By now, you probably already know that electric vehicles were one of the hottest markets, if not the single hottest market in 2020.

You might also already know that Tesla soared 592%, and that its Chinese counterparts NIO, Xpeng, and Li Automobile soared 1411%, 105%, and 106% respectively.

But what you may not yet know is that there’s another opportunity emerging in EV markets.

Some of the biggest opportunities in the exploding EV space aren’t to be found only in stocks of EV makers, instead, they could be made in companies that are setting up the entire ecosystem that supports the entire industry.

Electric vehicles have slowly become more popular during the last decade, but so far, it’s always been a bit of a chicken and the egg story. After all, who wants to buy a swanky electric vehicle if there are no charging points, no dealer network, no fleet services, and no financing options?

Behind the scenes, venture capitalists, ESG investment funds, and private equity investors have kickstarted a trend to revolutionize electric transportation not for the happy few, but for the masses.

Morgan Stanley’s Adam Jonas recently noted that the real money in the EV business isn’t made in the production of electric cars, instead, it’s all about tech, software, and services.

Commenting on Tesla’s latest price explosion, Jonas notes that, "Tesla is on the verge of a profound model shift from selling cars to generating high margin, recurring software, and services revenue … To only value Tesla on car sales alone ignores the multiple businesses embedded within the company”

But Tesla isn’t the only company trying to break into this huge new tech and services market, other companies such as Canadian tech unicorn Facedrive ( TSX:FD.V ; OTCMKTS:FDVRF ) are jumping into the gap, offering smart solutions to bring electric vehicles to the masses.

Facedrive, which started out as a ride-hailing company in the booming Canadian market has recently acquired D.C. based Steer from America’s energy giant Exelon (NASDAQ:EXC), in a deal that included a $2-million strategic investment by energy giant Exelon’s wholly-owned subsidiary, Exelorate Enterprises, LLC.

Steer intends to revolutionize transportation by letting people get into EVs without breaking the bank, possibly upending conventional car ownership in the process.

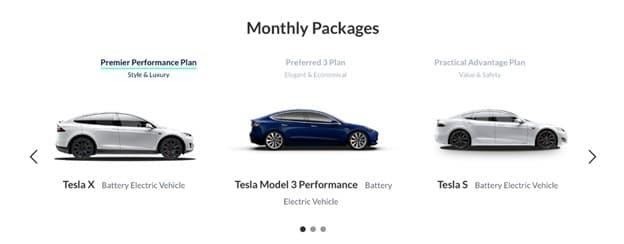

With this strategic move, Facedrive ( TSX:FD.V ; OTCMKTS:FDVRF ) became one of the first players in the world to offer a three-tier subscription service in which users can choose from a list of up to 17 electric and hybrid vehicles.

Signing up is easy, and upfront costs are kept low, giving new customers a chance to drive a number of different vehicles without having to commit to one car, and unlike with lease contracts or rental contracts, Steer doesn’t have a mileage limit.

Better yet, Steer’s subscription business has already proven that it lowers the bar for new EV drivers.

70% of Steer’s subscriber base are people that have never driven an EV before, and anyone who couldn’t afford to ride an EV before, can now.

Next to Facedrive , Chinese carmaker NIO (NYSE:NIO) is vying for a part of the EV services market, introducing a completely new concept : Battery as a Service. With this concept, NIO is looking to gain an edge over rivals such as Tesla by lowering the upfront purchase cost of its vehicles.

With the battery-as-a-service model, customers can buy just the vehicle shell outright, while agreeing to pay rental fees for the battery. NIO’s new venture handles the leasing, maintenance, charging, and upgrades of batteries for its customers, effectively taking away doubts about battery life, vehicle reliability, and resale value of the car. Customers can also opt to replace the battery with a newer, improved one in the same car shell as energy storage technology advances rapidly.

NIO’s BaaS concept could lower the base price of the new vehicle by more than $10,000, and could significantly expand its pool of customers in both China and abroad.

As the EV boom continues to gain traction, research shows that many car buyers remain hesitant to fork out $50,000+ on a new electric vehicle, citing doubts about battery life, limited range, and resale value of the vehicle.

The few smart companies out there that could solve these issues will be the undoubted winners of the EV boom.

The Giants Of The Industry Are Paving The Way

Tesla (NASDAQ:TSLA) is far and beyond the most popular and successful company in the EV boom. And it’s easy to see why. Armed with slick cars, game-changing technology and an out of this world CEO, Tesla has a lot going for it.

Tesla is now the most valuable car maker “of all time”. It is now worth almost $616 billion while the top three American automakers--GM, Ford and Chrysler--are only worth a fraction of that. Combined.

Billionaire – and mad scientist - Elon Musk had his eye on prize long before the hype started building. In fact, he released the first Tesla Roadster back in 2008, making electric vehicles cool when people were shunning at first-gen electric vehicles. Since then, Tesla’s stock has skyrocketed by over 14,000%. And it’s not just about cars, either. Musk is looking towards a much bigger picture, building the foundation for an electrified future on all fronts.

Clearly, its efforts are paying off, as it is without-a-doubt one of the most popular stocks on Wall Street. Even better for Musk, and shareholders, Tesla was just bumped up to the S&P 500. But while Tesla’s EV threat to the industry is clear, the competition is heating up in China.

XPeng Motors (NYSE:XPEV) is a newcomer in the Chinese electric vehicle boom. Though it only recently went public in the U.S., it’s taken the market by storm. Riding on the coattails of the success of Tesla and NIO, it has carved out its own demand, especially among the younger generation of traders looking for the next big company to blow.

Since its NYSE debut in August, the ambitious electric vehicle company has risen by more than 107% thanks to its promising financials and growing demand for its stylish vehicles.

In addition to retail interest, Xpeng has also received a ton of interest from Big Money. Earlier this year the company raised over $500 million from the likes of Aspex, Coatue, Hillhouse Capital and Sequoia Capital China, and even more recently, secured another $400 million from heavy hitters such as Alibaba, Qatar Investment Authority and Abu Dhabi’s sovereign wealth fund Mubadala.

As the demand for electric vehicles continues to grow, newcomers like Xpeng provide an excellent opportunity for investors to jump on this undeniable trend even if the missed out on Tesla’s meteoric rise to glory.

Li Automotive (NASDAQ:LI) is the newest hot stock in the electric vehicle boom. It was founded in 2015 by its namesake, Chairman and CEO Li Xiang. And while it may not be a veteran in the market like Tesla or even NIO, it’s quickly making waves on Wall Street.

Backed by Chinese giants Meituan and Bytedance, Li has taken a different approach to the electric vehicle market. Instead of opting for pure-electric cars, it is giving consumers a choice with its stylish crossover hybrid SUV. This popular vehicle can be powered with gasoline or electricity, taking the edge off drivers who may not have a charging station or a gas station nearby.

Though it just hit the NASDAQ in July, the company has already seen its stock price more than double. Especially in the past month during the massive EV runup that netted investors triple digit returns. It’s already worth more than $30 billion but it’s just getting started. With estimates suggesting that there could be as many as 125 million electric vehicles on the road in the next ten years, and a growing call to ban gasoline powered cars, companies like Li are sure to grow exponentially.

Electra Meccanica Vehicles Corp (NASDAQ:SOLO) is another electric vehicle stock that has turned heads this year. The Canadian company’s single-seat electric vehicle carries a lower, and more appealing price point for consumers that do not need all the bells and whistles that come with luxury brands like Tesla.

It’s also on the cusp of an emerging market. In fact, demand for single-seat electric vehicles are projected to grow significantly in the coming years, and SOLO is one of the few companies in this market, representing a great opportunity for investors looking for an easy-entry EV stock with a lot of potential upside.

Electric Meccanica isn’t only interested in the niche tiny EVs, however. It’s also planning to roll out an electric sports car for two, the Tofino, and another electric two-seater boasting an old-school design that will appeal to a wide range of consumers. Given that the stock is only trading at $7.40 at the moment, there is a lot of room to grow, though not without potential risks.

Compared to Tesla or NIO, Fisker ( NYSE:FSR) is a relative newcomer to the scene, having only IPO’d in October. While it hasn’t seen quite the attention other electric vehicle stocks have seen in recent weeks, it is an important company to watch. It’s unique in the industry because it boasts the most sustainable vehicle on the road: It’s not just electric… it’s also is made with some recycled materials. That’s a huge plus considering how much investors are focusing on sustainability these days.

Though Fisker has underperformed on the market compared to NIO, Tesla, Xpeng or Li, it’s still trading on massive volume and in just one month, has already climbed by more than 50% since its IPO. Clearly, investors are still waiting to see how the company will hold up, especially following the Nikola disaster.

But that doesn’t mean the company isn’t going places. The four-year old California based EV provider is already turning heads thanks to its innovative battery tech, and it’s already securing some major deals. In fact, just last month, Fisker signed a deal with Viggo, a European ride-hailing service to add hundreds of vehicles to its fleet.

Fisker’s efforts are paying off, as well. Since its IPO at $9 per share, Fisker has already jumped by 76%, with analysts suggesting it has plenty of room to run still.

GreenPower Motor ( TSX.V:GPV ) is a bustling electric bus manufacturer based in Canada. For the time being, its focus is primarily on the Canadian and U.S. markets, but its ambitions are much larger. Founded over 10 years ago, GreenPower has been on the frontlines of the electric transportation movement, with a focus on building affordable battery-electric busses and trucks. This year alone, GreenPower Motor has seen its share price soar from $2.03 to a high of $36.88 before correcting to the $26 range it occupies at the moment.

NFI Group ( TSX:NFI ) is another ambitious young Canadian electric automaker. The company struggled a bit at the start of 2020, but has since cut its debt and begun to address its cash flow difficulties in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

In the previous months, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

The EV Boom Isn’t Only About Cars

Magna International ( TSX:MG ) is a fantastic way to get in on the explosive EV market without betting big on one of the new hot stocks tearing up among the millennials right now. The 63-year-old Canadian manufacturing giant provides mobility technology for automakers of all types. From GM and Ford to luxury brands like BMW and Tesla, Magna is a master at striking deals. And it’s clear to see why. The company has the experience and reputation that automakers are looking for.

Another way to get some indirect exposure to the booming EV industry is through AutoCanada ( TSX:ACQ ), a company that operates auto-dealerships through Canada. The company carries a wide variety of new and used vehicles and has all types of financial options available to fit the needs of any consumer. While sales have slumped this year due to the COVID-19 pandemic, AutoCanada will likely see a rebound as both buying power and the demand for electric vehicles increases. As more new exciting EVs hit the market, AutoCanada will surely be able to ride the wave.

Like Magna , Westport Fuel Systems (TSX:WPRT) is another hardware and tech provider in the auto-industry.It builds products to help the transportation industry reduce their carbon footprint. In particular, it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow.

By Tom Kool for Oilprice.com

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

Forward looking statements in this publication include that Facedrive will be able to expand to the US and Europe; that transport in and Steer’s rental program of EVs will become much more popular and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that competitors may offer better or cheaper alternatives to the Facedrive businesses; Facedrive’s ability to obtain and retain necessary licensing in each geographical area in which it operates; and whether markets justify additional expansion. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company and the writer are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.