(TheNewswire)

|

-

ooSignificant zones of mineralisation intersected include:

-

oo149.4m @ 0.84 %CuEq (0.7 % Cu, 0.2 g/t Au 1.3 g/t Ag) from 12.8m (LS21-016) including:

-

-

4.6m @ 4.04 %CuEq (3.1 % Cu, 1.4 g/t Au 11.7 g/t Ag) from 108.8m

-

4.3m @ 1.29 %CuEq (1.1 % Cu, 0.2 g/t Au 7.4 g/t Ag) from 45.1m

-

9.2m @ 1.17 %CuEq (1.0% Cu, 0.2 g/t Au 4.7 g/t Ag) from 127.1m

-

oo33.2m @ 1.26 %CuEq 0.9 % Cu, 0.5 g/t Au 4.5 g/t Ag) from 16.5m (LS21-015)

-

oo54.9m @ 0.86 %CuEq (0.7 % Cu, 0.2 g/t Au 3.4 g/t Ag) from 6.1m (LS21-021) (note: only 50% of assays received thus far) including:

-

oo25.3m @ 0.84 %CuEq (0.7 % Cu, 0.2 g/t Au 1.4 g/t Ag) from 50.3m (LS21-024)

-

oo3.1m @ 3.32 %CuEq (2.6% Cu, 0.9 g/t Au 8.6 g/t Ag) from 108.8m

and 8.2m @ 1.99 %CuEq (1.3 % Cu, 1.0 g/t Au 4.8 g/t Ag) from 119.5m (LS21-011)

-

ooResults from a further 6 completed drill holes still outstanding with drilling continuing 24/7.

|

|

Vancouver, B.C. Canada – TheNewswire - April 1, 2022; Belmont Resources Inc. (“Belmont”), (or the “Company”), (TSX.V: BEA; FSE: L3L2) is pleased to announce results from the latest batch of assays at the Belmont-Marquee Resources. (ASX: MQR) (“Marquee”) Lone Star Joint Venture (JV) in North Eastern Washington State.

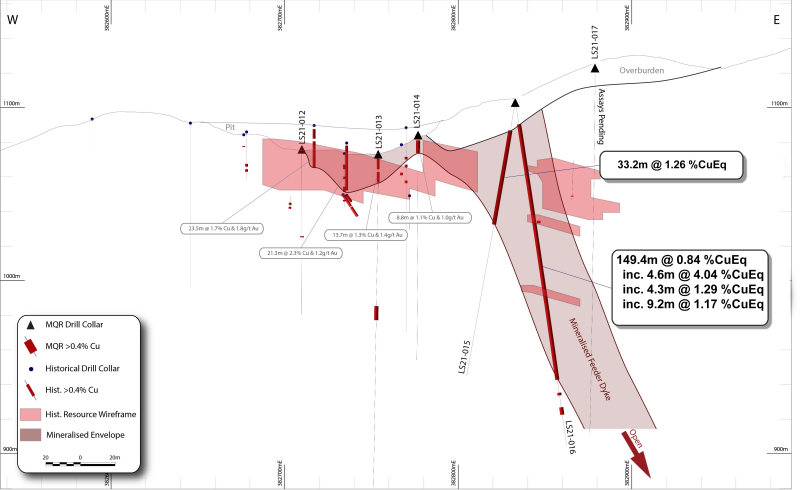

Results from this batch of assays have intersected up to 150m of significant copper mineralisation that extends well beyond the extents of historical drill hole results. The long intercepts of copper mineralisation are interpreted to be related to sub-vertical feeder dyke that has been the conduit for upwelling magmas during rhyolite dome emplacement and mineralisation (Figure 1).

President & CEO, Mr. George Sookochoff, commented: “It’s great to see the drilling further unlock our knowledge of the Lone Star deposit and extend the envelope of mineralisation well beyond the previously defined limits. These results validate the geological model developed by the Project Geologist on-site and opens up the potential to identify further sub-vertical, well-mineralized rhyolite dykes.”

“Drilling continues 24/7 and we have a further 6-holes at the lab awaiting assays, so it’s going to be an exciting few months as we work towards completing our maiden drill campaign at the Project. We know the mineralisation at Lone Star plunges to the south-east, so we expect to see the excellent results continue as we systematically work through the drilling program from north to south. Resource modelling studies continue in the background and we are highly encouraged by what the drilling has produced thus far.”

Click Image To View Full SizeFigure 1: Cross-section 5428236N highlighting the mineralised feeder dyke intersected in drill holes LS21-015 & LS21-016.

Significant results from the latest batch of assays include:

-

-

4.6m @ 4.04 %CuEq (3.1 % Cu, 1.4 g/t Au 11.7 g/t Ag) from 108.8m

-

4.3m @ 1.29 %CuEq (1.1 % Cu, 0.2 g/t Au 7.4 g/t Ag) from 45.1m

-

9.2m @ 1.17 %CuEq (1.0% Cu, 0.2 g/t Au 4.7 g/t Ag) from 127.1m

-

oo33.2m @ 1.26 %CuEq 0.9 % Cu, 0.5 g/t Au 4.5 g/t Ag) from 16.5m (LS21-015)

-

oo54.9m @ 0.86 %CuEq (0.7 % Cu, 0.2 g/t Au 3.4 g/t Ag) from 6.1m (LS21-021) (note: only 50% of assays received thus far) including:

-

oo25.3m @ 0.84 %CuEq (0.7 % Cu, 0.2 g/t Au 1.4 g/t Ag) from 50.3m (LS21-024)

-

oo3.1m @ 3.32 %CuEq (2.6% Cu, 0.9 g/t Au 8.6 g/t Ag) from 108.8m

and 8.2m @ 1.99 %CuEq (1.3 % Cu, 1.0 g/t Au 4.8 g/t Ag) from 119.5m (LS21-011)

1.True widths of the reported mineralized intervals have not been determined.

2. Assumptions used in USD for the copper equivalent calculation were metal prices of $4.00/lb. Copper, $1,800/oz Gold, $20/oz Silver, and recovery is assumed to be 100% given the level of metallurgical test data available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.656) + (Silver (g/t) x 0.00729).

The geological model that has been developed for the Lone Star deposit is that at least three separate rhyolite layers, with associated volcanogenic massive sulphide (VMS) copper-silver mineralisation, are fed by sub-vertical feeder dykes. The mineralised sub-vertical dykes are estimated to be approx. 20-40m wide, extend laterally for tens to hundreds of metres, and are vertically extensive. Identification of the mineralised dykes opens up the possibility of defining significant additional mineralisation outside the flat-lying, VMS mineralisation that has been historically identified.

High-grade gold mineralisation is discordant with high-grade copper-silver mineralisation and it is interpreted that early volcanogenic massive sulphide (VMS) style copper-silver mineralisation has been overprinted by later shearing, brecciation and hydrothermal gold deposition. As such, the results indicate the potential to define further high-grade, structurally controlled gold mineralisation that was not a focus of historical exploration programs.

Lone Star Diamond Drilling Program Update

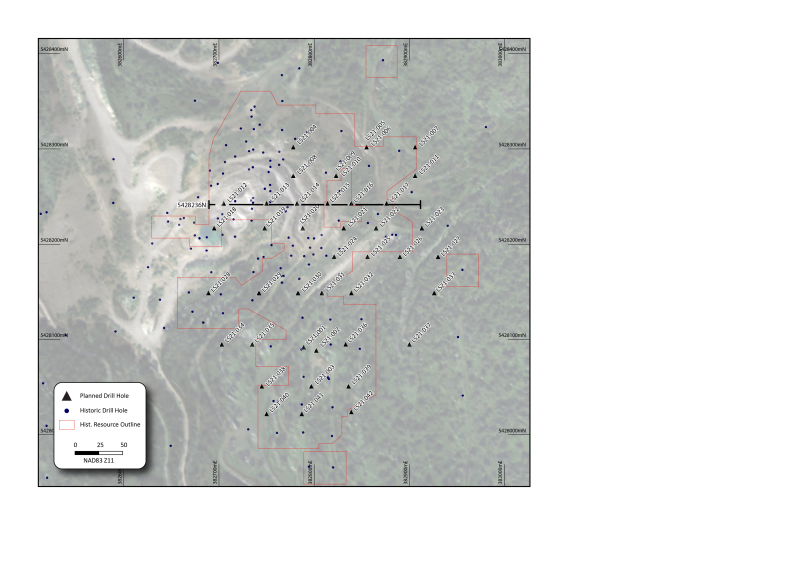

To date, 25 diamond drill holes for 4,664m have been completed at Lone Star (Table 1) with full assay results from the first 18 drill holes received.

Batches of core are being delivered to the laboratory every two weeks with regular results expected over the coming months. Drilling continues 24 hours a day as part of the forty-three hole, ~7,000m diamond drilling program. Drilling is expected to be completed at the Lone Star Copper-Gold Project in Q1-2022 with the phase 1 drill program designed to satisfy three key objectives:

-

--Validate the historical drill hole database and resource model;

-

--Deliver a JORC/43-101 compliant mineral resource estimate; and

-

--Test for extensions to the historical resource.

Additionally, Mining Plus Pty Ltd have begun resource modelling studies as the Company pushes towards delivering a 2022 JORC/43-101 compliant resource in 1H-2022.

Click Image To View Full Size

Figure 2: Lone Star drill plan map

Table 2: Significant Intercepts from the Lone Star drilling Program

|

Hole_ID

|

From

|

To

|

Interval

|

CuEq

|

Cu %

|

Au g/t

|

Ag g/t

|

|

(m)

|

(m)

|

(m)

|

|

LS21-001

|

41.5

|

50.3

|

9.1

|

0.75

|

0.6

|

0.2

|

3.2

|

|

LS21-001

|

54.9

|

61.2

|

6.9

|

1.82

|

1.2

|

0.8

|

12.9

|

|

LS21-001

|

65.8

|

110

|

44.2

|

1.46

|

1.3

|

0.2

|

4.6

|

|

inc.

|

65.8

|

88.7

|

19.8

|

2.78

|

2.4

|

0.5

|

6.7

|

|

LS21-001

|

115.8

|

138.7

|

19.1

|

0.40

|

0.4

|

|

|

|

LS21-001

|

140.4

|

162.5

|

22.1

|

1.41

|

1.2

|

0.3

|

2.2

|

|

inc.

|

140.4

|

162.5

|

8.5

|

2.64

|

2.1

|

0.8

|

2.4

|

|

LS21-001

|

198.7

|

200.9

|

4.7

|

1.00

|

0.8

|

0.3

|

1

|

|

LS21-002

|

46.9

|

60.8

|

15.5

|

5.05

|

3.7

|

1.8

|

23

|

|

inc.

|

56.7

|

59.3

|

2.6

|

26.10

|

18.5

|

10.4

|

106

|

|

LS21-002

|

95.1

|

101.1

|

6

|

0.42

|

0.4

|

|

2.5

|

|

LS21-002

|

120.7

|

176.1

|

53.6

|

1.08

|

0.8

|

0.4

|

2

|

|

inc.

|

167.6

|

176.1

|

7.6

|

3.06

|

2.1

|

1.4

|

6.2

|

|

LS21-002

|

193.8

|

194.7

|

0.9

|

4.62

|

3.8

|

1.2

|

4

|

|

LS21-002

|

199.3

|

200.5

|

1.2

|

4.28

|

3

|

1.9

|

4

|

|

LS21-002

|

202

|

203.6

|

1.6

|

1.57

|

0.9

|

1

|

2

|

|

LS21-003

|

72.4

|

77.4

|

5

|

4.35

|

3.5

|

1.1

|

17.5

|

|

LS21-003

|

125.6

|

147.9

|

22.3

|

1.06

|

0.8

|

0.4

|

|

|

inc.

|

133.8

|

143.3

|

9.5

|

1.47

|

1.1

|

0.5

|

5.6

|

|

LS21-003

|

155.2

|

211

|

55.8

|

0.60

|

0.6

|

|

|

|

inc.

|

165.9

|

175.1

|

9.2

|

1.20

|

1

|

0.3

|

|

|

LS21-004

|

7

|

14.6

|

7.6

|

1.40

|

1.2

|

0.3

|

|

|

LS21-006

|

99.7

|

111.6

|

11.9

|

2.34

|

1

|

2

|

3.3

|

|

inc.

|

108.5

|

110.1

|

1.6

|

9.83

|

2.1

|

11.7

|

7

|

|

LS21-007

|

107.9

|

125.6

|

17.7

|

3.48

|

1.6

|

2.8

|

5.9

|

|

inc.

|

112.2

|

116.3

|

4.1

|

6.41

|

5.3

|

1.5

|

16.8

|

|

inc.

|

117.4

|

122.3

|

4.9

|

5.70

|

0.5

|

7.9

|

2.6

|

|

LS21-008

|

5.5

|

23.2

|

17.7

|

0.80

|

0.6

|

0.3

|

|

|

LS21-009

|

6.4

|

46

|

39.6

|

0.40

|

0.4

|

|

|

|

LS21-009

|

63.4

|

70.7

|

7.3

|

0.76

|

0.5

|

0.4

|

|

|

LS21-010

|

7.8

|

43.9

|

37.9

|

1.30

|

1

|

0.4

|

4.5

|

|

inc.

|

21

|

33.2

|

12.2

|

2.79

|

2

|

1.1

|

8.8

|

|

LS21-010

|

59.2

|

80.5

|

21.3

|

0.62

|

0.6

|

|

3.3

|

|

LS21-010

|

127.1

|

138.4

|

11.3

|

0.42

|

0.4

|

|

3.2

|

|

LS21-011

|

108.8

|

111.9

|

3.1

|

3.32

|

2.6

|

1

|

8.6

|

|

LS21-011

|

119.5

|

127.7

|

8.2

|

1.99

|

1.3

|

1

|

4.7

|

|

LS21-012

|

50.3

|

50.9

|

0.6

|

3.38

|

2.4

|

1.4

|

8

|

|

LS21-013

|

87.8

|

96

|

8.2

|

0.53

|

0.4

|

0.2

|

0.5

|

|

LS21-014

|

3.1

|

10.4

|

7.3

|

0.55

|

0.4

|

0.2

|

2.5

|

|

LS21-015

|

16.5

|

71.6

|

33.2

|

1.26

|

0.9

|

0.5

|

4.5

|

|

LS21-016

|

12.8

|

162.2

|

149.4

|

0.84

|

0.7

|

0.2

|

1.3

|

|

inc.

|

45.1

|

49.4

|

4.3

|

1.29

|

1.1

|

0.2

|

7.4

|

|

inc.

|

108.8

|

113.4

|

4.6

|

4.04

|

3.1

|

1.3

|

11.7

|

|

inc.

|

127.1

|

136.3

|

9.2

|

1.17

|

1

|

0.2

|

4.7

|

|

LS21-016

|

169.8

|

171.3

|

1.5

|

1.30

|

1.1

|

0.3

|

|

|

LS21-016

|

178.3

|

182.6

|

4.3

|

1.03

|

0.7

|

0.5

|

|

|

LS21-018

|

NSR

|

|

|

0.00

|

|

|

|

|

LS21-019

|

NSR

|

|

|

0.00

|

|

|

|

|

LS21-021

|

6.1

|

89.3

|

54.9

|

0.86

|

0.7

|

0.2

|

3.4

|

|

inc.

|

6.1

|

13.4

|

7.3

|

2.70

|

2.1

|

0.7

|

19.1

|

|

LS21-024

|

50.3

|

75.6

|

25.3

|

0.84

|

0.7

|

0.2

|

1.4

|

|

LS21-024

|

110

|

178

|

64.3

|

0.49

|

0.4

|

0.1

|

2.8

|

-

True widths of the reported mineralized intervals have not been determined.

-

Assumptions used in USD for the copper equivalent calculation were metal prices of $4.00/lb. Copper, $1,800/oz Gold, $20/oz Silver, and recovery is assumed to be 100% given the level of metallurgical test data available. The following equation was used to calculate copper equivalence: CuEq = Copper (%) + (Gold (g/t) x 0.656) + (Silver (g/t) x 0.00729).

About the Lone Star

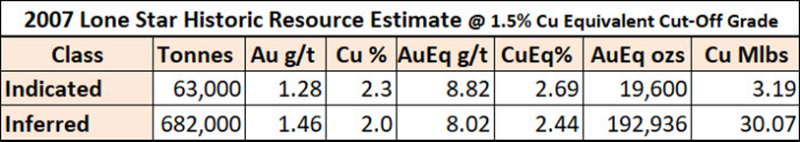

The Lone Star is a past producing open pit and underground mine situated on the north end of the prolific Republic Graben of Washington State. The project has 252 historic drill holes. In 2006 former owner Merit Mining drilled an additional six holes and completed a 2007 resource as reported in a “Technical Report and Resource Estimate on the Lone Star Deposit, Ferry County Washington (September 23, 2007)” for Merit Mining Corp. and authored by P&E Mining Consultants Inc.

The company went into receivership shortly after the publishing of the resource estimate due to the 2008 economic crisis. Belmont acquired the Lone Star property in July 2021 and is the first company to continue where Merit Mining left off, in advancing the Lone Star to production.

Click Image To View Full Size

Lone Star 2007 Historical Resource

Calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb.

(1) Mineral resources which are not mineral reserves do not have demonstrated economic viability.

(2) Gold equivalent (AuEq) grade was calculated utilizing a gold price of US$593/oz and copper price of US$2.84/lb., based on the 24 month (at July 31, 2007) trailing average of gold and copper prices, to obtain a conversion factor of % copper x 3.284 + gold g/t = Au Eq g/t. Metallurgical recoveries and smelting/refining costs were not factored into the gold equivalent calculation.

(3) The Cu equivalent (CuEq) cut-off value of 1.5% was calculated and rounded utilizing the following: Cu price US$2.84/lb, $US exchange rate $0.88, process recovery $95%, smelter payable 95%, smelting and refining charges C$7/tonne mined, mining cost C$62/tonne mined, process cost $C28/tonne processed, G&A cost $7.50/tonne processed.

(4) A qualified person has not done sufficient work to classify the historic estimate as current mineral resources or mineral reserves. As such the issuer, Belmont Resources, is not treating this historical estimate as current mineral resources or mineral reserves.

Belmont-Marquee Joint Venture

Marquee Resources (ASX:MQR) is earning the right to acquire an 80% interest in the Lone Star property (NR Nov. 4, 2021 – Belmont Signs Option/JV Agreements With Marquee Resources On Lone Star Property) by committing to the following:

• $504,000 cash payments

• $2,550,000 Work Program

• 3,000,000 MQR Shares

• Produce a NI 43-101 & JORC Resource and Preliminary Economic Assessment on the project

• Within a 24 month term.

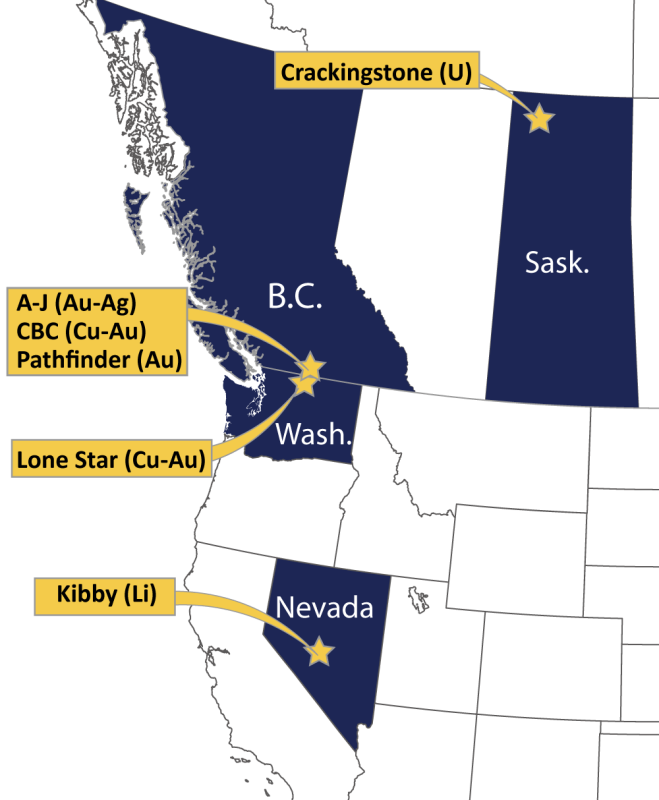

About Belmont Resources

Belmont Resources is engaged in the business of acquiring and re-developing past producing copper-gold-silver mines in southern British Columbia and Northern Washington State. This region is considered to have the highest concentration of mineralization and past producing mines in western North America.

By utilizing new exploration technology, geological modelling and specialized 3D data analysis, the company is successfully identifying new areas of mineralization beneath and/or in the near vicinity of the past producing mines.

Click Image To View Full Size

The Belmont project portfolio:

-

Athelstan-Jackpot, B.C. – * Gold-Silver mines

-

Come By Chance, B.C. – * Copper-Gold mine

-

Lone Star, Washington – * Copper-Gold mine

-

Pathfinder, B.C. – * Gold–Silver mines

-

Black Bear, B.C. – Gold

-

Pride of the West, B.C.- Gold

-

Kibby Basin, Nevada – Lithium

-

Click Image To View Full Size

Crackingstone, Sask. – Uranium

* past producing mine

NI 43-101 Disclosure:

Technical disclosure in this news release has been approved by James Ebisch P.Geo, a Qualified Person as defined by National Instrument NI 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President

Ph: 604-505-4061

Email: george@belmontresources.com

Website: www.BelmontResources.com

We seek safe harbor. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange has not approved nor disapproved of the information contained herein.

Copyright (c) 2022 TheNewswire - All rights reserved.