VANCOUVER, BC / ACCESSWIRE / January 11, 2021 / Banyan Gold Corp. (the "Company" or "Banyan") (TSXV:BYN) is pleased to announce, diamond drill assay results from the next eight (8) diamond drillholes received from the 2020 exploration program at Powerline and Aurex Hill, AurMac Property, Yukon.

Highlights from these new analytical drill results include:

- 0.69 g/t Au over 38.3 metres from 65.1 metres in AX-20-46

- 1.09 g/t Au over 40.0 metres from 52.5 metres in AX-20-47

- 0.91 g/t Au over 20.5 metres from 7.0 metres in AX-20-54

"These results, along with our previous and historical results demonstrate that the AurMac mineralized system extends over 2.5 km including Powerline and Aurex Hill." stated Tara Christie, President and CEO. "Our team is now positioned to target interpreted higher grade areas within this rapidly developing portion of the Property - yet another target to allow Banyan to build additional near surface resources and confirm our belief in the multi-million ounce potential of the AurMac property."

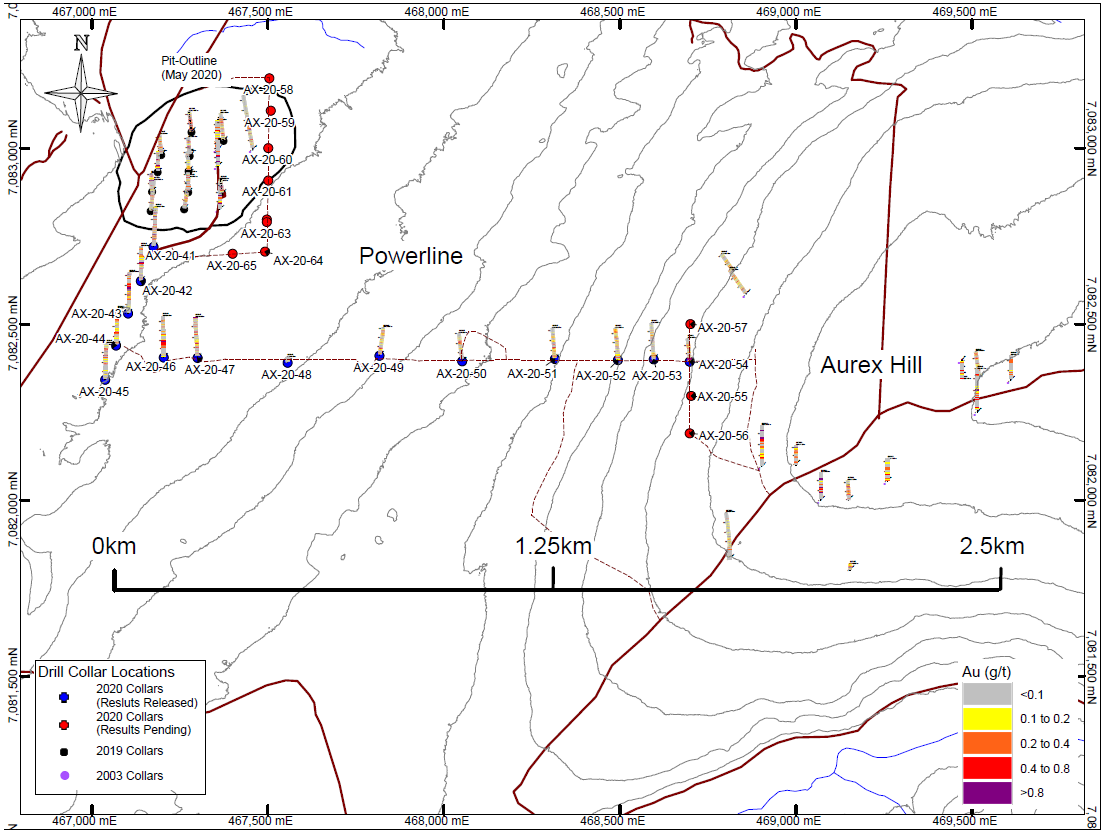

Figure 1: Plan map showing 2020 Drill holes and 2.5km of mineralization between the Powerline Zone and Aurex Hill. Holes AX-20-46 to 54 were drilled along the route of the access trail.

Powerline Zone

The Powerline deposit lies approximately one kilometre south of the Airstrip Deposit of the AurMac Property and shares all the infrastructure of Airstrip. Importantly, Powerline is open to expansion in all directions and represents another near surface bulk tonnage minable target at AurMac. At a 0.20 g/t Au cut-off, the pit-constrained, inferred mineral resources are 6.6 million tonnes at an average gold grade of 0.61 g/t for a total of 129,019 ounces of gold. (See Table 2).

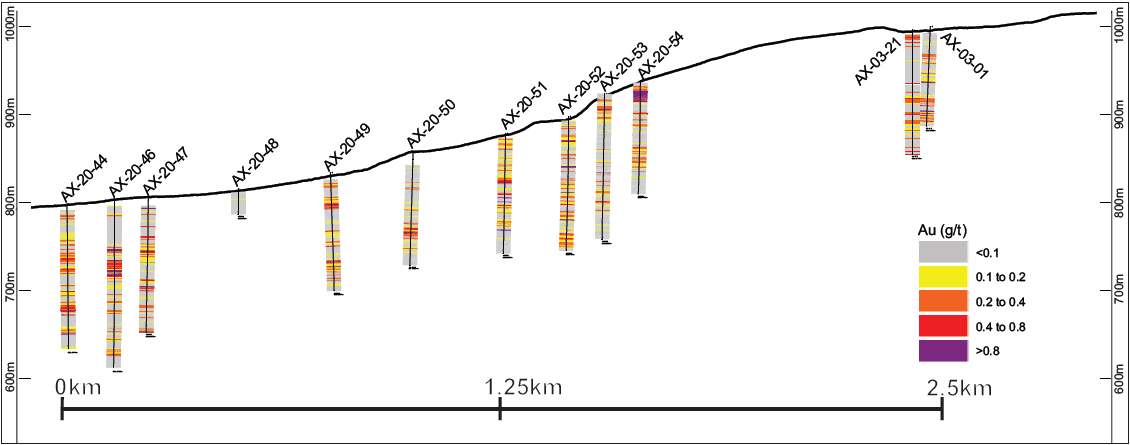

Phase 1 2020 drilling at Powerline includes drill holes AX-20-41 through to AX-20-51, with highlighted results from holes AX-20-46 through to AX-20-51 in table 1 below and shown on Figures 1 and 2. These holes were drilled along the access trail constructed into the Aurex Hill Zone. Results for this phase of drilling demonstrated that gold mineralization at the Powerline is part of a much larger gold system than captured in the 2020 Powerline Deposit Resource Model. As the 2020 drilling progressed South and East from the Powerline Deposit there was a transition from stratigraphically controlled gold mineralization to structurally controlled gold mineralization with discordant sheeted quartz-arsenopyrite veins interpreted to host the bulk of the gold mineralization intercepted in these holes.

Figure 2: Long Section showing Mineralization at from AX-20-44 to AX-20-54 drilled by Banyan Gold and 2003 holes AX-03-21 and AX-03-01 drilled by Strata Gold Corp in 2003.

Aurex Hill

Drilling at Aurex Hill includes drill holes AX-20-52 through to AX-20-57 and was designed to test a previously undrilled, strong Au-in-soil anomaly of approximately 1,000 m by 400 m, located just North of the historic Aurex Hill drilling (Figures 1 and 2). This first ever drilling of this area identified an on/near surface zone of pervasive oxidation to depths of ~40 m coincident with extensive discordant sheeted quart-arsenopyrite veins. As these veins and oxidized zone correspond with the coincident Au-in-soil anomaly, it has opened up a large target area for exploration under the 10 km2 of anomalous Au-in soils (Figure 3) to be prospective for on-surface, bulk-tonnage gold mineralization.

Figure 3: Plan map showing Au in-soils anomalies associated with Airstrip and Aurex Hill zones (10 km2). Location of drill holes with significant intercepts over 1 gram is show.

Table 1: 2020 Highlighted Diamond Drill Analytical Results

|

Hole ID

|

From

(m)

|

To

(m)

|

Interval*

(m)

|

Au

(g/t)

|

|

AX-20-46

|

65.1

|

103.4

|

38.3

|

0.69

|

|

including

|

65.1

|

68.0

|

2.9

|

1.57

|

|

including

|

79.5

|

81.1

|

1.6

|

1.32

|

|

including

|

92.7

|

94.1

|

1.4

|

2.02

|

|

including

|

95.6

|

96.9

|

1.3

|

3.95

|

|

including

|

98.9

|

100.4

|

1.5

|

1.68

|

|

|

AX-20-47

|

14.0

|

15.5

|

1.5

|

1.03

|

|

and

|

52.5

|

92.5

|

40.0

|

1.09

|

|

including

|

73.0

|

74.5

|

1.5

|

1.88

|

|

including

|

89.5

|

89.9

|

0.4

|

92.3

|

|

and

|

115.0

|

131.5

|

16.5

|

0.38

|

|

including

|

124.0

|

125.5

|

1.5

|

1.75

|

|

and

|

186.5

|

192.0

|

5.5

|

0.62

|

|

including

|

191.0

|

192.0

|

1.0

|

2.27

|

|

|

AX-20-49

|

13.7

|

19.8

|

6.1

|

0.26

|

|

and

|

32.0

|

48.5

|

16.5

|

0.35

|

|

and

|

76.2

|

142.1

|

65.9

|

0.23

|

|

including

|

124.1

|

125.3

|

1.2

|

2.50

|

|

|

AX-20-50

|

93.9

|

116.5

|

22.6

|

0.39

|

|

including

|

95.5

|

96.0

|

0.5

|

1.77

|

|

|

AX-20-51

|

20.5

|

22.0

|

1.5

|

0.63

|

|

and

|

61.3

|

67.5

|

6.2

|

0.55

|

|

and

|

76.0

|

97.0

|

21.0

|

0.42

|

|

including

|

76.0

|

76.2

|

0.2

|

4.96

|

|

including

|

85.0

|

86.5

|

1.5

|

2.65

|

|

including

|

91.0

|

92.0

|

1.0

|

1.15

|

|

and

|

118.0

|

131.0

|

13.0

|

0.29

|

|

|

AX-20-52

|

24.0

|

33.5

|

9.5

|

0.38

|

|

and

|

65.5

|

67.0

|

1.5

|

1.21

|

|

and

|

80.8

|

116.5

|

35.7

|

0.20

|

|

including

|

99.5

|

100.5

|

1.0

|

1.23

|

|

and

|

123.4

|

137.0

|

13.6

|

0.35

|

|

including

|

123.4

|

123.6

|

0.2

|

4.82

|

|

including

|

135.5

|

137.0

|

1.5

|

1.01

|

|

and

|

154.5

|

175.0

|

20.5

|

0.29

|

|

|

AX-20-53

|

17.5

|

34.0

|

16.5

|

0.27

|

|

and

|

105.0

|

106.0

|

1.0

|

1.65

|

|

and

|

115.0

|

115.2

|

0.2

|

2.18

|

|

|

AX-20-54

|

7.0

|

27.5

|

20.5

|

0.91

|

|

including

|

14.0

|

21.3

|

7.3

|

1.35

|

|

including

|

24.0

|

25.0

|

1.0

|

1.65

|

|

including

|

25.9

|

27.5

|

1.6

|

1.37

|

|

and

|

56.1

|

58.6

|

2.5

|

0.43

|

|

and

|

83.4

|

116.5

|

33.1

|

0.32

|

|

including

|

83.4

|

83.8

|

0.4

|

5.94

|

|

including

|

116.2

|

116.5

|

0.3

|

4.75

|

*True widths are estimated to be greater than 90% of the reported intervals.

NB. Drill hole AX-20-48 was abandoned due to technical drilling issues.

Summary of high grade intervals include:

- 3.95 g/t Au over 1.3 metres in AX-20-46

- 92.3 g/t Au over 0.4 metres in AX-20-47

- 4.96 g/t Au over 0.2 metres in AX-20-51

- 5.94 g/t Au over 0.4 metres in AX-20-54

- 4.75 g/t Au over 0.3 metres in AX-20-54

Analytical Method

All drill core splits collected from the 2020 AurMac program were analyzed at Bureau Veritas Minerals of Vancouver, B.C. utilizing the aqua regia digestion ICP-MS 36-element AQ200 analytical package with FA450 50-gram Fire Assay with AAS finish for gold on all samples. All core samples were split on-site at Banyan's core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas' Analytical laboratory in Vancouver, B.C. for pulverization and final chemical analysis. A robust system of standards, ¼ core duplicates and blanks was implemented in the 2020 exploration drilling program and was monitored as chemical assay data became available.

Upcoming Catalysts

January 13, 2021 - Vancouver Resource Investment Conference

January 21, 2021 - AME Roundup 2021 - Virtual Presentation

Q1 2020 - Drill results from 2020 program

Q1 2020 - Resume drilling at AurMac Property

Qualified Person

Paul D. Gray, P.Geo., Vice President of Exploration for the Company, is a "qualified person" as defined under NI 43-101 and has reviewed and approved the content of this news release.

COVID-19 Update

Banyan has taken proactive measures to protect the health and safety of our employees and communities from COVID 19 and exploration activities in 2021 will have additional safety measures in place, following and exceeding all the recommendations made by the Yukon's Chief Medical Officer.

About Banyan

Banyan's primary asset AurMac is adjacent to Victoria Gold's new Eagle Gold Mine, in Canada's Yukon Territory, which announced commercial production on July 1, 2020. The AurMac initial resource of 903,945 oz Au (see Table 2 below) was announced in May 2020. Our major strategic shareholders include Osisko Gold Royalties, Sprott Funds, Alexco Resource Corp, and Victoria Gold Corporation. Banyan is focused on gold exploration projects that have the geological potential, size of land package and proximity to infrastructure that is advantageous for a mineral project to have potential to become a mine. Our Yukon based projects both fit this model and our objective is to gain shareholder value by advancing projects in our pipeline.

The 173 sq km AurMac Property lies 30 km from Victoria Gold's Eagle Project and adjacent to Alexco 's Keno Hill Silver District and is highly prospective for structurally controlled, intrusion related gold-silver mineralization. The property is located adjacent to the main Yukon highway and just off the main access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Property benefits from a 3-phase powerline, existing Yukon Energy Corp. switching power station and cell phone coverage. Banyan has optioned the properties from Victoria Gold and Alexco respectively with a right to earn up to a 100% subject to royalties.

The 2020 Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 ("NI 43-101") guidelines for the AurMac Property is 903,945 ounces of gold. It is a near surface, road accessible pit constrained Mineral Resource contained in two near/on-surface deposits: The Airstrip and Powerline deposits. The Mineral Resource is summarized in Table 2 below.

Table 2: Pit-Constrained Inferred Mineral Resources at a 0.2 g/t Au Cut-Off - AurMac Property

|

Deposit

|

Classification

|

Tonnage

Tonnes

|

Average Au Grade

g/t

|

Au Content

oz

|

|

Airstrip

|

Inferred

|

45,997,911

|

0.524

|

774,926

|

|

Powerline

|

Inferred

|

6,578,609

|

0.610

|

129,019

|

|

Total Combined

|

Inferred

|

52,576,520

|

0.535

|

903,945

|

Notes:

- The effective date for the Mineral Resource is May 25, 2020.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing,changes in global gold markets or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,500/ounce, US$1.50/t mining cost, US$2.00/t processing cost, US$2.50/t G+A, 80% heap leach recoveries, and 45° pit slop.

- Mineral Resource Estimate prepared in accordance with 43-101 guidelines by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc, with technical report filed July 7,2020.

The Hyland Gold Project, located 70 km NE of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt is a sediment hosted, structurally controlled, intrusion related gold deposit, with a large land package (over 125 sq km), with the resource contained in the Main Zone area (900 m x 600 m) daylighting at surface and numerous other known surface gold targets. The Main Zone oxide zone is amenable to heap leach open pit mining, with column leach recoveries of 86%. The project has an existing gravel access road.

Table 3 shows the Hyland Main Zone Indicated Gold Resource Estimate, prepared in accordance with NI 43-101, at a 0.3 g/t gold equivalent cutoff, contains 8.6 million tonnes grading 0.85 g/t AuEq for 236,000 AuEqounces with an Inferred Mineral Resource of 10.8 million tonnes grading 0.83 g/t AuEq for 288,000 AuEq ounces. NI 43-101 prepared by Robert Carne, Allan Armitage and Paul Gray on May 1, 2018.

Table 3: Hyland Main Zone Indicated Gold Resource Estimate

|

Cut-off Grade

(AuEq g/t)

|

In situ Tonnes

|

Au

|

Ag

|

AuEq

|

|

Grade (g/t)

|

Ozs

|

Grade (g/t)

|

Ozs

|

Grade (g/t)

|

Ozs

|

|

Indicated

|

|

0.3

|

8,637,000

|

0.78

|

216,000

|

7.04

|

1,954,000

|

0.85

|

236,000

|

|

Inferred

|

|

0.3

|

10,784,000

|

0.77

|

266,000

|

5.32

|

1,845,000

|

0.83

|

288,000

|

Notes:

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate.

- Mineral resources are reported at a cut-off grade of 0.3 g/t AuEq. AuEq grade is based on $1,350.00/oz Au, $17.00/oz Ag and assumes a 100% recovery. The AuEq calculation does not apply any adjustment factors for difference in metallurgical recoveries of gold and silver. This information can only be derived from definitive metallurgical testing which has yet to be completed.

Banyan trades on the TSX-Venture Exchange under the symbol "BYN". For more information, please visit the corporate website at www.BanyanGold.com or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie

Tel: (888) 629-0444

Email: tchristie@banyangold.com

David Rutt

Tel: (888) 629-0444

Email: drutt@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release contains forward-looking information, which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, Banyan's objectives, goals or future plans, statements regarding exploration expectations, exploration or development plans and mineral resource estimates. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, uncertainties inherent in resource estimates , capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan's public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Statements in this news release regarding Banyan which are not historical facts are "forward-looking statements" that involve risks and uncertainties. Such information can generally be identified by the use of forwarding-looking wording such as "may", "will", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations.

SOURCE: Banyan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/623741/Banyan-Drills-109-GT-Gold-Over-40-Metres-and-Links-Powerline-and-Aurex-Hill-Zones-Aurmac-Property-Yukon