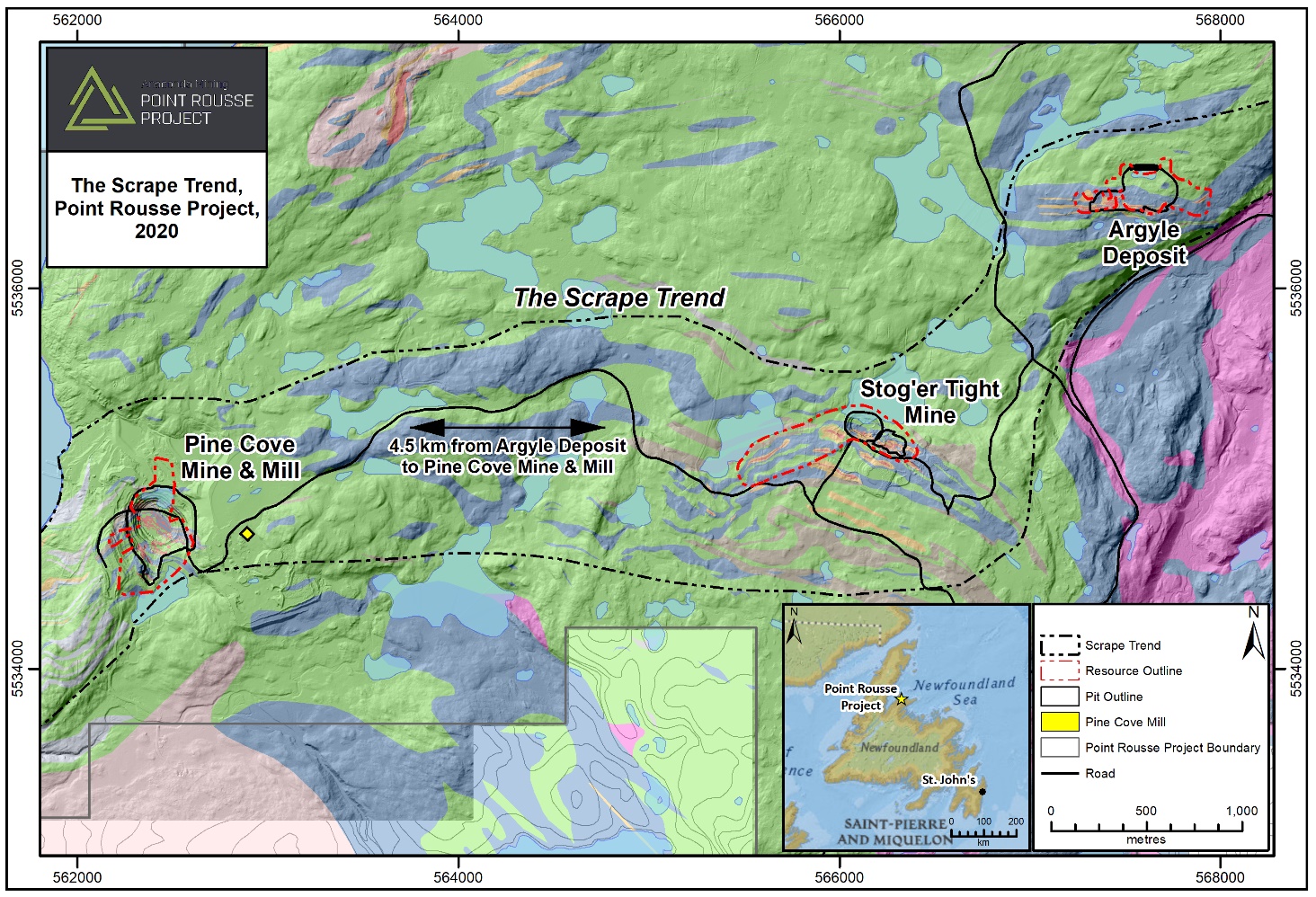

TORONTO, ON / ACCESSWIRE / August 4, 2020 / Anaconda Mining Inc. ("Anaconda" or the "Company") (TSX:ANX) (OTCQX:ANXGF) is pleased to announce an open-pit Mineral Reserve for the Argyle Deposit ("Argyle") at the Company's Point Rousse Project and has commenced certain mine development activities in anticipation of ore production in the fourth quarter of 2020. Mine ore tonnes will be trucked approximately 4.5 kilometres to the Company's operating Pine Cove Mill and tailings facility in Newfoundland (Exhibit A). The development of Argyle is based on a recent Updated Mineral Resource Estimate ("Mineral Resource") and initial Mineral Reserve ("Mineral Reserve") prepared in accordance with National Instrument 43-101 ("NI 43-101") and 2019 CIM MRMR Best Practice Guidelines. All currencies in this press release are reported in Canadian dollars unless otherwise specified (US amounts are based on a foreign exchange rate of CAD$0.75/US$1.00).

Highlights of the Argyle Deposit Include:

- Probable Mineral Reserve of 535,592 tonnes at an average diluted grade of 2.06 grams per tonne ("g/t") gold containing 35,477 ounces, using a base case gold price of $1,900 (US$1,425);

- Gold production of 30,865 ounces over a 22-month Life of Mine ("LOM") based on an 87% overall mill recovery;

- Low upfront capital requirements of $2.98M and LOM sustaining capital $2.69M;

- Operating cash costs per ounce sold and all-in sustaining cash costs ("AISC") per ounce sold of $1,219 (US$915) and $1,306 (US$980), respectively;

- Pre-tax net present value at a 5% discount rate ("NPV 5%") of $13.1M and an Internal Rate of Return ("IRR") of 262%, and an after-tax NPV 5% of $11.4M with an IRR of 245%, all based on a $1,900 gold price;

- At a gold price of $2,600 per ounce (US$1,950), Argyle produces a pre-tax NPV 5% of $32.7M and an IRR of 1,336% and an after-tax NPV 5% of $24.5M and an IRR of 1,273%; and

- Indicated Mineral Resource of 488,000 tonnes at an average grade of 3.14 g/t gold containing 49,300 ounces (open-pit constrained), using a base case gold price of $1,900 (US$1,425);

"Building on continuous mining at Point Rousse for over ten years, we are pleased to again extend the mine life of the Point Rousse Project with the declaration of Mineral Reserves at Argyle. The discovery of the Argyle Deposit and now moving forward with its development into a producing mine validates our strategy of continued exploration at the Point Rousse Project to leverage our existing mill and tailings infrastructure and dedicated staff, contractors and stakeholders. Argyle generates after-tax cumulative free cash flow of over $12.5 million at a Canadian dollar gold price of $1,900, however at current spot gold prices Argyle could generate over $26 million in after-tax free cash flow over the next 22 months. With the recently announced drill discovery at Stog'er Tight on July 7, 2020 and $5.51M strategic financing, the Company is in an excellent position to execute on its growth strategy and provide strong potential for increased shareholder value."

~ Kevin Bullock, President and CEO, Anaconda Mining Inc.

Argyle Mineral Reserve

Total Probable Mineral Reserve at Argyle is 535,592 tonnes at an average diluted gold grade of 2.06 g/t and contains 35,477 gold ounces at a strip ratio of 8.1 to 1 (Table 1). "Open Pit" Indicated Category Mineral Resources reported below are inclusive of Mineral Reserves.

The Mineral Reserve was derived from an ultimate pit shell design based on parameters from the pit shell used to constrain the Mineral Resource. The ultimate pit shell design was created using Surpac 6.8™ mining software and running a reserve report between this shell and the most recently surveyed topographic surface. Probable Mineral Reserves were estimated at a cut‐off grade of 0.56 g/t gold and gold price of CAD$1,900/oz (US$1,425/oz) and are based only on Indicated Mineral Resource blocks. Proven Reserves were not defined, as the block model used for reserve reporting did not contain Measured Mineral Resource blocks.

The cut‐off grade of 0.56 g/t gold was derived from Anaconda's mining, processing, and general administration costs and process recovery at Point Rousse. This cut‐off grade is the minimum ore grade required to process the ore economically. Table 3 below shows some of the key assumptions and costs used in the ultimate pit optimization process and definition of Mineral Reserves. The costs and the selling price estimates are equal to the budgeted costs and revenues for the current (2020) fiscal year, which are in line with actual costs and revenues achieved year to date.

Table 1: Argyle Mineral Reserve Estimate - Effective Date: August 4, 2020

|

Category

|

Tonnes

|

Au (g/t)

|

Ounces

|

|

Probable

|

535,592

|

2.06

|

35,477

|

Footnotes:

See Gold Price, Capital, Operating and Tax Assumptions in Table 2 below.

Project Economics and Production Decision

Total gold ounces mined over the 22-month life of mine is expected to be 35,477 ounces at an average grade of 2.06 g/t gold from 535,592 tonnes of ore mined (see Table 2). It is expected that Argyle ore will be mined using conventional open pit mining methods with waste rock being stored locally at site and ore being transported by truck to the Pine Cove Mill. Total mined waste tonnes are 4,346,119 tonnes at an average strip ratio of 8.1 waste tonnes to ore tonnes. Inferred Mineral Resource within and adjacent to the current pit design will be assessed for conversion to Indicated Mineral Resource as mining progresses.

It is expected that Argyle ore will be batch-processed at approximately 1,200 tonnes per day with additional material from Pine Cove stockpiles supplementing the mill capacity of 1,300 tonnes per day. This will be accomplished with stockpile management techniques and circuit inventory methods in the mill to account for different mill feeds.

Argyle has robust economics with a pre-tax discounted NPV 5% of $13.05M with an IRR of 262%, and an after-tax NPV 5% of $11.4M with an IRR of 245%. Total initial capital requirements of $2.98M are required, mainly for pre-stripping of waste and site preparation.

Production from Argyle is slated to commence in August 2020. To date, the Argyle Deposit has been released from the Environmental Assessment Process, has received the required Mining and Surface leases, and is currently awaiting the final review of the Development, Rehabilitation and Closure Plan. These permits, in addition to an amendment to the existing Certificate of Approval for the Point Rousse Project, are expected in mid-August and development will commence soon after, as the Company transitions from mining at Pine Cove to Argyle during the third quarter of 2020.

Table 2: Key Assumptions and Costs Used in the Mineral Reserve

|

Production Profile

|

|

Gold Price - Base Case

|

CAD$1,900/ounce

|

|

Total Tonnes Milled

|

535,592 tonnes

|

|

Diluted Head Grade

|

2.06 g/t gold

|

|

Total Gold Ounces Mined

|

35,477 ounces

|

|

Reserve Cut-Off Grade

|

0.56 g/t gold

|

|

Mine Life (LOM)

|

22 months

|

|

Total Waste Tonnes

|

4,346,119 tonnes

|

|

Strip Ratio

|

8.1:1

|

|

Daily Mill Throughput

|

1,200 tonnes per day

|

|

Gold Recovery

|

87%

|

|

Total Gold Production

|

30,865 ounces

|

|

|

|

Capital Requirements

|

|

Pre-production Capital Cost

|

$2.98M

|

|

LOM Sustaining Capital Cost

|

$2.69M

|

|

|

Unit Operating Costs

|

|

Mining Costs

|

$42.32/tonne milled

|

|

Processing Costs

|

$23.26/tonne milled

|

|

G&A

|

$4.90/tonne milled

|

|

LOM Operating Cash Costs(1)

|

CAD$1,219 per ounce sold (US$914)

|

|

LOM All-in Sustaining Cash Costs(1)

|

CAD$1,306 per ounce sold (US$980)

|

|

|

|

Project Economics

|

|

Royalties(2)

|

3% net smelter return

|

|

Income Tax/Mining Tax Rates

|

30%/15%

|

|

Pre-Tax

|

|

|

NPV (5% Discount Rate)

|

$13.05M

|

|

Internal Rate of Return

|

262%

|

|

Payback Period (months)

|

12

|

|

Cumulative Cash Flows

|

$14.34M

|

|

After-Tax

|

|

|

NPV (5% Discount Rate)

|

$11.44M

|

|

Internal Rate of Return

|

245%

|

|

Payback Period (months)

|

12

|

|

Cumulative Cash Flows

|

$12.57M

|

(1) Cash cost includes mining cost, mine-level G&A, mill and refining cost. This is a non-GAAP performance measure; please see "Non-GAAP Measures and Other Financial Measures" below.

(2) A portion of the project is also subject to a 7.5% net profits interest ("NPI") with Royal Gold Inc. Depending on the price of gold in the future, operating and capital costs, the production profile of Argyle, the NPI could become payable at a future date.

Gold Price Sensitivity

An analysis of the Argyle economics was completed at a variety of gold selling prices, and on the base case CAD$1,900 optimized pit and Probable Reserves as outlined in Table 3. The analysis demonstrates robust economics for Argyle at CAD$1,900, with strong leverage to rising gold prices which have exceeded CAD$2,600 per ounce at times. At a gold price of CAD$2,600 per ounce (US$1,950), which approximates current spot prices, Argyle produces a pre-tax NPV 5% of $32.7M and an IRR of 1,336% and an after-tax NPV 5% of $24.5M and an IRR of 1,273%.

Table 3: Gold Selling Price Sensitivity Analysis

|

Gold Price

|

$1,500

|

$1,700

|

Base Case

$1,900

|

$2,100

|

$2,300

|

$2,600

|

|

Pre-tax NPV 5%

|

$1.8M

|

$7.4M

|

$13.1M

|

$18.7M

|

$24.3M

|

$32.7M

|

|

Pre-tax IRR

|

28%

|

124%

|

262%

|

459%

|

1,732%

|

1,336%

|

|

After-tax NPV 5%

|

$1.2

|

$6.5M

|

$11.4M

|

$15.9M

|

$19.3M

|

$24.5M

|

|

After-tax IRR

|

21%

|

114%

|

245%

|

443%

|

687%

|

1,273%

|

Argyle Mineral Resource

The total Open Pit Indicated Mineral Resource of 488,000 tonnes at an average grade of 3.14 g/t gold contains 49,300 gold ounces and the total Open Pit Inferred Mineral Resource of 9,000 tonnes at an average grade of 3.80 g/t gold contains 1,100 gold ounces at the 0.5 g/t gold cut-off (Table 4).

The Argyle Mineral Resource update was carried out by Mercator Geological Services Limited ("Mercator") of Dartmouth, Nova Scotia. Mercator also prepared the maiden Mineral Resource Estimate for the Argyle Deposit in 2017. The Mineral Resource is defined at a 0.50 g/t gold cut-off and is based on 1 metre assay composites capped at 20 g/t gold (Table 4). The Mineral Resource is undiluted and reflects partial percentage block modelling using Geovia-Surpac™ Ver. 2020 software. The Mineral Resource is constrained by a base case pit shell defined using a gold price of CAD$1,900, $4.00/tonne mining cost and $29.00/tonne cost for combined processing and G&A. Geovia Whittle™ Ver. 4.7.3 software was used by Dassault Systèmes Canada Inc. for pit optimization purposes. Mining, G&A, and processing costs plus gold price assumptions used in the optimization are based on the Company's 2020 budget.

Table 4: Argyle Mineral Resource - Effective Date: August 4, 2020

|

Type

|

Au (g/t) Cut -off

|

Category

|

Rounded Tonnes

|

Au g/t

|

Rounded Ounces

|

|

Open Pit

|

0.50

|

Indicated

|

488,000

|

3.14

|

49,300

|

|

Inferred

|

9,000

|

3.80

|

1,100

|

|

Out of Pit

|

2.00

|

Indicated

|

62,000

|

2.86

|

5,700

|

|

Inferred

|

56,000

|

3.89

|

7,000

|

|

Combined

|

0.50/2.00

|

Indicated

|

550,000

|

3.11

|

55,000

|

|

Inferred

|

65,000

|

3.88

|

8,100

|

Mineral Resource Estimate Notes

- Mineral Resources were prepared in accordance with NI 43-101, the CIM Definition Standards (2014) and 2019 CIM MRMR Best Practice Guidelines.

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Open Pit Mineral Resources occur within an optimized pit shell developed by Dassault Systèmes Canada Inc.; base-case optimization parameters include: mining at $4.00 per tonne, combined processing and G&A at $29.00 per tonne, average pit slope angles of 48 degrees (north) and 35 degrees (south); and a gold price of CAD$1,900/oz (US$1,425/oz)

- "Open Pit" Mineral Resources are reported at a cut-off grade of 0.50 g/t gold within the optimized pit shell.

- "Out of Pit" Mineral Resources are external to the optimized pit shell and are reported at a cut-off grade of 2.00 g/t gold. They are considered to have reasonable potential for future economic development using conventional underground mining methods based on a mining cost of $91 per tonne, processing and G&A cost of $29.00 per tonne, and a gold price of CAD$1,900/oz.

- "Combined" Mineral Resources are the tonnage-weighted average summation of Open Pit and Out of Pit Mineral Resources.

- Mineral Resources were interpolated using Ordinary Kriging methods applied to 1 metre downhole assay composites capped at 20 g/t gold.

- An average bulk density value of 2.77 g/cm3 was applied to all Mineral Resources.

- Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Mineral Resource tonnages and troy ounces have been rounded to the nearest 1,000 and 100, respectively; totals may vary due to rounding.

A Technical Report prepared in accordance with NI43-101 for the Point Rousse Project will be filed on SEDAR (www.sedar.com) within 45 days of this news release. For readers to fully understand the information in this news release, they should read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Reserves. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Qualified Persons

This news release has been reviewed and approved by Kevin Bullock, P.Eng., President and CEO and Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., "Qualified Persons" and Michael Cullen, P.Geo., and Matthew Harrington, P.Geo. of Mercator Geological Services Limited., "Independent Qualified Persons", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

Mr. Cullen, P.Geo. and Mr. Harrington, P.Geo. are responsible for disclosure regarding the Argyle Mineral Resource Estimate and Mr. Bullock, P.Eng. is responsible for disclosure regarding the Argyle Mineral Reserve Statement and related Project Economics.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in Atlantic Canada. The company operates mining and milling operations in the prolific Baie Verte Mining District of Newfoundland which includes the fully-permitted Pine Cove Mill, tailings facility and deep-water port, as well as ~11,000 hectares of highly prospective mineral lands including those adjacent to the past producing, high-grade Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information" within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects", or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or "believes" or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will be taken", "occur", or "be achieved". Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda's annual information form for the year ended December 31, 2019, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NON-IFRS MEASURES

Anaconda has included certain non-IFRS performance measures as detailed below. In the gold mining industry, these are common performance measures but may not be comparable to similar measures presented by other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Operating Cash Costs per Ounce of Gold - Anaconda calculates operating cash costs per ounce by dividing operating expenses per the consolidated statement of operations, net of silver sales by-product revenue, by the gold ounces sold during the applicable period. Operating expenses include mine site operating costs such as mining, processing and administration as well as royalties, however excludes depletion and depreciation and rehabilitation costs.

All-In Sustaining Costs per Ounce of Gold - Anaconda has adopted an all-in sustaining cost performance measure that reflects all of the expenditures that are required to produce an ounce of gold from current operations. While there is no standardized meaning of the measure across the industry, the Company's definition conforms to the all-in sustaining cost definition as set out by the World Gold Council in its guidance dated June 27, 2013. The World Gold Council is a non-regulatory, non-profit organization established in 1987 whose members include global senior mining companies. The Company believes that this measure will be useful to external users in assessing operating performance and the ability to generate free cash flow from current operations.

The Company defines all-in sustaining costs as the sum of operating cash costs (per above), sustaining capital (capital required to maintain current operations at existing levels), corporate administration costs, sustaining exploration, and rehabilitation accretion and amortization related to current operations. All-in sustaining costs excludes capital expenditures for significant improvements at existing operations deemed to be expansionary in nature, exploration and evaluation related to growth projects, financing costs, debt repayments, and taxes. Canadian and US dollars are noted for realized gold price, operating cash costs per ounce of gold and all-in sustaining costs per ounce of gold. Both currencies are considered relevant and the Company uses the average foreign exchange rate for the period.

FOR ADDITIONAL INFORMATION CONTACT:

Anaconda Mining Inc.

Lynn Hammond

|VP, Corporate Affairs

(709) 330-1260

lhammond@anacondamining.com

Exhibit A. A map showing the location of the Argyle Deposit in the eastern part of the Scrape Trend and its proximity to the Pine Cove Mine and Mill Complex, Point Rousse Project.

SOURCE: Anaconda Mining Inc.

View source version on accesswire.com:

https://www.accesswire.com/600216/Anaconda-Mining-Declares-a-Mineral-Reserve-at-the-Argyle-Deposit-and-Finalizes-Mine-Plan-with-an-After-Tax-IRR-of-245-at-Cad1900-Per-Ounce