VANCOUVER, BC / ACCESSWIRE / May 7, 2020 / MGX Minerals Inc. ("MGX" or the "Company") (CSE:XMG)(FKT:1MG)(OTC PINK:MGXMF) is pleased to announce an agreement to purchase a 100% interest in the Heino-Money gold deposit and Tillicum Claims (MINFILE 082FNW234 including Grizzley, Annie Flats, and Silver Queen occurrences, located approximately 12 kilometres east of Burton (110 km east of Kelowna), in the West Kootenay region of British Columbia. By issuing shares and cash totaling $5,000,000 CDN and completing a work program of $1,050,000 CDN over a three year term, MGX will acquire a 100% interest in the property with a Net Smelter Return to the Vendors of 5%, which may be bought back for $1,000,000 CDN.

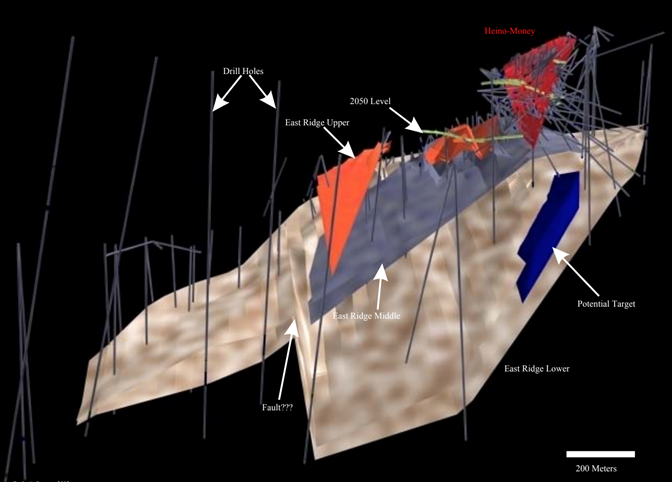

Figure 1 - 3D Drill Hole Model (Assessment Report 27144)

Property Exploration History

In 1981, a bulk sample of 58 tonnes shipped from the Money Pit averaged 78.8 grams per tonne gold. In 1986, a 3175- tonne bulk sample was shipped to the Dankoe mill at Keremeos and yielded 109.44 kilograms of gold (Assessment Report 19437). In 1993, as a result of mining at the Heino-Money zone, a total of 5503 tonnes of mineralization with an estimated head grade of 24.4 grams per tonne gold was shipped to the Goldstream mill (MINFILE 082M 141) for processing. Approximately 102,443 grams of gold and 149,546 grams of silver were recovered into concentrates that were shipped to Japan for smelting (George Cross News Letter No. 237 December 10, 1993).

Summary of production from Heino-Money zone, 1981 to 1993:

Exploration activity in 1982 included 1128 metres of diamond drilling in 16 holes on the Heino-Money zone, eight holes on the East Ridge zone and three holes on the Jenny zone. In 1983, a 60.9-metre crosscut adit was driven on the East Ridge zone and further geochemical surveys and trenching carried out. Diamond drilling was done in 18 holes on the Heino-Money zone. Drilling in 1983 totalled 2319 metres in 38 holes. In 1984, a 60-metre adit was driven into the upper part of the Heino-Money zone. Further diamond drilling was done in five holes on the East Ridge zone. La Teko provided financing of exploration to the end of 1985 ($2.28 million) to earn a 39.6 per cent interest in Esperanza. La Teko was unable to provide further financing and the 1982 option agreement expired at the end of 1985. In 1986, Esperanza Explorations completed a drill program of 25 surface diamond drill holes, totalling 835.5 metres and nine underground diamond drill holes, totalling 176.8 metres, including DDH Haus86-6 which intercepted 12.8 meters @ 90.57 g/t Au. Underground development, included 153 metres of drifting and 46.5 metres of raises. By this time, 5 levels had been developed at elevations of 2112, 2130, 2148, 2160 and 2171 metres on the Heino-Money zone. In 1989, a further 10 diamond drill holes, totalling 1437.6 metres, were completed on the East Ridge zone.

The East Ridge zone is 300 metres east of the Heino-Money zone. Gold mineralization occurs in a blanket-like zone that straddles the contact between porphyritic diorite and meta-arkose, quartzite, siltstone and minor argillite. The gold-bearing, near-vertical calc-silicate skarn structures occur within a 9.1 to 24.3- metre zone that strikes northeast and dips 70 degrees northwest. The skarn structures have widths that vary from 1.5 to 4.6 metres, but average 2.1 metres. The East Ridge zone has been traced by drilling for 1100 metres along strike and 365 metres down-dip at an average width of 1.5 metres. The East Ridge zone is comprised of two parallel upper skarn structures 0.9 to 1.5 metres thick and a lower skarn structure. Gold occurs in randomly distributed high- grade pockets separated by areas of lower grade material. Within the zone, gold-bearing sulphide mineralization consists of pyrrhotite, pyrite-marcasite, arsenopyrite, chalcopyrite, sphalerite, galena and native gold with traces

In 1989, Esperanza Explorations Ltd wrote a summary of the mineralization on the Heino-Money Zone (Property File 825275, Roberts, 1989):

The gold mineralization is contained in a near vertical skarn structure which averages about six feet in width and which, to date, has been delineated over a strike length of about 600 feet and a vertical extent of 300 feet. The mineralized zone remains open both on strike and to depth.

In 1993, Bethlehem Resources Corporation and Goldnev Resources Inc. optioned the property and

obtained a permit for an underground mining operation. Mining commenced in mid-August of that year

and was completed in late October. A total of 29,009m of surface and 3,865m of underground drilling for a total of 376 holes. In addition, underground development consisting of 1,374m in the Heino-Money zone and 410m in the East Ridge zone was completed.

In 1994 Columbia Gold Mines Ltd. (formerly Esperanza Explorations Ltd.) commissioned Ross Glanville & Associates to carry out a valuation of the Tillicum Mountain project.

Figure 2 - Topography with Zones of Mineralization (Assessment Report 35269)

Property Geology

The Tillicum Mountain area is underlain by metamorphosed siltstone, calcareous siltstone, arkose, and wacke, with lesser amounts of basalt, tuff, argillite, impure carbonate and marble layers, that have been subjected to Lower Jurassic regional metamorphism and folding that predates the Middle to Upper Jurassic intrusion of the monzonitic stocks. This resulted in sillimanite- grade metamorphism throughout most of the Nemo Lakes Belt, however, the metamorphic grade is lower around Tillicum Mountain and resulted in the formation of biotite, muscovite, chlorite and amphibole. In addition to the regional metamorphism, the rocks were locally subjected to two episodes of contact metamorphism. The first is associated with swarms of dioritic sills that probably accompanied the regional deformation, the second is hornfelsing related to the intrusion of the large monzonitic stocks and postdates the regional deformation. The structure on the property is dominated by steep angle normal and reverse faults. Most faults have little offsets, however, several faults with major displacements divide the property into fault-bounded blocks. The metamorphic fabric of the rock closely parallels the bedding planes with minor or parasitic folding only very rarely observed. The Heino-Money zone is offset by a series of left-lateral, steep- angle, northeast- striking faults that have displacements of up to 9.0 metres. Within a 500 metre radius of the Heino-Money zone, three other significant mineralized zones have been discovered. These are the East Ridge zone, the Jenny zone and the Blue zone.

At the Heino-Money zone, strata-bound, gold-bearing, siliceous calc-silicate skarn alteration is hosted in a thin, wedge-shaped package of basaltic tuff and tuffaceous sedimentary rocks, which is bounded to the west by metabasalts and to the east by a large, altered feldspar porphyritic diorite body. The skarn is pinkish-green and is generally well layered with sub-parallel thin quartz veins and variable amounts of sulphides. The skarn assemblage includes quartz, tremolite-actinolite, clinozoisite, plagioclase, diopside, biotite, garnet and microcline, with minor amounts of sericite and carbonate. Free gold occurs as fine to coarse disseminations and fracture fillings within and along walls of the quartz sulphide veins; gold is generally associated with pyrrhotite, pyrite, galena and sphalerite. The zone is cut by north-trending, steeply dipping lamprophyre dykes, which postdate both the skarn development and sulphide mineralization. A polished section study of this mineralization shows that gold grains are generally free, but may also be intimately associated with pyrrhotite, arsenopyrite, sphalerite and pyrite-marcasite. Some pyrrhotite grains are rimmed with colloform pyrite-marcasite while others contain small masses of hematite and graphitic material. Minor to trace amounts of tetrahedrite, chalcopyrite and possibly electrum also occur. Polished thin section studies and geochemical studies suggest that the mineralizing process at the Heino-Money zone involved two phases of precious metal deposition. The first phase included the introduction of gold, arsenopyrite and possibly sphalerite, accompanied by the crystallization of quartz, carbonate and calc-silicate minerals. This was followed by the deposition of argentiferous galena and the continued introduction of arsenopyrite and sphalerite. Gold and silver-bearing horizons are present in the skarns at the Heino-Money zone but they do not occur together.

Silver Queen Geology

The Silver Queen Crown Grants are underlain by highly deformed Triassic and older volcanic and sedimentary rocks of and younger aplite and feldspar porphyry dikes, and granitic intrusions. Locally, impure tuffs and sandy sediments, striking east to north east and dipping steeply south to west, have been intruded by numerous dykes. An open cut at a point 50 metres down the southern slope, at an elevation of 2350 metres, exposes a carbonate band, approximately 1 metre wide, in these sedimentary rocks that hosts concentrations of pyrite. The gold and silver mineralization is associated with various dykes and sills and the mid-Jurassic Goat Canyon granitic stock. A 10-metre shaft at 2,100 metres elevation and an adit 100 metres to the south west develop similar occurrences. The main adit is driven north east for 35 metres then turns north for approximately the same distance before ending in aplitic granite. The adit is principally in limy and garnetiferous greenstone. Mineralization has been traced over a strike length of 950 metres. Drilling on the zone has identified several 20- metre thick mineralized skarn zones hosted in a 30- metre wide sequence of impure calcareous quartzites, siltstones and thin marble beds marginal to feldspar porphyry sills. Sulphide mineralization consisted of pyrite, pyrrhotite, tetrahedrite, sphalerite, galena, pyrargyrite and arsenopyrite. Alteration minerals include quartz, tremolite, actinolite and anhedral garnet.

In 1982, sampling of an open-cut exposing the carbonate band assayed 3.4 grams per tonne gold and 960 grams per tonne silver. While, a silicified sample from the portal of the adit assayed 3.4 grams per tonne gold and 1060 grams per tonne silver… In 1984, diamond drilling intersected values from 40.1 grams per tonne silver over 3.65 metres to 144.7 grams per tonne over 4.51 metres. In 2001, samples from the adit dump assayed from 1.4 to 3.4 grams per tonne gold and 685 to 1060 grams per tonne silver with 2.7 per cent lead and 2.6 per cent zinc. Another mineralized zone, located approximately 300 metres north east of the adit, yielded up to 2.1 grams per tonne gold and 257 grams per tonne silver, while another sample from the ridge crest approximately 200 metres west of the mountain summit assayed 3.4 grams per tonne gold and 960 grams per tonne silver (MINFILE 082FNW220).

Payments and Exploration Commitments

(a) The Purchaser agrees to pay to the Vendors cash payments totaling $2,000,000 for the 90% Consideration under the following schedule:

(i) $25,000 within 14 days of the Execution Date;

(ii) $50,000 prior to July 15th 2020;

(iii) $100,000 prior to October 1, 2020;

(iv) $100,000 prior to January 1, 2021;

(v) $100,000 prior to March 1, 2021;

(vi) $125,000 prior to July 1, 2021;

(vii) $125,000 prior to October 1, 2021;

(viii) $125,000 prior to January 1, 2022;

(ix) $125,000 prior to March 1, 2022;

(x) $125,000 prior to May 1, 2022;

(xi) $125,000 prior to October 1, 2022;

(xii) $125,000 prior to January 1, 2023;

(xiii) $125,000 prior to March 1, 2023;

(xiv) $125,000 prior to May 1, 2023;

(xv) $125,000 prior to October 1, 2023

(xvi) $125,000 prior to January 1, 2024;

(xvii) $125,000 prior to March 1, 2024;

(xviii) $125,000 prior to May 1, 2024;

(b) The Purchaser agrees to issue 20,000,000 common shares of the Purchaser, at a deemed price of $0.10 per share, to the Vendors, and together with Initial Cash Payment, for the 90% Consideration under the following schedule:

(i) 2,000,000 within 14 days of the Effective Date;

(ii) 2,000,000 prior to October 1st, 2020;

(iii) 2,000,000 prior to May 1, 2021.

(iv) 2,000,000 prior to October 1st, 2021

(v) 2,000,000 prior to May 1, 2022

(vi) 2,000,000 prior to October 1, 2022

(vii) 2,000,000 prior to May 1, 2023

(viii) 2,000,000 prior to October 1, 2023

(ix) 4,000,000 prior to May 1, 2024;

(c) The 10% remaining interest maybe purchased for $1 million at any time.

(d) The Purchaser grants to the Vendors a Net Smelter Return of 5% which may be bought back for $1 million.

(e) The Company shall fund and pay exploration expenditures, in respect of the project, in the aggregate amount of $1,050,000 as follows: $50,000 shall be expended by the Purchaser prior to August 1, 2020, $500,000 shall be expended by the Purchaser prior to December 01, 2021 and $500,000 shall be expended by the Purchaser prior to December 01, 2023.

N.I. 43-101 and Customary Approvals

The Company will complete a N.I. 43-101 Technical Report within 45 days and will seek to verify data and previous work. All work prior to the implementation of N.I. 43-101 was completed by qualified professionals of their day and is believed to be accurate, but is not N.I. 43-101 compliant. The Company is currently seeking final exchange and corporate approvals.

Qualified Person

Andris Kikauka (P. Geo.), Vice President of Exploration for MGX Minerals, has prepared, reviewed and approved the scientific and technical information in this press release. Mr. Kikauka is a non-independent Qualified Person within the meaning of National Instrument 43-101 Standards.

About MGX Minerals Inc.

MGX Minerals invests in commodity and technology companies and projects focusing on battery and energy mass storage technology, extraction of minerals from fluids, and exploration for battery metals, industrial minerals, and precious metals.

Contact Information

Patrick Power

Chief Executive Officer

ppower@mgxminerals.com

Web: www.mgxminerals.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This press release contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking information provided by the Company is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Company's public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Company's profile on SEDAR at www.sedar.com.

SOURCE: MGX Minerals Inc.

View source version on accesswire.com:

https://www.accesswire.com/588862/MGX-Minerals-Announces-Acquisition-of-Heino-Money-Gold-Deposit-and-Tillicum-Claims-Located-in-the-West-Kootenay-Region-British-Columbia