Never before have this many life-changing trends converged at the same time to give investors a cornucopia of rewarding opportunities.

In the energy tech space, we’re staring in the face of a multi-trillion-dollar transition. It’s a high-speed train in some respects, with investors misunderstanding the timing. But when it’s done right, these are longer-term smart plays of the kind that will surely mint the next millionaires--or billionaires.

What the future holds for battery tech is where some of the biggest money is heading in this transition landscape.

In the healthcare sector, we’re in the middle of a wellness revolution that first saw a cannabis boom that rewarded many investors nicely, with round two likely in the making, but now, something even bigger might be afoot.

Psychedelics are being prepped now--even from the FDA’s perspective--as an answer to an out-of-control global problem with depression. Heading towards $4.5 trillion, the global wellness sector is exploding, and the answers to many of our problems is the holy grail.

In the cyber security segment, the recent ransomware attack on America's largest natural gas pipeline brought our abysmal security into full view--if it wasn’t already. Add to that the new, pandemic-driven trend for remote work and online schooling has rendered the ‘cloud’ a very precarious place to be, indeed. The future of cyber security is in the cloud, and investors should be looking for the next pioneer.

Here are 3 stocks that are aiming to reshape our future in a very big way:

#1 Quantumscape (NYSE:QS)

Quantumscape and its “Jesus battery” is one of the most exciting stocks on the speculative, futuristic energy transition scene. It’s backed by Bill Gates and Microsoft (NASDAQ:MSFT), not to mention Volkswagen (OTCMKTS:VWAGY). And it fully intends to radicalize EV battery technology.

What’s not to love?

But timing here is important. Investors piled into this far too soon, pushing it far too high, too fast. Now, it’s settled back down to a reality that reflects the timing.

There will be a second-coming, though, and we think this is one of the better longer-term bets on our multi-trillion-dollar energy transition.

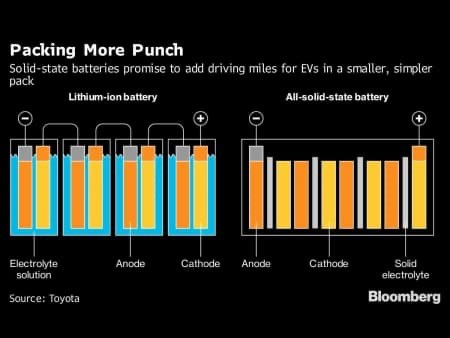

Why? Because this solid-state battery offering could disrupt everything …

Solid-state battery cells are the EV game-changer, offering high performance and safety at a low cost.

QuantumScape’s prototype batteries use a solid ceramic electrolyte, which the company sees as a safer alternative to liquid electrolytes. They claim that the battery can hit an 80% charge in just 15 minutes. That removes one of the biggest hurdles to widespread, mainstream adoption of EVs. Currently, the best lithium-ion batteries pack about 250Wh/kg, while solid-state batteries already exceed 400Wh/kg.

Eventually, this company stands to be one of the biggest winners of the energy transition, but it’s an investment that will take some patience for that juicy end reward.

#2 HAVN LIFE ( CSE: HAVN ; OTC: HAVLF )

Look no further than this for the next entry into servicing this megatrend in the $52-billion pain management market, the $14-billion antidepressant market and a soon-to-be $4.5 trillion global wellness space.

This is where psychedelics are now losing their stigma and could soon be in the mainstream. This could get even bigger than cannabis because it could end up being a solution to the most tragic illness of our time--depression.

Psychedelics are emerging as the potential key to pain management and multiple forms of depression. And it’s all about science, with HAVN Life gunning for pole position in the supply chain.

HAVN Life is an extraction innovator that is setting itself up to be the supplier to the growing number of labs and clinical providers hedging their bets on this healthcare breakthrough. Even the FDA is calling the key compound that for cases of severe depression.

The key to it all is a compound called psilocybin, the active ingredient in magic mushrooms.

We are optimistic about HAVN Life’s strong emergence in this segment because some of its management played a huge role in the first cannabis boom--another major element of a mega wellness revolution that is unfolding.

The Chairman of HAVN Life ( CSE: HAVN ; OTC: HAVLF ) Vic Neufeld and CSO Gary Leong were the founders of Aphria (NYSE:APHA), which netted the earliest investors gains of over 2,300% .

They’ve got two revenue verticals: Havn Labs and Havn Retail.

HAVN Labs is looking to meet soaring demand for psilocybin for clinical research, and it’s spending C$800,000 on a new state-of-the-art mycology laboratory in Vancouver. That lab is scheduled to launch this year and stands to become the premier extraction facility for naturally-derived clinical compounds.

HAVN retail is hedging on surging demand for supplements, with the total Canadian vitamins and minerals market valued at $521 million , and the U.S. market valued at over $7.4 billion . In this huge market, mushrooms were the second fastest growing natural health supplement and are underserved in the market. HAVN Life intends to change that.

This stock has already been added to the Horizons Psychedelic Stock Index ETF (PSYK) , where investors gain exposure to a basket of 17 publicly traded companies focused on using psychedelics to treat a wide range of mental health issues.

The news flow is expected to be fast-paced, especially amid a new decriminalization drive that if successful, could make psychedelics a $100-billion market segment before we know it.

And we’ll be closely watching the next big potential boost for this company: Results from preclinical trials to investigate the effects of psilocybin on the immune system--a potentially ground-breaking study that could lead to the development of new medicines.

#3 CrowdStrike (NASDAQ:CRWD)

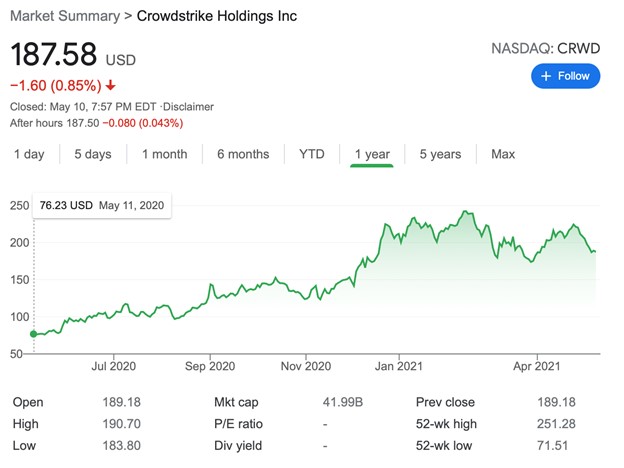

The cyber security segment is over-ripe for a major disruption, and CrowdStike seems ready to do just that, if it hasn’t already gotten a great foothold on the cyber security of the future.

Everything’s on the cloud these days. Now, it’s time for cyber security--always a few steps behind the hackers--to catch up.

This company is arguably the pioneer of the security cloud. There is quite a lot of new tech here that sets CrowdStrike apart from others in the cyber security field, but the growth potential here is what investors should be looking at.

CrowdStrike’s platform uses crowdsourced data for analysis and continual improvements.

And while it’s only got 10,000 customers right now, it’s the growth trajectory that has radar pinging. Not to mention spectacular revenue numbers: CRWD grew revenue by over 81% for fiscal 2021.

On this one, it’s already exploded, so wait for the dip to get in. That dip isn’t going to come just yet because CRWD just announced some fairly big news: A new deal with Google Cloud .

Already partners, CrowdStrike and Google Cloud announced on May 10th that they will be extending their partnership via new product integrations that will allow customers to share telemetry and data between the two platforms.

Bonus: Canadian Firms With Ambitious Missions

Blackberry Limited (TSX:BB) is one of Canada’s most exciting tech plays. While it has pivoted away from its iconic cell phones of yesteryear, it is still very much involved in pushing tech, and by extension all of mankind, further. It’s even building a global digitized healthcare database leveraging blockchain technology. This could be a game-changer for how health data is managed and distributed. But that’s just one facet of its big picture push. From it’s high-profile partnerships with the likes of Amazon and more, to its key posturing in the Internet of Things explosion, BlackBerry is tackling the industry from all fronts, and will be an important player for years to come.

BlackBerry also launched a new research and development arm called BlackBerry Advanced Technology Labs. "Today’s cybersecurity industry is rapidly advancing and BlackBerry Labs will operate as its own business unit solely focused on innovating and developing the technologies of tomorrow that will be necessary for our sustained competitive success, from A to Z Artificial Intelligence to Zero-Trust environments," Charles Eagan, BlackBerry CTO explained.

Shopify Inc (TSX:SHOP) is a breath of fresh air in the e-commerce world. It has made it possible for anyone, regardless of industry experience or tech know-how to create their own store. In fact it would be hard to have not stumbled onto a shop built with its technology. More than 1,000,000 businesses rely on Shopify’s game-changing e-commerce solutions, including Tesla, Budweiser and Red Bull, among many others. Shopify makes purchasing goods and services easy for anyone – and in a time where convenience is king, Shopify surely has staying power.

Shopify has already shown its potential in the markets, but as it continues to grow, so will its innovative solutions for businesses, and by extension, its share price. Shopify is one of the few e-commerce companies that may very well be able to compete with the likes of giants like Amazon or Alibaba in the years to come.

Mogo Finance Technology Inc. (TSX:MOGO) is a Canadian fintech firm that is out to transform credit as we know it. Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online-only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “ the Uber of finance ” by CNBC, Mogo is should definitely be on investors’ radars.

Though Mogo has had a turbulent year so far, it’s still got tons of potential. With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could even find itself as an acquisition target in the coming years.

3D Signatures Inc (TSXV:DXD) is a high-tech Canadian firm that has found itself in the center of two explosive sectors. It’s armed with an innovative new software platform which uses 3D analysis to target various diseases and help clinicians identify a diagnosis and optimize treatment plans. 3D Signatures’ software is saving doctors time which could be the difference of life and death for some patients. 3D Signatures sets itself apart from its competition through creating individualized treatment plans for patients. Using its mapping platform, the software can determine how a disease will progress and whether or not the patient will respond to treatment

3D Signatures’ broad scope and futuristic technology brings a promising opportunity to potential investors. It truly is at the forefront of a new era in medicine, and investors should not overlook this company’s massive potential.

Canada is not likely to be left out of the electric vehicle boom, either. GreenPower Motor (TSXV:GPV) is an exciting company that produces larger-scale electric transportation. Right now, it is primarily focused on the North American market, but the sky is the limit as the pressure to go green grows. GreenPower has been on the frontlines of the electric movement, manufacturing affordable battery-electric busses and trucks for over ten years.

From school busses to long-distance public transit, GreenPower’s ambitious plan to transform transportation isn’t going unnoticed. Since May of 2020, the company has seen its share price skyrocket from around $2 per share to its current price of $17. And there’s still plenty of room to run, especially as pressure to go green continues to grow.

By. Davao Vance

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the global wellness market will continue to increase and that demand for mushroom based supplements and nutraceuticals will grow; that the market for psychedelic mushrooms will continue to increase for research purposes focused on alternative mental health treatments; that psychedelics will gain regulatory, medical, commercial and social acceptance as a potential treatment for various mental and other illnesses; that HAVN can be a supplier of functional and psychedelic mushroom products; that HAVN can be a leader in scientific research and achieve a new standard in naturally derived psilocybin; that HAVN can successfully build out supply agreements with researchers and obtain supply agreements to create commercialized products; that HAVN will develop fungi-based nutraceutical products for the wellness market that will achieve Health Canada approval and be sold on e-commerce sites and by retailers; that HAVN can produce products using specialized extracts which have a greater therapeutic effect for patients; the projected timing of product launches and availability through retailers; that psychedelic mushrooms will be decriminalized and gain acceptance as a viable medical treatment for mental illness; that HAVN will develop a state-of-the-art research lab and become a supplier for the psychedelic and functional mushroom markets; and that HAVN can carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the global wellness market may not increase as anticipated and that demand for supplements, and in particular mushroom based supplements and nutraceutical based products may not increase; that the market for psychedelic mushrooms does not increase; that psychedelic mushroom based treatments are found to be dangerous, ineffective or have unwanted side effects; that psychedelics will fail to gain regulatory, medical, commercial and social acceptance as a potential treatment for various mental and other illnesses; that HAVN may be unable to develop its business as a supplier of functional and psychedelic mushroom products; that HAVN may fail to become a leader in scientific research or achieve a new standard in naturally derived psilocybin; that HAVN may fail to achieve supply agreements with researches or obtain supply agreements to create any additional commercialized products; even if they do successfully produce products, competitors may offer better and cheaper products; that HAVN’s products may prove not effective; and that its intellectual property may be challenged as infringing on others’ IP. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. FinancialMorningPost.com and its owners and affiliates (“FinancialMorningPost.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:HAVN. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner and affiliates of FinancialMorningPost.com own shares of HAVN and therefore have an additional incentive to see the featured company’s stock perform well. FinancialMorningPost.com is therefore conflicted and is not purporting to present an independent report. The owner and affiliates of FinancialMorningPost.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of FinancialMorningPost.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. FinancialMorningPost.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.