These two gases are some of the best options for zero-carbon fuel.

That could make them the hottest commodities on the planet … and the future stars of a multi-trillion-dollar energy transition.

Everyone from governments and institutions to Big Tech, energy companies, and the investing universe may get fully locked in.

The first gas is hydrogen, the simplest element on earth that makes up over 90% of all the atoms in the universe.

Investors are already taking note of this, and one report says that demand for hydrogen may rise eight-fold by 2050 .

Governments across the world are taking action and spending trillions of dollars on clean energy infrastructure.

One report estimates the total investment necessary to meet the Paris Agreement targets that aim to keep global warming to below 1.5°C above pre-industrial temperatures is a staggering $131 trillion.

And now, after decades of multiple false dawns, we think the hydrogen economy is primed for a major takeoff.

Bank of America says hydrogen technology is at a tipping point and could be set to explode with a total market potential reaching $11 trillion by 2050.

Hydrogen has traditionally been regarded as a leading superfuel, but a hydrogen-powered economy is fraught with major challenges including high production costs and a high risk of fires due to hydrogen’s extreme flammability.

That’s where our second gas comes into play: Ammonia the answer to the hydrogen conundrum.

“Green ammonia” is now being viewed as the holy grail of these superfuels...

The ideal hydrogen carrier, ammonia may be used in the future to power everything from cars to vans, trucks, forklifts… even ships and jets .

All thanks to ammonia’s unique properties including being much safer to transport than hydrogen as well as being a much better hydrogen carrier than even liquefied hydrogen itself.

Over the past few years, visions of green ammonia's potential as an energy source and an energy carrier in a future carbon-free economy may have started to transition towards a viable reality.

And we think one company is positioning itself as a global leader in green ammonia production.

Michigan-based AmmPower Corp. ( CSE:AMMP ; OTC:AMMPF ) is working on the development of a proprietary solution to produce green ammonia and hydrogen-based alternative fuel options for industrial-scale transportation platforms.

Green ammonia is produced using renewable energy, meaning, like green hydrogen, it has zero carbon footprint.

AmmPower is aiming be to the green ammonia industry what Plug Power Inc. (NASDAQ:PLUG) is to the hydrogen fuel cell industry: A pioneer developing disruptive technology and unique intellectual property (IP).

Here are four reasons we’re going to keep a close eye on AmmPower ( CSE:AMMP ; OTC:AMMPF ) as our multi-trillion-dollar energy transition looks for its hydrogen solution:

#1 Possibly The Perfect Transition Fuel

At first glance, one might wonder why anyone would consider using anhydrous ammonia rather than hydrogen. Hydrogen, after all, contains much higher LHV (lower heating value) energy than ammonia (51,500 BTU/lb vs 7,987 BTU/lb or 119.93 kJ/g vs 18.577 kJ/g) on a weight basis.

But that’s the only advantage pure hydrogen has over ammonia.

Everywhere else where it really matters, ammonia looks like it beats hydrogen hands down.

Ammonia has several desirable characteristics that make it an effective hydrogen carrier and could make it an excellent transition fuel.

First off, on a volume basis (which is what really matters), ammonia is a much better hydrogen carrier than even liquefied hydrogen. The energy density of liquefied hydrogen is 8,491 kJ/litre compared to ammonia's 11,308 kJ/litre. Although ammonia contains 17.65% of hydrogen by weight, the fact that there are 3 hydrogen atoms attached to a single nitrogen atom allows ammonia to contain about 48% more hydrogen by volume than liquefied hydrogen. That is to say, a cubic meter of liquid hydrogen contains 71 kg of hydrogen compared with 105 kg for liquid anhydrous ammonia.

Second, ammonia can be liquefied under mild conditions, with a melting point of minus 33 degrees celsius compared to minus 253 degrees celsius for hydrogen. This makes it much easier to transport hydrogen as ammonia and transform it back. In fact, ammonia stores and handles very much like Liquefied Petroleum Gas (LPG). Its boiling point is -33.35 °C (-28.03 °F), slightly higher than propane, the main constituent of LPG, which has a boiling point of -42.07 °C (-43.73 °F). This means that ammonia can be stored in simple, inexpensive pressure vessels comparable to LPG vessels.

In contrast, the low energy density of compressed hydrogen gas makes storage and transport very expensive. Indeed, transporting compressed hydrogen gas any significant distance by truck can consume more energy in diesel fuel than what is contained in the hydrogen. Liquefied hydrogen is obviously more energy-dense than compressed hydrogen gas but a significant amount of energy must be expended to liquefy hydrogen and keep it refrigerated because its boiling point is a very low–423 ºF (–253 ºC). Liquefaction requires about 30% of the energy content of liquid hydrogen while compression to 800 bar requires about 10-15% of energy carried by the hydrogen. Hydrogen is typically transported as a compressed gas and a 40-tonne truck that can carry 26 tons of gasoline can only carry about 400 kg (0.4 tonnes) of compressed hydrogen due to the weight of the high-pressure hydrogen tanks.

To complicate matters further, hydrogen molecules are very small and difficult to contain. Hydrogen will slowly leak out from hoses and its rate of leakage is much higher than larger molecule gases like ammonia and propane. Hydrogen also causes embrittlement in metals which requires periodic replacement of metallic tubing, valves, and tanks.

Third, green ammonia is 100% non-polluting and can be readily decomposed (cracked) over a catalyst to produce the desired fuel--hydrogen (H2) along with nitrogen (N2), a non-toxic, non-greenhouse gas. Blue ammonia produced through the traditional Haber-Bosch Ammonia method from hydrocarbons such as natural gas but using CCS (Carbon Capture & Storage) is also simpler and cheaper than hydrogen delivery, and final use in an internal combustion engine or fuel cell produces no harmful greenhouse gases.

Finally, ammonia may make for an excellent transition fuel. It can potentially be burned directly in an internal combustion engine (ICE) with no carbon emissions; converted to electricity directly in an alkaline fuel cell or cracked to provide hydrogen for non-alkaline fuel cells (FC).

#2 Ample growth runways

After lagging for decades, we think there’s little doubt that the hydrogen economy is finally ready to take off.

And few sectors have been hotter than hydrogen fuel cell companies lead by Plug Power, Bloom Energy Corporation (NASDAQ:BE), and Ballard Power Systems (NASDAQ:BLDP).

We think that’s because energy experts and Wall Street believe that sector is at a tipping point.

Bank of America says hydrogen technology is poised to take off as falling production costs, technological improvements, and a global push toward sustainability converge. The firm believes this will generate $2.5 trillion in direct revenue --or $4 trillion if revenue from associated products such as fuel cell vehicles is counted--with the total market potential reaching $11 trillion by 2050.

Last year, the European Union set out its new hydrogen strategy as part of its goal to achieve carbon neutrality for all its industries by 2050 with the objective to see the regional bloc develop a minimum of 40 gigawatts of electrolyzers within its borders and a similar amount of green hydrogen capacity in neighboring countries that can export to the EU by the same date.

And now the private sector is looking to give the EU a run for its money.

Some of the world’s green hydrogen leaders have announced a coalition with an ambitious goal to drive a 50-fold scale-up in green hydrogen production over the next six years.

The Green Hydrogen Catapult Initiative is a brainchild of founding partners Saudi clean energy group ACWA Power, Australian project developer CWP Renewables, European energy giants Iberdrola and Ørsted, Chinese wind turbine manufacturer Envision, Italian gas group Snam, and Yara, a Norwegian fertilizer producer.

The companies hope to drive 25GW of green hydrogen production by 2026, a scale that could significantly drive down hydrogen costs to below $2/kg thus making the fuel source competitive with fossil fuels in power generation.

Green hydrogen is produced using renewables as an energy source in the electrolysis of water.

But make no mistake about it: The hydrogen and ammonia sectors may be inextricably joined at the hip.

According to Argus Media , global ammonia production currently stands at 180mn t/yr, but its potential use as an energy source and energy carrier could see demand for it rise to a multi-billion tonne market for use in a wide range of applications.

Indeed, according to some reports the global ammonia industry is set to reach US$70.3 billion by the year 2027.

Argus says that Green ammonia is now one of the main fuels being considered by the maritime sector to enable the shipping industry to meet new CO2 reduction targets proposed by 2030 and 2050. Ammonia is also being seriously considered as a means to store renewable energy for delayed use, and as a carrier for hydrogen transportation.

As an energy source, ammonia has 9x the energy capacity of lithium-ion batteries and is 1.8x more energy-dense than liquid hydrogen.

Yet, widespread use of ammonia in these sectors can be viable only if the CO2 emissions associated with its actual production are sharply reduced. This will require significant fresh investment in new technology and, based on current renewable energy prices, a rise in operating costs.

Green ammonia as a marine fuel

Following on from the introduction of the International Marine Organization (IMO) in 2020, which imposed a cap on marine sulfur emissions, Argus reports that the next major regulatory change for the shipping industry is for vessels to sharply reduce CO2 emissions. The IMO’s initial strategy on this effort calls for CO2 emissions to be reduced by 40pc by 2030 and 70pc by 2050, compared with 2008 levels .

While efficiency gains and the substitution of hydrocarbon fuels can go a long way towards meeting the 2030 target, there is emerging consensus in the maritime industry that in order to meet IMO requirements, traditional fossil fuels will no longer be viable for use as a bunkering fuel after the 2050 deadline. A number of energy sources are being considered as replacements, and these include hydrogen and ammonia.

Green ammonia is gaining particular ground, both for combustion as a marine fuel and in fuel cells on ships.

Unlike conventional ammonia, which is typically produced using natural gas as feedstock, green ammonia is produced by using solar/wind/hydropower to produce electricity that then feeds an electrolyzer to extract hydrogen from water, while nitrogen is separated from air using an air separation unit.

There’s a big push in the ammonia technology field to use renewable energy to produce ammonia while addressing the crucial issues of maximizing energy efficiency and reducing capital expenditure and operating costs.

Over 120 global ports already accept ammonia currently.

A number of new green ammonia projects were launched in 2020, the largest--an ambitious $5bn joint venture in northwest Saudi Arabia--will see a 1.2mn t/yr green ammonia plant being built in the new cross-border city of Neom. The project is a joint venture between US firm Air Products , Saudi-based ACWA Power and Neom, and the plant will run on 4GW of renewable solar and wind energy.

AmmPower Corp. ( CSE:AMMP ; OTC:AMMPF ) is aiming to pioneer green ammonia in North America. The company is working on innovative ways to improve the ammonia production process by developing proprietary technologies that may potentially move away from the traditional Haber-Bosch process altogether.

#3 First Mover Advantage

As we have pointed above, AmmPower Corp. ( CSE:AMMP ; OTC:AMMPF ) aims to be to the green ammonia industry what Plug Power Inc. (NASDAQ:PLUG) is to the hydrogen fuel cell industry: A clean energy pioneer seeking to develop disruptive technology and unique intellectual property (IP).

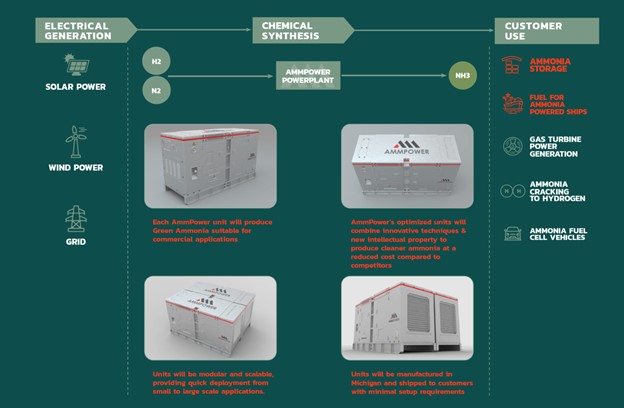

AmmPower is planning to build modular, scalable, stackable green ammonia producing units that are flexible enough to fit a wide array of customers from individual organizations, large marine ports, and distribution hubs.

The AmmPower team is working with its partners to develop a more efficient ammonia production process by incorporating innovative catalysts and refining processing conditions to more efficiently produce ammonia.

Further, AmmPower is in the process of securing a manufacturing facility in Michigan to develop optimal catalytic reactions that produce green ammonia.

We think AmmPower Corp. along with a handful of smaller organizations such as Iceland-based Atmonia and Colorado-based Starfire Energy , may enjoy a clear first-mover advantage as some of the first companies developing innovative ways to improve the entire ammonia production process and produce carbon-free ammonia.

AmmPower is aiming to scale up quickly, producing modular units able to produce between 1 - 2 tons of ammonia per day in Phase 1 of their plan.

#4 We Think AmmPower Has Great Potential

Hydrogen may eventually end up taking a very large role in heavy industry. Green ammonia will enable it to do that, and so much more. In our view, this could be far bigger than lithium.

We think that means AmmPower ( CSE:AMMP ; OTC:AMMPF ) is sitting on a massive opportunity. The technology it’s developing may be used to safely store and ship hydrogen.

And over 120 ports around the world have already built or are in the process of building scalable ammonia handling facilities.

The first ammonia tankers may start coming online soon, as global economies emerge from pandemic lockdown.

The company is aiming to develop a process and intellectual property to improve the efficiency in production of Green Ammonia, and we think there couldn’t be a better time to harness the potential of this space.

Yet, the market cap of this small, ambitious company is only about $C80 million. It’s developing technology in a sector which might become one of the biggest opportunities since the industrial revolution itself.

Source: Yahoo Finance

That makes it look grossly undervalued to us in today’s energy equation. Potentially, not for long.

Other companies to watch as the hydrogen market heats up:

Even old-school fossil fuel producers are getting in on this race. Suncor (NYSE:SU, TSX:SU) might be known mostly for its oil production. But it’s one of the few majors really pushing the boundaries. In fact, it has pioneered a number of high-tech solutions for finding, pumping, storing, and delivering its resources. When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

But that’s just one part of its business, however. Suncor is also a world leader in renewable energy innovations. Recently, the company invested $300 million in a wind farm located in Alberta. Additionally, as Canada moves away from oil, Suncor is well positioned to take advantage of another one of the country’s resource reserves; Lithium. The best part? It doesn’t even have to move very far. In fact, Alberta’s oil sands are a major hotspot for lithium production.

Cenovus Energy (TSX:CVE) is most known for its oil business, but it is also actively investing in renewable energy. More importantly, however, is that it has set truly ambitious sustainability goals for itself, aiming to cut emissions by a massive 30% in just 10 years.

This is one of the most actively traded stocks on the TSX. The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

Westport Fuel Systems (NASDAQ:WPRT, TSX:WRPT) isn’t necessarily a resource play, but it is an important company to watch as new fuels and new forms of energy take the spotlight. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since May 2020, the company has seen its stock price rise by 322%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

While alternative fuels are worth watching, another mineral is set to play a critical role in the alternative transportation of tomorrow. That’s right, it’s lithium. And a leader in that realm is Lithium Americas Corp. (TSX:LAC). It is one of North America’s most important and successful pure-play lithium companies. With two world-class lithium projects in Argentina and Nevada, Lithium Americas is well-positioned to ride the wave of growing lithium demand in the years to come. It’s already raised nearly a billion dollars in equity and debt, showing that investors have a ton of interest in the company’s ambitious plans, and it will likely continue its promising growth and expansion for years to come.

It’s not ignoring the growing demand from investors for responsible and sustainable mining, either. In fact, one of its primary goals is to create a positive impact on society and the environment through its projects. This includes cleaner mining tech, strong workplace safety practices, a range of opportunities for employees, and strong relationships with local governments to ensure that not only are its employees being taken care of but locals as well.

By. Chris Hope

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the global demand for ammonia and hydrogen as commodities will continue to increase; that the research and development in the energy sector will lead to adoption of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future; that governments will continue to implement initiatives supporting reduced carbon emissions and that ammonia and hydrogen will gain traction and commercial viability as potential carbon-free or low carbon fuel alternatives; that AMMP will be able to develop an efficient process and proprietary intellectual property for the production of green ammonia and that AMMP’s process, if developed, will be adopted commercially to allow use of green ammonia and/or hydrogen as a viable fuel sources; that investors will continue to seek opportunities for investment in green technologies and that hydrogen and ammonia will be considered as viable investment opportunities in the future; and that AMMP can carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the global demand for ammonia and hydrogen may not actually continue to increase if other energy alternatives such as solar, wind or hydroelectric are favored over ammonia and hydrogen; that the research and development in the energy sector may lead to rejection of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future, and that research may find that other fuels or energy sources provide safer, more cost efficient and/or more viable fuel alternatives; that governments may not implement the anticipated funding and initiatives to support reduced carbon emissions sufficient for ammonia and hydrogen to gain necessary traction or commercial viability as fuel alternatives; that AMMP may be unable to develop an efficient process or any unique proprietary intellectual property for the production of green ammonia or, even if developed, may ultimately fail to be adopted as commercially viable for various reasons; that investors favour other clean energy opportunities than hydrogen and ammonia or that other fuel alternatives such as solar, wind and hydroelectric may be considered more commercially viable; and that AMMP may, for any number of reasons, fail to carry out its intended business plans. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “Oilprice.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:AMMP. In addition, AMMP has issued 500,000 restricted stock units to Oilprice which will unconditionally convert to common shares after 4 months. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner and affiliates of Oilprice.com own shares and/or other securities of AMMP and therefore have an additional incentive to see the featured company’s stock perform well. Oilprice.com is therefore conflicted and is not purporting to present an independent report. The owner and affiliates of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation, nor are any of its writers or owners.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.