There’s a new mega-trend taking Wall Street by storm… with everyone from Amazon’s Jeff Bezos to BlackRock taking notice.

One renowned Stanford University economist expects the disruption to personal travel choices to put an extra $5,600 per year back into the average family’s pockets every year.

All the biggest names in tech are jumping onboard -- Apple, Google, Amazon, and more -- but one startup from Canada’s Silicon Valley is aiming to upend the personal transportation industry as we know it.

It didn’t take Uber long to step onto the scene and disrupt a hundred-year-old dynasty, bringing the taxi industry to its kneeswithin 7 years.

Now, a booming mega-trend could upend Uber much faster thanks to its broken business model and lack of profitability.

Sitting at an incredible $53 billion market cap, Uber is already enormous compared to hundred-year-old auto industry giants like Ford, General Motors, and Chrysler.

But they’re also been riddled with controversy in recent years, with both riders and drivers leveraging harsh criticism over Uber’s policies.

And this is why the massive mega-trend sweeping Wall Street may be the death knell for Uber.

All the biggest names are pouring money into ESG or sustainable investing - the ethical and eco-friendly investing trend ballooning in popularity in recent years.

Goldman Sachs started a $1.5 billion ESG cash fund, which is becoming a go-to for major companies like Apple and JetBlue Airways.

Amazon founder, Jeff Bezos, just devoted $10 billion to a Global Earth Fund.

And BlackRock, the largest asset manager in the world, plans to have $1.2 trillion in ESG assets within the next 10 years.

One company from Canada’s Silicon Valley seems to have spotted this trend from a mile away… And it’s positioned itself to take advantage of Uber’s long list of missteps and challenge for the ride sharing throne—complete with corporate deals with two giant household names (Amazon is one).

Facedrive (TSXV:FD; OTC:FDVRF) has already locked in major contracts with government agencies, A-list celebrities, and global tech titans. And they’ve done it all as a startup less than a few years old.

But one thing is clear: they don’t plan on stopping there. In the coming months, they’re set to expand into the United States and internationally, thanks in part to the ESG mega-trend sweeping across the globe.

Here are 5 reasons to keep an eye on the ESG mega-trend right now:

1 - This Mega-trend is the Future of Business

The ESG investing craze has skyrocketed just over the last year or two, and it’s showing no signs of slowing down.

In fact, even with the stock market tanking in March with the global pandemic, ESG funds continued to soar. Around the world, sustainable investing is attracting more and more investors.

The biggest names on Wall Street have started moving serious capital in this direction. They’re sending a message that’s crystal clear -- businesses need to get with the program if they expect access to capital in this new economy.

BlackRock (NYSE:BLK) has been quick to jump on the trend, with over $90 billion in ESG assets under its control.

It’s planning to more than 10x that number over time though, aiming to boost that number to over $1 trillion by 2030.

This should serve as a massive wake-up call for investors everywhere, as BlackRock - the $84 billion hedge fund - has replaced Goldman Sachs as the most important banking company in the world.

That’s also the reason it’s gone beyond banking, even reaching “4th branch of government” status.

It’s not alone though. Many across Wall Street and beyond have been vocal about the direction ESG investing is heading.

Nigel Green, the CEO of the deVere Group, an independent financial advisory firm, touts that the global pandemic has only accelerated this trend, saying ESG investing is moving toward a “skyward surge.”

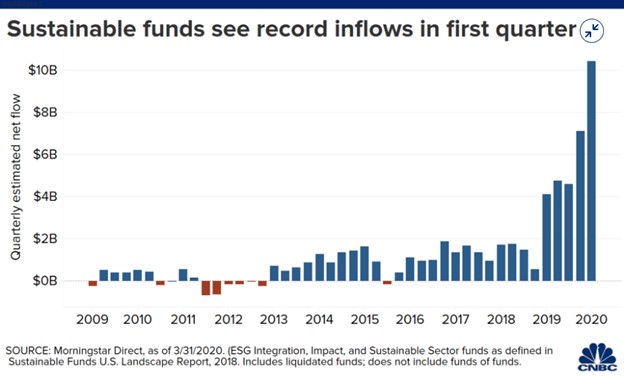

Source: CNBC

And the stats on ridesharing have put the industry right in the crosshairs of ESG investors.

While ridesharing was expected to lower pollution with many opting to rideshare rather than own their own vehicles, the reality couldn’t be further from the truth. Recent studies show that it’s actually produced nearly 70% more pollution.

But the brains behind Facedrive saw this trend coming and, through next-gen technology and key partnerships with environmental agencies, it’s positioned itself ahead of the pack.

With a goal of being the leader in this sector, it’s making a huge step toward solving ridesharing’s sustainability problem, planned to be all without sacrificing profit. Uber, on the other hand, is still trying to work towards breaking even 10 years after launching.

Facedrive leads by living up to its word with its “People and Planet First” philosophy. It gives riders the choice to hail a ride from an electric, hybrid, or gas-powered vehicle, all without paying an extra premium for the option.

After the ride, Facedrive’s in-app algorithm calculates how much CO2 was created for each journey and sets aside a portion of the fare to offset the carbon footprint - planting trees to do it.

In other words, you ride, the company plants a tree. It’s simple.

That puts Facedrive squarely in the middle of two megatrends: the disruption of the $80 Billion global on-demand transportation service industry… and big money’s shift into sustainable investing, already over $30 billion in 2018.

2 - Major Deals are Sending this Trend Surging

With so much money on the table, it seems everyone is making the move toward greater sustainability.

Even companies that we never associate with being eco-friendly are spending buckets of cash to get in on the action. And they’re doing it with big money acquisitions and massive government contracts.

General Motors (NYSE:GM) just started a joint venture with Korea’s LG Chem to mass produce next-gen battery cells for electric vehicles, together investing $2.3 billion over the next few years.

Amazon (NASDAQ:AMZN) is investing big on the transportation of tomorrow too – leading a $700 million investment round in EV startup Rivian before acquiring robo-taxi startup Zoox for over $1 billion.

But it’s not just limited to transportation. Earlier in July, Perpetual Limited, an Australian asset manager, acquired sustainable investment firm Trillium Asset Management, for a whopping $3.3 billion!

The money involved in this global shift toward sustainability is staggering.

Which is why, with Facedrive (TSXV:FD; OTC:FDVRF) filling a need where Uber is failing, major partners are already putting this startup on the map.

The major bit of news that might have escaped investors is this: One global powerhouse and one Canadian giant have now thrown in with Facedrive.

Global ecommerce giant Amazon and Canadian Tier-1 telecoms giant Telus jumped in on Facedrive’s corporate partnership program.

That means both giants will be receiving preferred pricing on Facedrive services and that their employees have a deal to use Facedrive at a discount.

And they won’t just be using Facedrive, they’ll be helping it expand its technology infrastructure around the world as it branches out globally.

With Amazon and Telus on board, other household names are likely to follow.

Facedrive has also taken a creative approach in the health sector, partnering up with the University of Waterloo and MT>Ventures to create TraceSCAN - a wearable technology used to help slow the spread of COVID-19.

The Laborers’ International Union of North America (LIUNA) is already on board, signing on to adopt the technology, putting their trust in Facedrive to protect 130,000 of their members and their families.

But their biggest grab yet came when the Government of Ontario announced they’re endorsing and supporting the deployment of this breakthrough technology.

This means their technology could in future be doing the important work of contact tracing thousands of people at sporting venues, corporate offices, healthcare and long-term care facilities, and many other locations all across the area, to help fight against the spread of viruses like Covid-19.

3 – In the New Economy, Diversification is King

In the growing age of sustainability, the global leaders are seeing that it doesn’t pay to be a one-trick pony.

That’s why many of the biggest companies in the world are broadening their horizons and diversifying into sustainable ventures.

Take TSLA (NASDAQ:TSLA), for example. It’s already well-known for being eco-friendly with their high-end electric vehicles.

But it’s gone beyond transportation into green energy in several other arenas, acquiring the solar energy company SolarCity for $2.6 billion in 2016.

When it tried to do the same with the solar installation company Vivint this year though, they got beat out when a competitor came in offering up an incredible $3.2 billion!

Google (NASDAQ:GOOGL) has branched out too, going far beyond your go-to search engine. On top of getting in on autonomous vehicles with Waymo, they established their own clean energy company, Google Energy.

Today, not only are they using this as an opportunity to lower their own energy costs at Google’s headquarters… they also got the green light from the government to sell energy to others.

And now Facedrive’s showing that they see itself as far more than just a rideshare service, as well.

In the midst of the COVID-19 crisis, Facedrive saw an opportunity to help the community while drawing attention and adding new customers. Establishing Facedrive Health, it’s gone above and beyond.

From providing discounted rides for healthcare workers and specialized vehicles for those with additional needs, to contactless delivery of over-the-counter medicines and medical supplies, it’s using its unique position to benefit the greater good.

And its latest acquisition signaled they’re not just taking on Uber in the ridesharing business… They’re doing it in the food delivery service too.

The global food delivery market is expected to grow from $24 billion in 2018 to over $98 billion by 2027.

And with so much money at stake, it’s no wonder Facedrive is moving in to grab a piece of the pie here too.

Recently, Facedrive acquired Foodora Canada, a subsidiary company of the $20-billion multinational food delivery service, Delivery Hero, operating in 40 countries and servicing more than 500,000 restaurants.

With this move, it has access to hundreds of thousands of customer names and over 5,500 new restaurant partners.

As Uber continues to struggle toward profitability, Facedrive’s winning strategy of diversifying income streams across health, food, and more is likely to drive its miles ahead in the race for profits.

4 – Millennials Give 1 Trillion Reasons to Go Green

While big money has shown it’s making sustainability a top priority, millennials are voting with their wallets too.

In a recent analysis from the renowned services firm Ernst & Young, they discovered that 84% of millennials have named ESG investing as a main goal.

And more importantly, the vast majority say they’re willing to pay more for a sustainable alternative.

So when millennials are worth a massive $1 trillion in consumer spending, it pays to pay attention to what they value.

Because when it comes to sustainability, that’s not an added bonus, it’s the price of admission.

That’s why Facedrive has made it a no-brainer for riders to make the jump.

Even though consumers have made it clear they’re willing to pay more to support a sustainable service… they won’t have to with Facedrive, as they get these benefits without paying a premium for it.

They’re not stopping there though, because millennials don’t just buy a service – they buy the brand. So, in this new economy, branding will help determine who rises to the top and who falls off the map.

Facedrive is aiming to become a household name, and Will Smith’s Bel Air Athletics clothing brand is betting big on them as the ride of the future. That’s why it announced they’re co-branding an entire line of exclusive clothing with Facedrive.

It’s also why WestBrook Inc., the company Smith shares with his wife Jada Pinkett Smith, is partnering with the rideshare startup that could soon challenge Uber for the throne as they grow.

It seems to have found a perfect partner in this relationship too. Bel-Air Athletics is green and in line with Facedrive principles, as its goal is to have all clothing materials 100% sustainably sourced by next year.

Over 1,000 new products co-branded by Bel-Air and Facedrive have launched on the Facedrive Marketplace website, and demand has been through the roof.

5 – The World’s Biggest Visionaries are Leading the Charge

The truth is, even though some are just jumping on the ESG bandwagon now that it’s clear it’s here to stay… other visionaries have been forecasting this global shift for years.

Billionaire Richard Branson, the founder and CEO of the Virgin Group, has been a part of the sustainability conversation for nearly 15 years now.

He first committed to spending $3 billion on clean energy initiatives back in 2006, and since then, he’s been one of the world’s biggest advocates of renewable energy.

In fact, he’s so committed to making transportation sustainable, a flight to space and back in Virgin Galactic’s spaceships is expected to have a lower carbon footprint than your typical flight from New York to LA.

His foresight and innovation have helped Virgin Galactic’s stock shoot up a massive 269% in less than a year, until the Covid-19 scare reduced the price in February, 2020.

Billionaire Elon Musk also had his eye on this trend far before the hype started building.

He released the first Tesla Roadster back in 2008, making electric vehicles cool when people were still snubbing their noses at the first-generation EVs.

Since then, Tesla’s stock has soared from $23 to over $1300 – an incredible 5,632% gain over time for early investors.

But he’s planning much more in the future, as he’s at the cutting edge of solar energy, reusable rockets, and the next-gen underground “Hyperloop” for high-speed public transportation.

Facedrive’s CEO, Sayan Navaratnam, saw the sustainable writing on the wall years ago too.

While this megatrend has picked up major steam in the last couple of years, he’s had the plan for green ridesharing since 2016.

Now, he’s timed the launch of the startup perfectly, getting a stock exchange listing in Q3 2019 and taking off exponentially now in 2020.

Consider this: in just their first year they’ve accomplished all of the following:

First, in April, it acquired HiRide -- an innovator coming out of Ontario’s version of “Shark Tank”, giving them access to the entire user base of a unique long-distance car-pooling solution for students and professionals.

Over the next two months, without missing a beat, it launched a string of new revenue-generating services from Facedrive Foods and Facedrive Health to COVID-19 contact tracing tech TraceSCAN, and even its own exclusive line of Bel-Air clothing co-branded with Will Smith.

Then in early May, it landed a deal with the Laborers’ Intentional Union of North American to use TraceSCAN.

Days later, it announced plans to acquire Foodora Canada from Delivery Hero in a deal that solidifies the launch of Facedrive Foods.

Then they launched Facedrive Marketplace with Jada Pinkett Smith’s and Will Smith’s WestBrook, Inc.

The ESG mega-trend is certain to change the world – and our economy – as we know it…

And it’s entirely possible that this gritty sustainable startup becomes the one-stop-shop of the future -- grabbing hold of this mega-trend and putting Uber firmly in their rearview mirror.

Here are just a few other companies hopping on the ESG trend:

Shopify Inc (TSX:SHOP)

Shopify is a rapidly-expanding tech giant in the e-commerce sector. It’s already got over 1 million businesses using its platform, including Budweiser, Tesla and Red Bull. Shopify has revolutionized the e-commerce world, allowing anyone, even if they do not know how to code, build and deploy an e-commerce website.

And it’s environmentally conscious, too! Shopify has even started its own sustainability fund, which it adds $5 million to each year to help tackle the climate crisis.

Shaw Communications Inc (TSX:SJR.B)

Shaw is one of Canada’s leading telecom infrastructure and cloud service providers. Its dominance in Canada’s telecom sector means that if any internet-based services want to operate, they’ll likely be utilizing the company’s infrastructure. After all, without telecoms, these TaaS companies would not be able to operate. And that’s not necessarily a bad thing when you consider Shaw’s sustainability goals. Not only is it working on reducing its own emissions, it is also building a portfolio of green energy investments, as well.

BCE Inc. (TSX:BCE)

BCE is another household name in Canadian telecom. Throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms. BCE is currently at the forefront of the Internet of Things movement in Canada. That means it will play a vital role in building new sustainability projects and making Canada’s cities smarter and more efficient.

Westport Fuel Systems (TSX:WPRT)

Westport is a renewable energy provider for the transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

Polaris Infrastructure (TSX:PIF)

Polaris is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

By: Jason Eckerman

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements / This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for TaaS and ride sharing services will grow, and transportation as a service industry will grow substantially; that the demand for environmentally conscientious ride sharing services companies in particular will grow quickly and take a much larger share of the market; that Facedrive’s marketplace will offer many more sustainable goods and services, and grow revenues outside of ride-sharing; that new products co-branded by Bel Air and Facedrive will continue to sell well; that Facedrive can achieve its environmental goals without sacrificing profit; that Facedrive Foods will expand to other regions outside southern Ontario soon; that Facedrive’s Corporate Partnership Program will move Facedrive firmly into the United States market and internationally; and could be contact tracing people to help in fight the spread of Covid-19;that Facedrive will be able to fund its capital requirements in the near term and long term; that diversifying its business is more likely to make Facedrive profitable; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract a sufficient number of drivers to meet the demands of customer riders; the ability of the company to attract drivers who have electric vehicles and hybrid cars; the ability of Facedrive to attract providers of good and services for partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; that the products co-branded by Facedrive may not be as merchantable as expected; that the Foodora purchase does not bring the customers, partnerships or revenues expected; that Facedrive’s diversity may not lead to profitability, as one or more of the businesses may lose money; the ability of the company to keep operating costs and customer charges competitive with other ride-hailing companies; and the company’s ability to continue agreements on affordable terms with existing or new tree planting enterprises in order to retain profits. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. An affiliated company of Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has signed an agreement to be paid in shares to provide services to provide marketing and promotional activities to expand ridership and attract drivers. In addition, the owner of Oilprice.com has acquired additional shares of Facedrive (TSX:FD.V) for personal investment. This compensation and share acquisition resulting in the beneficial owner of the Company having a major share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.