There ’ s a breaking energy story that could potentially be a repeat of Texas ’ multi billion dollar Midland Basin…

A basin that has been producing since the 1930s and won ’ t reach peak production until 2035 at a phenomenal 3.8 million boe/d …

The most trusted name in natural resource assessments—Wood Mackenzie-- says this new discovery is analogous not just to the giant Midland, with a development value of $540 million, but to two other world-class basins.

In fact, it could become the biggest stock story of 2021… And the oil and gas rights to the ENTIRE Basin is owned by one small under the radar oil company that is quickly making waves amongst investors called Reconnaissance Energy Africa ( TSX: RECO.V , OTCMKTS:RECAF )

One of the key men behind what could end up being the onshore exploration play of the decade, former Navy Submarine Force Yeoman Dan Jarvie , once searched the depths of the Pacific for submarines...

But today he is one of the most respected petroleum geochemists in the world…

And what he is uncovering could change the entire African energy sector.

This might soon become the largest oil play in the last 20-30 years...

A 6,000-foot-thick Permian basin that could prove up 120 billion barrels of high-quality oil and gas in place.

Early investors could be rewarded, too.

This is a lottery ticket find ... with the concomitant risk that could see early stock investors lose their money or make 100X... or more.

The full exclusive story on Reconnaissance Energy Africa ( TSX: RECO.V , OTCMKTS:RECAF ) is below and make sure you are at least aware of it before the first 3 drill results make front page news...

A MAJOR NEW PERMIAN DISCOVERY IN 2021?

During the Permian era there was only one continent…

And the earth ’ s vast ocean was teeming with marine plants and animals.

This organic matter fell to the bottom of the sea... and over time turned in to high-quality thick oil.

The world ’ s most famous Permian formations are currently in the US.

In fact, a little over a year ago, Texas’ Permian basin had become the top producer in the world , outdoing even the best the Saudis had to offer.

The Permian basin is a 250-mile-wide, 300-mile-long sedimentary basin housing the Midland Basin, the Delaware Basin and the Central Basin Platform across West Texas and Southeast New Mexico.

It currently boasts the world ’ s thickest deposits of sedimentary rocks formed during the Permian geological period.

It ’ s a geological wonder: Over nearly 300 million years , layer upon layer of rock, sand, silt, and water run-off added to the mix, creating a pressure that created one of the most lucrative bonanzas of natural resources anyone has ever seen.

We ’ re talking a lucrative 28.9 billion barrels of oil and 75 trillion cubic feet of gas, with no sign of letting up. As of the time of writing, the Permian basin is producing over 4 million barrels per day. And while today the Permian Basin is synonymous with unconventional oil and gas, the majority of the production (and value) to date has come from the conventional oil and gas plays, good old fashion vertical wells which don ’ t need to be frac ’ ed, don ’ t need a lot of water and produce for 20 years.

And now Recon Africa ( TSX: RECO.V , OTCMKTS:RECAF ) has locked up what even WoodMackenzie sees as a potential NEW Permian basin with conventional oil and gas potential… for 25 years.

THE GEOCHEMIST GENIUS WHO UNCOVERED IT

Dan Jarvie, one of the most respected petroleum geochemists in the world, uncovered what could be one of the largest oil basins in the world, with over 100 billion barrels of oil--and that ’ s what he deems to be a conservative estimate. The oil just needs to be discovered and proven out.

Daniel Jarvie is globally recognized as a leading analytical and interpretive organic geochemist and “Hart Energy’s Most Influential People for the Petroleum Industry in the Next Decade.”

He was a key force behind the giant Barnett gas play and former chief geochemist for EOG Resources.

He ’ s jumped on this basin because he sees a “ very strong, independent junior explorer… sitting on a sedimentary basin that rivals South Texas in a massively underexplored region”.

Earlier this month, Jarvie came out with his own estimates showing the potential for this basin not only almost the size of Switzerland, but to be aligned with the Permian in Texas.

The end result of Jarvie's research?

A new – Permian type– basin with an estimated 66-120 BILLION barrels of oil to be generated....

And, the craziest fact of all?

His survey only accounts for 12% of the land.

There is still 88% more that hasn't been quantified.

Even better, while finalizing their drilling permits, they used two other non-invasive scientific investigations to support Jarvie's conclusions...

First, a high density aero-mag survey...

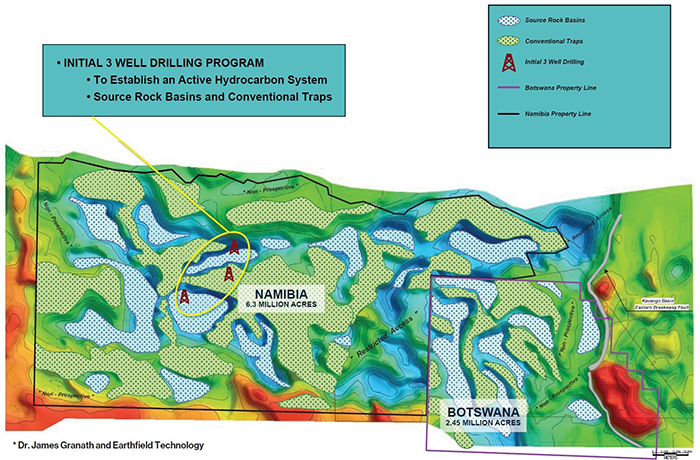

And, second, the identification of a new Rift system that helped create the basin, by noted PHD structural geologist and ReconAfrica Board member Dr Jim Granath.

The results were just as positive...

ADDITIONAL SURVEYS FIND 30,000 FT OF SEDIMENTARY ROCK BASIN FILL

The high-density aero-mag survey in this case revealed the depth of this basin and detailed its floor definition.

This high-tech survey showed up to 30,000 feet of sedimentary rock basin and showed a thick Permian petroleum system.

Those are the numbers that have attracted a “ who ’ s who” exploration and technical team to move this project forward with Recon Africa ( TSX: RECO.V , OTCMKTS:RECAF )

- Jay Park, RECO COB and director, is a veteran energy lawyer with tons of Africa experience and was designated Queen ’ s Counsel in Canada in 2011. He ’ s advised oil companies and governments in 50 countries, and he has a following of the best of the best.

- Scot Evans CEO, Geologist, oil expert, is an energy industry leader with a combined 35 years of experience with Exxon, Landmark Graphics and Halliburton.

- Daniel Jarvie is globally recognized as a leading analytical and interpretive organic geochemist of Barnett fame, and “ Hart Energy ’ s Most Influential People for the Petroleum Industry in the Next Decade.”

- Nick Steinberger , a world-class drilling and completion expert, then innovative engineer behind the giant Barnett gas play

- Bill Cathey is geologist to the supermajors, including Chevron, ExxonMobil, ConocoPhillips …

This is the best of the best--all of them confident in the chance of discovering the largest oil play in the last 20 to 30 years.

And they ’ re also the numbers that helped Jarvie arrive at that estimate he stresses is highly conservative: a potential 120 billion barrels generated.

In short…

Using the most advanced survey technology known to the industry and decades of experience as a world-class geochemist, Jarvie estimates 120 billion barrels…

Investors will find out soon as Reconnaissance Energy Africa ’ s ( TSXV:RECO , OTC:RECAF ) 3-test drill results come in.

$98 MILLION COMPANY HOLDING ALL RIGHTS TO POTENTIALLY THE NEXT PERMIAN BASIN

Reconnaissance Energy Africa could be the best oil play for 2021.

Now that the drilling permits have been awarded… and a 25-year lease is locked in…

Three drills are now being moved in to place. 400km of 2D seismic is being permitted and shot.

The first 12,000-foot drill is already operating... and the first 6-2 well has already been spudded.

Results should come in by quarter’s end.

Few analysts cover this little-known stock...

But Haywood Capital Markets predicts a quick 100% upside…

They ’ ve just increased their price target on this stock from $2.50 to $4.00 amid all the drilling excitement.

After that, expect two more drills to provide information on additional areas of the basin that Jarvie ’ s research, the areo-mag survey and Haliburton litho-tect survey say is underground.

If that happens, this could be front page news …

Time will tell, but one thing is certain… smart investors will want to track this story over the coming days.

Other companies looking to win big on the rebound in oil:

British Petroleum (NYSE:BP) is a UK-based energy giant with a massive influence in the industry. BP has been criticized in the past for being slow or late to the environmental cause, but it could now leapfrog its peers. Though the world is still a long way from Beyond Petroleum, it is doing its best to make the leap. In fact, chief executive Bernard Looney believes that we are only 30 years from a net-zero BP. He has promised that in September the company will lay out a more detailed plan that shows the path to that destination. But he has shown already that there is more to his commitment to net-zero than there was to Beyond Petroleum 20 years ago. “Renewables and natural gas together account for the great majority of the growth in primary energy. In our evolving transition scenario, 85% of new energy is lower carbon,” Spencer Dale, BP group chief economist, said, commenting on the outlook to 2040.

Like the rest of the heavily oil-focused supermajors, BP felt the full weight of the oil price collapse in 2020, and is still struggling to find its feet in the COVID-stricken marketplace. Despite this, however, bullish news is mounting for the company thanks to its diversification efforts and its key bets on natural gas. BP’s share price is already up 20% since the start of the year, and it will likely climb even higher as energy markets level out.

Enbridge (NYSE:ENB, TSX:ENB ) is in a unique position as oil and gas stages its 2021 comeback. As one of the more potentially undervalued companies in the sector, it could be set to win big this year. But that’s only if it can overcome some of the challenges in its path. Most specifically, its Line 3 project which has faced scrutiny from environmentalists.

The $2.6-billion project plans to replace Enbridge's existing 282 miles of 34-inch pipeline with 337 miles of 36-inch pipe. The new Line 3 would have the capacity to move 370,000 barrels of oil per day, alleviating the takeaway capacity constraints that Canadian oil producers have been struggling with for years now. Line 3 is one of two pipeline projects in the works that are—in their unfinished state—keeping Canada's oil industry from reaching its potential.

While this challenge may prove difficult for Enbridge to overcome, the health of the Canadian oil industry is improving, and with it, the outlook for Canadian producers such as Enbridge. The company has already started the year off strong, and if it can continue its momentum, it will likely be able to see a sustained rally in its share price over the course of the year.

CNOOC Limited (NYSE:CEO, TSX:CNU) is one of China’s oil majors. It’s the country’s most significant producer of offshore crude oil and natural gas, and may well be one of the most controversial oil stocks for investors on the market. A label that has nothing to do with its operations, however.

Recently, U.S. regulators announced their intention to de-list Chinese companies from the New York Stock Exchange, going back on their announcement just a few days later. The sustained negative press surrounding Chinese companies, however, has put CNOOC in an uncomfortable position for investors. While many analysts see the company as significantly undervalued, it is still struggling to gain traction in U.S. markets.

It's only natural to wonder why CNOOC was targeted and not CNPC or Sinopec. Lin Boqiang, dean of the China Energy Policy Research Institute at Xiamen University in southern ChinaSo, suspects CNOOC's drilling activity in the South China Sea area is responsible for putting it at loggerheads with U.S. authorities.

It's not yet clear how the growing antipathy between the two nations will affect the U.S. natural gas sector, given that CNOOC is China's largest importer of LNG. But as the Biden Administration prepares to take power, Chinese companies, including CNOOC, are likely to breathe freely once again, and it could be a boon for Chinese stocks.

Franco-Nevada Corporation (TSX:FNV) specializes in securing precious-metal streams, but the company also works in the oil and gas industry. With key assets in some of North America’s most desirable oil and gas plays, including Texas, Oklahoma and Alberta, it is clear that the company has amazing potential in the coming years.

Cenovus Energy (TSX:CVE) is most known for its oil business, but it is also actively investing in renewable energy. More importantly, however, is that it has set truly ambitious sustainability goals for itself, aiming to cut emissions by a massive 30% in just 10 years.

This is one of the most actively traded stocks on the TSX. The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

Inter Pipeline Ltd (TSX:IPL) is another pipeline company that holds plenty of upside for the coming year, IPL is particularly interesting for its exposure to the oil sands sector which is sure to see a boost in production as more and more companies focus on increasing output in the new high oil price environment.

The crisis in Venezuela has already seen heavy oil imports to North America drop, and as demand for the product increases and prices for oil continue to rise, companies in the space are sure to see growth.

By. Freddie Lambert

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements. Statements contained in this document that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of Recon. All estimates and statements with respect to Recon’s operations, its plans and projections, size of potential oil reserves, comparisons to other oil producing fields, oil prices, recoverable oil, production targets, production and other operating costs and likelihood of oil recoverability are forward-looking statements under applicable securities laws and necessarily involve risks and uncertainties including, without limitation: risks associated with oil and gas exploration, timing of reports, development, exploitation and production, geological risks, marketing and transportation, availability of adequate funding, volatility of commodity prices, imprecision of reserve and resource estimates, environmental risks, competition from other producers, government regulation, dates of commencement of production and changes in the regulatory and taxation environment. Actual results may vary materially from the information provided in this document, and there is no representation that the actual results realized in the future will be the same in whole or in part as those presented herein. Other factors that could cause actual results to differ from those contained in the forward-looking statements are also set forth in filings that Recon and its technical analysts have made, We undertake no obligation, except as otherwise required by law, to update these forward-looking statements except as required by law.

Exploration for hydrocarbons is a speculative venture necessarily involving substantial risk. Recon's future success will depend on its ability to develop its current properties and on its ability to discover resources that are capable of commercial production. However, there is no assurance that Recon's future exploration and development efforts will result in the discovery or development of commercial accumulations of oil and natural gas. In addition, even if hydrocarbons are discovered, the costs of extracting and delivering the hydrocarbons to market and variations in the market price may render uneconomic any discovered deposit. Geological conditions are variable and unpredictable. Even if production is commenced from a well, the quantity of hydrocarbons produced inevitably will decline over time, and production may be adversely affected or may have to be terminated altogether if Recon encounters unforeseen geological conditions. Adverse climatic conditions at such properties may also hinder Recon's ability to carry on exploration or production activities continuously throughout any given year.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) have been paid by Recon seventy thousand U.S. dollars to write and disseminate this article. As the Company has been paid for this article, there is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:RECO. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.