ENDEAVOUR ANNOUNCES A 1MOZ INCREASE IN INDICATED RESOURCES AT HOUNDÉ

Kari West & Center discoveries lift Houndé’s Indicated resource by 32% at a $15/oz discovery cost

HIGHLIGHTS:

- Kari West’s and Kari Center’s combined 1.0Moz maiden Indicated resource increases Houndé’s M&I resources by 32% to 4.1Moz, excluding 2019 depletion

- Combined Indicated resource of 19.4Mt at 1.61 g/t Au for 1.0Moz based on a 0.5 g/t cut-off, which includes 7.2Mt at a higher grade of 2.55 g/t Au for 590Koz at Kari West based on a 1.5 g/t cut-off

- Combined Inferred resource of 3.8Mt at 1.60 g/t Au for 195koz based on a 0.5 g/t cut-off, which includes 1.5Mt at a higher grade of 2.45 g/t Au for 120Koz at Kari West based on a 1.5 g/t cut-off

- 84% of the maiden resource is classified in the Indicated category, with the potential of converting additional Inferred resources to Indicated

- The mineralization at Kari West remains open at depth, to the west and the east, while Kari Center remains open to the southwest

- Favourable mining characteristics as the deposits are amenable to open pit mining with an expected low strip ratio and a significant portion of the Indicated resource located within the oxide and transition zones

- Metallurgical tests are underway; preliminary results indicate 92% for oxide/transitional and 88% for fresh ore

- Low discovery cost of $15 per Indicated resource ounce

- The Kari area has been the main exploration focus over the past two years with over 350,000m drilled, resulting in the delineation of 2.0Moz of Indicated resources through the discoveries of Kari Pump, Kari West and Kari Center

- Exploration efforts at Kari Pump have resulted in the addition of 0.7Moz of P&P reserves, as published early this year, while the maiden reserves for Kari West and Kari Center are expected to be published in Q1-2020

- A 145,000m drilling program will begin in the coming weeks, focused on extending the mineralization at the Kari deposits and exploring additional targets located within 10km of the Houndé processing plant

Abidjan, November 25, 2019 – Endeavour Mining (TSX:EDV) (OTCQX:EDVMF) is pleased to announce a 1.0Moz Indicated maiden resource for the previously announced Kari West and Kari Center discoveries at its Houndé mine in Burkina Faso.

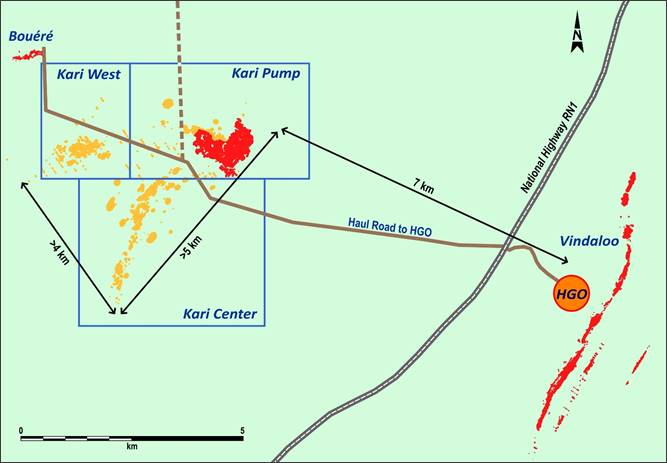

As a result, Houndé’s M&I resources have increased by 32% from 3.1Moz (44.7Mt at 2.18 g/t Au) to 4.1Moz (64.1Mt at 2.01 g/t Au), excluding 2019 depletion. This resource increase is in addition to the Kari Pump 1.0Moz Indicated maiden resource (see press release dated November 15, 2018) increasing the total discoveries for the Kari anomaly to 2.0Moz of Indicated resource, as shown in Figure 1 below. The Kari anomaly is located 7km away from the Houndé processing plant, extending over a large area measuring 6km long and 3km wide. Approximately 25% of the target is still to be drilled.

Table 1: Houndé Mineral Resource Estimate

| On a 100% basis. Resources shown inclusive of Reserves | MEASURED RESOURCE | | INDICATED RESOURCE | | INFERRED RESOURCE |

| Tonnage | Grade | Content | | Tonnage | Grade | Content | | Tonnage | Grade | Content |

| (Mt) | (Au g/t) | (Au koz) | | (Mt) | (Au g/t) | (Au koz) | | (Mt) | (Au g/t) | (Au koz) |

| Kari West | - | - | - | | 15.7 | 1.71 | 861 | | 3.4 | 1.65 | 179 |

| Kari Center | - | - | - | | 3.7 | 1.18 | 140 | | 0.4 | 1.21 | 16 |

| Kari Pump | - | - | - | | 11.3 | 2.71 | 987 | | 0.3 | 2.21 | 20 |

| Total Kari Area | - | - | - | | 30.7 | 2.02 | 1,988 | | 4.1 | 1.65 | 215 |

| Houndé Mine1 | 3.6 | 1.56 | 180 | | 29.8 | 2.05 | 1,967 | | 2.9 | 2.69 | 248 |

| Total Houndé | 3.6 | 1.56 | 180 | | 60.5 | 2.03 | 3,955 | | 6.9 | 2.08 | 463 |

1Vindaloo, Bouere and Dohoun deposits.

Mineral Resource and Reserve estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for Mineral Resources and Reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources are constrained by MII $1,500/oz Pit Shell and based on a cut-off of 0.5 g/t Au. The Kari Pump Resource has an effective date of November 2018. The Hounde Mine Resource is current as of December 31, 2018 and includes Reserves but does not include 2019 mine depletion. For the notes relating to the Houndé Mine Resource Estimate, please consult the March 5, 2019 press release available on the Company’s website. The Kari West and Kari Center Mineral Resource have an effective date of November 15, 2019.

Sébastien de Montessus, President and CEO, stated: “We are delighted to announce this substantial maiden resource for the Kari West and Kari Center discoveries and we look forward to publishing maiden reserves in the first quarter of next year, allowing us to further extend the mine life of Houndé.

The resources at Kari West and Kari Centre were both discovered at an industry-leading low cost of $15/oz, underscoring why investment in exploration continues to be a key strategic priority for Endeavour as we build a sustainable business and deliver long-term value for our shareholders.”

Patrick Bouisset, Executive Vice President Exploration and Growth, stated: “We are very pleased with the maiden resource delineated at Kari West and Kari Center, which has exceeded our expectations. As part of our strategic exploration plan, we were initially targeting a minimum of 500,000 ounces at over 2.5 g/t Au, which ultimately became 590Koz at 2.55 g/t Au based on a 1.5 g/t Au cut-off for Kari West. Due to a low strip ratio of roughly 6:1, we were able to delineate more ounces, increasing the total for Kari West and Kari Center to 1.0 million ounces at a grade of 1.61 g/t based on a cut-off grade of 0.5 g/t Au.”

“In less than two years, we have drilled over 350,000 meters and successfully delineated 2 million ounces in the Kari area. It remains highly prospective and we are excited to continue drilling at a number of remaining exploration targets, with another significant 145,000 meter drill campaign due to begin shortly.” added Mr. Bouisset.

Due to the intensive infill drill program completed, 84% of maiden total resource for Kari West and Kari Center has been classified in the Indicated category, with the potential to convert additional Inferred resources to the Indicated category. The ore bodies have favourable mining characteristics since they are amenable to open pit mining with mineralization starting at surface. They are expected to have low strip ratios, with the Indicated resource pit shell strip ratio amounting to 6.2:1 and 5.5:1 for Kari West and Kari Center respectively. In addition, the maiden resource brings significant oxide and transition ore additions, representing approximately 30% and 75% of the respective Kari West and Kari Center Indicated resource.

The Kari West maiden resource covers an area 1km long by 0.5km wide and remains open towards the east and west. The Kari Center maiden resource covers an area 1.3km long by 0.3km wide and is open to the southwest in the direction of Kari Center South.

Another 145,000-meter drill program is expected to start before year end, focused on extending the mineralization of the Kari discoveries and testing other nearby targets located within 10km of the processing facility.

ABOUT THE KARI AREA EXPLORATION PROGRAM

As shown in Figure 1 below, the Kari area is a large gold-in-soil anomaly which covers an area 6km long by 3km wide and is located 7km northwest of the Houndé processing plant.

Figure 1: Kari Area General location and Mineralized Envelops (500 ppb Leapfrog Envelops)

The Kari area has been the focus of extensive exploration since 2017, with over 350,000 meters drilled and three discoveries made: Kari Pump, Kari Center and Kari West with the drilling activity summarized as follows:

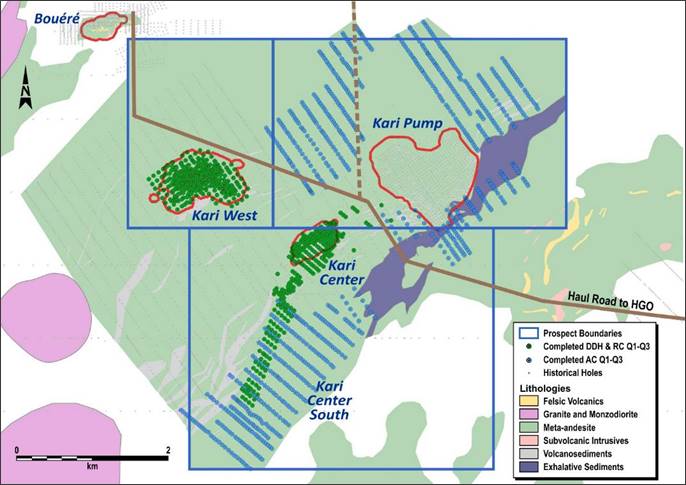

- The first 18 month exploration campaign comprised of a total of 2,237 holes (1,431 Air Core (“AC”), 716 Reverse Circulation (“RC”) and 90 Diamond Drill (“DD”)) amounting to 203,900 meters of drilling and was completed in November 2018. The holes comprised of the drilling focused on an area which represented only 35% of the large Kari gold in soil anomaly. Drill results from these campaigns were previously announced on November 13, 2017, May 24, 2018 and on November 15, 2018 respectively, which resulted in the delineation of the Kari Pump maiden Indicated resource.

- A second exploration campaign was launched in late 2018 and recently completed, comprising a total of 1,493 holes (886 AC, 538 RC and 69 DD). This amounted to 166,280 meters focused on extending the mineralization of Kari Pump and delineating a maiden resource for both the Kari West and Kari Center, as shown in Figure 2 and 3 below. The preliminary results were published on July 2, 2019, with further drilling resulting in the delineation of a maiden resource for both the Kari West and Kari Center discoveries. As per the previous exploration campaign, this latest one was also very successful with more than 80% of all RC holes and 90% of all the DD holes encountering at least one interval of mineralization of 0.5 g/t Au with a minimum width of more than 2 meters.

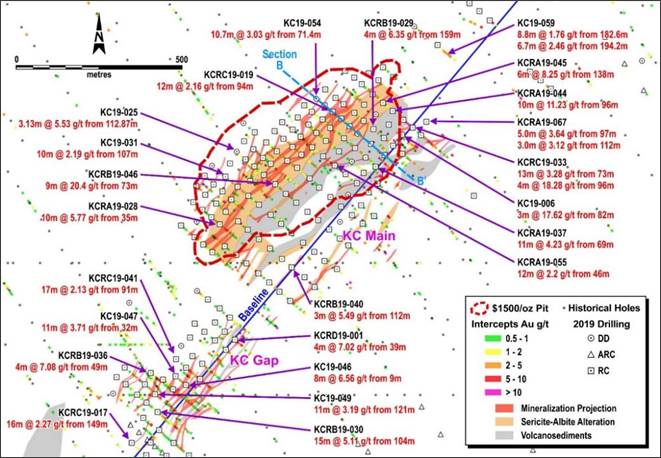

Figure 2: 2019 Drilling Activity in the Kari Area

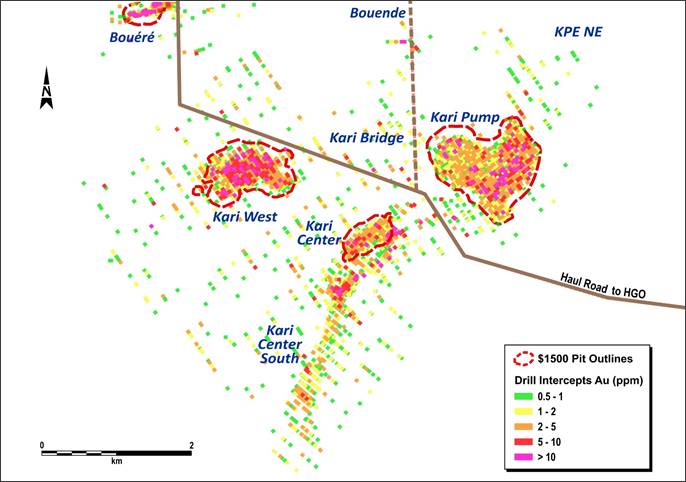

Figure 3: Kari Area Resource pit Boundaries as at November 2019

A sensitivity analysis performed at a gold price of $1,250/oz demonstrates the robustness of the Kari Area resource models due to their shallow nature and type, as shown in Table 2 below.

Table 2: Kari West and Center November 2019 Mineral Resource Estimate

| | BASED ON GOLD PRICE

OF $1,500/OZ | | BASED ON GOLD PRICE

OF $1,250/OZ |

| | |

| On a 100% basis. Resources shown inclusive of Reserves | Tonnage | Grade | Content | | Tonnage | Grade | Content |

| (Mt) | (Au g/t) | (Au koz) | | (Mt) | (Au g/t) | (Au koz) |

| INDICATED RESOURCE | | | | | | | |

| Kari Pump | 11.3 | 2.71 | 987 | | 7.9 | 3.15 | 796 |

| Kari West | 15.7 | 1.71 | 861 | | 14.1 | 1.75 | 795 |

| Kari Center | 3.7 | 1.18 | 140 | | 2.9 | 1.22 | 113 |

| Total Kari Area | 30.7 | 2.02 | 1,988 | | 24.9 | 2.13 | 1,704 |

| INFERRED RESOURCE | | | | | | | |

| Kari Pump | 0.3 | 2.21 | 20 | | 0.2 | 2.36 | 15 |

| Kari West | 3.4 | 1.65 | 179 | | 2.6 | 1.69 | 141 |

| Kari Center | 0.4 | 1.21 | 16 | | 0.2 | 1.40 | 9 |

| Total Kari Area | 4.1 | 1.65 | 215 | | 3.0 | 1.72 | 165 |

No Measured Resources have been estimated. Mineral Reserve and Resource estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for Mineral Resources and Reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII $1,500/oz Pit Shell and for sensitivity purpose by MII $1,250/oz pit shell and based on a cut-off of 0.5 g/t Au.

ABOUT KARI WEST

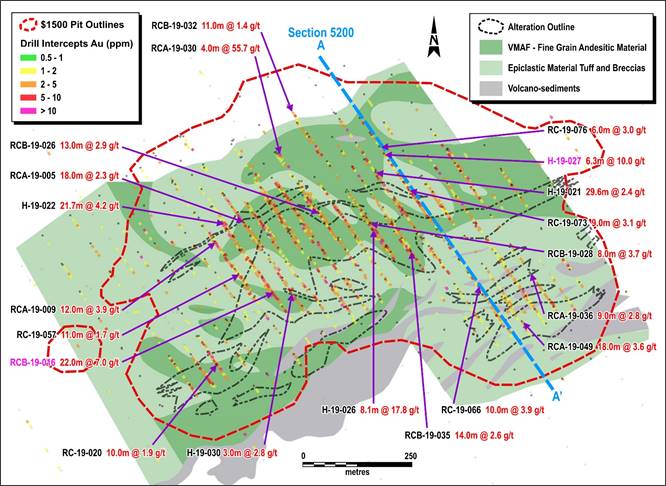

Kari West was also discovered in 2018 during the aggressive AC drilling program aimed at evaluating the strong gold-in-soil geochemical anomalies over the Kari area. In 2019, follow-up RC drilling has successfully defined a mineralized area of at least 1,000 meters in strike length at a width of approximately 500 meters, as shown in Figure 4 below. The maiden resource estimate is based on drill results from this area.

Figure 4: 2019 Drilling activity over Kari West

Table 3 below demonstrates the robustness of the Kari West Resource Estimate based on various cut-off grades.

Table 3: Kari West Cut-off Grade Analysis Constrained by a $1,500/oz Pit Shell

| | INDICATED RESOURCE | | INFERRED RESOURCE |

| | Tonnage | Grade | Content | | Tonnage | Grade | Content |

| Cut-off Grade (Au g/t) | (Mt) | (Au g/t) | (Au koz) | | (Mt) | (Au g/t) | (Au koz) |

| 0.5 | 15.7 | 1.71 | 861 | | 3.4 | 1.65 | 179 |

| 0.9 | 12.4 | 1.97 | 787 | | 2.6 | 1.92 | 163 |

| 1.5 | 7.2 | 2.55 | 590 | | 1.5 | 2.45 | 120 |

No Measured Resources have been estimated. Mineral Reserve and Resource estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for Mineral Resources and Reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII $1,500/oz Pit Shell.

The weathered bedrock and saprolite thickness vary between 25 meters and 75 meters with thicker zones noted to the south. Laterite up to 20 meters thick covers most of the area. The Kari West deposit is located in the hanging wall of a N240 trending and steep northwest-dipping lithological contact zone between dominantly meta-volcanic units (hanging wall) and a dominant metasedimentary unit (footwall). The deposit was formed under purely brittle conditions.

The mineralization of Kari West remains open down dip along the low angle structures and steeper and deeply rooted structures and open along the central extensions of the deposit on the east (100 meters wide) and on the west/southwest.

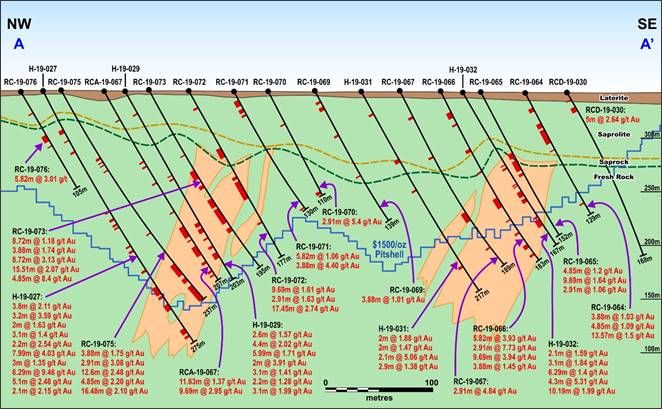

Figure 5: Section 5200 over Kari West

ABOUT KARI CENTER

Mineralization was first intercepted at Kari Center during AC initial reconnaissance drilling in 2017. Follow up RC and DD drill programs in 2018 confirmed mineralized trends and significantly extended the continuity towards the southwest. The 2019 drilling along 130° azimuth delineated two areas of mineralization, each with characteristic trends and dips. The whole area covers almost 4km and is composed of two main areas, Kari Center Main and Kari Center South.

Figure 6: 2019 Drilling activity over Kari Center

At Kari Center the mineralization is lithologically constrained, having developed at the contact between a mafic volcanic unit to the northwest and a volcano-sedimentary unit (graywacke, locally black shales) to the southeast. During a trans-compressive episode following the major regional directions N20°, thrusts faults have developed and at a more local scale, sediments have concentrated the deformation (due to the rheological contrast).

Later, this structural network has drained a pervasive sericite-albite alteration episode through the whole lithological pile. Alteration has developed mainly in volcanics due to porosity but also to rock chemistry (feldspar), giving bleached white rock totally overprinting original texture where the alteration is most intense, very similar to the one observed at Kari West. In more impermeable sediments and with unfavorable chemistry, alteration is only very rarely expressed, only very locally along narrow veins.

Gold mineralization is therefore developed mainly within volcanics, associated with whitish sulfide-sericite-albite alteration and fine disseminated pyrite, at the hanging wall of the volcanic/sediments contact, N60° strike, dipping 45° to the northwest. The mineralization is diffuse, locally high grade (> 2 g/t Au) but mostly lower grade with large volumes of oxidized and argilized ore. In brittle sedimentary units, gold grades are structurally controlled, locally very high grade (> 5g/t Au) but on narrower tension gashes type intercepts. To date, neither visible gold nor arsenopyrite have been observed in drill cuttings.

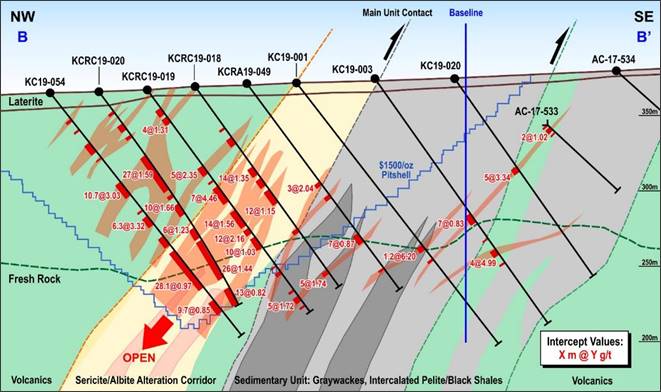

Figure 7: B – B’ Kari Center Section

The 2019 Maiden Resource covers only the principal part of Kari Center Main, at the volcanic/sediment contact, trending N60° over a length of 800 meters.

Mineralization in the southern area, referred to as Kari Center South, strikes north-northeast (N20°) and dips moderately to the west. The trend covers an area approximately 2,100 meters along strike at a width of approximately 400 meters and is yet to be delineated. The Kari Center South trend has not yet been included in this new Resource Estimate.

RECOVERY

A selection of 489 coarse rejects from RC and DD samples spread across the main mineralized zone were analyzed by Bulk Liquid Extractable Gold (BLEG) to give an indication of leach characteristics ahead of full metallurgical test results. The samples were assayed at ALS-Chemex Ouagadougou.

The recovery factor does not indicate presence of refractory minerals nor graphite with average recoveries over 92% in oxide and transition material, and 88% in fresh rock.

NEXT STEPS

- A 145,000-meter drilling program is due to begin in December 2019 and will continue in 2020, with the following key objectives:

- Pursue Kari Pump, Kari West and Kari Center extensions

- Infill the gaps existing between the deposits and increase the Kari area resource base

- Test additional nearby targets such as Vindaloo Deep and South

- Drill other high ranked targets such as Dohun, Sia/Sianikoui and Grand Espoir

- Metallurgical tests on Kari West and Kari Center are underway and a Reserve Estimate is expected to be published in Q1-2020.

KARI WEST AND KARI CENTER RESOURCE MODELLING

The geological models, statistical analyses and resource estimates were prepared by Helen Oliver, FGS CGeol. Ms Oliver is Endeavour Mining's Group Resource Geologist and a Qualified Person as defined by NI 43-101.

The Kari West and Kari Center Mineral Resource Estimates were developed in Geovia’s Surpac software. 94 mineralized zones, grouped into eight domains, were defined from the current drilling data (as of September 1, 2019) and geological interpretations at Kari West. 16 mineralized zones were defined at Kari Center. The gold assays from the drill holes were composited to one metre intervals within the mineralized wireframes and capped at 6 g/t Au and 15 g/t Au by domain at Kari West and at 6 g/t Au at Kari Center. Spatial analysis of the gold distribution within the mineralized zones using variograms indicated a good continuity of the grade along strike and down-dip and were used to establish ordinary kriging (OK) parameters.

Kari West density was measured in 1,307 core samples within the various rock types and averaged within the model by weathering; the laterite density is 2.04 t/m3, the saprolite 1.76 t/m3, the transition 2.40 t/m3 and the fresh rock 2.72 t/m3. Kari Center density was measured in 934 core samples with an average laterite density of 2.12 t/m3, saprolite 1.77 t/m3, transition 2.27 t/m3 and fresh rock 2.75 t/m3.

The gold grade was estimated by the OK method, constrained within the mineralized wireframes. The grade was estimated in multiple passes to define the higher confidence areas and to extend the grade into areas of extrapolated mineralization.

The grade estimation was validated by visually comparing drilling data and block grades, comparing inverse distance squared and OK estimated grades and by swath plots comparing block grades and composite grades.

The mineralization was classified as Indicated and Inferred Mineral Resources depending on the sample spacing, number samples, confidence in mineralized zone continuity and geostatistical analysis. Indicated Mineral Resource classification was generally applied to blocks within the mineralized zone defined by a minimum of five samples from at least three drill holes with a 55-meter search at Kari West and 60-meter search at Kari Center. Inferred Mineral Resource classification was defined by a minimum of three samples within a 75-meter search at Kari West and 80m at Kari Center.

The Mineral Resources were constrained by $1,500 pit shells and a 0.50 g/t Au cut-off grade. The Whittle pit shell optimizations assumed a base mining cost of $2.00/t and an adjusted ore mining cost of $2.60/t for oxide, $3.00/t for transition and $3.50/t for fresh rock, a mining recovery of 95%, mining dilution of 20%, a pit slope of 40o, gold recovery of 90% in oxide, transition and fresh rock, and a processing and G&A cost of $16.20/t for oxide, $18.00/t for transition and $20.50/t for fresh rock.

ASSAYS AND QUALITY ASSURANCE / QUALITY CONTROL / DRILLING AND ASSAY PROCEDURES

RC drill samples were collected at one meter intervals using dual tube, percussion hammer with drop center bit. This same configuration was used on modified AC drills for regional drill programs.

RC and AC samples were split at the drill site using one tier or three tier riffle splitters based on bulk sample weight collected at the cyclone. The target was a 2kg to 3kg sample for Au analysis in addition to an equivalent backup reference sample. Bulk weights, analysis sample weights and reference sample weights were all recorded. All measures were employed to avoid collecting wet samples; however, if wet samples were generated the entire sample was dried and split using one tier and three tier splitting equipment. Representative samples for each interval were collected with a spear from the bulk sample bag and sieved into chip trays for geological logging and stored in a secure location.

Drill core (PQ, HQ and NQ size) samples were selected by geologists and cut in half with a diamond blade saw at the project site. Half of the core was retained in the core trays at the site for reference purposes. The average sample interval was approximately one meter in length and 2kg to 3kg in weight.

All aspects of sampling at the Kari Area project site were monitored with a quality assurance–quality control (QA-QC) program, compliant with NI 43-101 Standards. This to ensure there are adequate internal quality control samples in each analytical batch: coarse blanks, field duplicates and certified reference material (CRM) were inserted by geologists into the sample stream for verification of the analysis at the laboratory. QA-QC sample insertion rates include: one blank, one field duplicate and one CRM per 30 samples in regional AC programs; one blank, one field duplicate and one CRM per 25 samples in RC delineation drilling; and one blank and one CRM per 20 to 25 samples in DD core sample batches. In addition, the laboratory was contracted to generate one coarse crush duplicate and one pulp duplicate per 60 samples for regional AC programs, 50 samples for RC delineation drilling and 40 samples in DD core sample sequences.

Kari Area drill and QA-QC programs were audited by external consultants in February and May 2019.

Full drill results since July 02, 2019 are available by clicking here.

QUALIFIED PERSONS

The scientific and technical content of this news release has been reviewed, verified and compiled by Gérard de Hert, EurGeol, Senior VP Exploration for Endeavour Mining. Gérard de Hert has more than 20 years of mineral exploration and mining experience and is a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The resource estimation was completed by Helen Oliver, FGS, CGeol, Group Resource Geologist for Endeavour Mining and a "Qualified Person" as defined by National Instrument 43-101.

CONTACT INFORMATION

Martino De Ciccio

VP – Strategy & Investor Relations

+44 203 640 8665

mdeciccio@endeavourmining.com | Brunswick Group LLP in London

Carole Cable, Partner

+44 7974 982 458

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate African gold producer with a solid track record of operational excellence, project development and exploration in the highly prospective Birimian greenstone belt in West Africa. Endeavour is focused on offering both near-term and long-term growth opportunities with its project pipeline and its exploration strategy, while generating immediate cash flow from its operations.

Endeavour operates 4 mines across Côte d’Ivoire (Agbaou and Ity) and Burkina Faso (Houndé, Karma).

For more information, please visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.