It’s finally happening: peak gold.

The big gold companies can’t grow any bigger, and the biggest ones are losing steam.

Today, the real golden opportunities are in the small miners.

Just think about it:

- Big potential upside

- Lower prices

- Higher potential for big strikes

- Higher chance of mergers and big gains

And there’s one little company in West Africa that appears ready to break out.

With a new CEO and a near-term target of 50,000 ounces of gold per year, African Gold Group (TSX.V: AGG; OTC:AGGFF) should be popping up on your radar. And it’s just getting started: the company is shooting for 100,000 ounces per year, from a mine that already has an estimated 2.2 million ounces of gold in the ground.

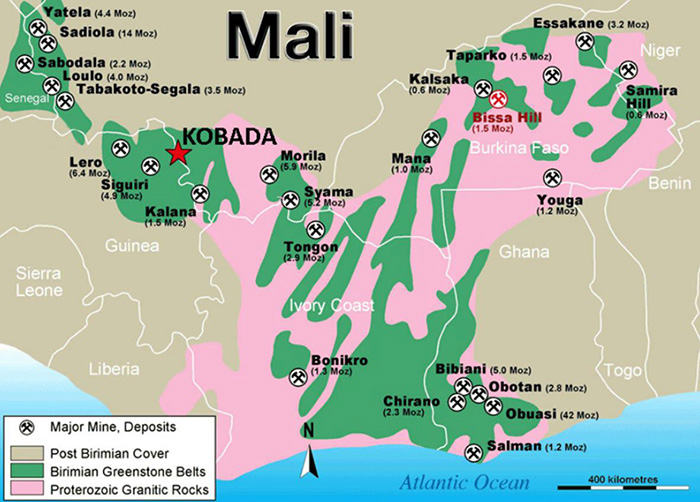

AGG has locked in the Kobada Mine, astride Mail’s prolific Birmian Greenstone belt and industry titan Stan Bharti has just joined as CEO.

Bharti has known Mali for a decade or more, and he’s already turned one company around, realizing a 20x profit: in 2008 he took over Avion for $20 million and sold it to Endeavor four years later for a cool $500 million.

And he’s hoping to repeat this magic with AGG.

The timing couldn’t be better: Gold is building. Major miners are looking for fresh acquisitions. Banks are hoarding gold and talk of the gold standard has spiked.

All of this means the world’s most precious metal is set for a major rebound.

Here are 5 Reasons to take another look at AGG (TSX.V: AGG; OTC:AGGFF)

#1 From Big to Small

Major gold miners can’t hack it right now.

Bloated from over-investment in declining assets, even high gold prices can’t save the big firms from losing value.

In fact, Goldcorp Inc. Chairman Ian Tefler has said we’ve reached “peak gold,” with years of growth finally stalling for the big miners.

So to balance out, they’re looking to snap up smaller firms.

This means there could be big gains coming from little firms like AGG (TSX.V: AGG; OTC:AGGFF) with fresh assets just waiting for new capital.

Small gold-miners and gold ETFs are booming right now, with the VanEck Vectors Junior Gold Miners ETF jumping 36%.

So it’s the start of a new round of mergers for the big companies, as they snap up whatever assets they can find.

Barrick Gold took over Randgold in 2018 for $18.3 billion. Newmont Mining took on Goldcorp, just after Tefler’s “peak gold” comments, laying down $10 billion.

President Trump is talking openly about returning the US to the gold standard: a fantastical idea, to be sure, but one that is sure to boost gold prices in the near term. Attaching the US dollar to gold would require massive gold purchases by the US Treasury—another factor leading to higher prices.

Gold assets are being snapped up in equity markets around the world in preparation for a possible economic downturn in 2020. If you’re worried, buy gold—that’s been the mantra for decades.

And no one knows this better than AGG CEO Stan Bharti, whose been immersed in gold throughout his career.

He’s identified AGG as the newest low-priced gold asset. And there are few compelling reasons why.

#2 Location, Location, Location

AGG (TSX.V: AGG; OTC:AGGFF) is sitting on a literal gold mine: the Kobada mine, lying on top of Mali’s prolific Birmian Greenstone Belt.

It’s a colossal formation running across 350,000 sq. km of first-class gold deposits in Burkina Faso, Ghana, Guinea, Mali, Niger, Senegal, and Côte d’Ivoire.

The Kobada Mine sits in the middle of this formation, with a total estimated resource already of more than 2.2 million ounces.

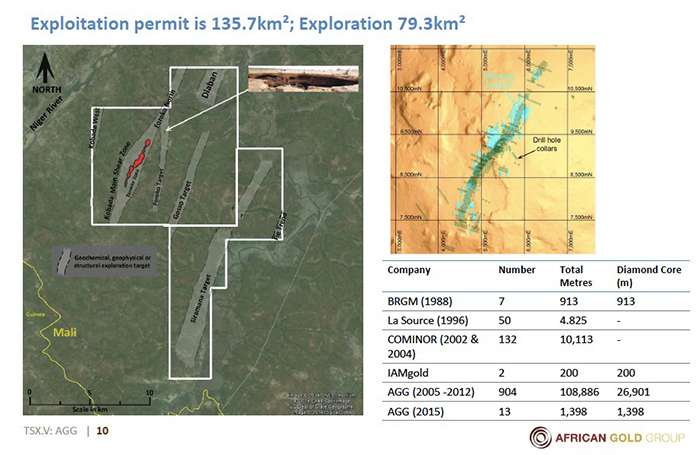

The property is 25 km long and 15 km wide covering an area of more than 200 square kilometres, with AGG owning the whole license. It’s already proven the 2.2 million ounce haul, with the bulk near the surface—the deepest AGG has dug thus far is 300 meters.

A 2016 feasibility study supported Kobada’s worth. It’s an open-pit operation, using gravity separators and leach, a low-cost operation in an area with a high proven return rate. AGG estimates average LOM at $557/Oz Au, exclusive of royalties, with LOM sustaining cash operating costs of $788/Oz Au.

That’s against a current price of $1500/Oz.

And a lot of the progress has come in the last few months, with AGG completing their accommodation camp and bringing in more staff. By early November, three drills were turning with a fourth on the way, in line for a completion date of December 12, more than a month ahead of schedule. A new definitive feasibility study is scheduled for April 2020.

The company’s on a fast track, working through the rainy season, with a new hole drilled every 3 days.

#3 By the Numbers

The 2016 feasibility numbers at Kobada are exactly what investors should be looking for: flows from starter pits and a post-tax IRR of 43%, based on $1200 gold, or 55% based on $1400 gold…with an even higher figure on $1500 gold.

The AGG feasibility study highlighted a $45.4 million pre-production capital cost, and it is currently spending about $180k per week on drilling, at $70k per hole.

African Gold Group (TSX.V: AGG; OTC:AGGFF) is targeting a 1.5-year payback from the start of commercial production, and full payback in only 2.5 years: modest, attainable goals that it should reach no problem, considering the high potential of the Kobada mine.

The 2016 feasibility study shows that AGG can produce 50,000 ounces of gold a year with the potential to build that to 100,000 ounces a year …

All for a steal, at only $50 million.

There are a lot of good gold projects out there, but few see the light of day.

That’s not the case with Kobada.

The mine is on track for a new feasibility study in April. Extensive exploration and metallurgical tests have proven the mine’s potential.

And that’s thanks to AGG’s secret weapon…

#4 The Gold Standard of Leadership

There’s a new man at the helm of AGG: legendary gold exec Stan Bharti.

He took over AGG on August 7, when he was appointed chairman of the board, President and CEO.

An engineer, international financier, seasoned entrepreneur who brought in $3 billion in investment for past companies, Bharti’s got a long history with Mali, the site of the Kobada mine.

His firm Forbes & Manhattan, based in Toronto, is a leading firm specialized in distressed assets. For gold, that means a good management team with lots of gold in the ground and a need for lots of capital.

Kobada represents the newest opportunity, for a few reasons:

- A solid feasibility study with a resource of 2 million ounces close to the surface.

- A good location in a prolific African gold belt.

- Old management that just wasn’t cutting it.

F&M took it over and brought on a new board, including Stan Bharti as Chairman, President & CEO.

With new management in position, it’s time to get to the gold.

Bharti’s track record on turnarounds is self-evident, but there are other AGG board members and managers to take note of:

Sir Sam Jonah is the former CEO of Anglo Gold Ashanti, one of the two major gold companies operating in Africa in the 1990s, and one of the most highly respected African gold veterans around.

There’s also Bruce Humphrey, former COO of giant Goldcorp, the 2nd-largest gold company in the world.

John Begeman, the CEO of Avion—the Mali-based gold company that he and Bharti grew from $20 million to $500 million.

And now, AGG can boast another big name: Daniel Callow, a 12-year veteran for trading/mining giant Glencore’s African copper operations, the new AGG COO.

#5 More News to Come

AGG (TSX.V: AGG; OTC:AGGFF) is looking to churn out 50,000 oz per year. And that’s the start.

With a new feasibility study on the way, the company hopes to reach 100,000 oz per year fairly soon. The completion date for drilling of December 12 looks do-able, thanks to rapid progress and the company’s new staff facilities.

AGG’s proved up resources of 2.2 million ounces alone are worth billions in revenue at today’s soaring gold prices—prices that will top $1500 per oz.

And that’s just the 2.2 million oz proven as of writing. With a mine of this size, sitting on top of the world’s most prolific gold belt, the actual reserves could be much larger.

With new management, rising prices, and a great climate for small miners, AGG is looking to make a splash—and that could potentially bring talks of acquisitions before too long.

This is a little company with a big future ahead of it.

Keep an eye on this one.

But what makes the company potentially worth even more is the fact that the big miners are on the hunt for just this type of junior they hope can replenish their declining reserves in the only way possible.

Other opportunities to watch as peak gold nears:

Seabridge Gold Inc. (NYSE:SA, TSX:SEA)

Seabridge is an ambitious young company taking the industry by storm. It has a unique strategy of acquiring promising properties while precious metals prices are low, expanding through exploration, and then putting them up for grabs as prices head upward again.

The company owns four core assets in Canada; the KSM project, which is one of the world’s largest underdeveloped projects measured by reserves, Courageous Lake, a historically renowned property, and Iskut, a product of a recent acquisition by Seabridge.

Recently, Seabridge closed a major extension deal to continue expansion at its KSM project. CEO Rudi Fronk stated: "We are pleased that our EA Certificate has been renewed until 2024 under the same terms and conditions, reaffirming the Government of British Columbia's support for KSM and the robustness of the original 2014 EA.”

Teck Resources (NYSE:TECK, TSX:TECK)

Teck could be one of the best-diversified miners out there, with a broad portfolio of Copper, Zinc, Energy, Gold, Silver and Molybdenum assets. Its free cash flow and a lower volatility outlook for base metals in combination with a potential trade war breakthrough could send the stock higher in H2 of this year.

Teck’s share price stabilized last year and many investment banks now see the stock as undervalued. Low prices for Canadian crude and disappointing base metals prices weighed on Q4 earnings.

Despite its struggles, however, Teck Resources recently received a favorable investment rating from Fitch and Moody’s, and will likely benefit from its upgraded score. “Having investment grade ratings is very important to us and confirms the strong financial position of the company,” said Don Lindsay, President and CEO. “We are very pleased to receive this second credit rating upgrade.”

Kinross Gold Corporation (NYSE:KGC, TSX:K)

Kinross Gold Corporation is relatively new on the scene, founded in the early 90s, but it certainly isn’t lacking drive or experience. In 2015, the company received the highest ranking for of any Canadian miner in Maclean's magazine's annual assessment of socially responsible companies.

While Kinross posted a significant loss in the fourth quarter of 2018, the company is making strong moves to turn around its earnings, including the hiring of a new CFO, Andrea S. Freeborough.

“Andrea’s successful track record at Kinross and throughout her career, including accounting, international finance, M&A, and deep management experience, will be an excellent addition to our leadership team,” said Mr. Rollinson. “We have great talent at Kinross and succession planning is a key aspect of retaining that talent for the future success of our Company.”

Wheaton Precious Metals Corp. (NYSE:WPM, TSX:WPM)

Wheaton is a company with its hands in operations all around the world. As one of the largest ‘streaming’ companies on the planet, Wheaton has agreements with 19 operating mines and 9 projects still in development. Its unique business model allows it to leverage price increases in the precious metals sector, as well as provide a quality dividend yield for its investors.

Recently, Wheaton sealed a deal with Hudbay Minerals Inc. relating to its Rosemont project. For an initial payment of $230 million, Wheaton is entitled to 100 percent of payable gold and silver at a price of $450 per ounce and $3.90 per ounce respectively.

Randy Smallwood, Wheaton's President and Chief Executive Officer explained, "With their most recent successful construction of the Constancia mine in Peru, the Hudbay team has proven themselves to be strong and responsible mine developers, and we are excited about the same team moving this project into production. Rosemont is an ideal fit for Wheaton's portfolio of high-quality assets, and when it is in production, should add well over fifty thousand gold equivalent ounces to our already growing production profile."

Eldorado Gold Corp. (NYSE:EGO, TSX:ELD)

This Canadian mid-cap miner has assets in Europe and Brazil and has managed to cut cost per ounce significantly in recent years. Though its share price isn’t as high as it once was, Eldorado is well positioned to make significant advancements in the near-term.

In 2018, Eldorado produced over 349,000 ounces of gold, well above its previous expectations, and is set to boost production even further in 2019. Additionally, Eldorado is planning increased cash flow and revenue growth this year.

Eldorado’s President and CEO, George Burns, stated: “As a result of the team’s hard work in 2018, we are well positioned to grow annual gold production to over 500,000 ounces in 2020. We expect this will allow us to generate significant free cash flow and provide us with the opportunity to consider debt retirement later this year. “

By: Joao Piexe

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by 2227929 Ontario Inc. to conduct investor awareness advertising and marketing concerning African Gold Group. Inc.2227929 Ontario Inc. paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the company’s gold exploration and extraction activities, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditionsIf you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.