In the biggest boost for cannabis since Canada legalized recreational use in 2018, the United Nations has reclassified marijuana , removing it from its most strict drug control list, paving the way for a flurry of positive legal activity the world over …

But while U.S. states line up to legalize recreational use, and while a change of power at the White House bodes well for cannabis stocks, there are two multi-billion-dollar elements that were missing, and one upstart company is aimed directly at this kingdom.

The kingdom is quality cannabis underpinned by the kind of big data that could make Big Pharma come knocking on doors.

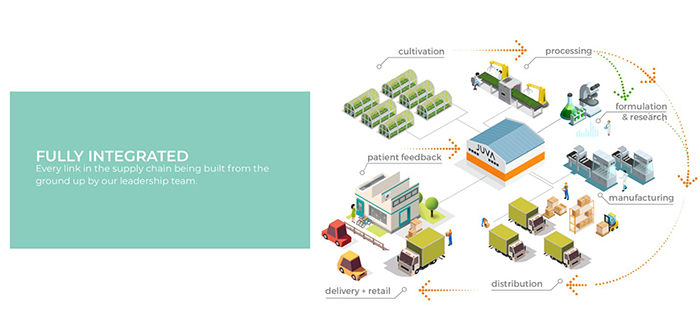

And one of the potential keys to that kingdom could be held by Juva Life ( CSE:JUVA ; OTC:JUVAF ), a California-based, vertically integrated company that is building an entire ecosystem of cannabis cultivation, R&D, distribution, retail, delivery and the missing data and IP links.

This could make all the difference, and the timing is perfect ...

Five more states just legalized marijuana in ballot initiatives on November 3rd, and stock prices are already heralding the Cannabis Boom 2.0.

The first round was a massive spend by deep-pocketed cannabis companies on building quantity with little regard for quality … and investors failed to see sustained returns.

The second round is about data-driven innovation, and that means quality.

And none of it means anything if Big Data isn’t there to prove it up and sell it on.

In a rapidly evolved marketplace, it’s Juva Life’s “precision cannabis” that aims to put the money-making science back into marijuana.

Part cannabis stock... part thera-tech stock... any of their 3 businesses could potentially reward investors with front-page news in 2021.

Here are 3 reasons to keep a very close eye on Juva Life Inc this quarter:

#1 The Second Cannabis Boom Starts in California

Investors in the first cannabis boom in 2018 who timed things right saw huge returns …

- Aurora Cannabis Inc. (NYSE:ACB) went from $4.43 on November 4th to $11.21 on November 9th.

- Canopy Growth (NYSE:CGC) shot from $19 on November 4th to almost $25 five days later, in a run it hasn’t seen since the first cannabis boom of 2018.

- Tilray (NASDAQ:TLRY) surged from $6.00 on November 4th to over $10 on November 9th.

But the first boom ended with a dull thud after a while because everyone focused on quantity rather than quality--and there wasn’t enough science.

Now, the legal marijuana market is on track to reach $73.6 billion by 2027, according to Grand View Research.

And California--where Juva is based--is one of the harbingers of the second boom--the better boom … the bigger and sustainable boom.

California's cannabis market is forecast to grow to $3.5 billion in 2021...

That’s even bigger than Canada’s market, and it’s a market that Juva Life ( CSE:JUVA ; OTC:JUVAF ) plans to dominate by playing the game in an entirely different way …

There’s probably only one guarantee for success in the cannabis sector: patents, permits and licenses.

And that’s exactly where Juva has the serious advantage. Its CEO received the first-ever permit in the state of California and Juva now has a head start on the competition.

But while they are on an aggressive expansion wave across California, they’re also aiming to make a significant footprint in a national medical cannabis market that is heading to $9 billion.

#2 The Biggest Money in Pot Is in Patents and IP

The real money in Cannabis 2.0 is probably in the patents … and Juva’s endgame is a focus on therapies, bolstered by growing retail sales revenues.

Juva’s flagship Hayward facility is already permitted and under construction. It’s a massive 18,000 sq ft structure with an adjoining 11,000 sq ft greenhouse.

And it’s ISO Class 5 cleanroom will be the scene of Juva’s state-of-the-art “science of cannabis” research and development.

They will do everything in this facility from cultivation and research to manufacturing and retail--all focused on achieving low-cost, high-quality growth operations combined with state-of-the-art research.

On October 22nd, Juva received a Conditional Use Permit, which is likely to expedite additional permitting, with full production anticipated by mid-2021.

It’s also just won conditional approval to develop a boutique flagship retail operation in a designer-styled environment at its Hayward facility by the city of Hayward.

Now comes the major push for development of “precision cannabis” products for targeted delivery of the “right formulation to the right individual at the right time”.

Juva Life ( CSE:JUVA ; OTC:JUVAF ) is going after the IP scene full force across multiple verticals, setting it up to be the “Integrated Vertical First Mover of Cannabis”, starting in California.

#3 This Is A Big Data Coup

Cannabis data is the difference between a successful market and a very successful market.

It’s the only thing connecting medical cannabis to medical science …

It’s the missing element that could cut millions of dollars off the costs of getting new cannabis based pharmaceutical drugs approved …

That also means it’s one thing that will attract the lucrative attention of Big Pharma.

It’s also one thing Juva has brought to the table.

And when the company went public in November, it heralded a business plan of creating a potential--lucrative--nexus between medical cannabis and big pharma.

Juva is working with top scientists to create the a research database that aims--for the first time ever to show consumers, manufacturers, doctors, natural healthcare providers and Big Pharma exactly which natural health products really work, for which health problems.

And it’s where natural health products get put on a sound scientific foundation, as Juva, led by CEO Doug Chloupek , works with top scientists for the ultimate evolution of cannabis research.

Their first 2,000 patient research registry has been approved...

And the results are expected within 6 months, possibly making Juva a ripe target for Big Pharma.

Then Juva aims to patent and sell new cannabis brands targeted toward different ailments. That development is expected to open big new markets for Juva in the medicinal space.

Juva’s big data system for cannabis combined with its biotech prowess aims to create an entire life science ecosystem … and one that would make it, for the first time in this industry’s young history, efficient.

Juva’s ( CSE:JUVA ; OTC:JUVAF ) state-of-the-art technology platform, if successful, won’t just help the industry find its footing and consumers find a heightened level of confidence and efficacy, it will also present a valuable licensing opportunity for Big Pharma.

One of Big Pharma’s biggest problems is the mountains of money it costs and time it takes to get new pharmaceutical drugs approved.

Juva’s research protocols, already approved by the Western Institutional Review Board, could speed up the process for getting new medical products licensed for sale.

Welcome to California

This is where the second boom starts …

With a savvy company that’s plays the new cannabis game in terms of patents, permits, licenses, science and big data.

Juva raised a total of $24 million in its pre-IPO funding rounds, helping it to become a fully integrated cannabis company. And that money is creating a revenue stream that is allowing it to break into the even more lucrative life sciences industry.

Retail cannabis is Juva’s entry into the business. Scientific research on medical cannabis and a big data play that could bring Big Pharma to its doors is Juva’s first mover advantage.

The news flow on this one is expected to be fast for 2021, with patent applications, licensing and permitting announcements across multiple verticals being put into position, not to mention the tailwinds of a change in regime in the White House.

Canada started the marijuana boom, but California is the catalyst for casting this net far wider.

Other companies to watch as the U.S. marijuana boom heats up:

OrganiGram Holdings (NASDAQ:OGI; TSX:OGI) is a Canadian holdings company looking to take the burgeoning cannabis industry by the horns. With numerous subsidiaries from which it produces and distributes recreational and medical marijuana, OrganiGram is well-positioned to ride the next Green Wave into profits.

OrganiGram has carved out its place in cannabis royalty by securing deals across Canada, from Saskatchewan to British Columbia. In addition to its in-person sales strategy, OrganiGram also offers another unique method of distribution. Online and over-the-phone options. More than that, however, OrganiGram and its partners know how to manage the surging Canadian demand that has left other distributors without product for periods of time.

OrganiGram, like many in the industry, struggled through 2020. The COVID-19 fueled market downturn saw its share prices collapse from a yearly high of $3.26 in early January to a low of $1.03 in September. But that wasn’t the end of OrganiGram. In fact, the company has started the year off with a bang, with its stock price rising more than 25% in the first two trading weeks of the year. And with the U.S. push for cannabis legalization accelerating, especially with the inauguration of Joe Biden just days away, the future of the industry is looking bright, and OrganiGram is looking to take full advantage of it.

Curaleaf Holdings (OTC:CURLF, CSE:CURA) is an up-and-coming U.S. cannabis company with big plans for vertical integration. The multi-faceted company has its hands in all levels of the cannabis game, where it cultivates and manufactures a wide range of products (concentrates, edibles, tinctures, capsules, vaporizer cartridges, dry natural marijuana, etc.), operates dispensaries, and much more.

The Massachusetts-based company has seen significant growth since it went public in what the Motley Fool called “ the largest cannabis debut in history .” And it’s lived up to the hype. Curaleaf has had a stellar year, with its stock price bouncing from a low of $3.16 back in March to an all-time high of $10.88 at the time of writing.

And this could be just the beginning for the homegrown U.S. company. As President-Elect Joe Biden prepares to take office in just a few days, the idea of a federal ban on marijuana could soon be history. Though nothing is set in stone just yet, investors are optimistic that a second cannabis boom could be in the making.

Village Farms International (NASDAQ:VFF; TSX:VFF) is a Canadian company with a unique approach to the industry. It’s not just about cannabis, either. Village Farms is a full-on vertically integrated produce grower with over 30 years in the industry. It’s known for its low cost vegetables and focus on clean, environmentally-friendly production. Its cutting-edge greenhouses use less water, land and chemicals, making it an ideal choice for conscious investors.

While Village Farms was built on produce, it has also jumped on the cannabis bandwagon in a big way. With its joint partnership known as Pure Sunfarms with cannabis cultivator, Emerald Health Therapeutics (OTC:EMHT.F), Village Farms has used its expertise and innovative technology to make major waves in the marijuana business. The company reported that its all-in growing costs were only $0.49 per gram with an EBITDA margin of 78%, and with production at the PureSunfarms greenhouse sitting at approximately 150,000 kilograms per year, the sun is shining on Village Farms.

Thanks to its foray into the wild world of weed, Village Farms has drawn significant interest from investors. In fact, Village Farms has seen its share price skyrocket from a low of $2.39 in March 2020 to a high of $14.35 today. And like other companies in the industry, it will likely win big as more and more governments legalize marijuana.

Burcon NutraScience Corporation (TSX:BU) is a Canadian tech firm bridging the gap between food and health, a connection that should not be overlooked. It is known for its high-purity, sustainable, flavorful, and affordable products. The company has checked every box in the modern customer’s book. Founded over 20 years ago, Burcon has been at the forefront of the since 1998, and it’s only become more refined since.

In its mission statement, Burcon explains that it “seeks to improve the health and wellness of global consumers through the discovery and development of sustainable, functional and renewable plant-based products for the global food and beverage industries.”

Emblem Corp. is a leading licensed marijuana producer in Canada. With a number of cannabis-based products, Emblem works closely with the medical community to ensure both patients and physicians have the information necessary to make decisions regarding treatments involving marijuana.

Recently, Emblem completed testing on a new oral extended release product with partner Canntab Therapeutics. With the successful tests, the companies announced that they will be moving forward into clinical trials. In addition to its advancements in the medical field, Emblem is also working towards a safer community, partnering with DriveABLE in an effort to curb accidents from impaired drivers.

Nick Dean, CEO, Emblem Corp. explained, “Impairment – whether from alcohol, cannabis, fatigue, underlying medical conditions, or narcotics – is a serious issue that affects safety on roads and in the workplace.”

By. Brenda Lansdowne

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the results expressed or implied by the forward-looking statements. Such forward-looking information includes that cannabis use and sales will grow as currently predicted; timing of Juva’s construction or acquisition of facilities and commencement of associated additional revenues; that Juva will be granted patents for its specific formulations; that cannabis patents will prove valuable assets; Juva’s intended expansion into more markets; Juva’s plans to bring the latest science and technology to its product research and development; that it could be granted growing and sales licenses; that Juva can lease new sales locations and gain brand recognition; that through efficiency and vertical integration Juva can substantially lower its production costs and time below competitors; that Juva can sell its product profitably; that Juva will create a range of cannabis consumer healthcare products, to be distributed through their own distribution channels; that Juva can successfully integrate pharmaceutical breakthroughs into its products; that Juva can achieve its sales targets and gross profit margins as planned; and that it will be able to carry out its business plans. Readers are cautioned to not place undue reliance on forward-looking information. Forward looking information is subject to risks and uncertainties which include, among other things: that regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; growing competition in the cannabis industry; announced or expected business plans may not come to fruition because of inability to come to final terms, or inability to obtain regulatory compliance; competitors may quickly enter the industry; general economic conditions in the US, Canada and globally; the inability to secure financing necessary to carry out its business plans; competition for, among other things, capital and skilled personnel; the possibility that government policies or laws may not permit legal cannabis sales or growth or that favorable laws in place may change; interruption or failure of information or other technology systems; the cannabis market may not grow as expected; Juva’s drive for efficiency, time and cost savings may not achieve the expected results and its accomplishments may be limited; Juva may not successfully develop a cannabis consumer brand; and it may not be successful in developing a cannabis based treatment for medical uses; even if it develops successful healthcare treatments, the products may not be accepted by the market; the company may not be able to protect its intellectual property; its patent applications may be rejected or successfully challenged; Juva’s business plan carries risk, including its ability to comply with all applicable governmental regulations in a highly regulated business; early entry risk by engaging in activities currently considered illegal under US federal laws; and regulatory risks relating to Juva’s business, financings and strategic acquisitions.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, owned by Medtronics Online Solutions Ltd., and their owners, managers, employees, and assigns (collectively “Safehaven.com”) have been paid by the profiled company to disseminate this communication. In this case Safehaven.com has been paid by Juva ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters.

SHARE OWNERSHIP . The owner of Safehaven.com owns shares of Juva and therefore benefits from its price appreciation. Safehaven.com will not notify the market when it decides to buy or sell shares of this issuer in the market. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Safehaven.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.