NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA OR TO US WIRE SERVICES

- Extended the term on the existing $1.8M debt financing into May 2022

- In Q2-2022, Rogue Stone sold 5,431 tons realizing $81/ton1 with COGS of $42/ton

- Rogue recorded $74,474 in Adjusted EBITDA in Q2-2022

- Acquired and commissioned a dual Guillotine circuit at Orillia, to enhance the existing Bulk product line

- Rogue owns 6,666,667 of EV Nickel Inc., which began trading on the TSXV with the ticker "EVNI"

- A Corporate Update conference call will be held with investors on Thursday, January 4th, 2021 at 12:00pm EST

TORONTO, ON / ACCESSWIRE / December 14, 2021 / Rogue Resources Inc. (TSXV:RRS) ("Rogue" or the "Company") has chosen to extend the $1.8M debt financing (the "Debt Facility") with a leading Canadian, non-bank lender (the "Credit Group"). The Debt Facility is secured against all of the Company's assets and will be extended for 6 months. The financing originally had a 12-month term, to which 3 months were added almost immediately when the Company negotiated relief around the early impact of COVID-19 (for further detail see the March 5, 2020 and April 27, 2020 news releases) and then was extended 6 months ago (refer to June 7, 2021 news release). The Debt Facility has interest-only payments until the principal is due in full at maturity, carrying an interest rate equal to the higher of prime plus 8.05% or 12%. There were no penalties or further fees related to the extension.

"Though expensive, the Debt Facility has financed a cash flowing business and the Credit Group have been good partners", said Sean Samson, President and CEO of Rogue. "There is good potential across the Stone business and we continue to believe that lower interest financing will be supported with the lengthening track record."

Rogue Stone - Q2-2022, August-October Update

The Company is pleased to announce continued progress at Rogue Stone with 5,431 tons sold in Q2-2022, from August through October, with an average realized price per ton of $81 and Cost of Goods Sold ("COGS") of $42/ton. The Company has filed its Q2-2022 financials for the quarter ended October 31, 2021 (available on Rogue's website or through the SEDAR filing system).

"We are pleased to see that the demand and sales of limestone are continuing to meet or exceed expectations.", said Sean Samson, President and CEO of Rogue. "We anticipate that our sales volume will continue to be strong through the winter period working collaboratively with our customers, restocking their stone yards and providing them with high quality limestone products."

|

Period

|

Tons

|

Average Realized Revenue per ton sold

|

Average Cost of Goods ("COGS") per ton sold

|

| Q3-2021 (Nov 2020 - Jan 2021) |

6,914

|

$70

|

$37

|

| Q4-2021 (Feb - April) |

5,398

|

$80

|

$48

|

| Q1-2022 (May - July) |

6,547

|

$88

|

$40

|

| Q2-2022 (Aug - Oct) |

5,431

|

$81

|

$42

|

Rogue Stone - Growing into selling Guillotined Stone alongside current Bulk focus

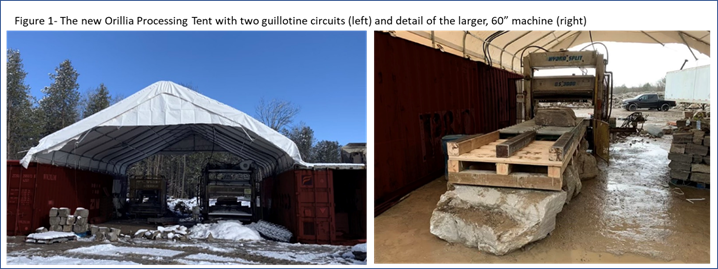

The Company has purchased and commissioned two used stone guillotines and erected an industrial tent at its Orillia Quarry to complement the existing Bulk Stone sales. Rogue Stone commenced production and sales of Guillotined Stone in November 2021. To date, Rogue Stone has been focused on extracting stone and after some basic shaping, loading it directly onto a flatbed or placed on a skid and then loaded. The guillotines provide Rogue Stone with the capability to break stone to more consistent specifications that are sold as higher value skidded material. Product sold through this new processing circuit will realize higher revenue per ton sold than the COGS increase resulting in higher unit margins.

"The opportunity presented itself to acquire these two guillotines and the Company jumped at the chance to get into the higher value, guillotine stone market,", said Sean Samson, President and CEO of Rogue. "I'm proud of how the team has been able to erect and commission the equipment, operating the circuits safely and getting Rogue Stone positioned as vendors of this premium guillotined stone."

EV Nickel IPO

EV Nickel Inc. ("EVNi") has successfully completed the process for an Initial Public Offering ("IPO") and is now trading on the TSX-V, with the ticker "EVNI". Rogue sold the Langmuir Property to EVNi, to launch that company's business in the Shaw Dome near Timmins, Ontario (see news release dated March 26, 2021). All information related to the process and the company's plans are available at www.evnickel.com.

Since Rogue owns 6,666,667 shares of EVNi, Rogue shareholders are urged to pay close attention to the developments of EVNI as any success will provide potential upside for Rogue, through its financial participation. Concurrent with EVNi's IPO, the company raised $5.4M and plans to continue exploration with the proceeds of this funding (there are no further contributions required from Rogue shareholders).

As outlined in the public filings, Rogue and EVNi share management. The Rogue Board feels this is the best way to preserve Rogue's interests in EVNi and the EVNi investors want to leverage the skills and expertise of the Rogue Management Team.

Corporate Update Conference Call

These developments will be discussed in greater detail on a conference call with management scheduled for Thursday January 4, 2021, at noon Eastern (9am Pacific, 6pm in Western Europe). Rogue CEO Sean Samson and VP, Technical Paul Davis will give a brief presentation followed by a question and answer period. Interested investors can forward questions in advance to questions@rogueresources.ca. Dial-in numbers to access the conference call as well as a new corporate presentation will be available by noon the day before, on the Rogue webpage at www.rogueresources.ca.

As with past calls, a playback of the call will be available online soon afterwards.

About Rogue Resources Inc.

Rogue is a mining company focused on generating positive cash flow. Not tied to any commodity, it looks at rock value and quality deposits that can withstand all stages of the commodity price cycle. The Company includes Rogue Stone selling quarried limestone for landscape applications from two operating quarries in Ontario; Rogue Quartz focused on advancing its silica/quartz business with the Snow White Project in Ontario and the Silicon Ridge Project in Québec; Rogue Timmins with the gold potential at Radio Hill and an ownership position in EV Nickel (TSXV:EVNI), exploring in the Shaw Dome.

Qualified Person

The Company's Projects are under the direct technical supervision of Paul Davis, P.Geo., and Vice-President of the Company. Mr. Davis is a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical information in this press release. There are no known factors that could materially affect the reliability of the information verified by Mr. Davis.

For more information visit www.rogueresources.ca or contact:

+1-647-243-6581

info@rogueresources.ca

Cautionary Note Regarding Forward-Looking Statements:

This news release contains certain statements or disclosures relating to the Company that are based on the expectations of its management as well as assumptions made by and information currently available to the Company which may constitute forward-looking statements or information ("forward-looking statements") under applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "believes", "anticipates", "expects", "plans", "intends", "target", "estimates", "projects", "continue", "potential" and similar expressions, or are events or conditions that "will", "would", "may", "could" or "should" occur or be achieved. In particular, but without limiting the foregoing, this news release contains forward-looking statements pertaining to the following: closing of future tranches of the Private Placement.

The forward-looking statements contained in this news release reflect several material factors and expectations and assumptions of the Company including, without limitation: business strategies and the environment in which the Company will operate in the future; commodity prices; exploration and development costs; mining operations, drilling plans and access to available goods and services and development parameters; regulatory restrictions; the ability of the Company to obtain applicable permits; the ability of the Company to service its debt obligations; the Company's ability to qualify for government funded support programs; the Company's ability to raise capital on terms acceptable to it or at all; activities of governmental authorities (including changes in taxation and regulation); currency fluctuations; the unpredictable economic impact of the COVID-19 pandemic, including the acquisition of equipment and recruitment of human resources required for the sales expansion; the global economic climate; and competition.

The Company believes that the material factors, expectations and assumptions reflected in the forward-looking statements contained in this news release are reasonable at this time but no assurance can be given that these factors, expectations and assumptions will prove to be correct. The forward-looking statements included in this news release are not guarantees of future performance and should not be unduly relied upon. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements including, without limitation, those risks identified in the Company's most recent annual and interim management's discussion and analysis, copies of which are available on the Company's SEDAR profile at www.sedar.com. Readers are cautioned that the foregoing list of factors is not exhaustive and are cautioned not to place undue reliance on these forward-looking statements.

The forward-looking statements contained in this news release are made as of the date hereof and the Company undertakes no obligations to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the U.S. Securities Act) unless registered under the U.S. Securities Act and applicable state securities laws, or an exemption from such registration is available.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

1 The landscape stone trade is transacted using imperial "tons" in contrast to both base metals and industrial minerals (including nickel and quartz, which use metric "tonnes". Permitting of stone in Ontario is regulated in tonnes.

SOURCE: Rogue Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/677690/Rogue-Update-Extends-Debt-Facility-Stone-Sales-Continue-and-Moves-into-Added-Value-Guillotined-Product-EVNi-now-Trading