Affinity Bancshares, Inc. (NASDAQ:“AFBI”) (the “Company”), the holding company for Affinity Bank (the “Bank”), today announced net income of $1.8 million for the three months ended June 30, 2022 as compared to $2.3 million for the three months ended June 30, 2021. For the six months ended June 30, 2022, net income was $3.6 million as compared to $4.5 million for the six months ended June 30, 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220726006107/en/

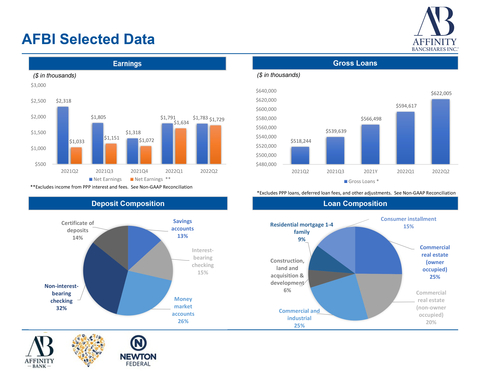

AFBI Selected Data (Graphic: Business Wire)

|

For the three months ended,

|

|

Performance Ratios:

|

June 30,

2022

|

|

March 31,

2022

|

|

December 31,

2021

|

|

September 30,

2021

|

|

June 30,

2021

|

|

Return on average assets (1)

|

0.95%

|

|

0.97%

|

|

0.66%

|

|

0.91%

|

|

1.18%

|

|

Return on average equity (1)

|

6.13%

|

|

5.97%

|

|

4.36%

|

|

6.00%

|

|

7.95%

|

|

Net interest margin (1)

|

4.06%

|

|

4.47%

|

|

3.60%

|

|

3.74%

|

|

4.06%

|

|

Efficiency ratio

|

67.23%

|

|

69.00%

|

|

74.29%

|

|

65.87%

|

|

58.30%

|

|

|

|

|

|

|

|

|

|

|

(1) Annualized.

Results of Operations

Net income was $1.8 million for the three months ended June 30, 2022, as compared to $2.3 million for the three months ended June 30, 2021, as a result of a decrease in Payroll Protection Program (PPP) loan related interest and fee income as we have been receiving forgiveness payments for these loans partially offset by a decrease in interest expense. Net income was $3.6 million for the six months ended June 30, 2022, as compared to $4.5 million for the six months ended June 30, 2021, as a result of lower interest and fee income on PPP loans partially offset by a decrease in interest expense primarily related to the recognition of remaining discounts upon the payoff of acquired Federal Home Loan Bank advances.

Net Interest Income and Margin

Net interest income decreased $269,000, and was $7.1 million for the three months ended June 30, 2022, compared to $7.4 million for the three months ended June 30, 2021, as a result of a decrease in Payroll Protection Program (PPP) loan related interest and fee income as we have been receiving forgiveness payments for these loans partially offset by a decrease in interest expense. Net interest income decreased $859,000, and was $14.9 million for the six months ended June 30, 2022, compared to $15.8 million for the six months ended June 30, 2021, as a result of a decrease in PPP loan related interest and fee income as we have been receiving forgiveness payments for these loans partially offset by a decrease in interest expense primarily related to the recognition of remaining discounts upon the payoff of acquired Federal Home Loan Bank advances. Average interest-earning assets decreased by $27.1 million, and was $702.9 million for the three months ended June 30, 2022, compared to $730.0 for the three months ended June 30, 2021. Average interest-earning assets decreased by $29.1 million, and was $698.1 million for the six months ended June 30, 2022, compared to $727.2 million for the six months ended June 30, 2021. This decrease was a result of the decrease in PPP loans as forgiveness payments were received for both the three- and six-month periods ended June 30, 2022. The Company’s net interest margin remained constant at 4.06% for the three months ended June 30, 2022, and June 30, 2021. Net interest margin for the six months ended June 30, 2022, decreased to 4.27% from 4.33% for the six months ended June 30, 2021. For the three months ended June 30, 2022, the cost of average interest-bearing liabilities decreased to 0.47% from 0.70% for the three months ended June 30, 2021, as a result of paying off Federal Home Loan Bank advances and decreasing deposit rates related to the decrease in market rates. For the six months ended June 30, 2022, the cost of average interest-bearing liabilities decreased to 0.02% from 0.72% for the six months ended June 30, 2021, as a result of paying off Federal Home Loan Bank advances and recognizing $1.0 million in accretion from fair value adjustments on acquired advances. The total cost of deposits was 0.46% for the three months ended June 30, 2022, compared to 0.65% for the three months ended June 30, 2021. For the six months ended June 30, 2022, the total cost of deposits was 0.47% compared to 0.69% for the six months ended June 30, 2021. The decrease was due to decreasing deposit rates related to the decrease in market rates for both the three- and six-month periods ended June 30, 2022.

Provision for Loan Losses

For the three months ended June 30, 2022, the provision for loan loss expense was $217,000 compared to $300,000 for the three months ended June 30, 2021. For the six months ended June 30, 2022, the provision for loan loss expense was $467,000 compared to $750,000 for the six months ended June 30, 2021. We increased our provision expense in 2021 due to the uncertainty related to the COVID-19 pandemic. We continue to assess current economic conditions when determining the level of provision expense. Net loan charge offs were $25,000 for the six months ended June 30, 2022, compared to net loan recoveries of $276,000 for the six months ended June 30, 2021.

Non-interest Income

For the three months ended June 30, 2022, noninterest income increased $42,000 to $648,000 compared to $606,000 for the three months ended June 30, 2021. For the six months ended June 30, 2022, noninterest income decreased $91,000 to $1.2 million compared to $1.3 million for the six months ended June 30, 2021. This was a result of the decrease in other non-interest income as income was received in 2021 for a bank-owned life insurance death benefit claim and no such benefit claim was received in 2022.

Non-interest Expense

Operating expenses increased $564,000, and were $5.2 million for the three months ended June 30, 2022, compared to $4.7 million for the three months ended June 30, 2021. For the six months ended June 30, 2022, operating expenses increased $431,000, and were $11.0 million for the six months ended June 30, 2022, compared to $10.6 million for the six months ended June 30, 2021. The increase in salaries and employee benefits were due to the Company’s strategic initiative to attract and retain talent for both the three- and six-month periods ended June 30, 2022.

Income Tax Expense

We recorded income tax expense of $552,000 for three months ended June 30, 2022, compared to $725,000 for the three months ended June 30, 2021. For the six months ended June 30, 2022, income tax expense was $1.1 million compared to $1.3 million for the six months ended June 30, 2021. The lower tax expense for both the three- and six-month periods ended June 30, 2022, was primarily due to lower pretax income.

Financial Condition

Total assets decreased by $21.4 million to $766.7 million at June 30, 2022, from $788.1 million at December 31, 2021. The decrease was due primarily to a decrease in cash and cash equivalents of $56.4 million due to paying off Federal Home Loan Bank advances, partially offset by an increase in net loans. Cash and equivalents decreased $56.4 million, to $55.0 million at June 30, 2022, from $111.8 million at December 31, 2021, as excess liquidity was utilized to payoff Federal Home Loan Bank advances. Total investment securities available for sale decreased by $4.0 million at June 30, 2022, as compared to December 31, 2021, as our unrealized loss on the investment portfolio increased due to the rise in interest rates. Total net loans increased $38.5 million to $614.4 million at June 30, 2022 from $575.8 million at December 31, 2021, including Paycheck Protection Program (PPP) loans of $916,000 and $17.9 million at June 30, 2022 and December 31, 2021, respectively. Loans increased due to our continued success with our strategic initiatives to grow organically and diversify our loan portfolio. This includes adding additional lenders to our business development team. Deposits increased by $11.4 million to $626.2 million at June 30, 2022 compared to $614.8 million at December 31, 2021, which reflected an increase in interest-bearing, market rate, and non-interest-bearing deposits of $23.0 million. The loan-to-deposit ratio at June 30, 2022 was 98.1%, as compared to 93.7% at December 31, 2021. Stockholders’ equity decreased to $115.4 million at June 30, 2022, as compared to $121.0 million at December 31, 2021, primarily due to the decrease in additional paid in capital from the repurchase of 308,602 shares of common stock totaling $4.8 million with an average price per share of $15.48 as well as an increase in accumulated other comprehensive loss related to our investment portfolio.

Asset Quality

The Company’s non-performing loans remained constant at $7.0 million at June 30, 2022 and December 31, 2021. The allowance for loan losses as a percentage of non-performing loans was 129.5% at June 30, 2022, as compared to 122.1% at December 31, 2021. The Company’s allowance for loan losses was 1.44% of total loans at June 30, 2022, as compared to 1.46% of total loans at December 31, 2021.

About Affinity Bancshares, Inc.

The Company is a Maryland corporation based in Covington, Georgia. The Company’s banking subsidiary, Affinity Bank, opened in 1928 and currently operates a full-service office in Atlanta, Georgia, two full-service offices in Covington, Georgia, and a loan production office serving the Alpharetta and Cumming, Georgia markets.

Forward-Looking Statements

In addition to historical information, this release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which describe the future plans, strategies and expectations of the Company. Forward-looking statements can be identified by the use of words such as “estimate,” “project,” “believe,” “intend,” “anticipate,” “assume,” “plan,” “seek,” “expect,” “will,” “may,” “should,” “indicate,” “would,” “contemplate,” “continue,” “target” and words of similar meaning. Forward-looking statements are based on our current beliefs and expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Accordingly, you should not place undue reliance on such statements. We are under no duty to and do not take any obligation to update any forward-looking statements after the date of this report. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to, changes in general economic conditions, interest rates and inflation; changes in asset quality; our ability to access cost-effective funding; fluctuations in real estate values; changes in laws or regulations; changes in technology; failures or breaches of our IT security systems; our ability to introduce new products and services and capitalize on growth opportunities; our ability to successfully integrate acquired operations or assets; changes in accounting policies and practices; our ability to retain key employees; the impact of the COVID-19 pandemic; and the effects of natural disasters and geopolitical events. These risks and other uncertainties are further discussed in the reports that the Company files with the Securities and Exchange Commission.

Average Balance Sheets

The following tables set forth average balance sheets, average yields and costs, and certain other information for the periods indicated. No tax-equivalent yield adjustments have been made, as the effects would be immaterial. All average balances are monthly average balances. Non-accrual loans were included in the computation of average balances. The yields set forth below include the effect of deferred fees, discounts, and premiums that are amortized or accreted to interest income or interest expense.

|

|

|

For the Three Months Ended June 30,

|

|

|

|

|

2022

|

|

|

2021

|

|

|

|

|

Average

Outstanding

Balance

|

|

|

Interest

|

|

|

Average

Yield/Rate

|

|

|

Average

Outstanding

Balance

|

|

|

Interest

|

|

|

Average

Yield/Rate

|

|

|

|

|

(Dollars in thousands)

|

|

|

Interest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans excluding PPP loans

|

|

$

|

609,646

|

|

|

$

|

7,212

|

|

|

|

4.73

|

%

|

|

$

|

505,912

|

|

|

$

|

6,310

|

|

|

|

4.99

|

%

|

|

PPP loans

|

|

|

3,750

|

|

|

|

71

|

|

|

|

7.58

|

%

|

|

|

107,154

|

|

|

|

1,687

|

|

|

|

6.30

|

%

|

|

Securities

|

|

|

46,461

|

|

|

|

279

|

|

|

|

2.40

|

%

|

|

|

29,619

|

|

|

|

163

|

|

|

|

2.20

|

%

|

|

Interest-earning deposits

|

|

|

41,856

|

|

|

|

79

|

|

|

|

0.76

|

%

|

|

|

84,950

|

|

|

|

39

|

|

|

|

0.18

|

%

|

|

Other investments

|

|

|

1,187

|

|

|

|

12

|

|

|

|

3.95

|

%

|

|

|

2,346

|

|

|

|

18

|

|

|

|

3.06

|

%

|

|

Total interest-earning assets

|

|

|

702,900

|

|

|

|

7,653

|

|

|

|

4.36

|

%

|

|

|

729,981

|

|

|

|

8,217

|

|

|

|

4.50

|

%

|

|

Non-interest-earning assets

|

|

|

51,662

|

|

|

|

|

|

|

|

|

|

57,220

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

754,562

|

|

|

|

|

|

|

|

|

$

|

787,201

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings accounts

|

|

$

|

82,478

|

|

|

|

87

|

|

|

|

0.42

|

%

|

|

$

|

93,598

|

|

|

|

103

|

|

|

|

0.44

|

%

|

|

Interest-bearing checking accounts

|

|

|

97,618

|

|

|

|

45

|

|

|

|

0.19

|

%

|

|

|

84,571

|

|

|

|

44

|

|

|

|

0.21

|

%

|

|

Market rate checking accounts

|

|

|

150,863

|

|

|

|

93

|

|

|

|

0.25

|

%

|

|

|

131,466

|

|

|

|

128

|

|

|

|

0.39

|

%

|

|

Certificates of deposit

|

|

|

90,194

|

|

|

|

259

|

|

|

|

1.15

|

%

|

|

|

108,936

|

|

|

|

409

|

|

|

|

1.50

|

%

|

|

Total interest-bearing deposits

|

|

|

421,153

|

|

|

|

484

|

|

|

|

0.46

|

%

|

|

|

418,571

|

|

|

|

684

|

|

|

|

0.65

|

%

|

|

FHLB advances

|

|

|

14,341

|

|

|

|

27

|

|

|

|

0.76

|

%

|

|

|

45,610

|

|

|

|

123

|

|

|

|

1.08

|

%

|

|

Other borrowings

|

|

|

137

|

|

|

|

1

|

|

|

|

1.71

|

%

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Total interest-bearing liabilities

|

|

|

435,631

|

|

|

|

512

|

|

|

|

0.47

|

%

|

|

|

464,181

|

|

|

|

807

|

|

|

|

0.70

|

%

|

|

Non-interest-bearing liabilities

|

|

|

202,296

|

|

|

|

|

|

|

|

|

|

206,119

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

637,927

|

|

|

|

|

|

|

|

|

|

670,300

|

|

|

|

|

|

|

|

|

Total stockholders' equity

|

|

|

116,635

|

|

|

|

|

|

|

|

|

|

116,901

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

754,562

|

|

|

|

|

|

|

|

|

$

|

787,201

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

$

|

7,141

|

|

|

|

|

|

|

|

|

$

|

7,410

|

|

|

|

|

|

Net interest rate spread (1)

|

|

|

|

|

|

|

|

|

3.89

|

%

|

|

|

|

|

|

|

|

|

3.80

|

%

|

|

Net interest-earning assets (2)

|

|

$

|

267,269

|

|

|

|

|

|

|

|

|

$

|

265,800

|

|

|

|

|

|

|

|

|

Net interest margin (3)

|

|

|

|

|

|

|

|

|

4.06

|

%

|

|

|

|

|

|

|

|

|

4.06

|

%

|

|

Average interest-earning assets to interest- bearing liabilities

|

|

|

161.35

|

%

|

|

|

|

|

|

|

|

|

157.26

|

%

|

|

|

|

|

|

|

|

(1)

|

|

Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average rate of interest-bearing liabilities.

|

|

(2)

|

|

Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

|

|

(3)

|

|

Net interest margin represents net interest income divided by average total interest-earning assets.

|

|

|

|

For the Six Months Ended June 30,

|

|

|

|

|

2022

|

|

|

2021

|

|

|

|

|

Average

Outstanding

Balance

|

|

|

Interest

|

|

|

Average

Yield/Rate

|

|

|

Average

Outstanding

Balance

|

|

|

Interest

|

|

|

Average

Yield/Rate

|

|

|

|

|

(Dollars in thousands)

|

|

|

Interest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans excluding PPP loans

|

|

$

|

596,429

|

|

|

$

|

14,004

|

|

|

|

4.70

|

%

|

|

$

|

501,596

|

|

|

$

|

12,514

|

|

|

|

4.99

|

%

|

|

PPP loans

|

|

|

8,035

|

|

|

|

275

|

|

|

|

6.84

|

%

|

|

|

115,260

|

|

|

|

4,577

|

|

|

|

7.94

|

%

|

|

Securities

|

|

|

47,549

|

|

|

|

539

|

|

|

|

2.27

|

%

|

|

|

26,701

|

|

|

|

256

|

|

|

|

1.92

|

%

|

|

Interest-earning deposits

|

|

|

45,026

|

|

|

|

97

|

|

|

|

0.43

|

%

|

|

|

81,469

|

|

|

|

82

|

|

|

|

0.20

|

%

|

|

Other investments

|

|

|

1,094

|

|

|

|

17

|

|

|

|

3.21

|

%

|

|

|

2,169

|

|

|

|

36

|

|

|

|

3.29

|

%

|

|

Total interest-earning assets

|

|

|

698,133

|

|

|

|

14,932

|

|

|

|

4.28

|

%

|

|

|

727,195

|

|

|

|

17,465

|

|

|

|

4.80

|

%

|

|

Non-interest-earning assets

|

|

|

52,661

|

|

|

|

|

|

|

|

|

|

55,514

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

750,794

|

|

|

|

|

|

|

|

|

$

|

782,709

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings accounts

|

|

$

|

84,326

|

|

|

|

169

|

|

|

|

0.40

|

%

|

|

$

|

93,881

|

|

|

|

210

|

|

|

|

0.45

|

%

|

|

Interest-bearing checking accounts

|

|

|

96,949

|

|

|

|

87

|

|

|

|

0.18

|

%

|

|

|

90,509

|

|

|

|

95

|

|

|

|

0.21

|

%

|

|

Market rate checking accounts

|

|

|

147,677

|

|

|

|

182

|

|

|

|

0.25

|

%

|

|

|

127,858

|

|

|

|

261

|

|

|

|

0.41

|

%

|

|

Certificates of deposit

|

|

|

92,318

|

|

|

|

549

|

|

|

|

1.19

|

%

|

|

|

119,366

|

|

|

|

915

|

|

|

|

1.53

|

%

|

|

Total interest-bearing deposits

|

|

|

421,270

|

|

|

|

987

|

|

|

|

0.47

|

%

|

|

|

431,614

|

|

|

|

1,481

|

|

|

|

0.69

|

%

|

|

FHLB advances

|

|

|

11,596

|

|

|

|

(948

|

)

|

|

|

(16.35

|

)%

|

|

|

37,624

|

|

|

|

219

|

|

|

|

1.16

|

%

|

|

Other borrowings

|

|

|

69

|

|

|

|

1

|

|

|

|

1.70

|

%

|

|

|

69

|

|

|

|

14

|

|

|

|

41.69

|

%

|

|

Total interest-bearing liabilities

|

|

|

432,935

|

|

|

|

41

|

|

|

|

0.02

|

%

|

|

|

469,307

|

|

|

|

1,714

|

|

|

|

0.72

|

%

|

|

Non-interest-bearing liabilities

|

|

|

198,680

|

|

|

|

|

|

|

|

|

|

201,098

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

631,615

|

|

|

|

|

|

|

|

|

|

670,405

|

|

|

|

|

|

|

|

|

Total stockholders' equity

|

|

|

119,179

|

|

|

|

|

|

|

|

|

|

112,304

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

750,794

|

|

|

|

|

|

|

|

|

$

|

782,709

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

$

|

14,891

|

|

|

|

|

|

|

|

|

$

|

15,751

|

|

|

|

|

|

Net interest rate spread (1)

|

|

|

|

|

|

|

|

|

4.26

|

%

|

|

|

|

|

|

|

|

|

4.08

|

%

|

|

Net interest-earning assets (2)

|

|

$

|

265,197

|

|

|

|

|

|

|

|

|

$

|

257,888

|

|

|

|

|

|

|

|

|

Net interest margin (3)

|

|

|

|

|

|

|

|

|

4.27

|

%

|

|

|

|

|

|

|

|

|

4.33

|

%

|

|

Average interest-earning assets to interest-bearing liabilities

|

|

|

161.26

|

%

|

|

|

|

|

|

|

|

|

154.95

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average rate of interest-bearing liabilities.

|

|

(2)

|

|

Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities.

|

|

(3)

|

|

Net interest margin represents net interest income divided by average total interest-earning assets.

|

|

AFFINITY BANCSHARES, INC.

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022

|

|

|

December 31, 2021

|

|

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

|

|

(In thousands)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks, including reserve requirement of $0 at June 30, 2022 and December 31, 2021

|

|

$

|

8,111

|

|

|

$

|

16,239

|

|

|

Interest-earning deposits in other depository institutions

|

|

|

47,288

|

|

|

|

95,537

|

|

|

Cash and cash equivalents

|

|

|

55,399

|

|

|

|

111,776

|

|

|

Investment securities available-for-sale

|

|

|

44,551

|

|

|

|

48,557

|

|

|

Other investments

|

|

|

1,400

|

|

|

|

2,476

|

|

|

Loans, net

|

|

|

614,358

|

|

|

|

575,825

|

|

|

Other real estate owned

|

|

|

3,538

|

|

|

|

3,538

|

|

|

Premises and equipment, net

|

|

|

4,048

|

|

|

|

3,783

|

|

|

Bank owned life insurance

|

|

|

15,549

|

|

|

|

15,377

|

|

|

Intangible assets

|

|

|

18,653

|

|

|

|

18,749

|

|

|

Accrued interest receivable and other assets

|

|

|

9,183

|

|

|

|

8,007

|

|

|

Total assets

|

|

$

|

766,679

|

|

|

$

|

788,088

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

Savings accounts

|

|

$

|

82,742

|

|

|

$

|

86,745

|

|

|

Interest-bearing checking

|

|

|

96,176

|

|

|

|

91,387

|

|

|

Market rate checking

|

|

|

159,900

|

|

|

|

145,969

|

|

|

Non-interest-bearing checking

|

|

|

198,177

|

|

|

|

193,940

|

|

|

Certificates of deposit

|

|

|

89,180

|

|

|

|

96,758

|

|

|

Total deposits

|

|

|

626,175

|

|

|

|

614,799

|

|

|

Federal Home Loan Bank advances

|

|

|

20,000

|

|

|

|

48,988

|

|

|

Accrued interest payable and other liabilities

|

|

|

5,133

|

|

|

|

3,333

|

|

|

Total liabilities

|

|

|

651,308

|

|

|

|

667,120

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

Common stock (par value $0.01 per share, 40,000,000 shares authorized; 6,590,362 issued and outstanding at June 30, 2022 and 6,872,634 issued and outstanding at December 31, 2021

|

|

|

65

|

|

|

|

69

|

|

|

Preferred stock (10,000,000 shares authorized, no shares outstanding at June 30, 2022 and December 31, 2021

|

|

|

—

|

|

|

|

—

|

|

|

Additional paid in capital

|

|

|

63,497

|

|

|

|

68,038

|

|

|

Unearned ESOP shares

|

|

|

(4,899

|

)

|

|

|

(5,004

|

)

|

|

Retained earnings

|

|

|

61,797

|

|

|

|

58,223

|

|

|

Accumulated other comprehensive loss

|

|

|

(5,089

|

)

|

|

|

(358

|

)

|

|

Total stockholders' equity

|

|

|

115,371

|

|

|

|

120,968

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

766,679

|

|

|

$

|

788,088

|

|

|

AFFINITY BANCSHARES, INC.

Consolidated Statements of Income

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30,

|

|

Six Months Ended June 30,

|

|

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

|

|

(In thousands)

|

|

|

Interest income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees

|

|

$

|

7,283

|

|

|

$

|

7,997

|

|

|

$

|

14,279

|

|

|

$

|

17,091

|

|

|

Investment securities, including dividends

|

|

|

291

|

|

|

|

181

|

|

|

|

556

|

|

|

|

292

|

|

|

Interest-earning deposits

|

|

|

79

|

|

|

|

39

|

|

|

|

97

|

|

|

|

82

|

|

|

Total interest income

|

|

|

7,653

|

|

|

|

8,217

|

|

|

|

14,932

|

|

|

|

17,465

|

|

|

Interest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

|

484

|

|

|

|

684

|

|

|

|

987

|

|

|

|

1,481

|

|

|

Borrowings

|

|

|

28

|

|

|

|

123

|

|

|

|

(947

|

)

|

|

|

233

|

|

|

Total interest expense

|

|

|

512

|

|

|

|

807

|

|

|

|

40

|

|

|

|

1,714

|

|

|

Net interest income before provision for loan losses

|

|

|

7,141

|

|

|

|

7,410

|

|

|

|

14,892

|

|

|

|

15,751

|

|

|

Provision for loan losses

|

|

|

217

|

|

|

|

300

|

|

|

|

467

|

|

|

|

750

|

|

|

Net interest income after provision for loan losses

|

|

|

6,924

|

|

|

|

7,110

|

|

|

|

14,425

|

|

|

|

15,001

|

|

|

Noninterest income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts

|

|

|

393

|

|

|

|

376

|

|

|

|

785

|

|

|

|

709

|

|

|

Other

|

|

|

255

|

|

|

|

230

|

|

|

|

458

|

|

|

|

625

|

|

|

Total noninterest income

|

|

|

648

|

|

|

|

606

|

|

|

|

1,243

|

|

|

|

1,334

|

|

|

Noninterest expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits

|

|

|

2,959

|

|

|

|

2,511

|

|

|

|

5,901

|

|

|

|

4,894

|

|

|

Deferred compensation

|

|

|

64

|

|

|

|

62

|

|

|

|

131

|

|

|

|

126

|

|

|

Occupancy

|

|

|

541

|

|

|

|

644

|

|

|

|

1,123

|

|

|

|

1,696

|

|

|

Advertising

|

|

|

118

|

|

|

|

100

|

|

|

|

198

|

|

|

|

180

|

|

|

Data processing

|

|

|

497

|

|

|

|

517

|

|

|

|

990

|

|

|

|

999

|

|

|

Other real estate owned

|

|

|

—

|

|

|

|

7

|

|

|

|

—

|

|

|

|

19

|

|

|

Net (gain) on sale of other real estate owned

|

|

|

—

|

|

|

|

(126

|

)

|

|

|

—

|

|

|

|

(127

|

)

|

|

Legal and accounting

|

|

|

203

|

|

|

|

226

|

|

|

|

385

|

|

|

|

402

|

|

|

Organizational dues and subscriptions

|

|

|

133

|

|

|

|

91

|

|

|

|

264

|

|

|

|

161

|

|

|

Director compensation

|

|

|

51

|

|

|

|

50

|

|

|

|

102

|

|

|

|

100

|

|

|

Federal deposit insurance premiums

|

|

|

52

|

|

|

|

67

|

|

|

|

112

|

|

|

|

140

|

|

|

Writedown of premises and equipment

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

873

|

|

|

FHLB prepayment penalties

|

|

|

—

|

|

|

|

—

|

|

|

|

647

|

|

|

|

—

|

|

|

Other

|

|

|

619

|

|

|

|

524

|

|

|

|

1,142

|

|

|

|

1,101

|

|

|

Total noninterest expenses

|

|

|

5,237

|

|

|

|

4,673

|

|

|

|

10,995

|

|

|

|

10,564

|

|

|

Income before income taxes

|

|

|

2,335

|

|

|

|

3,043

|

|

|

|

4,673

|

|

|

|

5,771

|

|

|

Income tax expense

|

|

|

552

|

|

|

|

725

|

|

|

|

1,099

|

|

|

|

1,321

|

|

|

Net income

|

|

$

|

1,783

|

|

|

$

|

2,318

|

|

|

$

|

3,574

|

|

|

$

|

4,450

|

|

|

Basic earnings per share

|

|

$

|

0.27

|

|

|

$

|

0.34

|

|

|

$

|

0.53

|

|

|

$

|

0.65

|

|

|

Diluted earnings per share

|

|

$

|

0.27

|

|

|

$

|

0.34

|

|

|

$

|

0.53

|

|

|

$

|

0.64

|

|

Explanation of Non-GAAP Financial Measures

Reported amounts are presented in accordance with GAAP. The Company’s management believes that the supplemental non-GAAP information, which consists of reported net income less interest and fees income on PPP loans provides a better comparison of the amount of the Company’s earnings. Management also believes that reported loans less PPP loans, deferred loan fees and other loan adjustments (consisting of loans in process), provides a better comparison of the amount of the Company’s loan portfolio. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures which may be presented by other companies. Refer to the Non-GAAP Reconciliation table at the end of this document for details on the earnings impact of these items.

|

June 30, 2022

|

|

March 31, 2022

|

|

December 31, 2021

|

|

September 30, 2021

|

|

June 30, 2021

|

|

(In thousands)

|

|

Non-GAAP Reconciliation

|

|

|

|

|

|

|

|

|

|

Total Loans

|

$

|

623,359

|

|

$

|

601,693

|

|

$

|

584,384

|

|

$

|

571,170

|

|

$

|

590,011

|

|

Plus:

|

|

|

|

|

|

|

|

|

|

|

Fair Value Marks

|

|

1,157

|

|

|

1,239

|

|

|

1,350

|

|

|

1,422

|

|

|

1,529

|

|

Deferred Loan fees

|

|

873

|

|

|

958

|

|

|

958

|

|

|

1,077

|

|

|

1,666

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

Payroll Protection

|

|

|

|

|

|

|

|

|

|

|

Program Loans

|

|

916

|

|

|

7,146

|

|

|

18,124

|

|

|

32,204

|

|

|

73,020

|

|

Indirect Auto

|

|

|

|

|

|

|

|

|

|

|

|

Dealer Reserve

|

|

2,386

|

|

|

2,058

|

|

|

1,846

|

|

|

1,724

|

|

|

1,495

|

|

Other Loan

|

|

|

|

|

|

|

|

|

|

|

Adjustments

|

|

82

|

|

|

69

|

|

|

224

|

|

|

102

|

|

|

447

|

|

Gross Loans

|

$

|

622,005

|

|

$

|

594,617

|

|

$

|

566,498

|

|

$

|

539,639

|

|

$

|

518,244

|

|

June 30, 2022

|

|

March 31, 2022

|

|

December 31, 2021

|

|

September 30, 2021

|

|

June 30, 2021

|

|

(In thousands)

|

|

|

|

Non-GAAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

$

|

1,783

|

|

$

|

1,791

|

|

$

|

1,318

|

|

$

|

1,805

|

|

$

|

2,318

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

PPP Interest Income

|

|

9

|

|

|

30

|

|

|

59

|

|

|

121

|

|

|

269

|

|

PPP Fee Income

|

|

62

|

|

|

174

|

|

|

271

|

|

|

741

|

|

|

1,419

|

|

Plus:

|

|

|

|

|

|

|

|

|

|

|

Tax Effect

|

|

17

|

|

|

47

|

|

|

84

|

|

|

208

|

|

|

403

|

|

Non-GAAP Net Income

|

$

|

1,729

|

|

$

|

1,634

|

|

$

|

1,072

|

|

$

|

1,151

|

|

$

|

1,033

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022

|

|

March 31, 2022

|

|

December 31, 2021

|

|

September 30, 2021

|

|

June 30, 2021

|

|

(In thousands)

|

|

|

|

Non-GAAP Reconciliation

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

$

|

115,371

|

|

$

|

116,358

|

|

$

|

120,968

|

|

$

|

119,703

|

|

$

|

117,635

|

|

Minus:

|

|

|

|

|

|

|

|

|

|

|

Goodwill

|

|

17,219

|

|

|

17,219

|

|

|

17,219

|

|

|

17,219

|

|

|

17,219

|

|

Core Deposit Intangible

|

|

1,435

|

|

|

1,483

|

|

|

1,530

|

|

|

1,578

|

|

|

1,626

|

|

Tangible Common Equity

|

|

96,717

|

|

|

97,656

|

|

|

102,219

|

|

|

100,906

|

|

|

98,790

|

|

Divided By:

|

|

|

|

|

|

|

|

|

|

|

Outstanding Shares

|

|

6,590

|

|

|

6,619

|

|

|

6,873

|

|

|

6,873

|

|

|

6,873

|

|

Tangible Book Value Per Share

|

$

|

14.68

|

|

$

|

14.75

|

|

$

|

14.87

|

|

$

|

14.68

|

|

$

|

14.37

|

|

|

|

|

|

|

|

|

|

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20220726006107/en/