Golden Minerals Company (“Golden Minerals”, “Golden” or the “Company”) (NYSE-A: AUMN and TSX: AUMN) is pleased to announce assay results from the first drill program ever conducted at its Sarita Este gold-silver-copper prospect in Salta Province, Argentina. The Company drilled 10 diamond drill (“DD”) holes totaling 2,518 meters (“m”) exploring several targets of untested epithermal gold-silver and copper porphyry targets. Highlights from the drilling include:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220119005176/en/

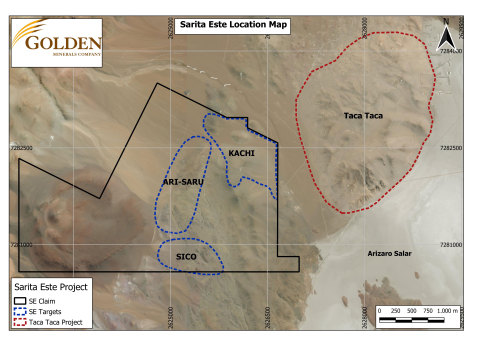

Figure 1: Sarita Este project location map (Graphic: Business Wire)

Epithermal gold target:

- 9.9m @ 1.91 grams per tonne (“g/t”) Au and 5.0 g/t Ag including 3.7m @ 2.52 g/t Au and 5.3 g/t Ag

- 8.0m @ 1.74 g/t Au and 1.0 g/t Ag including 1.0m @ 12.0 g/t Au and 1.9 g/t Ag

- 3.7m @ 1.64 g/t Au and 0.3 g/t Ag including 1.0m @ 5.17 g/t Au and 0.3 g/t Ag

Porphyry copper target:

- 240m @ 0.13% Cu

- 130.5m @ 0.13% Cu including 6m @ 1.17% Cu

The Sarita Este project is located in the highly mineralized Argentina porphyry belt adjacent to the Taca Taca copper porphyry deposit owned by First Quantum Minerals. Golden Minerals’ exploration drilling successfully identified two potentially related mineral systems: shallow oxide-gold, epithermal-style mineralization at the Sico target, and oxide and supergene enriched copper-porphyry style mineralization at the Kachi target.

Warren Rehn, Golden Minerals’ President and Chief Executive Officer, stated, “The gold results at the Sico epithermal target are very encouraging, as this is the first ever drilling on the property and the discovery of the shallow oxide gold shows widths and grades that are potentially economic. We are additionally encouraged by the results at the Kachi porphyry target which indicate the potential for a newly identified copper porphyry system that may be similar to the adjacent Taca Taca world class copper deposit.”

Sico and Ari Saru Targets

Six holes totaling 1,020 meters were drilled exploring a series of gold-bearing epithermal structures identified by surface mapping and sampling conducted in 2020 that returned grades up to 162 g/t Au at surface. The drill holes intersected multiple wide zones of near-surface oxide-gold mineralization, indicating the area has the potential to host a large bulk tonnage gold deposit. New permits have been submitted for trenching and additional drilling that the Company plans to complete during a 2022 field campaign.

Table 1: Significant results drilled at ‘Sico’ and ‘Ari Saru’ epithermal gold targets

| Sico & Ari Saru Epithermal Gold Targets |

| Hole ID |

From (m) |

To (m) |

Interval (m) |

Au g/t |

Ag g/t |

| SE21002 |

No Significant Results |

| SE21003 |

68.3

|

72.0

|

3.7

|

1.64

|

0.3

|

| including |

71.0

|

72.0

|

1.0

|

5.17

|

0.3

|

| SE21003 |

79.4

|

82.2

|

2.9

|

2.31

|

0.3

|

| including |

79.4

|

79.8

|

0.4

|

13.60

|

0.7

|

| SE21004 |

43.0

|

51.0

|

8.0

|

1.74

|

1.0

|

| including |

43.0

|

44.0

|

1.0

|

12.00

|

1.9

|

| SE21007 |

No Significant Results

|

| SE21008 |

16.4

|

26.2

|

9.9

|

1.91

|

5.0

|

| including |

22.5

|

26.2

|

3.7

|

2.52

|

5.3

|

| SE21008 |

31.5

|

34.6

|

3.1

|

1.11

|

5.6

|

| SE21010 |

No Significant Results |

Kachi Target

The Kachi target is located in the northern corner of the property where surface mapping and sampling has identified porphyry copper-style mineralization. The Company completed four holes totaling 1,498 meters exploring this target and the majority of the holes encountered wide zones of low-grade copper mineralization, suggesting that they intersected the periphery of a potentially large porphyry copper deposit.

Significant drill results are summarized in the tables below, with complete results available on the Company website. [link]

Table 2: Significant results drilled at ‘Kachi’ porphyry copper target

| Kachi Porphyry Copper Target |

| Hole ID |

From (m) |

To (m) |

Interval (m) |

Au g/t |

Cu % |

Mo ppm |

| SE21001 |

No Significant Results |

| SE21005 |

314.0

|

348.7

|

34.7

|

0.04

|

0.14

|

53.2

|

| including |

342.0

|

344.0

|

2.0

|

0.23

|

0.36

|

107.0

|

| SE21006 |

0.0

|

240.0

|

240.0

|

0.09

|

0.13

|

15.2

|

| including |

93.0

|

240.0

|

147.0

|

0.08

|

0.16

|

20.6

|

| including |

172.0

|

192.0

|

20.0

|

0.08

|

0.33

|

11.6

|

| including |

186.0

|

188.0

|

2.0

|

0.05

|

0.93

|

6.0

|

| SE21009 |

127.0

|

257.5

|

130.5

|

0.01

|

0.13

|

14.4

|

| including |

172.0

|

178.0

|

6.0

|

0.00

|

1.17

|

24.4

|

Note: Intervals in the tables represent drilled length. Intervals and grades have been rounded to either one or two decimal places.

About Sarita Este

Sarita Este is a gold-silver-copper prospect located in the Puna region of Salta province, northwest Argentina. The property is controlled by Golden Minerals Company through its 100% owned subsidiary, Colque Exploraciones S.A. Golden Minerals has an option agreement to acquire rights to 51% of the 830-hectare property from Cascadero Minerals Corporation, a company controlled by Cascadero Copper Corporation (TSX.V: CCD), by spending $2.5 million over four years. Golden has spent approximately $1.4 million since entering into the agreement in December 2019.

Review by Qualified Person and Quality Control

The technical contents of this press release have been reviewed by Aaron Amoroso, a Qualified Person (“QP”) for the purposes of NI 43-101. Mr. Amoroso has over 14 years of mineral exploration experience and is a Qualified Person member of the American Institute of Professional Geologists (QP Geology & Ore Reserves, 01548QP). To ensure reliable sample results, Golden Minerals uses a quality assurance/quality control program that monitors the chain of custody of samples and includes the insertion of blanks, duplicates, and reference standards in each batch of samples.

Quality Assurance / Quality Control

DD drilling was conducted with a CSD 1800 diamond drill rig provided by Eco Drilling S.A.. Holes were drilled azimuths ranging from 0 to 320° and a dip ranging from -50o to -90°. Drill holes were drilled to depths ranging from 138m to 490m. Local fresh water was used to flush, condition and recirculate within the holes. Holes were positioned with a hand-held GPS (accuracy +/- 5 meters) and will be surveyed with a Differential GPS once the campaign is completed. Sampling was conducted by qualified field assistants under the supervision of a geologist. The drilled core was photographed, measured, marked and cut into half and quarter core samples in lengths ranging from 30 centimeters to 2 meters. Diamond core was collected from the drill rig and logged by a geologist on site at the core shack.

Drill-core was shipped to ALS Chemex sample preparation facility in Godoy Cruz, Mendoza, Argentina for sample preparation and for analysis at the ALS laboratory in Lima, Peru. The ALS Mendoza and Lima facilities are ISO 9001 and ISO/IEC 17025 certified.

The samples were crushed to 70% passing 2mm (PREP-31) and a split of up to 250 grams pulverized to 85% passing 75 micrometres (-200 mesh). The sample pulps and crushed splits were transferred internally to ALS Global’s Lima, Peru analytical facility for gold and multi-element analysis. Pulps (30gram split) are submitted for Au analysis by Fire Assay with Atomic Absorption finish (Au-AA23) and silver samples were analyzed by an atomic absorption (Ag-AA62).

Over-limit Au and Ag samples are analyzed by Fire Assay with Gravimetric Finish Ore Grade (Au-GRA21 and Ag-GRA22). Overlimit base metals are analyzed by Four Acid Digestion followed by Ore Grade Inductively Coupled Plasma Atomic Emission Spectrometry (ICP-AES) for Cu, Pb and Zn (Cu-OG62, Pb-OG62, Zn-OG62).

In-house quality control samples (blanks, standards, duplicates, preparation duplicates) were inserted into the sample set by Golden Minerals. ALS Global conducts its own internal QA/QC program of blanks, standards and duplicates, and the results were provided with the Company sample certificates. The results of the ALS control samples were reviewed by Golden Minerals and the Company’s QP and evaluated for acceptable tolerances.

All sample and pulp rejects are stored at the Company’s secure warehouse in El Quevar, Salta province, Argentina pending full review of the analytical data, and future selection of pulps for independent third-party check analyses, if required.

About Golden Minerals

Golden Minerals is a growing gold and silver producer based in Golden, Colorado. The Company is primarily focused on producing gold and silver from its Rodeo Mine and advancing its Velardeña Properties in Mexico and, through partner funded exploration, its El Quevar silver property in Argentina, as well as acquiring and advancing selected mining properties in Mexico, Nevada and Argentina.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the economic potential of the discoveries at the Sarita Este property, the potential for a newly identified significant copper porphyry system at the Kachi porphyry, and anticipated trenching and additional drilling at the property in 2022. These statements are subject to risks and uncertainties, including changes in interpretations of geological, geostatistical, metallurgical, mining or processing information, and interpretations of the information resulting from exploration, analysis or mining and processing experience. Golden Minerals assumes no obligation to update this information. Additional risks relating to Golden Minerals may be found in the periodic and current reports filed with the SEC by Golden Minerals, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

Follow us at www.linkedin.com/company/golden-minerals-company/ and https://twitter.com/Golden_Minerals

For additional information please visit http://www.goldenminerals.com/

View source version on businesswire.com: https://www.businesswire.com/news/home/20220119005176/en/