2021 could be a big year for this soon-to-be $16-trillion biotech industry.

More importantly, it could be a big year for early investors in this new biotech breakthrough that could effectively treat the world’s #1 disability.

It’s a disability that’s costing the economy $1 trillion in lost production every single year.

In fact, the revolutionary treatment could be at our doorstep by 2021.

In clinical trials it’s successfully treated 80% of patients (see below).

Investors are piling in.

They call this new segment of biotech ‘transformational medicine'…

The next few months are critical.

Why? Global spending on mental healthcare could hit $16 trillion by 2030.

The science may read like the best of Isaac Asimov, but it's very real.

Researchers say it could have huge implications for people with...

- Depression and anxiety

- PTSD

- Addiction

- Bipolar Disorder, OCD and Schizophrenia

- Autism

- Alzheimer’s and Parkinson’s

- And many other disabling diseases…

And it's all thanks to four naturally occurring “miracle compounds” that help "reset" the human brain...

With the potential to transform the mental health of hundreds of millions starting as early as 2021.

LOBE SCIENCES ( CSE:LOBE ; OTC:GTSIF ) IS ON THE LEADING EDGE OF TRANSFORMATIONAL MEDICINE

Working in collaboration with the University of Miami...

Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) is on the leading edge of this biotech breakthrough.

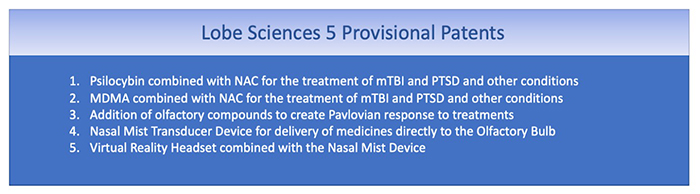

It already has 5 provisional patents pending on its technology...adding some serious swagger to the IP value here.

And they have more patent applications planned in 2021.

Lobe’s chief scientist, Maghsoud Dariani, with a history of developing medicines through FDA trials, says:

"These four compounds will revolutionize the treatment of mental health disorders. With just one of these compounds alone we're already seeing results in the early trials -- significant decreases in symptoms -- that are off the charts."

Lobe points to a Johns Hopkins study of the efficacy of these classic compounds for treatment of depression and anxiety (a market that could grow to $18.9 billion by 2026) that concluded that psilocybin eased depression and anxiety in patients with life-threatening cancer.

But that was back in 2016. Since then, a collection of new studies have taken this far beyond cancer patients and into the general population suffering from widespread depression, anxiety and PTSD.

Another study from November 2020 found that the compound psilocybin “worked better than the usual antidepressant medications. According to Alan Davis , the author of the study and a faculty member at Johns Hopkins University and Ohio State University, psilocybin’s effect was “more than four times greater”.

The FDA has even called this compound a " Breakthrough Therapy "--for a second time this year.

Nothing resounds louder with investors than that.

Smart investors are paying close attention to this new biotech trend… and they’re preparing to make millions.

THE SMART MONEY IS MOVING IN TO THE #1 OPPORTUNITY FOR INVESTORS IN 2021

Not only is transformational medicine good science...

But it's a tremendous opportunity for investors.

US News & World Report says this could be better than cannabis .

Rolling Stone calls it a “ miracle ”.

Wildly influential TED Talks is constantly spreading the word.

The Wall Street Journal calls it “fantastic”.

Forbes says the evidence is lining up quickly.

And then there’s the FDA, which--it’s worth repeating--has called it a “breakthrough therapy”.

Tim Ferriss , angel investor extraordinaire and bestselling author of The 4-Hour Workweek, funded Johns Hopkins’ psychedelic research center with over $2 million. Ferriss says this is the world’s proof-of-concept demonstration--the Silicon Valley of psychedelics.

Some of the smartest biotech investors are going all in...

In March 2019, European investors piled into Germany’s ATAI Life Sciences , a psilocybin compound manufacturer, investing more than $40 million in the company and bringing its value up to $240 million.

Brad Loncar, lead biotech investor at Loncar Investments, pinpointed the “ultimate sign for investors” when big pharma got its first approval for a psychedelic-based anti-depressant in the Spring of 2019.

Multi-billionaire and PayPal co-founder Peter Thiel has put big money into this industry.

Billionaire investor Mike Novogratz has also been selling the psychedelic space for years, lauding its massive investment merits.

Big Pharma has seen the writing on the wall. They are going all in, too.

Johnson & Johnson has been pouring money into R&D for years.

When the FDA approved Janssen’s SPRAVATO ketamine-like nasal spray--a J&J company--as an antidepressant in 2019, it was a signal to investors that the hallucinogenic side of biotech was about to explode.

Many are going all in on a $10.6-billion a year niche market for PTSD, depression and anti-anxiety.

And Lobe appears close to a transformational PTSD development, too.

Among four others, it boasts a patent pending for a nasal mist transducer device that aims to offer a transformational approach to PTSD treatment.

Development is already under way and the next news to come out may not just be transformational for PTSD—but for the stock, as well.

LOBE SCIENCES IS FOCUSING ON MULTI-BILLION-DOLLAR PTSD, DEPRESSION AND ANTI-ANXIETY MARKET

The numbers are overwhelming…

The addressable markets for medical access to psychedelics are in the hundreds of millions.

As of 2020, more than 264 million people of all ages suffer from depression, according to the World Health Organization.

Additionally, 1 in 13 people will develop PTSD at some point in their life.

During the global pandemic… 1 in 20 women… and 1 in 50 men were newly diagnosed.

Depression is now the No. 1 cause of disability in the world.

Considering many other mental disorders that psychedelic researchers are working to address, this could be a massive market opportunity.

The functional mushroom market is expected to be worth more than $34 billion by 2024 , according to data from Modor Intelligence.

And Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) is working with one of these four "miracle compounds" to reset the brain for PTSD sufferers.

It hopes to become the first treatment a person receives after a traumatic brain event...

To avoid any symptoms of PTSD…

That means no re-experience of trauma, emotional numbness, insomnia, lack of focus, irritability and more.

Current therapies are just 10%-30% effective...

But they are hoping their studies with this compound will achieve success rates higher than we're now seeing published in medical journals.

"These changes were sustained, with about 80% of participants continuing to show clinically significant decreases."

-- Johns Hopkins University

Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) already has five provisional patent applications on its therapy, methods and devices... and the stock’s future looks bright.

EVEN THE U.S. MILITARY IS GEARING UP TO USE FORMERLY "FORBIDDEN COMPOUNDS"

So, what are these four compounds? CBD, THC, MDMA and psilocybin.

As smart investors know, these formerly forbidden compounds are now being fast tracked for medical use...

According to Global Market Insights the CBD market will grow AT 52.7% to $89 billion by 2026.

According to Grand View Research the THC market will grow over 315% to $73.6 billion by 2027.

Early investors made incredible profits in these two compounds when the floodgates opened during the initial cannabis boom...

Cronos Group (NASDAQ:CRON) earned investors a 9,000% gain between 2015 and 2019.

Aphria Inc (NASDAQ:APHA) created 2,328% gains for investors between March 2015 and January 2018.

Canopy Growth (NYSE:CGC) went from $3.09 in April 2014 to $51.53 by Q3 2018, netting investors a 1,567% gain.

Tilray (NASDAQ:TLRY) rewarded investors with nearly 400% gains between July 20th and October 20th, 2018, when its stock shop up from $29.77 to $148.30.

GW Pharmaceuticals (NASDAQ: GWPH) went from $10.36 in 2012 to $119.69 today for a gain of over 1,055%.

And there’s now a second boom arising, with investors in Curaleaf Holdings Inc (OTCMKTS: CURLF) raking in nearly 300% gains just between March and November 2020.

And the next big scientific compound boom could be in the psilocybin market.

Compass Pathways (NASDAQ:CMPS), backed by billionaire Peter Theil, recently won FDA “ breakthrough therapy ” designation for its psilocybin treatment for depression, helping to further validate the industry.

Toronto-based Field Trip Health (CSE:FTRP) has plans to ramp up to 75 psychedelic treatment centers across North America.

Mind Medicine (MindMed) Inc. (OTCMKTS:MMEDF), the first publicly-traded company on this playing field, has multiple trials in Phase II , pushing shares to double over the past two months.

Champignon Brands (CN:SHRM) (OTC:SHRMF), IPO’ed earlier this year and is hot on the acquisition trail, doubling shareholder gains since March.

They’re all on a tear …

And now, even the U.S. Military is getting involved because U.S. combat veterans returning from war torn countries experience PTSD at rates of up to 30%...

So, the U.S. Defense Advanced Research Projects Agency (DARPA) just announced $26.9 million in funding for two of these compounds... psilocybin and ketamine.

Why? As mentioned earlier, the Journal of American Medicine Psychiatry found "psilocybin 4 times more effective than antidepressants in treating depressive disorder".

4 times more effective than antidepressants

-- Journal of American Medicine Psychiatry

Instead of a 20% success rate... the study found an 80% success rate. The science can't be ignored any longer.

Now, according to Data Bridge Market Research the psilocybin market alone will grow to $6.8 billion by 2027 .

And Lobe Sciences might be the #1 stock to profit from it…

Already, anyone tied to this emerging industry is soaring on the tailwinds of November 3rd elections that saw voters in two more states--Oregon and the District of Columbia--approve ballot initiatives to decriminalize the consumption of magic mushrooms, by margins of 56% to 44% and 76% to 24%, respectively.

THE #1 "BRAIN SCIENCE" STOCK FOR 2021

Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) is perfectly positioned to take advantage of the 2021’s transformational science trend.

But this is just the beginning, and this revenue hasn’t even been recognized yet.

Lobe has a cannabis asset— Cowlitz County Cannabis Cultivation —positioned to report approximately US$20 million in revenue this year.

More urgently, the floodgates are opening…

Just over the past year, Denver, Oakland, Santa Cruz, Ann Arbor, Oregon and Washington DC decriminalized psilocybin.

We saw this same pattern repeat at the beginning of the cannabis boom. But this time it will be bigger because the mental health of the entire world could be at stake.

The therapeutic potential of psychedelic drugs to treat the profound distress of Western society is becoming undeniable. Even the FDA thinks so.

Similar research has been shown to be 80% effective... compared to 20%-30% for big pharma treatments.

More studies will likely be published soon… building on this base of research.

Lobe Sciences hopes to have a lot of exciting news on its calendar for 2021.

"There is a smaller subset of investing verticals in the psychedelic space as it is more of an intellectual property race to develop drugs," says Michael Sobeck, managing partner at Ambria Capital, a San Juan, Puerto Rico-based asset manager.

And that’s where Lobe could have a clear advantage. Its already got 5 provisional patent applications and is in the process of applying for full patents to their technology.

And one more trick up its sleeve: Lobe has an option to acquire 100% of the Cowlitz cannabis asset for only $50,000, the sale of which could do two things investors like to hear: (i) Fund the critical patent portfolio in a non-dilutive manner; and/or (ii) distribute the consideration received for the asset to Lobe shareholders.

Remember, University of Miami pre-clinical trials are expected to be coming soon for Lobe Sciences.

When the results come out investors could be rewarded with gains of a lifetime because…

The news could send Lobe Sciences ( CSE:LOBE ; OTC:GTSIF ) … currently trading for pennies… to dollars and beyond.

Other companies looking to capitalize on this new regulatory shakeup:

Molson Coors (NYSE:TAP, TSX:TPS-A) is another iconic multi-national beer company, with brands that are recognizable across the United States and Canada. Not to be left behind in the marijuana boom, Molson Coors is also developing a line of non-alcoholic cannabis-based beverages with its partner, the HEXO Corporation.

Molson Coors Canada president and CEO Frederic Landtmeters noted , "While we remain a beer business at our core, we are excited to create a separate new venture with a trusted partner that will be a market leader in offering Canadian consumers new experiences with quality, reliable and consistent non-alcoholic, cannabis-infused beverages."

In August of this year, Molson Coors finally unveiled its cannabis drinks in its joint venture with HEXO. The lineup includes five new beverages containing CBD and THC. CEO Scott Cooper, CEO of Truss Beverage, the product of the joint venture, noted, “We’re thrilled to be introducing Canadians to new beverage options and leading the cannabis beverage category with our variety of products,” adding, “this well-rounded portfolio is designed to bring adult Canadians products that taste great and provide the consistent experience they need to enjoy responsibly.”

Curaleaf Holdings (NASDAQ:CURLF, CSE:CURA) is an up-and-coming U.S. cannabis company with big plans for vertical integration. The multi-faceted company has its hands in all levels of the cannabis game, where it cultivates and manufactures a wide range of products (concentrates, edibles, tinctures, capsules, vaporizer cartridges, dry natural marijuana, etc.), operates dispensaries, and much more.

The Massachusetts-based company has seen significant growth since it went public in what the Motley Fool called “ the largest cannabis debut in history .” And it’s lived up to the hype. Curaleaf has had a stellar year, with its stock price bouncing from a low of $3.16 back in March to an all-time high of $10.88 at the time of writing.

And this could be just the beginning for the homegrown U.S. company. As President-Elect Joe Biden prepares to take office in January, the idea of a federal ban on marijuana could soon be history. Though nothing is set in stone just yet, investors are optimistic that a second cannabis boom could be in the making.

The Green Organic Dutchman (TSX:TGOD) is primarily a research and development company focusing on cannabinoid-based products. Most of its products are dried organic cannabis, oils and edibles, but it also is involved in breeding plants to create new strains and distributing seeds for medical applications.

Recently, the Canada-based Dutchman announced that it has been approved to export medical cannabis to Europe. Sean Bovingdon, Interim CEO of TGOD, commented, "This is an important milestone as we get ready to begin the international shipping of our certified organically grown medical cannabis products. Germany is the first of several markets that we are planning to supply. Other countries that we anticipate shipping to in the future are Australia and Mexico.”

Namaste Technologies Inc (TSX.V:N) through its subsidiaries, operates as a retailer of a variety of marijuana products, including vaporizers and other smoking accessories. The company sells its goods through e-commerce sites operating in 26 countries. In addition to its accessory business, Namaste also engages in product development and the distribution of medical cannabis products in Canada.

This month, Namaste announced that it will be taking 100% ownership of CannMart Labs. Meni Morim, Chief Executive Officer of Namaste, noted of the transaction, "Acquiring the remaining interest in CannMart Labs is another important milestone achieved in establishing Namaste as a leading company within the Canadian cannabis sector,"

The Hexo Corporation (TSX:HEXO), as previously mentioned, made major waves with its partnership with Molson Coors to develop cannabis beverages. And though the company has had a rough year, losing nearly 50 percent of its value, its ability to close deals and continue to innovate make it a prime pick for value investors looking to scoop up some undervalued assets.

In Hexo’s fourth-quarter press release, the company shared some optimistic news regarding Truss’ progress, with Sebastien St-Louis, Hexo CEO and co-founder, explaining, “We are commanding significant market share in Quebec and this year we made major strides by launching Truss cannabis infused beverages in Canada in addition to our initial foray into the U.S. with Molson Coors, a world-class partner”

By. Olu Fashola

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT . This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Lobe Sciences to conduct investor awareness advertising and marketing. Lobe paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of sixty thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Lobe) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP . The Publisher owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS . This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business including the legality of Psilocybin and other psychedelics, the ability of the company to exercise or sell its option to acquire shares of Cowlitz County Cannabis Cultivation or otherwise monetize its interest in Cowlitz, the degree of success with research and development of the company’s medicines and devices, the success of clinical trials, governmental approval or clearance of the company’s medicines and devices, the size and growth of the market for the companies’ products and services, the ability of management to execute its business plan, the continuity of management, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY . By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE . By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use . If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use , please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY . GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.