Recurring service revenue jumps $1M over Q1 FY 2020

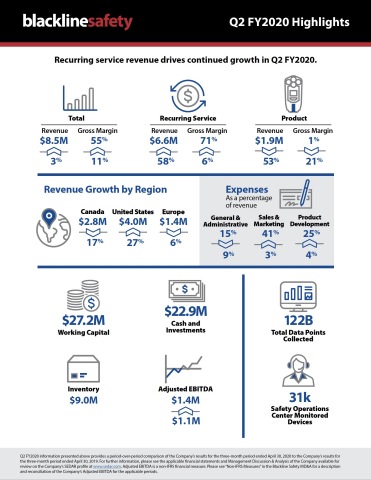

Blackline Safety Corp. (TSX.V: BLN), a global leader in gas detection and connected safety solutions, announced $8.5M record revenue for the quarter ended April 30, 2020. Total revenue grew to $8.5M with recurring service revenue increasing 58% to $6.6M from $4.2M in the prior year quarter. These results were achieved despite the quarterly impact of the emergence of COVID-19, declared as a global pandemic by the World Health Organization on March 11, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200625005109/en/

Blackline Safety Q2 FY2020 infographic (Graphic: Business Wire)

“There’s no question that a major theme for most businesses in 2020 is COVID-19 and the impact of the global pandemic on the world. During the quarter, coronavirus reduced Blackline’s growth rate as sales of new products were deferred by most prospective customers as they reacted to the pandemic,” said Cody Slater, CEO and Chairman at Blackline Safety. “Despite the impact on our hardware sales, the strength of Blackline’s offering was clear during this time as organizations around the world continued to rely on our connected services to keep their people safe. In fact, total field usage hours of our G7 wearables dipped less than 10% compared to pre-pandemic levels. The vast majority of our customers are essential businesses that span industrial sectors including manufacturing, public works and utilities. Blackline supported their continued operations during the pandemic, helping to keep their people safe wherever they work and whatever the challenge.”

“While hardware sales were limited by social distancing restrictions, the company saw the largest ever quarter-on-quarter revenue growth in its recurring service revenues, jumping from $5.6 to $6.6 million. This increase was driven by the deployment of product purchased in prior quarters and our strong retention rate, highlighting the value of Blackline’s recurring service business model in these times of uncertainty.”

Blackline closed the quarter with a strong working capital position, including cash and short-term investments of $22.9M. Blackline’s overall gross margin was 55%, an 11% increase over the prior year quarter with service margin improving to 71% from 65% due to growth of Blackline’s recurring service revenue. Blackline achieved its sixth successive quarter of positive Adjusted EBITDA, a non-GAAP metric that management believes is valuable for investors to use to track corporate performance.

During the quarter, Blackline developed and launched its industrial contact tracing technology to help businesses assess and manage their social distancing and self-isolation programs. Blackline’s new Close Contact report and other tools leverage its off-the-shelf and intrinsically safe G7 cloud-connected wearables that stream location-enabled data to the Blackline Safety Cloud. This new capability was released to Blackline customers at no additional cost, supporting contact tracing investigations. A suite of online reports provides businesses with an interactive map of close interactions while highlighting the individuals who had close proximity to an individual with symptoms or tested positive for COVID-19. One of a dozen interactive Blackline Analytics reports, the new Close Contact report has become one of the most used by Blackline clients to date.

Since the close of Q2 FY2020, many regions around the world have begun a phased return-to-work program. As markets open up, Blackline has begun to see the reopening of sales opportunities that were deferred during pandemic lockdown.

Second quarter highlights

- Thirteenth consecutive quarter of year-over-year revenue growth

- Sixth consecutive quarter of positive Adjusted EBITDA

- Total revenue of $8.5M, a 3% increase over the prior year’s Q2

- Recurring service revenue of $6.6M, a 58% increase over the prior year’s Q2

- Product revenue of $1.9M, a 53% decrease over the prior year’s Q2

- Total revenue grew by 27% in the United States over the prior year’s Q2

- Overall gross margin percentage was 55%, an 11% increase over the percentage achieved in the prior year’s Q2

- Overall gross margin percentage was comprised of product and service margin percentages of 1% and 71%, compared to 22% and 65% in the prior year’s Q2

- Contracted future service revenue (Blackline Complete 3-year lease commitments) was $6.3M at April 30, 2020

- Total cash and short-term investments of $22.9M at April 30, 2020

- Continued development of Blackline’s new G7 EXO area gas monitor product line for launch in Q4 FY2020

Financial Highlights

The subsequent values in this release are in thousands, except for percentages and per share data.

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended April 30

|

|

|

Six-Months Ended April 30

|

|

|

|

|

2020

|

|

2019

|

|

Change

|

|

|

2020

|

|

2019

|

|

Change

|

|

Revenue

|

|

|

$8,472

|

|

$8,189

|

|

3%

|

|

|

$17,390

|

|

$14,418

|

|

21%

|

|

Gross Margin

|

|

|

$4,658

|

|

$3,570

|

|

30%

|

|

|

$8,717

|

|

$6,412

|

|

36%

|

|

Gross Margin Percentage

|

|

|

55%

|

|

44%

|

|

11%

|

|

|

50%

|

|

44%

|

|

6%

|

|

Net Loss

|

|

|

($2,099)

|

|

($3,016)

|

|

30%

|

|

|

(4,454)

|

|

($4,761)

|

|

6%

|

|

Net Loss per Share

|

|

|

($0.04)

|

|

($0.06)

|

|

|

|

|

($0.09)

|

|

($0.10)

|

|

|

|

Net Loss excluding stock-based compensation expense

|

|

|

($1,272)

|

|

($1,848)

|

|

31%

|

|

|

($3,533)

|

|

($3,466)

|

|

(2%)

|

|

Adjusted EBITDA

|

|

|

$1,397

|

|

$253

|

|

452%

|

|

|

$1,918

|

|

$286

|

|

571%

|

|

Adjusted EBITDA per Share

|

|

|

$0.03

|

|

$0.01

|

|

|

|

|

$0.04

|

|

$0.01

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Financial Information

Second quarter revenue was $8,472, an increase of 3% from $8,189 in the comparable quarter of the prior fiscal year with revenue growth of 27% in the United States quarter-over-quarter.

Service revenue was $6,564, an increase of 58% compared to $4,165 in the same period last year. This growth was primarily driven by service revenue generated by increased adoption throughout international and diversified industrial markets of Blackline’s connected safety devices and strong device renewals.

Product revenue during the second quarter was $1,908, a decrease of 53% compared to $4,024 in the same period last year. The decrease here was an effect of the impact of COVID-19 on the ability for the company to generate new sales during the lockdown periods. An additional impact of the pandemic was the inclusion of a credit of $313 as a large UK customer reduced their planned deployment due to COVID-19.

Gross margin percentage for the second quarter was 55%, which was an 11% increase to that achieved in the comparable quarter of the prior year, with the service revenue margin improving to 71% from 65% driven by the growth of Blackline’s service revenue quarter-over-quarter.

Adjusted EBITDA was $1,397 for the second quarter compared to $253 in the comparable quarter of the prior year. The increase in the Adjusted EBITDA for the quarter was attributable to increased revenues and gross margin and reduced general and administrative expenses quarter-over-quarter.

Blackline’s unaudited condensed consolidated interim financial statements and management’s discussion and analysis on financial condition and results of operations for the period ended April 30, 2020 (including the reconciliation of non-GAAP measures) are available at www.sedar.com. All results are reported in Canadian dollars.

About Blackline Safety: Blackline Safety is a global connected safety leader that helps to ensure every worker gets their job done and returns home safe each day. Blackline provides wearable safety technology, personal and area gas monitoring, cloud-connected software and data analytics to meet demanding safety challenges and increase productivity of organizations in more than 100 countries. Blackline Safety wearables provide a lifeline to tens of thousands of men and women, having reported over 120 billion data-points and initiated over five million emergency responses. Armed with cellular and satellite connectivity, we ensure that help is never too far away. For more information, visit BlacklineSafety.com and connect with us on Facebook, Twitter, LinkedIn and Instagram.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively "forward-looking information") within the meaning of applicable securities laws relating to, among other things, Blackline Safety's expectation to realize potential from its intended investment in organic growth opportunities in 2020, Blackline's intention to expand its product offerings to total workplace connectivity and management's expectation that Blackline will continue to focus on its comprehensive approach to connected devices, live monitoring, consulting and integration services. Blackline provided such forward-looking statements in reliance on certain expectations and assumptions that it believes are reasonable at the time, including expectations and assumptions concerning business prospects and opportunities; customer demands, the availability and cost of financing, labor and services and the impact of increasing competition. Although Blackline believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Blackline can give no assurance that they will prove to be correct. Forward-looking information addresses future events and conditions, which by their very nature involve inherent risks and uncertainties, including the risks discussed in Blackline's Management's Discussion and Analysis. Blackline's actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Blackline will derive therefrom. Management has included the above summary of assumptions and risks related to forward-looking information provided in this press release in order to provide readers with a more complete perspective on Blackline's future operations and such information may not be appropriate for other purposes. Readers are cautioned that the foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this press release and Blackline disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200625005109/en/

Copyright Business Wire 2020