In 2021 two stocks could break out big (details and ticker symbols below).

The first is owned by the - soon to be - richest man on the planet.

And the second is just getting started.

This topsy-turvy year is finally looking - for investors - to end on a high note.

While 2020 has been a true rollercoaster ride, starting on a dizzying high before rapidly sinking into the abyss…

So, while the Covid-19 pandemic annihilated the global financial markets; wiped out three years of gains in a matter of weeks and set the record for the fastest stock market crash in history…

It’s all looking up from here, thanks to a deluge of Covid-19 vaccines.

The U.K. has become the first country in the world to approve the Pfizer-BioNTech BNT162b2 vaccine which has been shown to offer up to 95% protection against Covid-19.

The first 800,000 doses will be available in the country starting next week with another 40M doses on order.

Even better news: The U.S. could soon follow suit with an FDA approval and distribute enough of the Pfizer/BionTech vaccine to immunize 100M people - or a third of its population - by the summer...

There are at least five other promising vaccine candidates from Moderna , Johnson & Johnson , AstraZeneca , CureVac , and Sanofi - GlaxoSmithKline already in the pipeline...

...meaning the whole world is getting ready to bid goodbye to those dreaded lockdowns and go back to enjoying life to the fullest once again.

The exciting developments have helped the stock markets sputter back to life after spending months of the year in the red...

And the hottest sector of the market has truly turned on the afterburners: The Electric Vehicle (EV) Sector.

The EV sector boasts a 62% YTD gain vs. 13% by the S&P 500, having climbed 25% over the past 30 days alone.

That’s hardly surprising considering that Wall Street is unanimous that the future of the world is electric... especially for investors in the electric vehicle sector.

Tesla Inc. (NASDAQ:TSLA) is leading the way in America... handing investors 594% year to date.

And 2021 is setting up to be even better as the world comes out of lockdown...

And sales start picking up.

Elon Musk and Tesla are in the news every day, which might lead to many investors thinking they've missed out on the big profits.

But nothing could be further from the truth.

Why? Electric vehicles (EVs) currently account for only 2.5% of sales.

- Bloomberg projects EV sales to reach 28% over the next 9 years[A2].

- Deloitte projects EV sales to go even higher... hitting 32% of all sales by 2029[A3].

- The IEA projects even higher numbers... at 36%[A4].

That's 14X larger than the current market!

The tide is unstoppable because the flow of profits is unstoppable.

So, what’s the top large-and small-cap EV stock for 2021?

Let's start with the top large-cap EV stocks...

[TESLA] IS OUR TOP EV STOCK FOR 2021

Simply put, there’s a lot going for Tesla (NASDAQ:TSLA) that makes it a compelling long-term pick despite this year’s parabolic rally…

Tesla has continued to defy bearish expectations that low oil prices would put a damper on its core business of selling electric vehicles. For the fourth consecutive quarter, the EV maker posted yet another blowout that beat top-and bottom-line expectations. More importantly, it exceeded Wall Street delivery estimates and reported record profits to boot.

Tesla reported Q3 revenue of $8.77B, good for +39.2% Y/Y growth, and $460M above Wall Street consensus. Meanwhile, non-GAAP EPS of $0.76 beat by $0.16.

But more importantly, Tesla has a clear path to deliver 1M vehicles as early as 2021.

In Tesla's Q3 earnings call , New Street Research analyst Pierre Ferragu posed to Elon Musk whether the company remains on track to deliver 1M in 2021 to which Elon replied in the affirmative.

The math seems to agree with Musk's and Ferragu's optimism.

In its latest shareholder letter, Tesla revealed that its Fremont, California factory can churn out 500,000 Model 3 + Y units and another 90,000 Model S + X units per year. Meanwhile, Tesla's new Shanghai factory has ramped up capacity at an incredible clip and now has the capacity for 250,000 Model 3 vehicles annually. Adding that up brings us to Ferragu's lowball estimate of 840,000 deliveries in 2021.

But Tesla has a number of other gigafactories in the pipeline, which could significantly increase its production capacity as the quarters roll on: A Model Y factory in Austin, Texas, and a similar one in Berlin, Germany, with both under construction. Meanwhile, the company is adding a Model Y production line at its Shanghai factory.

Although Tesla has repeatedly missed deadlines in the past, the Shanghai plant was built and began vehicle assembly in just under a year. The bulls are, therefore, betting that two upcoming factories and the new Model Y plant in Shanghai will be completed before the end of the year and possibly ramp up capacity rapidly enough for Tesla to hit the magical 1M deliveries as early as 2021.

That feat will likely make Elon Musk the richest man on earth...and a lot of Tesla investors very rich as well.

The meteoric rise by TSLA stock has seen Musk leapfrog several billionaires including Bill Gates to become the second-richest man on earth with a net worth of $128B.

But there’s a very good chance that in 2021, Musk will surpass even Jeff Bezos to become the richest man in the world.

But that will be just the beginning for Musk and Tesla investors...

With the EV market set to grow 14-fold over the next decade, Tesla might be delivering more than 10M EVs by the turn of the decade...

And, while investors could make 2X to 5X their money on Tesla in 2021...

Investors could make a lot more by investing in small-cap companies that serve the vast EV ecosystem.

2021 SHOULD BE A RECORD YEAR FOR EV APPS

The top electric vehicle related industry to look at for this is software apps that have an EV connection.

Why?

The fastest way for a company to scale from zero to a million users nearly overnight is through apps.

Look no further than a device that you always have on you... your phone.

Apple, Google, and Samsung’s app stores are just a click away for billions of global users.

So, what are the top rising electric vehicle related apps?

Beyond the usual apps for finding charging stations...

There are three...

And they are all owned by the same little known tech company!

The first is "Uber for Electric Vehicles" called Facedrive Inc. ( TSXV:FD ; OTC:FDVRF )

The second is "DoorDash for Electric Vehicles" called Facedrive Foods .

The third is a car subscription service for Electric Vehicles" called Steer .

FACEDRIVE - THE UBER FOR EVs - IS GROWING

First, Facedrive Inc. ( TSXV:FD ; OTC:FDVRF ) ...

Popularly known by some as the UBER FOR ELECTRIC VEHICLES, Facedrive is the first electric ride-sharing platform.

Facedrive offers riders a choice of electric, hybrid, or gas-powered vehicles in an easy-to-use app that’s aiming at robust growth.

Simply, start the app;

- Select your pickup and drop off destinations.

- Choose your emissions profile.

- Order a car.

And away you go…

Other top features include:

- CO2 reduced rides through offset or riding electric.

- Order vehicle pick-up day or night.

- No surge pricing!

- All drivers vetted with rider safety tracking.

- Driver performance rating and commenting.

Facedrive is the cheapest rideshare app on the market today, bar none, driven by one megatrend: The sharing economy.

The sharing economy was already big business before Covid-19 reared its ugly head; it’s bound to become even bigger as economies everywhere recover quickly now that several viable Covid-19 vaccines could soon enter mainstream distribution.

Shared mobility, including services such as taxis, car sharing, and ride-hailing accounts for an estimated 5% of current passenger vehicle miles.

BloombergNEF sees that rising exponentially with shared mobility services projected to account for 19% of the total annual mileage completed by passenger vehicles in 2040.

The economics of EVs are considerably more favorable in a sharing economy, thanks to lower fuel and maintenance costs. EVs currently account for 1.8% of the shared mobility fleet but could climb to 80% by 2040 as per Bloomberg.

The Ridesharing Market was valued at $73 billion in 2019 and is expected to reach $218 billion by 2025 , good for a compound annual growth rate (CAGR) of nearly 20% over the forecast period.

The increase in demand for cost-saving and time-saving transport is expected to continue driving the market.

Meanwhile, the increasing cost of vehicle ownership, the need for reducing traffic for environmental concern, and government regulations promoting ridesharing options are some of the major factors driving the adoption of ridesharing services across the globe.

Source: MarketsandMarkets

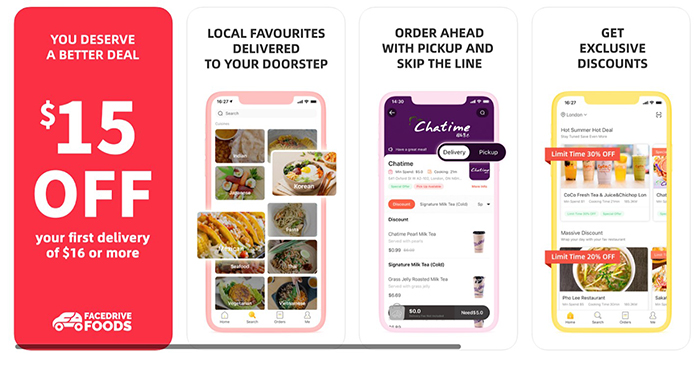

FACEDRIVE FOODS - THE DOORDASH FOR EVs - IS GROWING

Second, Facedrive Foods...

Facedrive Foods is essentially the DoorDash for EVs, hybrids and conventional cars that allows people to easily make money using their EVs.

Facedrive Foods, an initiative by Facedrive Inc . ( TSXV:FD ; OTC:FDVRF ) , is Canada’s first and only eco-friendly food delivery service. It helps connect people with their favorite restaurants and stores around the town and provide them great green deals.

Facedrive Foods is proud to have acquired Food Hwy Canada Inc. to make this green food delivery experience as easy as 1, 2, 3!

Customers can choose from a variety of restaurants and stores nearby and get the food delivered right to their doorstep via contactless delivery ensuring safety at all times.

Food delivery is big business... and still expanding at a fast clip.

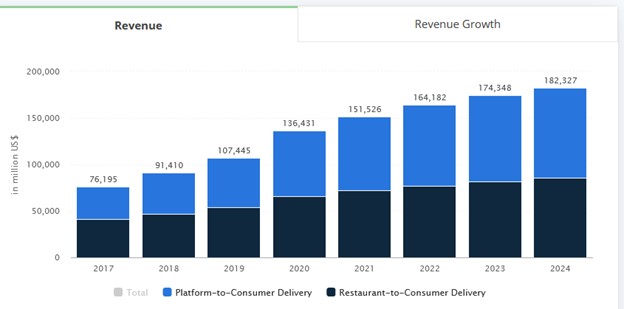

The global online food delivery services market is valued at $136 billion in 2020 but is expected to expand at 11.5% CAGR to reach $182 billion in 2024.

Facedrive recently released usage numbers from their food delivery service, proving there is a huge appetite from consumers who are conscious about where they are spending their money. The next chart shows overall online worldwide food delivery spends and projections to 2024.

Source: Statista

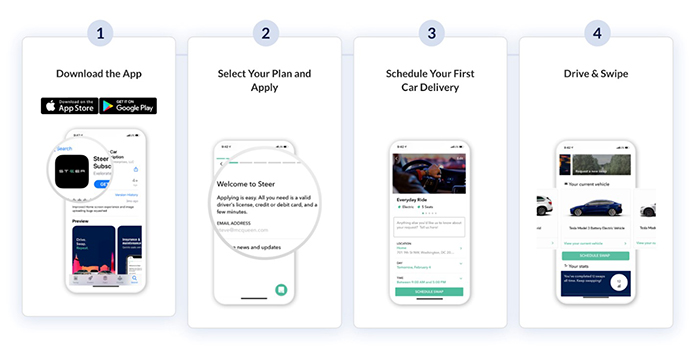

STEER - THE AIRBNB FOR EVS - IS GROWING

Third, Steer… christened the AIRBNB FOR ELECTRIC VEHICLES.

To take it one step further, this bustling ride-sharing company has set out to challenge the entire conventional private car ownership industry with the acquisition of Steer , a high tech Electric Vehicle subscription service.

Steer is a monthly vehicle subscription service that specializes in electric vehicles. Steer is a hassle-free, technology-driven, electric alternative to owning, leasing, or renting EVs. The subscriber simply pays one transparent, monthly fee that includes:

- Access to your own virtual multi-car garage of awesome vehicles for every occasion

- Insurance, maintenance, and repairs

- Unlimited miles

- A personal concierge for hassle-free delivery

- Charging solutions for in and out of your home

A Steer subscription gives the user the freedom and flexibility of driving many different cars for all their lifestyle needs. You still get the personal ownership experience: driving the car every day and parking it at your home, but none of the wasted time at dealerships and maintenance shops. Steers provides the whole package without the headache.

With the Steer acquisition, Facedrive isn't just looking to transform the ride-sharing business, it's aiming to disrupt the entire private car ownership industry, completely rethinking the way we "own" cars.

Its innovative hassle-free technology gives subscribers access to their own 'virtual garage' of low emissions vehicles.

And now as more and more people opt for ride-sharing and subscription-based alternatives over car ownership, this tech-based economy could explode, putting Facedrive right at the forefront of a brand-new megatrend.

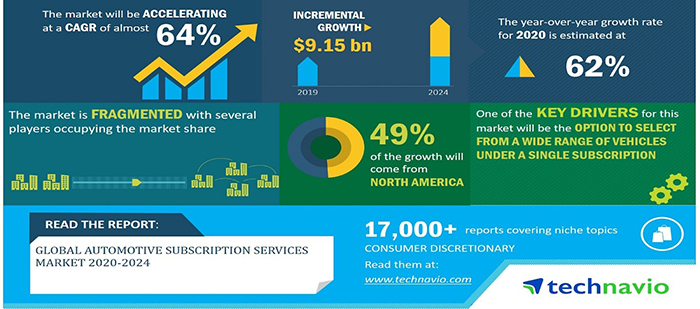

The global automotive subscription services market is expected to grow at a sizzling 64% CAGR with the market expanding by nearly $10 billion during 2020-2024, according to the latest market research report by Technavio.

The increasing adoption of smartphones and the internet have helped consumers to book cars online through a mobile app. Also, automotive subscription services offered through mobile apps ensure both convenience and cost-effectiveness. This is because mobile apps allow consumers to access a wide range of car models and compare them based on the requirement under a single platform.

These factors coupled with the increasing awareness among consumers are expected to boost the growth of the global automotive subscription services market over the next decade and beyond.

Source: Business Wire

THIS INCREDIBLE EV GROWTH WILL MINT MILLIONS IN NEW WEALTH

Source: Yahoo Finance

The EV sector is set to grow 14X over the next decade...

Tesla and the EV sector, in general, have been on a tear, with TSLA stock boasting a 16,600% gain since IPO… and a 615% gain in the year-to-date and looking to add another 2x-5x gain over the next couple of years.

Facedrive ( TSXV:FD ; OTC:FDVRF ) , in part related to the EV industry, has seen its share price explode by 515% just this year.

Thanks to the company’s multiple growth runways: EV rideshare, Food Delivery, and EV Subscription Service there should still be room for growth ahead.

EV and related industries is an incredible growth story that could mint many new millionaires, with Elon Musk himself set to become the richest man in 2021.

If you missed out on those Tesla profits, we think Facedrive offers an asymmetrical risk/reward opportunity with limited downside but major potential upside to multiply your investment by riding the ESG megatrend.

BONUS: 10 OTHER EV STOCKS SET TO WIN BIG IN 2021

Electra Meccanica Vehicles Corp (NASDAQ:SOLO) is electric vehicle stock that has turned a lot of heads this year, both on the street and on Wall Street. The Canadian company’s single-seat electric vehicle carries a lower, and more appealing price point for consumers that do not need all the bells and whistles that come with luxury brands like Tesla. It’s also on the cusp of an emerging market. In fact, demand for single-seat electric vehicles are projected to grow significantly in the coming years, and SOLO is one of the few companies in this market, representing a great opportunity for investors looking for an easy-entry EV stock with a lot of potential upside.

Electric Meccanica isn’t only interested in the niche tiny EVs, however. It’s also planning to roll out an electric sports car for two, the Tofino, and another electric two-seater boasting an old-school design that will appeal to a wide range of consumers. Given that the stock is only trading at $6.82 at the moment, there is a lot of room to grow, though not without potential risks.

Fisker (NYSE:FSR) is another newcomer in the electric vehicle scene. And it’s a speculative one, at that considering that It won’t start producing its EV SUVs until 2023. But again, it’s a story stock that looks a lot like Tesla did in the early days.

Citigroup analyst Italy Michaeli just picked up coverage of Fisker, with a “Buy” rating and a price target of $26. Michaeli gets the narrative here, reminding investors that “as a pre-revenue company, Fisker is clearly a higher-risk investment proposition”, but there’s a big reason to be bullish. Fisker has four long-term advantages here: It’s making an SUV, which Michaeli says is a good segment to target. It’s got a strong brand. It’s got a legacy behind the wheel: Henrik Fisker is Fisker’s founder and he’s a legend in automotive design. And it’s a massive saver of capital because it has an innovative “asset light” approach, getting Magna International to assemble its first vehicle. It’s already got 9,000 advance orders … prepaid.

NIO Limited ( NYSE:NIO) used to be an outlier in the market. In fact, much of Wall Street was to write off their losses and give up on the company. It was even on the brink of bankruptcy But China’s answer to Tesla’s dominance powered on, eclipsed estimates, and most importantly, kept its balance sheet in line. And it’s paid off. In a big way. The company has seen its share price soar from $3.24 at the start of 2020 to a high of $50 earlier this month, representing a massive 1443% returns for investors who held strong.

In November, NIO unveiled a pair of vehicles that would make even the biggest Tesla devotees truly contemplate their brand loyalty. The vehicles, meant to compete with Tesla’s Model 3, could be exactly what the company needs to take control of its domestic market.

By NIO’s fourth quarter report in October, the company announced that its sales had more-than doubled, projecting even greater sales in 2021. The EV up-and-comer has shocked investors and pulled itself back after its rumored potential bankruptcy in 2019, and if this year shows investors anything, it’s that its CEO William Li is as skilled and ambitious as anyone in the business.

XPeng Motors (NYSE:XPEV) is a newcomer in the Chinese electric vehicle boom. Though it only recently went public in the U.S., it’s taken the market by storm. Riding on the coattails of the success of Tesla and NIO, it has carved out its own demand, especially among the younger generation of traders looking for the next big company to blow. Since its NYSE debut in August, the ambitious electric vehicle company has risen by more than 157% thanks to its promising financials and growing demand for its stylish vehicles.

And retail investors aren’t the only ones showing interest in this EV newcomer. Xpeng has also garnered a ton of interest from Big Money. Earlier in 2020 the company raised over half a billion dollars from giants like Aspex, Coatue, Hillhouse Capital and Sequoia Capital China. Recently, Xpeng has even secured another $400 million from heavy hitters such as Alibaba, Qatar Investment Authority and Abu Dhabi’s sovereign wealth fund Mubadala.

As the demand for electric vehicles continues to grow, newcomers like Xpeng provide an excellent opportunity for investors to jump on this undeniable trend even if the missed out on Tesla’s meteoric rise to glory.

Magna International ( TSX:MG ) is a great way to gain exposure to the EV market without betting big on one of the new hot automaker stocks tearing up Robinhood right now. The 63 year old Canadian manufacturing giant provides mobility technology for automakers of all types. From GM and Ford to luxury brands like BMW and Tesla, Magna is a master at striking deals. And it’s clear to see why. The company has the experience and reputation that automakers are looking for.

Another way to gain exposure to the electric vehicle industry is through AutoCanada ( TSX:ACQ ), a company that operates auto-dealerships through Canada. The company carries a wide variety of new and used vehicles and has all types of financial options available to fit the needs of any consumer. While sales have slumped this year due to the COVID-19 pandemic, AutoCanada will likely see a rebound as both buying power and the demand for electric vehicles increases. As more new exciting EVs hit the market, AutoCanada will surely be able to ride the wave.

Like Magna , Westport Fuel Systems ( TSX:WPRT ) is another hardware and tech provider in the auto-industry. It builds products to help the transportation industry reduce their carbon footprint. In particular, it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

GreenPower Motor ( TSX.V:GPV ) is a thriving electric bus manufacturer based out of Vancouver. At the moment, its focus is primarily on the North American market, but its ambitions are much larger. Founded over 10 years ago, GreenPower has been on the frontlines of the electric transportation movement, with a focus on building affordable battery-electric busses and trucks. This year alone, GreenPower Motor has seen its share price soar from $2.03 to $36.88 before correcting to the $23 range it is currently sitting in.

NFI Group ( TSX:NFI ) is another one of Canada’s home-grown electric vehicle pioneers producing transit busses and motorcycles. The company had a tough go at it towards the beginning of the year, but has since cut its debt and begun to address its cash flow struggles in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

In the previous months, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

By. Richard Peterson

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services and food delivery services will continue to grow rapidly; that Steer can help completely change the way people view car ownership, that Steer can disrupt industry segments; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that food delivery services don’t meet projections; that competitors may offer better or cheaper alternatives to the Facedrive businesses; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract drivers who have electric vehicles and hybrid cars; and the company’s ability to carry out its business plans. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.