The African nation of Namibia has never produced a barrel of oil in its history. Now, for the second time in less than two months, it’s received positive signs that it could be home to 120 Billion barrels of oil generated in its giant Kavango basin.

The small-cap explorer that’s bringing in the good news for Namibia is Reconnaissance Energy Africa (“ Recon Africa ”) ( TSXV:RECO , OTC:RECAF ) , and its stock spiked last week after it encountered evidence of oil and gas for a second time and made an impressive commitment to ESG .

On April 15th, Recon Africa announced the results of its first of three drills (6-2), showing evidence of an active petroleum system .

Not only did the results point to indicators of an active petroleum system in this nearly 9-million-acre basin, but also provided 200 meters of oil and natural gas indicators/shows over three discrete intervals in a stacked sequence of reservoir and source rock.

Then, on June 3rd, RECO gave investors another reason to be excited, when the first section of its second well (6-1) provided further confirmation of a working petroleum system. At shallow depths, the well encountered 134 meters of light oil and gas.

The second well is 16 kilometers from the first well and is in the same sub-basin.

"In these first two wells, the many oil and gas shows, with such variety, is certainly remarkable. It is highly encouraging to see clastic and thick carbonate sections which appear to have similar reservoir characteristics as observed in many other petroleum provinces,” ReconAfrica director Dr. Jim Granath said in a statement.

With intermediate casing operations now complete and drilling on schedule, Recon Africa ( TSXV:RECO , OTC:RECAF ) expects to finish drilling its 6-1 well by the end of this month.

The company also announced its commitment to allocate a minimum of CA$10 million of ESG expenditures to the Kavango region in which it operates.

The anticipation appears to have increased excitement around the stock since mid-April when early results and indications of a working petroleum system in the giant Kavango basin came as a surprise to many. The anticipation for us is now palpable.

Stock forums look to be buzzing… particularly since the rights to this huge basin, the size of Belgium, belong to a small-cap explorer that appears to have significant potential and cash in the bank…

Spencer Hohan, a petroleum engineer, commented on Yahoo :

“As a Petroleum Engineer of 40 years now, having spent a career with major oil companies, and smaller independents, it's hard to emphasize how rare it is for some like this to be a ‘hit’ on the first penetration well drilled based primarily on a geomagnetic survey. This is astounding. If the second well shows anywhere near similar geophysical properties, and further confirms the basin structure, this could easily be worth more than a hundred times its current price. Sorry, shorts. You'd best cover today, or you are bankrupt. And it may be too late already.”

Doug, an early investor, commented on Yahoo :

“So far, so good, not only in exploration success, but also good will and investment in the people of Namibia. I invested in RECAF in October, 2020 at 0.7138. I then invested for 3 of my grandkids and showed them the company video to give them background on the oil exploration and talk about a company helping the community and country. Good companies not only make profit, they help people prosper. From what I can see, well done, team RECAF, well done.”

It’s a hot topic of conversation on Stocktwits , too:

We think that retail investors may just have found their favorite new stock.

The Fast-Paced De-Risking of Our Pick For The Onshore Oil Play of the Decade

When the first results came in April, Dan Jarvie – Recon Africa’s geochemist and advisory board member - confirmed the results as showing indicators of the existence of a working petroleum system , stating:

“These shows are indicative of migrated, thermogenic petroleum and occur over three different intervals in the 6-2 test well. The intervals penetrated include highly porous, permeable sediments and marine source rocks as predicted, and extensive marine carbonate lithofacies. Mud gas results indicate a high BTU gas with the presence of light oil in numerous cutting samples. Based on these initial results, the components and processes for a working petroleum system are all present.”

The Namibian government, too, felt there was cause for excitement.

Promising results could put Namibia on the world’s oil exploration map in a very positive way.

“This is great news for the people of Namibia, with the results of the well confirming a big potential for a very valuable energy resource for our country and therefore a significant development for Namibia onshore exploration efforts,” Hon. Tom Alweendo, Namibian Minister of Mines and Energy, stated in a press release. The positive results of this well have provided us with the critical information required to unlock the country’s petroleum prospectivity and is the first step in the process of locating significant accumulations, we can now confidently confirm Namibia is endowed with an active onshore petroleum basin.”

And it just keeps getting better.

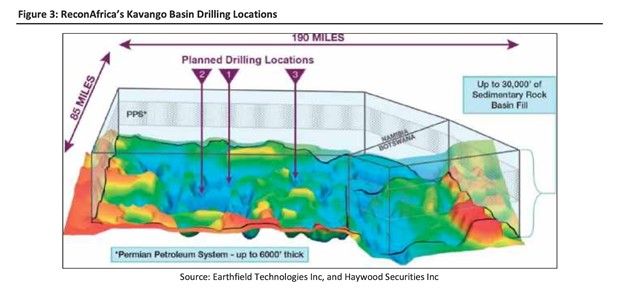

The Kavango basin is over 8.5 million acres and as deep as the Permian basin in Texas.

That’s a huge basin for a small-cap company, but it’s fully funded for a 6-well drill and extensive seismic campaign, and we think it’s so far proven that it has what it takes with its experienced team.

When Kavango started coming to the attention of some investors a few years ago, geologist and geophysicist Bill Cathey, who has worked with many of the oil and gas supermajors, commented about the basin: “nowhere in the world is there a sedimentary basin this deep that does not produce commercial hydrocarbons.”

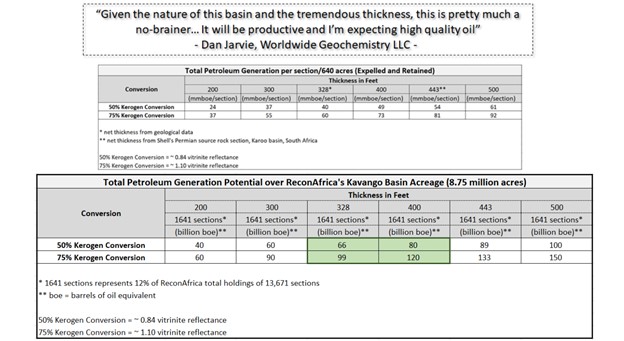

To put things into perspective, late last year, Dan Jarvie provided what he called a “conservative” estimate of Kavango’s potential based on only 12% of Recon’s holdings.

He estimated the basin could have generated 120 billion barrels of oil equivalent.

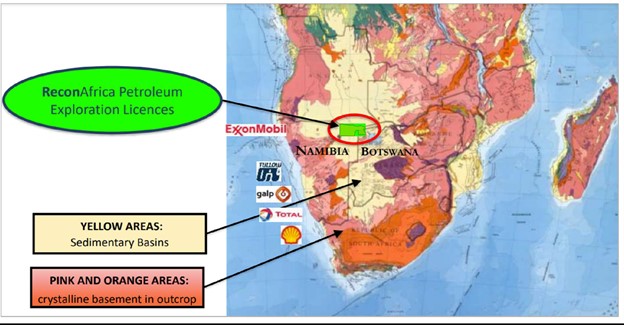

In November, Haywood Securities initiated coverage on RECO ( TSXV:RECO , OTC:RECAF ) , saying that a discovery success would present manifold opportunities for strategic joint ventures for further de-risking--without additional shareholder dilution.

A month later, Haywood adjusted their evaluation, noting that results showing evidence of the presence of a working hydrocarbons system, “should provide abundant opportunities for further exploration and appraisal drilling”.

Even without the recent positive first drill results showing indicators of a petroleum system, Haywood appeared to see material upside as Kavango may be de-risked:

Haywood’s adjustment also coincided with an analogous report from Wood Mackenzie , comparing RECO’s Kavango basin to the enormous (Permian aged) Midland Basin in Texas. The Midland basin’s estimated development value is $540 billion.

In April, when RECO ( TSXV:RECO , OTC:RECAF ) released its first results, Haywood raised its price target.

Shortly afterward, in May, ReconAfrica announced a C$25-million bought deal financing with Haywood.

Now, Haywood has adjusted its short term price target on RECO upwards, saying the company “has all the ingredients to establish the existence of a working hydrocarbon system (in a relatively short cycle time) and subsequently evaluate and exploit the potential of the Kavango Basin”.

That includes “a fully-funded six well drilling and extensive seismic program, nearly 100% working interest in acreage across a vast, relatively straightforward land access, an owned drilling rig, a committed and capable management and technical team, stable governments with attractive fiscal terms and proven commitment to responsible development” … among other things.

So now, the important question is whether it’s too late for investors to grab onto this opportunity. We don’t think so.

Year-to-date, RECO ( TSXV:RECO , OTC:RECAF ) is up approximately 377%.

There is a sizable amount of risk here. As Haywood notes, this is a high-risk/high-reward oil play. If the exploration fails, it could disappoint investors. But if it continues to find indicators of the existence of oil and its economic viability, we think it stands to have very exciting potential because this is a junior explorer sitting on a super-major size play.

The drivers of further upward movement in the near future include, most urgently, the completion of drill no. 2 by the end of this month, and the full analysis of all results from the wells 6-1 and 6-2 which are anticipated at the end of July.

From the first well (6-2) over 150 sidewall cores have been taken to Core Labs in Houston and 37 sidewall cores are on their way there as well from the shallower section of the second well (6-1).

And we think there are plenty more drivers further out …

We’re talking about a basin the size of Belgium, the rights to which are owned by a small-cap explorer with experienced geologists and cash to potentially go even beyond a six well drill campaign. If this continues, and it’s economically viable, it may enter JV territory, when investors could be rewarded for having jumped in on what could end up being the last major onshore oil discovery the world ever sees.

Other oil companies to watch as crude prices continue to climb:

Even old-school fossil fuel producers are getting in on this race. Suncor (NYSE:SU, TSX:SU) might be known mostly for its oil production. But it’s one of the few majors really pushing the boundaries. In fact, it has pioneered a number of high-tech solutions for finding, pumping, storing, and delivering its resources. When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

But that’s just one part of its business, however. Suncor is also a world leader in renewable energy innovations. Recently, the company invested $300 million in a wind farm located in Alberta. Additionally, as Canada moves away from oil, Suncor is well positioned to take advantage of another one of the country’s resource reserves; Lithium. The best part? It doesn’t even have to move very far. In fact, Alberta’s oil sands are a major hotspot for lithium production.

Asia isn’t going to be left behind in the oil race. In fact, as demand for energy continues to explode in a post-pandemic China, CNOOC Limited (NYSE:CEO, TSX:CNU) will likely be one of the biggest benefactors. It’s the country’s most significant producer of offshore crude oil and natural gas and may well be one of the most controversial oil stocks for investors on the market. A label that has nothing to do with its operations, however.

It is still unclear how the growing antipathy between China and the United States will affect America’s natural gas sector, given that CNOOC is China's largest importer of LNG. But as the Biden Administration grapples with some of the geopolitical missteps of the previous administration, Chinese companies, including CNOOC, are likely to breathe freely once again, and it could be a boon for Chinese stocks.

Enbridge (TSX:ENB ) is in a unique position as oil and gas stages its 2021 comeback. As one of the more potentially undervalued companies in the sector, it could be set to win big this year. But that’s only if it can overcome some of the challenges in its path. Most specifically, its Line 3 project which has faced scrutiny from environmentalists.

While this challenge may prove difficult for Enbridge to overcome, the health of the Canadian oil industry is improving, and with it, the outlook for Canadian producers such as Enbridge. The company has already started the year off strong, and if it can continue its momentum, it will likely be able to see a sustained rally in its share price over the course of the year.

Cenovus Energy (TSX:CVE) is most known for its oil business, but it is also actively investing in renewable energy. More importantly, however, is that it has set truly ambitious sustainability goals for itself, aiming to cut emissions by a massive 30% in just 10 years.

This is one of the most actively traded stocks on the TSX. The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

Tourmaline Oil Corp (TSX:TOU) is another Canadian resource producer focusing on exploration, production, development and acquisition within Western Canadian Sedimentary Basin. The company is in possession of an extensive undeveloped land position with long-term growth opportunities and a large multi-year drilling inventory. Tourmaline’s strong leadership make the company a promising pick for investors looking to take advantage of the tremendous Canadian oil opportunities which are due for a strong rebound as oil prices inch higher.

By. Chris Davey

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements. Statements contained in this document that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of Recon. All estimates and statements with respect to Recon’s operations, its plans and projections, size of potential oil reserves, comparisons to other oil producing fields, oil prices, recoverable oil, production targets, production and other operating costs and likelihood of oil recoverability are forward-looking statements under applicable securities laws and necessarily involve risks and uncertainties including, without limitation: risks associated with oil and gas exploration, including drilling and other exploration activities, timing of reports, development, exploitation and production, geological risks, marketing and transportation, availability of adequate funding, volatility of commodity prices, imprecision of reserve and resource estimates, environmental risks, competition from other producers, government regulation, dates of commencement of production and changes in the regulatory and taxation environment. Actual results may vary materially from the information provided in this document, and there is no representation that the actual results realized in the future will be the same in whole or in part as those presented herein. Other factors that could cause actual results to differ from those contained in the forward-looking statements are also set forth in filings that Recon and its technical analysts have made. We undertake no obligation, except as otherwise required by law, to update these forward-looking statements except as required by law.

Exploration for hydrocarbons is a highly speculative venture necessarily involving substantial risk. Recon's future success will depend on its ability to develop its current properties and on its ability to discover resources that are capable of commercial production. However, there is no assurance that Recon's future exploration and development efforts will result in the discovery or development of commercial accumulations of oil and natural gas. In addition, even if hydrocarbons are discovered, the costs of extracting and delivering the hydrocarbons to market and variations in the market price may render uneconomic any discovered deposit. Geological conditions are variable and unpredictable. Even if production is commenced from a well, the quantity of hydrocarbons produced inevitably will decline over time, and production may be adversely affected or may have to be terminated altogether if Recon encounters unforeseen geological conditions. Adverse climatic conditions at such properties may also hinder Recon's ability to carry on exploration or production activities continuously throughout any given year.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, the “Company”) have not been paid by Recon for this article, but has been paid for a promotional campaign in the past and may again be paid in the future. As the Company has been paid and may again be paid in future by Recon for promotional activity, there is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated for this particular article but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:RECO. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.