The $150-billion organic food industry has a major fertilizer problem that could hinder its growth.

Massive livestock operations from Europe to North America have an even bigger problem: They’re producing catastrophic volumes of polluting waste they have nowhere to put, and it’s a damage-control cost they have to deal with.

The solution to both will have to come from the tech world, and that crossroads of opportunity where farming, fertilizer, and low carbon energy could finally meet.

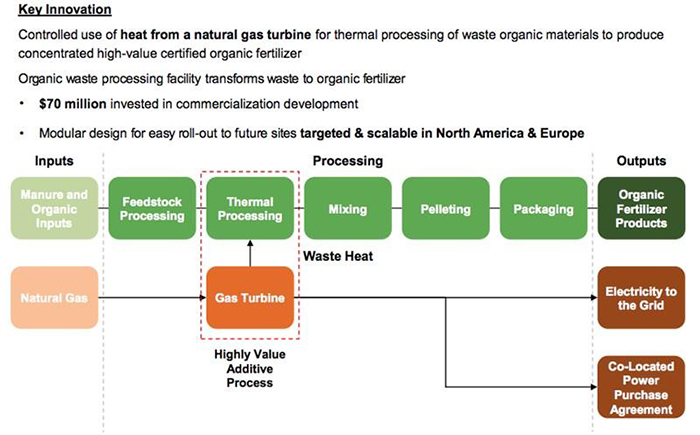

One answer very well may come from a Canadian junior called EarthRenew (CSE:ERTH; OTC:VVIVD), which is now preparing to showcase a new, patented technology that helps solve both of these problems, while generating its own electricity along the way for added revenue.

The patented technology turns livestock waste--a critical environmental problem--into a new organic fertilizer that hopes to change the game for the flourishing, $150-billion organic farming industry.

That alone would be fantastic…

But EarthRenew also plans to use the waste heat from its electricity production using natural gas to generate more electricity. That electricity is then used in its own fertilizer operations, with the surplus intended to be sold to the grid in an additional revenue stream. In fact, in January alone, EarthRenew raked in $100,000 just selling natural gas fired power to Alberta’s grid.

That makes this a low-cost operation: They are producing their own electricity, and most of the raw material for their patented new fertilizer process is free for the picking because EarthRenew’s processing plant at Strathmore, in Calgary, sits on a 25,000-head cattle farm.

The coup de grace is this: EarthRenew’s tech solutions are all about modularity. That means they can provide livestock operators with their own scalable facilities to turn a massive--and expensive--manure problem into an electricity-generating cost-saver.

Solving a Big Manure Problem

Livestock production continues to expand to meet the insatiable needs of the market, but the waste from these operations is also an environmental and logistics concern.

Farmers from America to Europe have massive herds of cattle that produce huge volumes of manure which contains levels of phosphorus that end up rivaling the worst of our carbon emissions. That phosphorus also gets into our groundwater and pollutes our waterways extensively.

Take the Netherlands, which alone has 1.8 million cows that have been producing so much waste—with nowhere to put it--that farmers were resorting to illegal methods to get rid of it. It raised major alarm bells and resulted in no less than a cattle genocide.

Some 80% of these farms produce more cow waste than they can ever use. The farmers end up paying an estimated $621+ million to get rid of it (just in the Netherlands). It’s even led to the creation of what can only be described as an organized crime ring around cow dung.

In 2019, the United States had 94.8 million head of cattle. A 1,000-pound cow produces an average of 80 pounds of manure every single day. That’s 7.6 billion pounds of toxic poo.

But it’s also 7.6 billion pounds of raw material that farmers are desperate to get rid of, and that an innovative company like EarthRenew plans to turn into two revenue streams: a high-tech organic fertilizer and … cheap energy that it can sell back to the grid.

It’s a win-win situation for everyone from farmers drowning in poo, to communities with threatened waterways, to sustainable investors who want to see someone turning healthier food into money-making environmental victories.

But there are even more victories to be had here:

The $150-billion organic farming market is flourishing, with health and Natural Foods now becoming a mainstream lifestyle supported by mountains of evidence, as well as a much more climate-friendly way to farm …

Market Research estimates that the global organic food and beverage market will grow from US$124.7 billion in 2017 to around $323.1 billion by the end of 2024, good for an impressive compound annual growth rate (CAGR) of 14.6% and more than 4x the total food sales growth of 3.6% predicted over the same timeframe.

But organic farming has its own problems.

It’s been using manure for “organic fertilizer” and the FDA is coming down hard because of its tendency to cultivate dangerous diseases.

In turning from industrial fertilizers to organic, farmers have relied heavily on raw manure, which can contain potentially deadly foodborne pathogens such as E. coli, Salmonella, Listeria monocytogenes, and Campylobacter. EarthRenew’s process kills all of these.

According to a study done by the Center for Science in the Public Interest in 2015, fresh produce was responsible for most of the foodborne illnesses in the U.S.

A recent example is the outbreak of E. coli O157:H7 infections associated with romaine lettuce that affected more than 200 people in the U.S. and four Canadian provinces.

In 2006, Earthbound Farm in California was linked to an outbreak of E. coli poisoning through its spinach that infected no less than 200 people with three dying.

This has led the FDA to overhaul its food safety regulations in a bid to limit the use of animal manure. There wasn’t a complete ban, but plenty of restrictions. While the FDA has not made a final ruling on this, the fear is that it could face a complete ban in the U.S. and Canada.

That’s a really big deal because a USDA survey found that farmers were using raw manure as a fertilizer on nearly 16 million acres of cropland.

That’s another huge problem EarthRenew solves for two segments of the farming industry: It takes manure from conventional farmers and turns it into safe high-nutrient organic fertilizer for the kingmaker of the agriculture industry: organic farmers.

The Key to the Patented Technology

Filling the fertilizer gap is the key to solving multiple energy and farming problems, and EarthRenew’s patented, low-cost production process is being created to do just that.

Located on a 25,000 head cattle feedlot, EarthRenew’s Strathmore Plant will produce heat-treated organic fertilizer that may end up being far superior to the composted manure full of hormones and antibiotics that are common in the market.

The company’s thermal treatment is set not only to drive off the unwanted contaminants but will also be richer in the key nutrients as well as being a slow-release compound.

Equally important: Because EarthRenew’s product will be sold in pellet form, it can be applied to the land when needed, not just during the spring and fall months when manure can be applied. It means flexibility for farmers.

It also can help lead to major savings for farmers.

EarthRenew’s product is being built so that it only needs to be applied in a single pass alongside seed planting compared to three passes with the conventional organic fertilizers (passing, tilling, and seeding) leading to up to 80% cost savings for the farmer.

Indeed, in October 2019; EarthRenew received key US and Canadian approvals for its organic fertilizer products. These important product certifications mean that in future the company will be permitted to sell its organic fertilizer products across those huge markets. The company’s predecessor invested about $70 million in the product development.

And the company has now partnered with CCm Technologies, a UK-based company that uses EarthRenew’s organic fertilizer as a base, upgrading it from a 1.8-1-1.6 nitrogen, phosphorus, potassium (“NPK”) ratio to a 7-1.7-2.2 NPK mix.

The higher nitrogen content of the upgraded 7-1.7-2.2 NPK organic fertilizer product has the potential to deliver up to 4x higher value for farmers, thus improving the value proposition of EarthRenew’s innovative product and allowing it to command better prices.

In fact, there are only a very limited number of other products available in EarthRenew’s target markets that provide this nutrient profile in an air-seedable pellet.

Self-Sustaining Innovation

EarthRenew produces energy through a Roll Royce turbine, creating 4MW of electricity. That electricity is sold back to the grid or to bitcoin miners on-site, while the waste heat from the turbine thermally treats the waste to make it ready to be mixed into organic fertilizer.

The company’s electricity sales offset the natural gas costs, making fertilizer production costs lower.

The turbine fits in a small bungalow, and the rest of the equipment fits in a small barn.

By generating its own electricity, using some and selling the surplus, EarthRenew estimates that it will be able to virtually recoup all its generation costs, essentially meaning that it will be thermally treating its manure feedstocks at near-zero power costs.

But it’s much more than energy savings for EarthRenew--it’s an entire revenue stream:

Once the engineering upgrades are complete, the company plans to use about 1.5 MWh of the 4 MWh generated by the Strathmore Plant to produce pelleted organic fertilizers made from cattle manure waste.

And the company’s new partnership with CCm Technologies has even more added-value: CCm converts captured carbon dioxide and other waste streams into stable value-added materials with multiple uses including fertilizer and energy storage.

Sustainable Investing

Creating your own energy …

Resolving a huge environmental problem coming from massively polluting livestock operations…

Offering a new fertilizer solution to the fastest-growing food industry …

And coming up with a modular, scalable fix for livestock farmers who can’t get rid of their volumes of manure in a cost-effective manner …

This is exactly what Big Capital is looking for today: Risk-mitigating, sustainable businesses.

When you bring these things all together under one umbrella you get a new player that opens up a vast expanse of growth opportunities.

Call it what you will--sustainable investing, impact investing or the formal ESG (environmental, social, and governance) investing--this megatrend already topped $30 billion in 2018.

Green investing no longer merely associated with a warm moral glow, or even political. It’s mainstream investing based on market sentiment and where Big Money is moving.

- 74% of global investors plan to increase their ESG allocations over the next year

- One-fifth of investors plan to increase their allocations to between 21% and 50% of their portfolios over the next five years.

- Money managers are feeling the ethical squeeze keenly, with BlackRock, the new king of Wall Street and the world’s biggest asset manager with more than $7 trillion in assets under management (AUM), has pledged to grow its ESG and green portfolio from $90 billion to more than a trillion dollars in the space of a decade.

- Backlash against companies that fail to integrate environmentally and socially conscious practices in their business has grown into a raging tide.

And the story that puts this all into perspective is this: Bayer AG, a German multinational pharmaceutical and life sciences company, has been forced to honor personal injury claims till it bled after acquiring Monsanto, the manufacturer of the deadly weed killer, Roundup, in 2018. Bayer has moved to the courts seeking to have its liability capped at $10 billion after being faced with a staggering 125,000 Roundup lawsuits.

EarthRenew’s business model consisting of clean organic fertilizers and reduced carbon energy really encapsulates what ESG is all about, and has earned the accolades of both Canadian and American authorities.

It’s a big reason why the shares have soared up to 400% over the past 12 months despite some very choppy trading.

The surging demand for organic foods is expected to drive an equally huge demand for organic fertilizers, with global sales expected to expand by 12% CAGR to hit $11.2 billion by 2022 with Northern America accounting for 40% of the market.

Organic fertilizers already have an impressive track-record; EarthRenew’s smart fertilizer is looking to exceed it and set a new benchmark.

The Farming Systems Trial has shown that after an initial decline during the three-year transition, yields on the organic plots have matched or exceeded the conventional-crop yields--and performed even better during drought years. The trial has also demonstrated that organic farming uses less energy, produces fewer greenhouse gases, and builds soil health rather than depletes it.

The company to get there first, with a solution to the industry fertilizer problems, plus the added benefit of producing and selling its own electricity might win the battle for this vital market.

Once EarthRenew manure-to-organic fertilizer modular units become available for livestock operators, the company will have yet another element to its multi-use technology.

The numbers are compelling: According to EarthRenew, a modular plan could cost around $12.7 million and would pay for itself within 3-5 years. The process is simple and maintenance costs are minimal.

So where are we now? Right at the crossroads: EarthRenew’s Strathmore facility is being upgraded right now and planned to produce commercially by the Spring of 2021, with new pellet formulations already certified organic, and more formulations being developed. And funds are being raised already for a second plant, making this one of the most promising new technologies to take advantage of the sustainable investing megatrend at a time when a global pandemic demands it.

Other companies pushing the green revolution to new heights:

Enphase Energy (NASDAQ:ENPH)

Enphase Energy has had an incredible year. While it doesn’t produce solar panels or windmills, it is definitely a major player in the renewable energy revolution. It’s a pure tech play that has paved the way for new possibilities in the industry. It’s hardware and software help regulate and utilize energy in the most efficient way possible.

Over the course of the past year, investors finally started to catch on to Enphase’s true value. Its stock rose from $18.23 last June to $52 this June. That’s a 185% increase. It’s 5 year returns are even more impressive, boasting a humbling 779% increase from June 2015 to today.

NextEra Energy (NYSE:NEE)

As one the world’s leading renewables producers, NextEra Energy is literally building the path towards a clearer tomorrow. Even more exciting, the company was the number one capital investor in green energy infrastructure, and the fifth largest investor across all sectors.

In addition to its already massive impact combatting the world’s looming climate crisis, it has ambitions of investing an additional $55 billion in infrastructure in the next two years in the United States. And while it helps deploy the world’s new energy reality, it has also committed to weaning itself off foreign oil. And shareholders are all in. Over the past 15 years, shareholders have seen 945% returns.

Suncor Energy (TSX:SU)

As one of the biggest names in energy, Suncor Energy has adopted a number of high-tech solutions for finding, pumping, storing, and delivering its resources. Not only is it big in the oil sector, however, it is a leader in renewable energy. Recently, the company invested $300 million in a wind farm located in Alberta.

If the next shale boom truly is to be in the oil sands then giants like Suncor is sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook.

Boralex Inc. (TSX:BLX)

Let’s start with some Canada’s renewable energy push. Boralex Inc. is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Polaris Infrastructure (TSX:PIF)

Polaris Infrastructure is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

Westport Fuel Systems (TSX:WPRT)

Westport Fuel Systems is another renewable energy provider for the transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

While renewable providers clearly take the lead, Canada’s tech and telecom giants won’t be left out!

Cenovus Energy (TSX:CVE)

Cenovus Energy is most known for its oil business, but it is also actively investing in renewable energy. More importantly, however, is that it has set truly ambitious sustainability goals for itself, aiming to cut emissions by a massive 30% in just 10 years.

This is one of the most actively traded stocks on the TSX. The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

By. Chris Everett

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Cautionary Note regarding Forward-Looking Information

This article contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to EarthRenew’s ability to sell electricity to the electrical grid, EarthRenew’s ability to execute its business plan, its commercial production facility redevelopment plan, implementing CCm’s technology into its processes, the evaluation and implementation of various technologies to increase and maximize the efficacy of its fertilizers; it will be able to virtually recoup all its generation costs; it can help solve energy and farming problems; that EarthRenew’s production process will be low cost, applied in a single pass alongside seed planting; upgraded 7-1.7-2.2 NPK organic fertilizer product has the potential to deliver up to 4x higher value for farmers; that it will be permitted to sell its organic fertilizer products across US and Canada; that it can virtually recoup all its power generation costs; its plans to use about 1.5 MWh of the 4 MWh generated by the Strathmore Plant to produce pelleted organic fertilizers; that it can sell modular, scalable plants to livestock farmers, a modular plan could at a cost around $12.7 million which would pay for itself within 3-5 years; EarthRenew’s smart fertilizercan to exceed current organic fertilizer sales and set a new benchmark; the Strathmore facility will produce commercially by the Spring of 2021; and that more pellet formulations are being developed.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; regulatory risks; the company may not be as able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements or lack of suitable employees, partners or suppliers; it may not be able to raise funds and develop better organic fertilizer than competitors; costs may be higher than expected and profits therefore lower;actual operating performance of the facilities may not meet expectations; that markets may not materialize as expected; and other risks of the energy and fertilizer industries. There may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) may in the future be paid by ERTH to disseminate future communications if this communication proves effective. In this case the Company has not been paid for this article. But the potential for future compensation is a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by ERTH but may in the future be compensated to conduct investor awareness advertising and marketing for ERTH. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.