Highlights:

- Program targeting definition of an initial resource for the gold-rich mineralized porphyry zone at NW Expo

- Up to 3,300 m drilling planned with a target of defining a 40 – 50 million tonne resource

- Preliminary gold deportment and metallurgical program to be initiated immediately

- Wireless IP program anticipated to commence during Q2, to aid in drill targeting for resource definition

- Trade-off studies to be completed to evaluate the impact on the North Island Project preliminary economics

Northisle Copper and Gold Inc. (TSX-V: NCX) (“Northisle” or the “Company”) is pleased to announce that it has finalized its 2022 work plans for the highly prospective new gold-rich zone at Northwest Expo. The 2022 plan is to define a resource around the gold-rich mineralized porphyry zone measuring 480 by 360 metres with an average true width of 86 metres and a true width-weighted average grade of 0.98 g/t Au or 1.23g/t Au Eq. Initial metallurgical testing will commence immediately and will be incorporated in updated trade off studies that will consider the impact of Northwest Expo on the currently defined North Island Project, where a PEA completed during 2021 indicated a preliminary after-tax NPV (8%) of C$1.1 billion based on a US$3.25/lb copper price and a US$1,650/oz gold price.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220331005307/en/

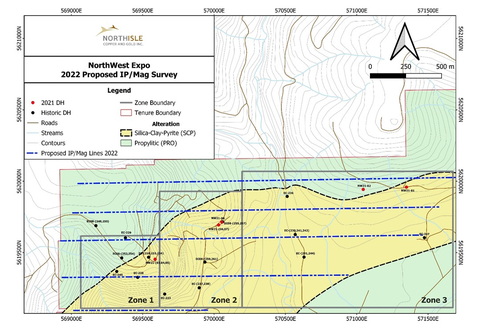

Figure 1: Proposed 2022 IP / Mag Survey (Graphic: Business Wire)

Sam Lee, President & CEO of Northisle stated “The gold-rich zone at Northwest Expo is very exciting as it opens up the possibilities for improving the economics on an already large and robust project. The fact that it is only 3.5 km away from the Red Dog deposit and that the gold-rich mineralization is open at depth and along strike makes Northwest Expo our top exploration priority for 2022. The goal for this year is to be able to include the gold-rich zone at Northwest Expo in the project’s mineral inventory at an exploration cost below $5 per ounce gold equivalent. In parallel, we will advance metallurgical and trade-off studies to assess the potential advantages that this higher grade gold zone may bring to our project.”

Northwest Expo Catalysts

Key activities at Northwest Expo for 2022 are detailed in Table 1:

|

Table 1: Key Catalysts at Northwest Expo

|

|

Timing

|

|

|

Category

|

|

|

Details

|

|

Q2 2022

|

|

|

Surface Exploration

|

|

|

Wireless IP north of Zones 1 - 3

|

|

Q3 2022

|

|

|

Preliminary Met. Results

|

|

|

Results from preliminary gold deportment studies and met testing at Northwest Expo

|

|

Q3 2022

|

|

|

Preliminary Site Investigation

|

|

|

Preliminary environmental investigations and identification of key factors for Northwest Expo target area

|

|

H2 2022

|

|

|

Drilling of Zone 1

|

|

|

Methodical drilling of Zone 1 in order to generate initial resource estimate

|

|

Q4 2022

|

|

|

Resource Estimate

|

|

|

Initial resource estimate for NW Expo gold-rich zone

|

|

Q4 2022 / Q1 2023

|

|

|

Trade-off Studies

|

|

|

Preliminary trade-off studies to evaluate impact of NW Expo gold-rich zone on North Island Project

|

Surface Exploration

The surface exploration program at Northwest Expo will include mapping and surface sampling, as well as a wireless surface geophysical survey. Surface sampling will be conducted by Northisle with the objective of outlining and sampling surface exposures of the gold-rich zone, and obtaining a better understanding of structure in the area. The geophysical program will focus on the areas to the north of IP surveys completed in 2012. The program consists of a total of 11 line- kilometres of IP and magnetometer surveys, testing to a depth of up to 800 metres, and is anticipated to provide further understanding of structure and locus of mineralization to ensure efficient use of drilling of this large target area. Figure 1 shows the location of the proposed surveys relative to recent drilling. This program is anticipated to commence in Q2 2022.

Drilling of Gold Rich Zone 1

Northisle anticipates drilling the gold-rich Zone 1 at Northwest Expo during the second half of 2022, following the IP/Mag survey, with the objective of augmenting the currently drilled significant gold intercepts (Table 2) with a target of defining an initial mineral inventory of 40-50 million tonnes. The program will include drilling of up to 11 diamond drill holes totalling 3,300 metres along approximately 100 metre spaced north-south sections extending from the eastern boundary of Zone 1 to the western extent of the geophysical lines shown in Figure 1. New drilling assays will be combined with previous drilling assays, as summarized in Table 2, in order to define a resource by the end of 2022.

|

Table 2: Zone 1 Significant Intercepts

|

|

Hole ID

|

|

From (m)

|

|

To (m)

|

|

Interval (m)

|

|

True Width (m)

|

|

Au Grade (g/t)

|

|

Cu Grade (%)

|

|

Mo Grade (%)

|

|

Re Grade (g/t)

|

|

Au Eq. Grade (g/t)

|

|

NW21-03

|

|

280.25

|

|

365.05

|

|

84.8

|

|

84.0

|

|

0.92

|

|

0.19

|

|

0.005

|

|

0.17

|

|

1.20

|

|

Including

|

|

280.3

|

|

305.0

|

|

24.8

|

|

24.8

|

|

1.30

|

|

0.10

|

|

0.007

|

|

0.30

|

|

1.46

|

|

EC-218

|

|

323.8

|

|

438

|

|

114.2

|

|

114.0

|

|

0.53

|

|

0.11

|

|

0.004

|

|

*

|

|

0.70

|

|

EC-228

|

|

151.85

|

|

221.9

|

|

70.1

|

|

70.0

|

|

1.15

|

|

0.22

|

|

0.018

|

|

*

|

|

1.52

|

|

EC-233

|

|

329.2

|

|

423.7

|

|

94.5

|

|

94.0

|

|

0.86

|

|

0.13

|

|

0.002

|

|

*

|

|

1.04

|

|

EC-234

|

|

286.5

|

|

384.0

|

|

97.5

|

|

97.5

|

|

0.94

|

|

0.16

|

|

0.003

|

|

*

|

|

1.18

|

|

EC-245

|

|

148.0

|

|

264.9

|

|

116.9

|

|

110.0

|

|

1.18

|

|

0.15

|

|

0.001

|

|

*

|

|

1.80

|

|

Including

|

|

234.7

|

|

264.9

|

|

30.2

|

|

28.4

|

|

2.03

|

|

0.25

|

|

0.001

|

|

*

|

|

2.37

|

|

EC08-254

|

|

270.00

|

|

386.00

|

|

116.0

|

|

95.0

|

|

1.00

|

|

0.17

|

|

0.005

|

|

0.37

|

|

1.26

|

|

Including

|

|

322.0

|

|

352.0

|

|

30.0

|

|

24.6

|

|

1.50

|

|

0.21

|

|

0.008

|

|

0.24

|

|

1.82

|

|

* Not analyzed in historical drilling.

|

|

Bolded holes are from 2021 drilling

|

|

Copper and gold equivalent calculations based on the following metal prices which were used in the Company’s 2021 PEA on the North Island Project:

|

|

Cu = US$3.25/lb, Au = US$1,650/oz, Mo = US$10/lb, Re = $1,256/kg. Calculations assume 100% recovery; totals may not add due to rounding

|

|

Note on equivalent calculation:

|

|

Copper equivalent is determined by calculating total contained metal value/ tonne, dividing by the copper price, and then dividing the resultant number of pounds of copper by 2204.6. Gold equivalent is determined by calculating total contained metal value/tonne, dividing by the gold price, and then multiplying the resultant number of troy ounces of gold by 31.103See news release on January 25, 2022 for additional details of the drill holes noted above.

|

Metallurgical Testing

Northisle will initiate metallurgical testing at Northwest Expo during Q2 2022, which will assess gold deportment as well as copper and gold recoverability. The initial gold deportment study will be carried out at SGS Natural Resources, Metallurgy and Consulting and will be completed in 8 to 12 weeks. The objective of this gold deportment study and metallurgical work, starting at Northwest Expo, where the gold grade is over 6 times higher than Hushamu, is to determine the approach to optimizing gold recovery at this target in anticipation of the completion of a mineral resource estimate.

Environmental Screening

Northisle is keenly focused on sustainable development of mineral resources and will conduct preliminary environmental investigations in the Northwest Expo area concurrently with mineral exploration. The focus of this program will be to continue engagement with First Nations, identify potential development constraints and opportunities, and prepare for integration of the target area into the wider environmental and socio-economic baseline study program being advanced on the project.

Share-based Compensation

Northisle’s Board of Directors has approved the issuance of 496,000 restricted share units (the “RSUs”), pursuant to the Company’s Share Unit Plan. The RSUs will vest one third per year commencing on March 29, 2023.

Further terms of the RSUs can be found in the Company’s Share Unit Plans as filed on SEDAR.

Logging, Sampling and Assaying Procedures

The diamond drill core logging and sampling program is being carried out under a rigorous quality assurance/quality control program using industry best practices. Drill intersections are typically HQ to 100 m and NQ thereafter to the end of holes. After drilling, core will be logged for lithology, alteration, including clay mineralogy utilizing a TerraSpec© Halo Mineral Analyzer, structure, and geotechnical characteristics utilizing Geospark© core logging software, then marked for sampling and photographed on site. The cores for analyses are marked for sampling based on geological intervals with individual samples 3 m or less in length. Drill core is cut lengthwise in half with a core saw. Half-core is sent for assays at SGS Laboratories (previously Bureau Veritas). Prior to cutting core for assay, bulk density is also determined on site by taking 20 to 25 cm lengths of whole core of each lithology at 10 m intervals. The ends of these are then cut at right angle to the core axis, retaining all pieces to be returned to the core box for later sample cutting and analysis. The diameter of each core sampled for bulk density is measured at each end with digital calipers to 3 decimal places and recorded. The length of the core is measured on four sides at 90 degrees to each other, to 2 decimal places and recorded. The software averages the lengths and diameters. The mass of the dry core is measured twice on an Ohaus© balance to 2 decimal places. If no discrepancy occurs, the measurement is recorded. If there is a discrepancy the measuring is repeated until there is no discrepancy between 2 measurements. The density is calculated using the formula Bulk Density = mass (g) divided by p times r² times h cm³ (where r is radius of core and h is length of core). Certified standard masses are used to calibrate the scale balance used for bulk density determinations. The balance in the core logging area is placed on a large concrete block to avoid vibration, is leveled, and surrounded by a wooden partition to avoid wind affecting the balance. The measurements are recorded in Geospark© logging software and Bulk Density (g/cm³) is calculated to 2 decimal places. This number can be used directly as tonnes/m³ in resource estimates.

A total of 5% assay standards or blanks and 5% core duplicates are included in the sample stream as a quality control measure and are reviewed after analyses are received. Standards are obtained from WCM Minerals, Vancouver and CDN Minerals, Langley. Blanks are obtained from unmineralized course bagged limestone landscaping rock. Standards and blanks in 2021 drill results to date have been approved as acceptable. Samples will be sent to SGS Natural Resources in Burnaby, BC for analyses. Each sample will be weighed, then dried at 105° C, then crushed to 75% passing 2mm, split 250g, then pulverized to 85% passing 75 microns (WGH10, DRY10, CRU11, SPL10, PUL10). Clean crushed material will be passed through the crusher and clean silica is pulverized between each sample.The pulps will be analyzed for gold by fire assay fusion of 50 g of the 250 g split, which is digested in HNO3/HCl then analysed using ICP-AES (GE_FA151V5). 49 element multielement determination will be carried out by four acid digestion (HClO4, HNO3, HF then taken to dryness then dissolved in HCl) followed by combination of ICP-AES/ICP-MS analyses (GE-ICM40Q12 plus Re). Any significantly anomalous Re will be reanalysed by sodium per Na2O2 fusion with ICP-MS finish (GE_IMS90A50-C).

Pulps and rejects of holes with significant assay intervals will be stored at West Coast Mineral Storage. The remaining split core will be indexed and stored at the Northisle logging and office facility in Port Hardy, BC.

Qualified Person

Robin Tolbert, P.Geo., Vice President Exploration of Northisle and a Qualified Person as defined by National Instrument 43-101, has approved the scientific and technical disclosure contained in this news release.

About Northisle

Northisle Copper and Gold Inc. is a Vancouver-based company whose mission is to become a leading and sustainable mineral resource company for the future. Northisle owns the North Island Project, which is one of the most promising copper and gold porphyry deposits in Canada. The North Island Project is located near Port Hardy, British Columbia on a more than 33,000-hectare block of mineral titles 100% owned by Northisle stretching 50 kilometres northwest from the now closed Island Copper Mine operated by BHP Billiton. Northisle recently completed an updated preliminary economic assessment for the North Island Project and is now focused on advancement of the project through a prefeasibility study while continuing exploration within this highly prospective land package.

For more information on Northisle please visit the Company’s website at www.northisle.ca.

On behalf of Northisle Copper and Gold Inc.

Nicholas Van Dyk, CFA

Chief Financial Officer

Tel: (778) 655-9582

Email: info@northisle.ca

www.northisle.ca

Cautionary Statements regarding Forward-Looking Information

Certain information in this news release constitutes forward-looking statements under applicable securities law. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as “may”, “should”, “anticipate”, “expect”, “intend” and similar expressions. Forward-looking statements in this news release include, but are not limited to, statements relating to the 2021 PEA results, anticipated 2021 or 2022 activities, the Company’s plans for advancement of the North Island Project, including the potential use of existing infrastructure, expectations regarding the 2021 exploration program; the Company’s plans for engagement with Indigenous nations, communities and key stakeholders, and the Company’s anticipated exploration activities. Forward-looking statements necessarily involve known and unknown risks, including, without limitation, Northisle’s ability to implement its business strategies; risks associated with mineral exploration and production; risks associated with general economic conditions; adverse industry events; stakeholder engagement; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and other risks. Readers are cautioned that the foregoing list is not exhaustive.

Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions, or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this news release represent the expectations of management of Northisle as of the date of this news release, and, accordingly, are subject to change after such date. Northisle does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220331005307/en/