LAS VEGAS, Aug. 12, 2020 (GLOBE NEWSWIRE) -- Reflecting the gaming industry’s increased focus on contactless and cashless solutions to facilitate player choice in funding options, Everi Holdings Inc. (NYSE: EVRI) (“Everi” or the “Company”), a gaming industry leader for cash access player funding, highlights its current in-market solutions and its roadmap for near- and mid-term cashless product implementations. Everi’s cashless/contactless solutions, which include products that are already live in casinos and CashClub Wallet®, the Company’s fully cashless integrated mobile solution that is expected to be live in the first casinos in the fourth quarter of 2020, collectively demonstrate the Company’s positioning as an industry innovator and leader for both cash and cashless funding solutions to address the unique needs of the highly regulated gaming industry.

“For almost two decades, our cash access solutions have been at the forefront of innovative player funding technology across the gaming industry,” said Chief Executive Officer Michael Rumbolz. “In 2019, we facilitated more than 115 million transactions that delivered $30 billion of cash to casino floors and generated $165 million in revenue for Everi. We have a large base of casinos and other facilities using our fully integrated FinTech network today, as well as our portfolio of compliance services and loyalty products. We stand ready to leverage the strengths of our current product suite, already live on casino floors, with our deep development pipeline of products and services to enhance our status as provider of choice in the gaming industry well into the future. Our focused innovation and breadth of integrated capabilities enables us to provide casino patrons with a seamless transition to our cashless alternatives, positioning us to meet players’ and casino operators’ preferences, whether players want to select cash or a cashless funding solution.

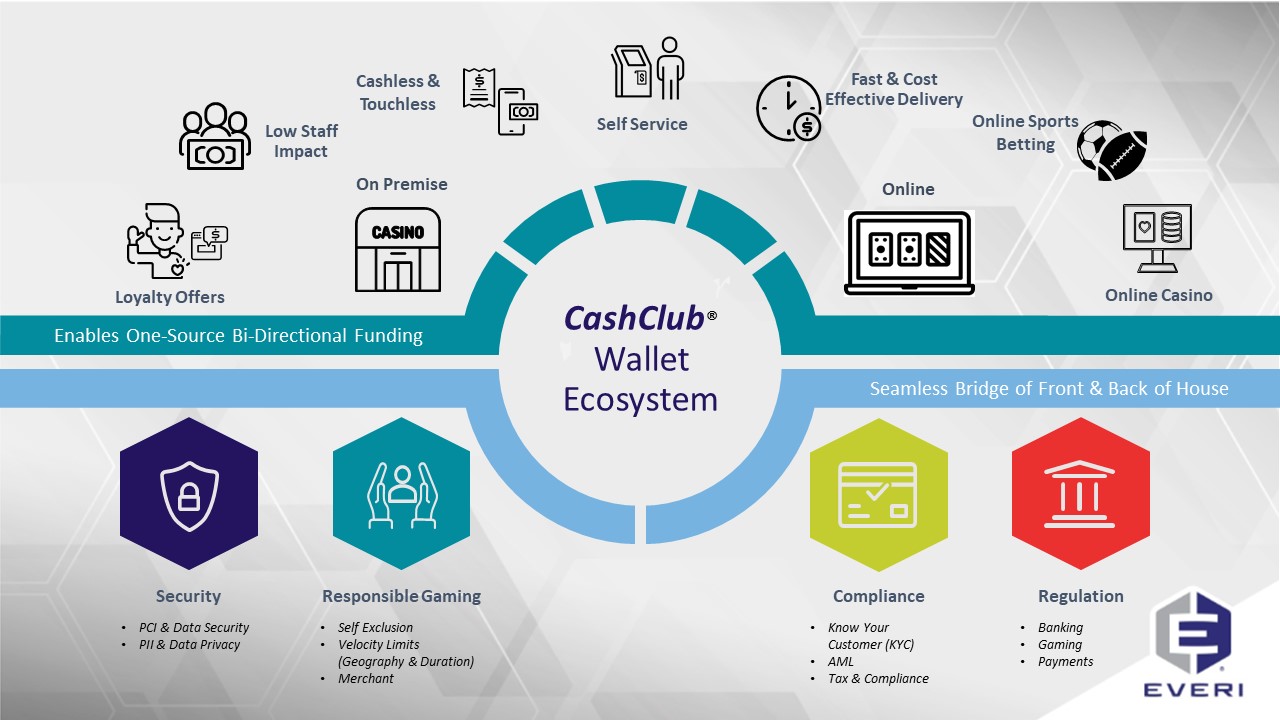

“In the near-term, we expect players’ choice for funding on the casino floor will continue to favor existing cash access solutions, such as ATM withdrawals or cash advances. Going forward, and over time, adoption of cashless and contactless funding solutions will grow, allowing players the ability to move value across gaming and non-gaming venues within our customers’ land-based operations, but also into and out of a casino’s online and sports wagering offerings, and finally back to the patrons’ checking, credit and debit accounts. These bi-directional funding solutions are the hallmark of Everi’s CashClub Wallet ecosystem. Players will have the opportunity to transfer funds into and out of their wallet from the comfort of their own home before arriving at their favorite casino. This will create additional opportunities for new incremental transactions and provide tremendous value for patrons,” added Rumbolz. “By providing cashless options for players, we are creating new revenue opportunities for our customers and Everi. With our superior solutions for cash and cashless funding access, combined with our money transmitter capabilities and our integration with third-party, cashless wagering systems, we’re strategically positioned to provide seamless, cost-efficient back-of-the-house functionality to solve the unique regulatory needs of casino operators – creating a fully integrated, multi-jurisdictional, on premise and online, cashless financial- and loyalty-based ecosystem that will provide compelling value for both casino operators and players.”

A Media Snippet accompanying this announcement is available by clicking on the image or link below:

Everi’s extensive, integrated FinTech and Loyalty product lines, including anti-money laundering (“AML”) and other compliance services necessary in the regulated gaming industry, provide unified and cost-efficient benefits on the casino floor - both front- and back-of-house - enabling card-based and mobile scenarios, while remaining agnostic to third-party integrations. This one-source, bi-directional functionality of the integrated CashClub Wallet makes it a convenient and cost-effective solution for casino and resort operators who desire 360-degree visibility and compatibility across their “On Premise and Online” player amenities. Everi’s integrated offering of cash and cashless options, together with their full suite of integrated products and services, provides operators with a seamless and low-cost transition for their patrons who switch from cash to cashless.

“Since the outbreak of COVID-19, the interest from our casino customers for cashless and contactless player funding technologies has greatly accelerated,” said Darren Simmons, Executive Vice President and FinTech Business Leader. “As players and casinos seek options that lessen interactions with casino employees and reduce handling of cash, we provide technology and solutions that are safer and support social distancing measures to protect players and employees. We have the opportunity now to reconcile the unique needs of the funding environment inside casinos with the quickly-evolving financial and payment environment outside the casino.”

“We’ve been innovating in this area for more than 15 years, including with our present-day self-service, cashless, gaming voucher platform,” added Simmons. “Everi is addressing casinos’ demand for immediate options today, while also developing the products that can establish a foundation to lead the industry in its embrace of true mobile cashless gaming technology in the future.”

Everi’s Cashless and Contactless Products

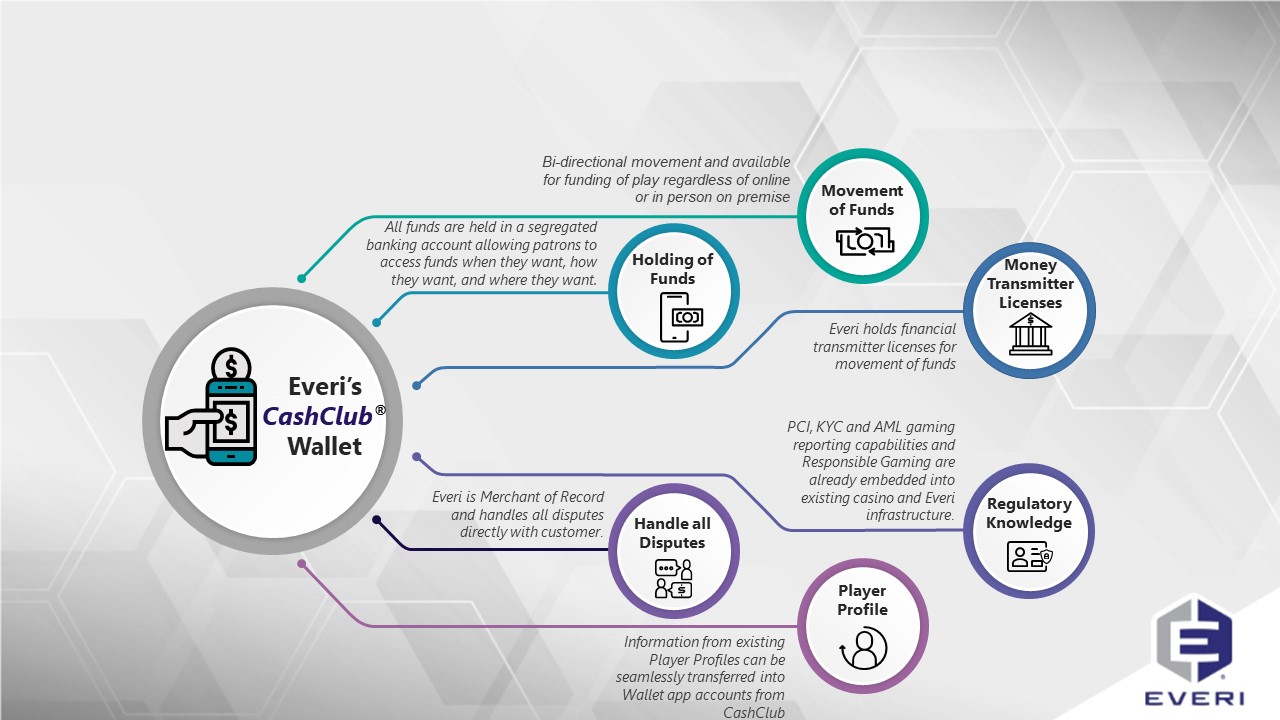

Each of the solutions highlighted below offer a convenient supplemental alternative to dispensing cash on the casino floor, while preserving value for operators and continuing to support a player’s choice of cash. Enabled by the Everi CashClub Wallet solution, players have for the first time the ability to move funding transactions bi-directionally: from gaming on the casino floor to a casino’s online offerings, such as sports betting and online gaming and back again, while also moving funds into the casino and depositing funds back into the wallet upon the conclusion of their casino experience. The hallmark of the Everi CashClub Wallet solution is its ability to move funds into, across and out of casinos without the need for handling of cash. This expanded capability provides seamless funds movement for the casino patron, while offering potential new transaction types to drive increased revenue for casino operators and Everi based on the flow of funds: whether to purchase a gaming voucher, fund a mobile wallet, or deposit funds back to the player’s bank account. Each solution helps lower operators’ costs by reducing cash handling, cashier cage lines, and kiosk maintenance expense by lowering the total load on the kiosk cash dispenser.

Product Highlights:

Digital CashClub Wallet® mobile app solution

- Expected to be live by 2020 year-end

- Enhances the guest experience by allowing players to access funds (cash or cashless) when they want, how they want and where they want

- A white-label, integrated, cashless wallet app that consolidates payment options to one source

- Secure PCI-certified, AML-integrated, multi-source payment processing engine: ATM, debit cards, credit cards, bank accounts, checks

- Allows players to store multiple payment methods, easily move funds bi-directionally into and out of the casino, and manage their spend limits

- Allows players to easily move funds both into and out of electronic gaming machines (“EGMs”) on the casino floor

- Integrated with Everi’s loyalty solutions and with leading third-party casino gaming systems

- Can be extended across casinos’ on-premise point-of-sale systems and online platforms (F&B, hotel, retail, sportsbook, online gaming and other offerings)

- Seamlessly integrate front-of-house gaming transactions with back-of-house processes

- Integrated with existing cash access platform for easy account creation for increased patron acceptance

- Funds can remain on the wallet or be cashed out via an ATM/kiosk by tapping contactless technology or deposited back into the player’s bank account or credit card (via ACH or OCT)

- If a player chooses, the Everi CashClub Wallet can also accept cash deposits and provide cash access from self-service devices

- Additional regulatory approvals, and / or field trials, may be necessary in certain commercial jurisdictions

- For additional information, click here

Everi Mobile Wallet with Gaming Voucher

- Ready for implementation in the third quarter 2020

- Extends the functionality of the QuikTicket® gaming voucher platform by allowing a white-label, core version of Everi’s CashClub Wallet mobile app to interface directly with a kiosk as the source of funds for the purchase of a gaming voucher

- Players fund a casino-branded mobile wallet and use the mobile wallet to purchase a gaming voucher from a kiosk

- Gaming vouchers dispensed from Everi kiosks can be used as virtual currency for gaming in the same way a traditional gaming voucher (Ticket In, Ticket Out) can be used among EGMs

- At the end of play, players can insert gaming vouchers into a QuikTicket-enabled kiosk to transfer funds back to their mobile wallet, enabling bi-directional movement. From there, the player can elect to leave the funds in the mobile wallet for use at a later time or transfer the funds back to their bank account or credit card

- Approved for use in almost all tribal and commercial jurisdictions

- For additional information, click here

A Media Snippet accompanying this announcement is available by clicking on the image or link below:

About Everi Holdings

Everi (NYSE: EVRI) is a leading supplier of imaginative entertainment and trusted technology solutions for the casino, digital, and gaming industry. With a focus on both customers and players, the Company develops entertaining games and gaming machines, gaming systems and services, and is the preeminent and most comprehensive provider of core financial products and services, player loyalty tools and applications, and intelligence and regulatory compliance solutions. Everi’s mission is to provide casino operators with games that facilitate memorable player experiences, offer seamless and secure financial transactions for casinos and their patrons, and deliver software tools and applications to improve casino operations efficiencies and fulfill regulatory compliance requirements. Everi provides these products and services in its effort to help make customers successful. For more information, please visit www.everi.com, which is updated regularly with financial and other information about the Company.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” as defined in the U.S. Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as “goal,” “target,” “future,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “project,” “may,” “should,” “designed to,” “in an effort to,” “will provide,” “look forward to,” or “will” and similar expressions to identify forward-looking statements. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of timing, future events or performance. Actual results may differ materially from those contemplated in these statements, due to risks and uncertainties. Examples of forward-looking statements include, among others, statements the Company makes regarding its ability to execute on key initiatives and deliver ongoing improvements; regain revenue momentum, generate positive Adjusted EBITDA and Free Cash Flow; and improve the Company’s capital structure; integrate acquisitions and achieve future growth; drive growth of the gaming operations installed base and DWPU; continue expanding the portions of the gaming floor the Company’s games address; and create incremental value for its shareholders.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are often difficult to predict and many of which are beyond our control. Our actual results and financial condition may differ materially from those indicated in forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, without limitation, the impact of the ongoing COVID-19 global pandemic on our business, operations and financial condition, our history of net losses and our ability to generate profits in the future; our substantial leverage and the related covenants that restrict our operations; our ability to generate sufficient cash to service all of our indebtedness, fund working capital, and capital expenditures; our ability to withstand unanticipated impacts of a pandemic outbreak of uncertain duration; our ability to withstand the loss of revenue during the closure of our customers’ facilities; our ability to maintain our current customers; our ability to compete in the gaming industry; our ability to execute on mergers, acquisitions and/or strategic alliances, including the timing and closing of acquisitions and our ability to integrate and operate such acquisitions consistent with our forecasts; our ability to access the capital markets to raise funds; expectations regarding our existing and future installed base and win per day; expectations regarding development and placement fee arrangements; inaccuracies in underlying operating assumptions; expectations regarding customers’ preferences and demands for future gaming offerings; expectations regarding our product portfolio; the overall growth of the gaming industry, if any; our ability to replace revenue associated with terminated contracts; margin degradation from contract renewals; technological obsolescence; our ability to comply with the Europay, MasterCard and Visa global standard for cards equipped with security chip technology; our ability to introduce new products and services, including third-party licensed content; gaming establishment and patron preferences; our ability to prevent, mitigate or timely recover from cybersecurity breaches, attacks and compromises; the level of our capital expenditures and product development; anticipated sales performance; employee turnover; national and international economic conditions; changes in global market, business and regulatory conditions arising as a result of the COVID-19 global pandemic; changes in gaming regulatory, card association and statutory requirements; regulatory and licensing difficulties that we may face; competitive pressures in the gaming and financial technology sectors; the impact of changes to tax laws; uncertainty of litigation outcomes; interest rate fluctuations; unanticipated expenses or capital needs and those other risks and uncertainties discussed in our most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on March 2, 2020 and Form 10-Q filed August 4, 2020. Given these risks and uncertainties, there can be no assurance that the forward-looking information contained in this press release will in fact transpire or prove to be accurate. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which are based only on information currently available to us and speak only as of the date hereof.