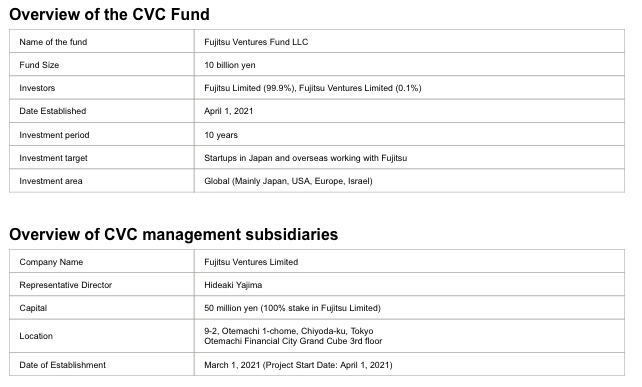

TOKYO, Mar 31, 2021 - (JCN Newswire) - Fujitsu Limited today announced the establishment of Fujitsu Ventures Fund LLC, a corporate venture capital (CVC) fund totaling 10 billion yen, under the management by the subsidiary Fujitsu Ventures Limited. The new fund will target investments in promising tech companies globally, including in Japan, the US, Europe, and Israel, and represents a key tool in a growth investment strategy to drive innovation and accelerate digital transformation (DX).

|

Following the establishment of Fujitsu's first CVC fund in 2006, a second and third fund were subsequently established in 2010 and 2015. With these funds, Fujitsu has made investments in promising startups both in Japan and abroad, to deliver encouraging results. In 2015, Fujitsu additionally initiated its FUJITSU ACCELERATOR program to boost co-creation venture activities. To date, the program has successfully promoted cooperation with more than 100 global startups in the tech space. In 2020, the Strategic Growth & Investment team was established to lead Fujitsu Group's inorganic activities which include investments into startups.

Partnering with dynamic startups represents an increasingly important priority in today's competitive business environment, serving as an engine for growth through innovation and DX. To this end, Fujitsu will establish a new CVC fund to further enhance the Strategic Growth & Investment team's startup investment capabilities and to enable more agile investments and further amplify the impact of its growth investment strategy, which remains a central element in its management direction policy. Fujitsu will make investments to bolster the foundation of innovative technologies that underlies DX and to create new business opportunities, by encouraging greater collaboration between start-ups and the company with a deeper involvement in the FUJITSU ACCELERATOR program.

Source: Fujitsu Ltd

Copyright 2021 JCN Newswire . All rights reserved.