3,412

|

|

|

|

|

|

|

3,189

|

|

|

|

|

|

Other income and (deductions)

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

(1,221

|

)

|

|

42

|

|

|

(b)

|

|

(1,138

|

)

|

|

8

|

|

|

(b)

|

Other, net

|

|

837

|

|

|

(501

|

)

|

|

(b),(c),(j)

|

|

212

|

|

|

200

|

|

|

(b),(j)

|

Total other income and (deductions)

|

|

(384

|

)

|

|

|

|

|

|

(926

|

)

|

|

|

|

|

Income before income taxes

|

|

3,028

|

|

|

|

|

|

|

2,263

|

|

|

|

|

|

Income taxes

|

|

626

|

|

|

(98

|

)

|

|

(b),(c),(d), (e),(f),(h), (i),(j),(k),(l)

|

|

262

|

|

|

348

|

|

|

(b),(c),(d), (e),(g),(h), (i),(j),(k),(l)

|

Equity in losses of unconsolidated affiliates

|

|

(182

|

)

|

|

164

|

|

|

(i)

|

|

(22

|

)

|

|

—

|

|

|

|

Net income

|

|

2,220

|

|

|

|

|

|

|

1,979

|

|

|

|

|

|

Net income attributable to noncontrolling interests

|

|

56

|

|

|

(58

|

)

|

|

(c),(e),(h),

(i),(j),(m)

|

|

121

|

|

|

35

|

|

|

(m)

|

Net income attributable to common shareholders

|

|

$

|

2,164

|

|

|

|

|

|

|

$

|

1,858

|

|

|

|

|

|

Effective tax rate(h)

|

|

20.7

|

%

|

|

|

|

|

|

11.6

|

%

|

|

|

|

|

Earnings per average common share

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

2.23

|

|

|

|

|

|

|

$

|

1.92

|

|

|

|

|

|

Diluted

|

|

$

|

2.22

|

|

|

|

|

|

|

$

|

1.92

|

|

|

|

|

|

Average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

972

|

|

|

|

|

|

|

967

|

|

|

|

|

|

Diluted

|

|

973

|

|

|

|

|

|

|

969

|

|

|

|

|

|

(a)

|

|

Results reported in accordance with accounting principles generally accepted in the United States (GAAP).

|

(b)

|

|

Adjustment to exclude the mark-to-market impact of Exelon’s economic hedging activities, net of intercompany eliminations.

|

(c)

|

|

In 2018, adjustment to exclude accelerated depreciation and amortization expenses and one-time charges associated with Generation's decision to early retire the Oyster Creek and TMI nuclear facilities, a charge associated with a remeasurement of the Oyster Creek ARO, partially offset by a gain associated with Generation's sale of its electrical contracting business. In 2019, adjustment to exclude net realized gains related to Oyster Creek's NDT fund investments, a net benefit associated with a remeasurement of the TMI asset retirement obligation and a gain on the sale of certain wind assets, partially offset by accelerated depreciation and amortization expenses associated with Generation's previous decision to early retire the TMI nuclear facility and certain fossil sites as well as the loss on sale of Oyster Creek to Holtec.

|

(d)

|

|

Adjustment to exclude changes to environmental liabilities.

|

(e)

|

|

Adjustment to exclude reorganization costs related to cost management programs.

|

(f)

|

|

Adjustment to exclude a gain related to a litigation settlement.

|

(g)

|

|

In 2018, adjustment to exclude costs related to the PHI acquisition.

|

(h)

|

|

In 2018, adjustment to exclude an increase at Pepco related primarily to asbestos identified at its Buzzard Point property. In 2019, adjustment to exclude a benefit related to Generation's annual nuclear ARO update for non-regulatory units.

|

(i)

|

|

In 2018, adjustment to exclude the impairment of certain wind projects at Generation. In 2019, adjustment to exclude the impairment of equity investments in certain distributed energy companies.

|

(j)

|

|

Adjustment to exclude the impact of net unrealized gains and losses on Generation’s NDT fund investments for Non-Regulatory and Regulatory Agreement Units. The impacts of the Regulatory Agreement Units, including the associated income taxes, are contractually eliminated, resulting in no earnings impact.

|

(k)

|

|

The effective tax rate related to Adjusted (non-GAAP) Operating Earnings is 18.4% and 18.7% for the nine months ended September 30, 2019 and September 30, 2018, respectively.

|

(l)

|

|

In 2018, adjustment to exclude the remeasurement of deferred income taxes as a result of the TCJA. In 2019, adjustment to primarily exclude deferred income taxes due to changes in forecasted apportionment.

|

(m)

|

|

Adjustment to exclude elimination from Generation’s results of the noncontrolling interests related to certain exclusion items, primarily related to the impact of unrealized gains and losses on NDT fund investments at CENG.

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20191031005232/en/

Copyright Business Wire 2019