Intends on Withholding Vote Against Directors Thomas I. Morgan and Lisa M. Palumbo at Annual Meeting

Chatham Asset Management, LLC ("Chatham"), a private investment firm which manages funds that beneficially own approximately 6.3% of the outstanding common stock of Rayonier Advanced Materials (“RYAM” or the “Company”) (NYSE: RYAM) and is a substantial bondholder of the Company, today issued an open letter to RYAM shareholders stating Chatham’s intent to withhold its vote against two long-tenured members of the Company’s Board of Directors (the “Board”), Thomas I. Morgan and Lisa M. Palumbo, at the Company’s annual meeting of shareholders on May 16, 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220410005054/en/

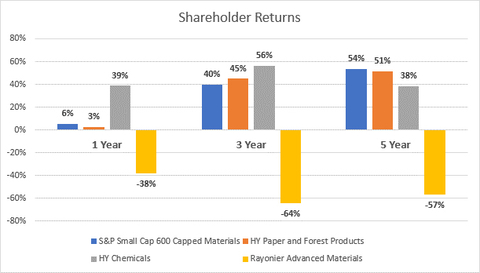

Shareholder Returns (Source: Bloomberg; Data as of April 12, 2022)

“Despite RYAM’s persistent poor stock price and financial performance, the Board has insulated itself from stockholder engagement while doling out generous compensation packages to management. We are left with no choice but to withhold our vote against Mr. Morgan and Ms. Palumbo at the Company’s upcoming annual meeting in an effort to instill accountability and protect shareholder value,” said Chatham.

The full text of the letter follows:

April 13, 2022

Dear Fellow Shareholders:

Chatham Asset Management, LLC (together with its affiliates, “we” or “Chatham”) is a substantial stockholder and bondholder of Rayonier Advanced Materials (“RYAM” or the “Company”), beneficially owning approximately 6.3% of the Company’s outstanding common stock, 75% of the Company’s 5.50% Senior Notes due June 1, 2024 (the “2024 Notes”), and 13% of the Company’s 7.625% Senior Secured Notes due January 15, 2026 (the “2026 Notes”).

Last month, we wrote an open letter to the independent members of RYAM’s Board of Directors (the “Board”) to express our serious concerns that management was not acting quickly enough to proactively address the Company’s upcoming debt maturities. Rather than address our concerns or the Company’s persistent poor stock price and financial performance, the Board unilaterally adopted an onerous stockholder rights plan, or “poison pill”, essentially claiming it needed to protect stockholders from Chatham. We believe what shareholders really need is a refreshed Board, with new directors added that possess capital allocation, strategic and corporate governance expertise to better address the Company’s long-term underperformance. Accordingly, we intend to withhold our vote against two long-tenured directors up for election this year, Thomas I. Morgan and Lisa M. Palumbo, who, if they fail to receive a majority of the votes cast, will be required to tender their resignations to the Board under the Company’s Corporate Governance Principles.

As further discussed below, we believe our withhold vote against Mr. Morgan and Ms. Palumbo is warranted, not only to show that this Board must be held accountable for years of shareholder value destruction, but also for their incredible entrenchment maneuver in adopting a poison pill without shareholder approval, despite having the ability to allow shareholders to vote on it at the Company’s upcoming annual meeting of shareholders scheduled to be held on May 16, 2022.

RYAM’s total shareholder returns (TSR) are poor.

RYAM’s stock has consistently underperformed over one, three and five year periods compared to relevant indices.

See Shareholder Returns chart

Source: Bloomberg; Data as of April 12, 2022

Despite selling its lumber and newsprint assets on August 30, 2021, the proceeds of which the Company disclosed would be used to repay debt and make strategic capital investments focused on its high purity cellulose segment, management and the Board have failed to discuss any specifics on their plan to address RYAM’s upcoming debt maturities. It is therefore unsurprising, although deeply disappointing, that the Company’s stock price has declined approximately 21% since these assets were sold, with the stock recently closing at $5.41 per share on April 12, 2022.

The Company’s financial performance is even worse.

Following the sale of the Company’s lumber and newsprint assets, the primary driver of the Company’s EBITDA going forward will likely be its high purity cellulose business. While we believe this business could have considerable value, the Company continues to underperform in this critical business segment. The Company’s high purity cellulose business has declined from an over $200 million EBITDA business with EBITDA margins in the 20% range in fiscal 2017 to reporting $139 million of EBITDA in fiscal 2021, with an EBITDA margin of 12.7%. While the demand and pricing environment remains solid, management does not appear capable of capitalizing on this opportunity, which we suspect is due in part to the Company’s inefficient operations and inability to maximize volumes when pricing is favorable.

Recently, management has announced significant capital expenditures to try to expand EBITDA margins and has decided to take plants offline in the first half of fiscal 2022 to make these improvements. As a result, the Company’s performance in at least the next two quarters is expected to be weak. However, there is no guarantee these capital expenditures will improve the Company’s financial performance, particularly at a time when the Company, like all companies, is facing an “extraordinary inflationary environment” compounded with “supply chain constraints”.1

At the same time, the Company’s net debt and leverage ratios are expected to increase over the next several quarters, as shown below, raising greater concerns from us that by the time this Company begins to pay attention to refinancing its 2024 Notes, it may be too late.

See Leverage Trend chart

Source: Company SEC filings; Consensus EBITDA estimates as shown on Bloomberg; Interest and Capex estimated based on Company SEC filings

It appears the Company is an outlier in not addressing its upcoming debt maturities.

When the Company entered into a new five-year senior secured asset-based revolving credit agreement (“ABL”) and completed its offering of the 2026 Notes in December 2020, the concept of “springing maturities” were included in both the ABL and indenture governing the 2026 Notes. The net effect of these “springing maturities” is that the ABL and 2026 Notes will come due 121 days and 91 days, respectively, before the maturity of the 2024 Notes, unless nearly all of the 2024 Notes are refinanced by those dates. Given this potential calamity, we would think that a proactive Board would be racing to refinancing its 2024 Notes, particularly as the credit markets begin to tighten. Instead, management and the Board have refused to engage with Chatham to discuss any of the specifics of Chatham’s refinancing proposal or provide feedback on the Company’s plan to address its balance sheet.

We note that when we look at the Bank of America U.S. Cash Pay High Yield Index, just 4.8% of the 2,038 bonds in that index mature on or before June 1, 2024, when the 2024 Notes mature, and only 14 bonds in that index, or less than 1%, that are rated CCC, like RYAM, still have maturities on or before June 1, 2024. Additionally, the yield on the 2026 Notes has increased from 5.56% to 8.05% since the sale of the Company’s lumber and newsprint assets, which suggests to us that the market views RYAM as a deteriorating credit.

Accordingly, despite what management or the Board publicly claim, we do not believe they are prudently managing the Company’s balance sheet, and each day they delay the refinancing of the 2024 Notes, the more unnecessary risk we see to the Company and its shareholders.

We have concerns that management’s compensation is not properly aligned with performance.

The below chart details the compensation for the Company’s top four executives over the past three fiscal years. Despite the Company’s stock declining 46.4%, and significantly underperforming relevant indices, these four individuals received total compensation of $27.4 million from 2019 to 2021.

|

|

Year Ended

|

|

Year Ended

|

|

Year Ended

|

|

Years

|

|

|

2019

|

|

2020

|

|

2021

|

|

2019-2021

|

| Paul G. Boynton (CEO) |

|

$7,348,393

|

|

$5,579,824

|

|

$5,665,507

|

|

$18,593,724

|

| Marcus J. Moeltner (CFO) |

|

$703,397

|

|

$903,958

|

|

$1,469,548

|

|

$3,076,903

|

| William R. Manzer (EVP Manufacturing) |

|

$1,096,183

|

|

$852,909

|

|

$1,261,625

|

|

$3,210,717

|

| James L. Posze, Jr. (CAO) |

|

$851,788

|

|

$717,621

|

|

$1,023,328

|

|

$2,592,737

|

| Total Compensation |

|

$9,999,761

|

|

$8,054,312

|

|

$9,420,008

|

|

$27,474,081

|

|

|

|

|

|

|

|

|

|

| Mgmt Average |

|

$2,499,940

|

|

$2,013,578

|

|

$2,355,002

|

|

$6,868,520

|

|

|

|

|

|

|

|

|

|

| Shareholder Return |

|

-63.94%

|

|

69.79%

|

|

-12.42%

|

|

-46.38%

|

|

Source: Company SEC filings

|

|

|

|

|

|

|

|

|

In our view, this lack of alignment may be a significant reason as to why the Board’s first response to our initial public letter was to adopt a poison pill and seemingly try to malign our reputation rather than engage in any meaningful dialogue regarding our concerns.

The Company’s adoption of a stockholder rights plan without facing any credible threat of takeover or putting it to a stockholder vote, further warrants a withhold vote against two long-tenured directors up for election this year.

Since adopting the poison pill on March 21, 2022, we have tried to engage with the Company to address the Company’s false narrative that somehow Chatham was engaged in “unusual stock trading activity.” That assertion is patently false and warrants immediate correction. Yet the Company seemed to want to escalate the situation by refusing to correct the public record. Given the lack of retraction by the Company, Chatham was forced to protect itself by filing a lawsuit applying for injunctive relief to order the Company to remove the defamatory reference to Chatham that it somehow improperly traded in the stock. See Chatham Asset Mgmt. LLC, et al. v. Rayonier Advanced Materials, Docket No. MRS-C-000050-22 (N.J. Ch.). It was only in the course of that litigation that the Company clarified publicly when responding to Chatham’s application that its press release should be read naturally to note all recent trading activity in RYAM stock, not just Chatham’s. While the court denied Chatham’s application for a temporary restraining order, the Court proceeded to schedule a hearing on a preliminary injunction. Chatham nonetheless voluntarily dismissed the lawsuit on April 12.

Equally important is the terrible precedent of companies adopting poison pills in advance of an annual meeting of shareholders and not submitting the plan for a shareholder vote. We feel this conduct is the epitome of poor corporate governance. If the Company felt it was acting in the best interest of shareholders in adopting the poison pill, it should have no reservations about putting it to a vote at the upcoming 2022 annual meeting of shareholders.

According to the Company’s Corporate Governance Principles, if any director fails to receive the affirmative vote of a majority of the votes cast with regard to his or her election, then such director must tender his or her resignation to the Board. The Board’s Nominating and Corporate Governance Committee (the “Nominating Committee”) would then consider such resignation and make a recommendation to the Board as to whether to accept or decline the resignation. The Board would then make a determination and publicly disclose its decision and rationale within 90 days after receipt of the tendered resignation.

At the 2022 annual meeting of shareholders, three directors are up for election, two of whom have served on the Board for eight years: Thomas I. Morgan and Lisa M. Palumbo. Mr. Morgan serves on both the Compensation and Management Committee and Nominating Committee, while Ms. Palumbo serves as Chair of the Nominating Committee. We note further that six of the ten members of the Board have served together since 2015 and have presided over the Company’s poor performance and questionable compensation packages. Clearly this Board needs a shakeup.

Accordingly, for the reasons set forth above, we intend on withholding our vote against Thomas I. Morgan and Lisa M. Palumbo who are up for election at the 2022 annual meeting of shareholders so that this Board may finally be held accountable for years of shareholder value destruction.

Sincerely,

/s/ Anthony Melchiorre

Anthony Melchiorre

Managing Member

Chatham Asset Management

1 RYAM Q4 2021 Earnings release dated 2/23/22

View source version on businesswire.com: https://www.businesswire.com/news/home/20220410005054/en/