Thousands of years ago, ancient Aztecs may have held the key to the next biotech breakthrough .

During ceremonial rituals, they used a special compound they called “the flesh of the gods”...

And today, researchers are discovering that this same compound could transform how we approach mental health moving forward…

Sparking an explosion of interest in what some experts project could be a $6.9 billion market by 2027

It’s already being studied in some of the top medical facilities in the United States, including Johns Hopkins University…

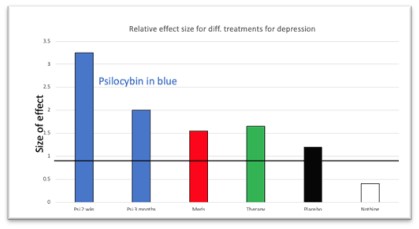

Where it was found that this chemical was up to 4x more effective in treating depression than typical antidepressants.

Source: BeckleyFoundation.org

Now, the media is taking the story mainstream as it continues to gain steam by the day.

CNN reported “One use of [this compound] reduces anxiety and depression in cancer patients.”

Fortune Magazine reported “Psychedelic drugs may revolutionize mental health care .”

And CNBC is reporting “Oregon becomes first state to legalize [the special compound] as more states ease drug laws in ‘psychedelic renaissance’ ”

This could become one of the greatest transformations in mental health care we’ve seen in decades, with the potential to treat chronic conditions much faster than typical treatments.

And one company plowing ahead at the forefront of this breakthrough is Lobe Sciences Ltd. ( CSE:LOBE ; OTC:GTSIF ).

Earlier this year, they acquired Eleusian Biosciences Corp., another growing biotech company with several provisional patents to their name.

Between the treatments they’ve identified and devices they’re in the process of developing, they have the potential to own a significant share of this booming market.

And at a market cap of just C$8 million , this could be a major boom for early investors as news continues to break in this fascinating field.

Here are 5 reasons why you should be paying attention to Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ).

#1 - The Massive Mental Health Market

In 2019, it was estimated that 1 in every 5 Americans lives with a mental illness , according to the National Institute of Mental Health.

And that was before the stress and uncertainty of living through a global pandemic.

That’s why the market for treating mental health and neurodegenerative disorders is projected to reach a whopping $240 billion by 2026 .

But the transformative medicine movement could be poised to grab a huge share of that market based on early results.

These chemical compounds work in a completely different way than standard medications used today.

While most treatment approaches for mental health tend to focus on treating the symptoms, these compounds take a different approach.

They work by addressing the root cause of the issue by giving you a transformational experience that can help “reset” the brain…

Interrupting the thought patterns and habit loops in the brain that can get people stuck for months or years in many cases.

A study from Johns Hopkins showed that when treating terminal cancer patients with psychedelics to reduce anxiety and depression…

They showed an incredible 80% success rate upon administering large doses of Psylocibin…

The number of treatments in psychiatry that can boast that kind of success rate is almost non-existent.

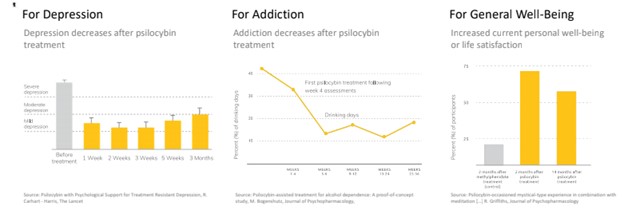

Which is why psilocybin and other special compounds like it are now being studied to treat everything from depression and anxiety to addictions and trauma, and much, much more.

And the FDA has even granted “Breakthrough Therapy” status to various psychedelic clinical trials looking to address treatment-resistant depression.

But successfully treating trauma has been a longstanding issue in psychiatry.

Each year, an estimated 8 million Americans suffer from PTSD. That’s more than the population of the entire state of Washington.

And with about 1 in every 13 people experiencing post-traumatic stress disorder (PTSD) at some point throughout their lifetime, this is a major priority in the mental health field.

But at this point, there are very few treatments in psychiatry that have been proven to help treat PTSD and relieve people of past trauma.

Plus, there’s another issue that often goes hand-in-hand with trauma that has gained mainstream attention.

Each year, millions of people sustain concussions , mild brain injuries that can be caused by anything from falls to car accidents to sports-related injuries.

But the current protocol given by the CDC tends to be little more than providing some education and telling folks to stay home, rest, and drink water.

Clearly this all leads to a massive market opportunity, with the alternatives on the market leaving many people continuing to struggle.

But Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) has already assembled concrete ingredients to address the trauma and concussion issues head on.

And as they look to play a major role in treating these issues with their solutions, they could stand to grab a huge part of this multi-billion dollar market.

#2 - Building A Giant Moat in This Booming Industry

As this industry continues to grow, Lobe is planting its flag and staking its corner of the market.

With its recent acquisition of the biotech company Eleusian Biosciences in July, Lobe now has 5 provisional patents to its name and counting.

3 of these provisional patents are for the chemical compounds themselves, and the other 2 are for their innovative devices.

The treatments are each focused around pairing these revolutionary substances with an over-the-counter drug…

Addressing both the head trauma and emotional trauma when experiencing concussions.

This could be incredibly promising news for the millions of people who experience a concussion each year - whether that was due to a fall, accident, military service, or any other head injury.

In short, the over-the-counter drug N-acetylcysteine (NAC) has already been shown to be effective in treating the head injury portion, according to studies published by the National Institute of Health (NIH)…

And these special compounds would work in combination with NAC, potentially preventing patients from experiencing the emotional trauma that often comes after the injury.

The devices Lobe is in the process of developing show incredible promise as well.

The first would spray a specific dose of the compound through the nasal cavity using extremely small droplets.

And the second is a virtual reality mask that could be used while receiving the treatment nasally.

With these breakthrough technologies, it would be possible to perform therapy using virtual reality while you receive the compound through the nasal spray.

This would be an opportunity unlike any on the market to help shift how patients experience past trauma.

Many other companies in the industry seem to be stretching themselves thin, trying to be everything to everyone…

Buying up treatment centers… developing the treatments… running clinical trials… and much more.

But Lobe plans to become the go-to name in a more focused area, by delivering top-notch treatments along with the innovative devices to deliver them.

And it becomes even more exciting when you see the caliber of the team and relationships they’ve built already.

#3 - World-Class Team and Connections

Lobe is pushing forward quickly to move its patented therapies through the 5 stages of research and development.

And much of it is happening in partnership with a renowned institution in the University of Miami.

Lobe ( CSE:LOBE ; OTC:GTSIF ) is already extremely undervalued in comparison to many of its competitors...

But when you consider that none of these competitors have relationships with universities like Lobe does, it’s plain to see why Lobe is the biotech company to watch in the weeks and months ahead.

At the moment, Lobe has already started pre-clinical studies at the University of Miami for its treatment of concussions and PTSD with psilocybin and NAC .

But it’s not just the relationships outside of the organization that give this opportunity so much promise.

The team that Lobe has built includes some world-class talent, showing they’re serious about moving their plans forward with the best at the helm.

Their CEO, Tom Baird, for example, has led engineering design, strategy, and product management for several companies over his career.

That includes his background working for TRW Inc., now Northrop Grumman, a $52 billion company.

This experience in engineering and product management will be invaluable in bringing not only Lobe’s treatments to market successfully, but its devices as well.

They’ve also picked up a valuable asset in Maghsoud Dariani, their new Chief Science Officer.

Dariani is the best of both worlds, with both the science smarts and the business savvy…

Making for a perfect combination for creating a quality product then developing a strategy to grow the business behind it.

He’s also currently the CEO of Semorex, a private company developing therapeutics for cancer.

And in his past roles as president and vice president of other impressive biotechs, he’s built an incredible list of achievements.

That includes bringing multiple drugs to FDA approval, helping another treatment reach the clinical evaluation stage, and assisting in negotiating the sale of one of these companies.

This includes Focalin and Focalin XR, a derivative of the popular ADHD medication Ritalin, which continues to be widely prescribed years later.

With his experience both bringing treatments to FDA approval and negotiating high-level business deals, this makes the potential of Lobe look even more promising.

But there’s another ace in the hole that could prove to be a major catalyst for shares to jump in the near future…

#4 - The “Triple Play” Asset Potentially Worth Tens of Millions

On top of the promising treatment developments and the plans for their proprietary delivery devices…

Lobe ( CSE:LOBE ; OTC:GTSIF ) also acquired the exclusive rights to purchase a Washington-based recreational cannabis firm, Cowlitz County Cannabis Cultivation, several years ago, for just US$50,000.

As one of the first states to legalize recreational marijuana, Washington has among the strongest sales of any state in America.

Sales were projected to reach an eye-popping $2.1 billion in 2020…

But they’ve actually exceeded expectations since that projection, with sales increasing during the pandemic.

And Cowlitz has become a prominent player in the massive Washington market over the last several years.

Based on filings with the state, they’re currently on pace to reach $20 million in revenue this year.

Revenue has continued to grow over the past several years, all while many industries have been crumbling around them recently.

And now, Lobe could exercise this option to acquire an asset producing $20 million in annual sales for just a modest $50,000 USD.

This unique situation could help Lobe be a winner in almost any scenario imaginable.

But three scenarios seem most likely at this point.

First, a landmark legal case is underway that may loosen Washington’s stringent rules on foreign cannabis ownership.

A change in state and federal regulations could allow Lobe to exercise their option and buy the multi-million dollar cannabis company outright.

Because this valuable asset isn’t shown on their balance sheet right now, that would mean an immediate boost to Lobe’s numbers, which could send shares soaring.

Second, they could choose to sell their option to the highest bidder.

And with Cowlitz’s growth rate over the last few years, it’s not hard to imagine how this could bring an offer with a serious price tag.

Generally, these kinds of assets can sell for 1x their revenue at the minimum, with many deals bringing back 3x valuations or more.

For Lobe, that means they could potentially bring in an additional $20 million or more with very little work.

Again, if this brought in a major flood of cash in the event of a sale, it could mean a jump in Lobe’s share prices once a deal is completed.

It could also deliver more shares for early investors, all without diluting the ones they’re already holding, which is a great situation for both the company and shareholders.

Finally, they could remain a winner with this option by doing nothing at all.

As it stands, Lobe receives monthly revenue through Cowlitz’s brand licensing and leasing to the firm.

In fact, that monthly revenue is enough to cover most of Lobe’s general and administrative costs at this point, making it even more profitable as a result.

So even if Lobe doesn’t exercise or sell the option, it will continue to receive a revenue boost each and every month, which has helped it remain funded with additional cash flow.

The Bottom Line

1) These ancient compounds are being recognized as a potential game-changer for mental health, sometimes showing results 4X better than current treatments .

2) Promising results have already been shown for certain psychedelic compounds in treating depression, anxiety, trauma, and substance use issues, with many others conditions being studied.

3) Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) has already assembled pieces and begun pre-clinical studies ahead of this growing wave.

4) With 5 patents pending, Lobe is planting their flag and setting themselves up to own a significant corner of this growing industry.

5) They’ve established an important relationship with the University of Miami, which will help test and validate their treatments and devices.

6) Plus, they own a valuable asset in a booming recreational cannabis company, which could potentially be sold for a large sum or kept for the consistent monthly revenue boost it provides now.

Here are a few more companies to watch out for during the biotech boom:

Field Trip Health (CSE:FTRP)

Field Trip Health, based out of Toronto, takes a three-pronged approach in their work in transformative medicine.

Not only are they involved in drug development, but they’re also involved in manufacturing and run a number of treatment clinics.

With clinics currently operating in Toronto, Los Angeles, and New York, they have plans to ramp up to 75 clinics – providing psychotherapy along with psychedelic treatments.

Trillium Therapeutics Inc. (TSX:TRIL)

Trillium is a specialized biotechnology company that takes a unique approach on the industry, harnessing insights from nature to develop novel immunotherapies to treat cancer. Trillium’s products tackle such diseases as lymphoma and myeloma and other blood cancers.

Trillium went public over 13 years ago, and has already garnered a name for itself in this industry. The Toronto giant is now one of the shining stars of Canada’s biotech scene.

Oncolytics Biotech Inc. (TSX:ONC)

Oncolytics Biotech is another Canadian biotech firm. The company got it start from a major series of discoveries based out of the University of Calgary and has grown significantly over the past two decades. Onoclytics’ primary product is REOLYSIN, a first-in-class, systemically administered, immuno-oncolytic virus created with the potential to act as a therapy for cancer patients.

OrganiGram Holdings (TSX.V:OGI)

OrganiGram is another Canadian holdings company looking to take the burgeoning cannabis industry by the horns. With numerous subsidiaries from which it produces and distributes recreational and medical marijuana, OrganiGram is well positioned to ride the next Green Wave into profits.

OrganiGram has carved out its place in cannabis royalty by securing deals across Canada, from Saskatchewan to British Columbia. In addition to its in-person sales strategy, OrganiGram also offers another unique method of distribution. Online and over-the-phone options. More than that, however, OrganiGram and its partners knows how to manage the surging Canadian demand that has left other distributors without product for periods of time.

Emblem Corp. (TSX.V: EMC)

Emblem is a leading licensed marijuana producer in Canada. With a number of cannabis-based products, Emblem works closely with the medical community to ensure both patients and physicians have the information necessary to make decisions regarding treatments involving marijuana.

Recently, Emblem completed testing on a new oral extended release product with partner Canntab Therapeutics. With the successful tests, the companies announced that they will be moving forward into clinical trials.

By. Charlotte Hawthorne

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT . This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Lobe Sciences to conduct investor awareness advertising and marketing. Lobe paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of sixty thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Lobe) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP . The Publisher owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS . This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business including the legality of Psilocybin and other psychedelics, the ability of the company to exercise or sell its option to acquire shares of Cowlitz County Cannabis Cultivation or otherwise monetize its interest in Cowlitz, the degree of success with research and development of the company’s medicines and devices, the success of clinical trials, governmental approval or clearance of the company’s medicines and devices, the size and growth of the market for the companies’ products and services, the ability of management to execute its business plan, the continuity of management, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY . By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE . By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use . If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use , please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY . GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.