Phase 1: gold oxide feed above water table (representing only 50% of current resource) delivers IRR 99%, NPV $77M, 1.1yr pay-back

VANCOUVER, British Columbia, Sept. 12, 2022 (GLOBE NEWSWIRE) -- Gold Bull Resources Corp. (TSX-V: GBRC) (“Gold Bull” or the “Company”) is pleased to report completion of its Sandman Scoping Study at its 100% owned Sandman Project (“Sandman” or the “Project”) located in Humboldt County, Nevada, USA.

The Sandman Scoping Study has identified a stand-alone low-cost start-up heap leach gold opportunity. The study focused on only mining mineralized material above the water table, which represents approximately 50% of the current NI 43-101 mineral resource. The Study highlights include:

- Scoping Study based on only 250,000 ounces of 494,000-ounce NI 43-101 gold resource (refer to table 6 for NI 43-101 resource breakdown)

- Production rate of 2.1 Mtpa for an initial 5-year operation

- 35,000 ounces of gold per annum produced from conventional heap leach

- At USD1,800/oz gold price:

- IRR of 99% (pre-tax)

- NPV 10% USD$77.2M (pre-tax)

- Payback period of 1.1 years (pre-tax)

- Average grade 0.74g/t gold (all oxide)

- Low strip ratio of 1.6:1

- Low Capital requirement of USD28.8M including working capital USD4.3M

- Low operating cost of USD15.99 per tonne

- All in Sustaining Cost (AISC) of USD1,173/oz of gold

- Phase 1 (this study) focusses on the oxide feed above the water table only

- Phase 2 and remainder of the gold resource below water table has not yet been investigated

This Scoping Study focused on the extraction of above water table oxide feed only, to facilitate cost effective and rapid mine commissioning. Additional Mineral Resources located below the water table will be included in future mine studies. The final Scoping Study will be a preliminary economic assessment, per NI 43-101 regulations, and will be filed on SEDAR within 45 days.

Gold Bull CEO, Cherie Leeden commented:

Sandman provides Gold Bull with a low-cost start-up opportunity. In our Phase 1 scoping study we only examined the oxide gold located above the water table, to investigate what a near-term small-scale development scenario could deliver. The IRR of 99% and pay back of just over a year is exceptional, considering this is not a life of mine study and neglects the other half of the resource lying below the water table, and the future resource growth potential. Sandman represents a realistic near-term mine scenario capable of generating cashflow, located in northern Nevada, a top mining jurisdiction.

STUDY HIGHLIGHTS

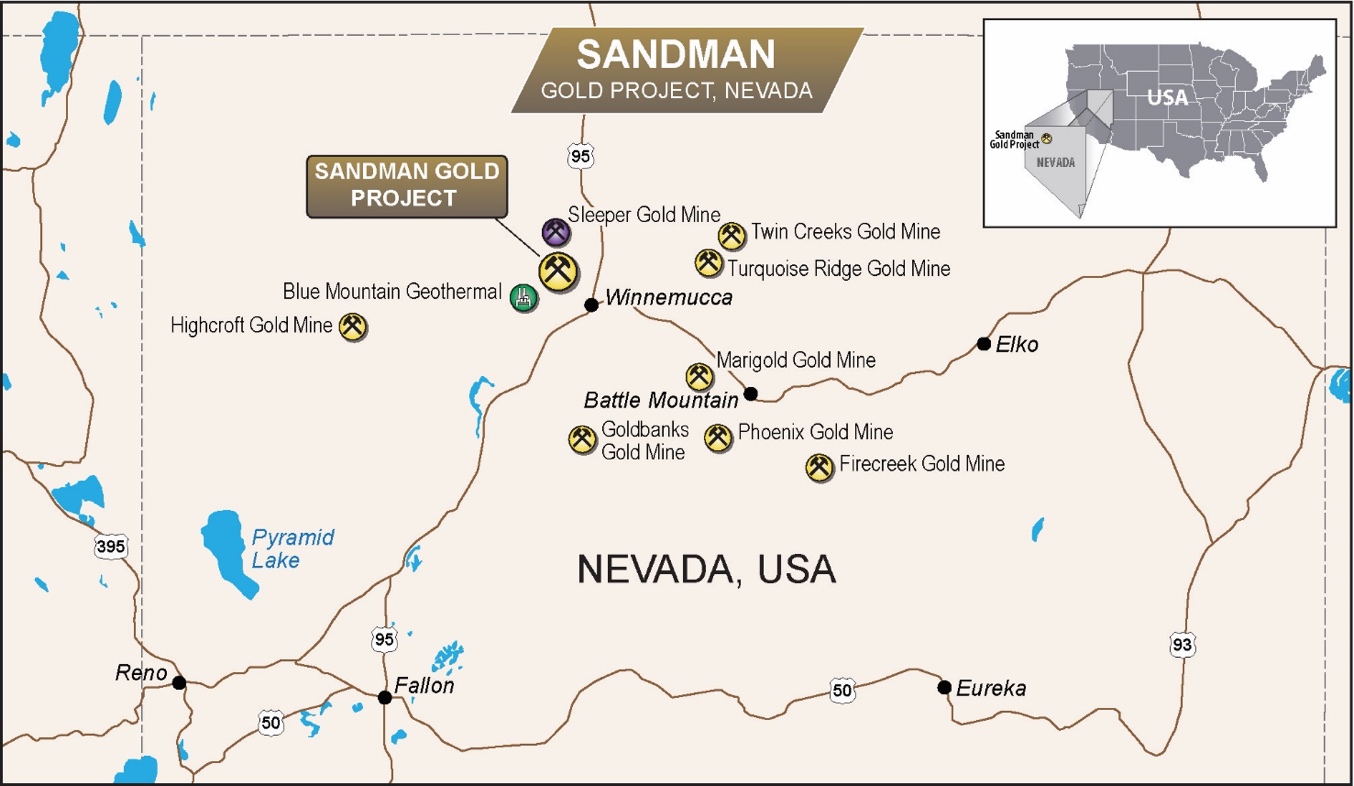

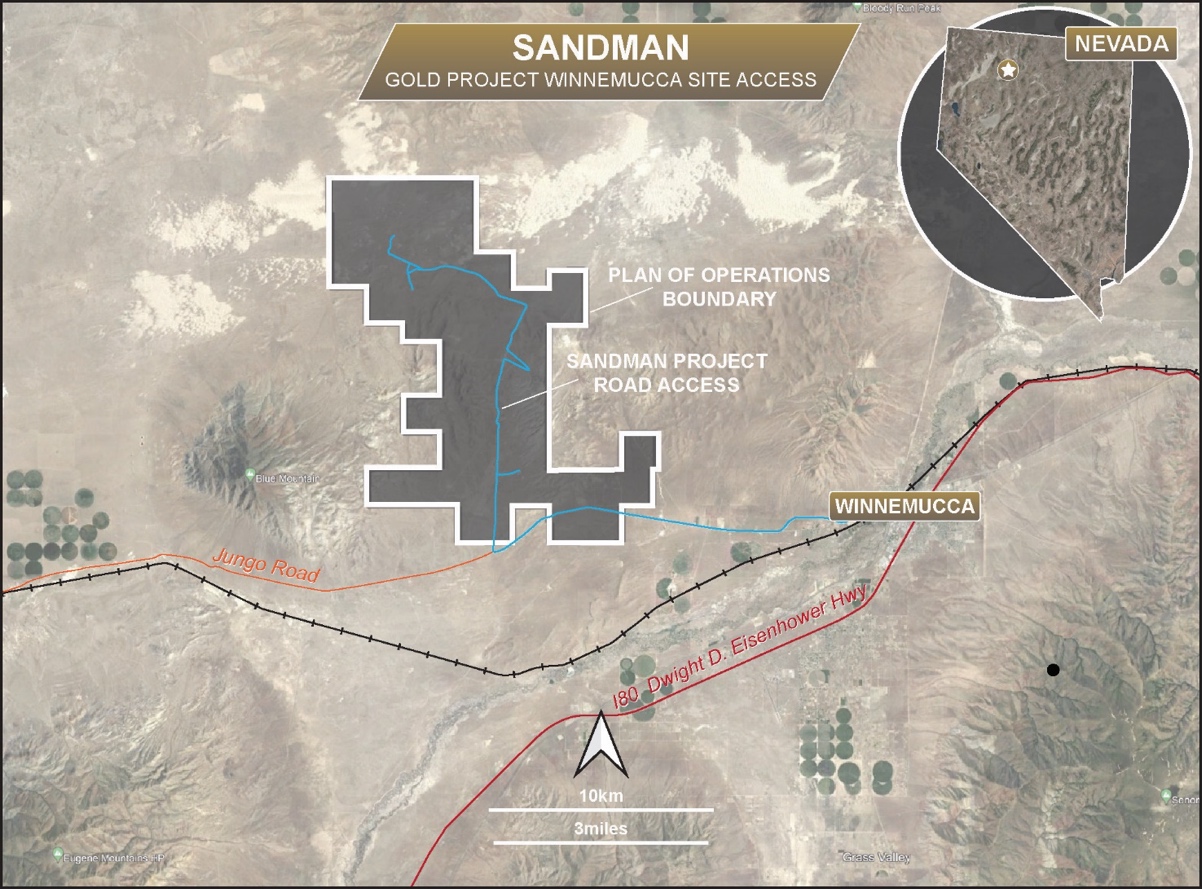

The Sandman Scoping Study [prepared by Jerod Eastman, President of DJ 6E Consulting LLC, an independent third-party consultant] has demonstrated potentially strong financial metrics for the Sandman Project based on a proposed stand-alone low-cost start-up heap leach gold mine project located approximately 25 km from the mining town of Winnemucca (Figure 1 and 2) in central Northern Nevada, USA. This study investigated a Phase 1 five-year mine plan of above water table oxide material processed onsite via conventional Heap Leach processing. Gold Bull considers Sandman to be technically low risk, given the low strip ratio and significant historical database that the study was based on. The Scoping Study was completed to an overall +/- 30% accuracy using the key parameters and assumptions set out in Tables 1 and 2.

The figures in the Scoping Study are focused only on the above water table mining scenario. There is additional oxide and sulfide gold mineralization below the water table and these mineralized materials will be included in future feasibility studies. The above water table mine scenario in the Scoping Study targets near-term cash flow to later fund below water table oxide mine studies and development. This work must include further studies for sulfide product processing and additional resource drilling.

The Sandman Project Scoping Study reports an IRR of 99%, NPV10% of USD77M, annual cashflow of estimated USD30M, and a payback period of 1.1 years when applying a gold price of USD1,800/oz of gold. The initial capital cost is USD28.8M, which includes working capital of USD4.3M, and a further USD8.3M will be required in year 3 as sustaining capital for additional mine studies and second leach pad commissioning. Total operating cost is $15.99 per tonne and all in sustaining cost of $1,173/oz gold. Royalty is low at 1.2% of product.

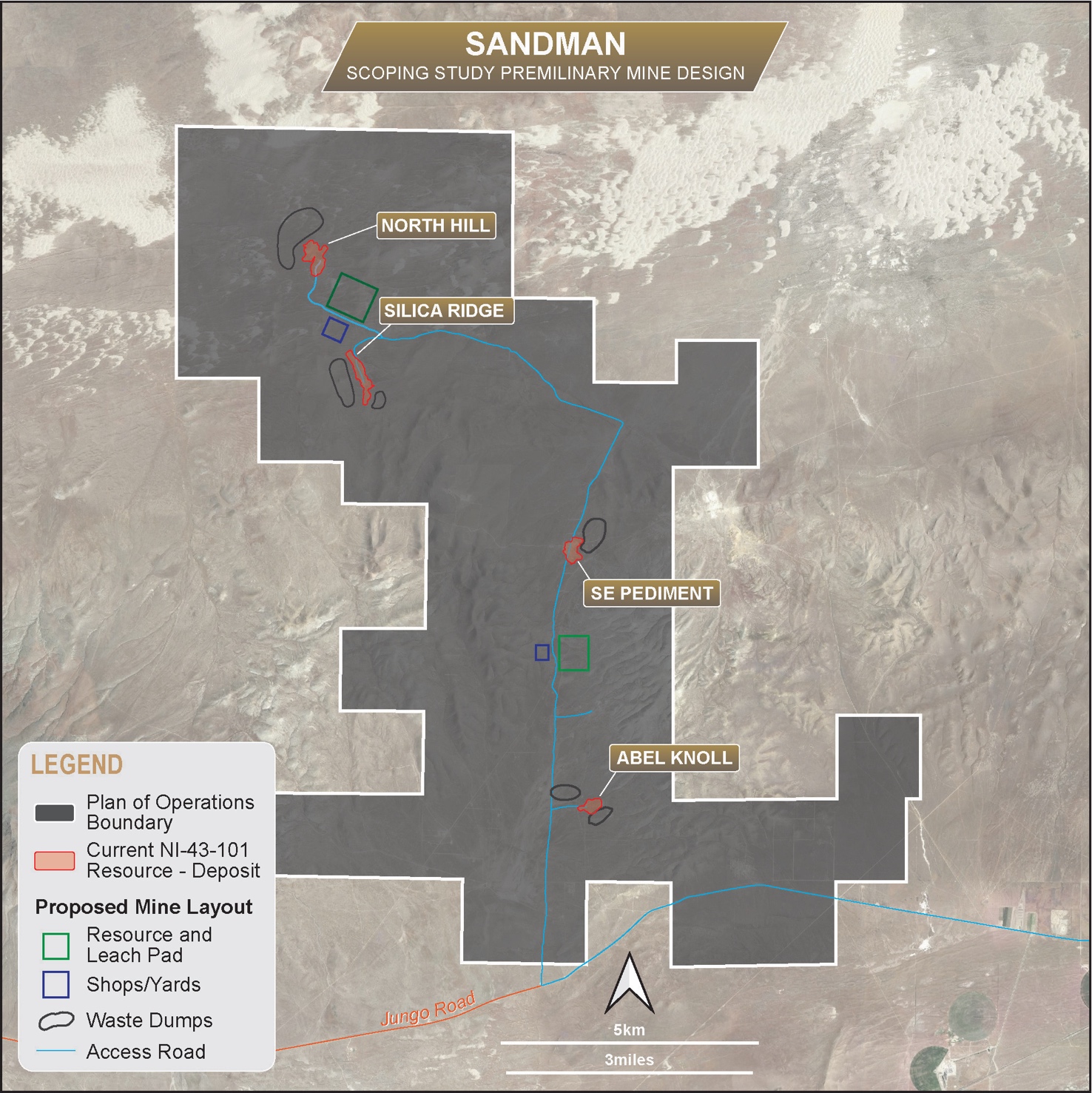

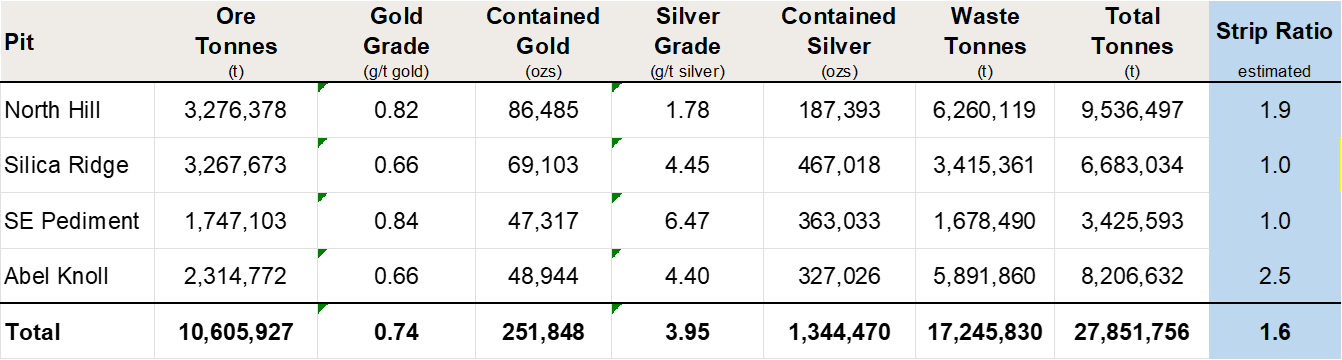

Phase 1 contained oxide gold above the water table amounts to approximately 250,000 ounces with a head grade of 0.74 g/t gold spread across four known gold deposits. The 250,000 ounces of contained gold above water table that this study is based upon comprises approximately 50% of the 2021 pit-constrained NI 43-101 Mineral Resource Estimate of 494,000 ounces. The four gold resources (see Figure 3: North Hill, Silica Ridge, Southeast Pediment, Abel Knoll) shall be mined via conventional open pit mining methods, with an average waste to product ratio of 1.6:1, annual production is 35K oz gold, with 2.2Mt feed production rate. Refer Table 1 for further details and estimated financial metrics.

| Metric for Phase 1 (oxide above water table only) |

Outcome |

| Economic Analysis |

|

|

| Internal Rate of Return (IRR) |

|

99 |

% |

|

| NPV @ 10% |

$ |

77,207,945 |

|

USD |

| Average Annual Cashflow |

$

|

29,762,342

|

|

USD |

| Undiscounted Cumulative Cashflow |

$ |

119,953,708 |

|

USD |

| Pay-Back Period |

|

1.1 |

|

years |

| Gold Price Assumption |

$ |

1,800 |

|

per ounce |

| All-in Sustaining Cost |

$ |

1,173 |

|

per ounce |

| Capital Costs |

|

|

| Initial Capital |

$ |

28,758,000 |

|

USD |

| Working Capital (included in above) |

$ |

4,300,000 |

|

USD |

| LOM Sustaining Capital |

$ |

8,342,000 |

|

USD

|

| Operating Costs (Average LOM) |

|

|

| Mining |

$ |

6.69 |

|

per ore tonne |

| Processing & Support |

$ |

5.43 |

|

per ore tonne |

| General & Administration (G&A) |

$ |

2.52 |

|

per ore tonne |

| Other Costs |

$ |

1.34 |

|

per ore tonne |

| Total Operating Cost |

$ |

15.99 |

|

per ore tonne |

| Production Data |

|

|

| Life of Mine (Phase 1 only) |

|

5 |

|

years |

| Ore Production Rate |

|

2,121,185 |

|

tonnes per annum |

| Total Tonnes of Ore Processed |

|

10,605,927 |

|

tonnes |

| Grade Au (Average) |

|

0.74 |

|

g/t Au |

| Contained Gold |

|

251,848 |

|

ounces |

| Metallurgical Recovery Au (Overall) |

|

70 |

% |

|

| Average Annual Gold Production1 |

|

35,259 |

|

ounces per annum |

| Total Gold Produced |

|

176,294 |

|

ounces |

| LOM Strip Ratio (Waste Tonnes : Ore Tonnes) |

|

1.6 |

|

: 1 |

Table 1. Scoping Study economic analysis of Sandman Project

Please note, it was assumed in this Cash Flow Model that Year 1 would follow the normal (reverse) S-curve for costs and performance. As such, there is an assumed ramp-up period for gold recovery, and operating costs are assumed to be higher in Year 1 during this ramp-up to steady state.

Figure 1. Sandman Project location map of Northern Nevada relative to the surrounding operating gold mines.

Figure 2. Sandman Project location relative to infrastructure and nearby regional mine servicing town of Winnemucca. The project is located on Jungo Road 20 kms from Winnemucca.

Figure 3. Sandman Scoping Study proposed mine design.

EXECUTIVE SUMMARY

The Sandman Project presents strong financial results and a compelling mine opportunity for a stand-alone open pit mine, commencing at the North Hill deposit, followed by the Silica Ridge, Southeast Pediment and Abel Knoll deposits. The mine proposal includes onsite single-stage crushing, which will move progressively from each pit location, with separate dumps and two localised leach pads. The first leach pad will be constructed for North Hill and Silica Ridge, and the second leach pad will be constructed for $8.3M in year 3 and will receive mineralized material feed from Southeast Pediment and Abel Knoll.

Economics are based upon contract mining, crushing and heap leach as the main processing method. It is planned to load the gold onto activated carbon and then transport the loaded carbon to off-site stripping and refining plants for final gold doré recovery. A simplified mining schedule is anticipated to produce 35,000-40,000 ounces of gold per annum.

Given the North Hill and Silica Ridge deposits outcrop at surface, these deposits present the best strip ratio starter pit mine scenarios. Above water table oxide product is targeted in this Scoping Study to enable rapid permitting for mine start-up and initial cash flow. There is further additional opportunity to mine the below water table oxide mineralization and use initial mine production profit to fund further below water table mine studies over the initial five-year mine period. The Scoping Study economics do not include the additional oxide mineralization located below the water table; as this will be included in future feasibility studies.

| Parameter |

Units |

Value |

| Gold Price |

US$/oz |

$1800 |

| Gold Recovery |

% |

70 |

| Silver Price |

US$/oz |

$20 |

| Silver Recovery |

% |

35 |

| Dilution |

% |

0 |

| Ore Loss |

% |

0 |

| Overall Pit Slope Angle |

Degrees |

50 |

| Processing Rate |

Tonnes per Annum |

3,000,000 |

| Carbon Stripping and Transportation |

$25.00 |

$/ounce |

| Final Refining and Marketing |

$10.00 |

$/ounce |

| Royalties |

1.2% |

|

| Property Tax |

$750,000 |

per year |

| New Mining Tax |

2.0% |

|

| Mining Waste |

$2.64 |

$/t (waste) |

| Mining Ore |

$2.40 |

$/t (ore) |

| Ore Crushing |

$0.76 |

$/t (ore) |

| Ore Haulage |

$1.05 |

$/t (ore) |

| Heap Leach Processing |

$3.05 |

$/t (ore) |

| G&A |

$2.52 |

$/t (ore) |

Table 2. Sandman Project Scoping Study mine factors applied to the economic evaluation

Comments

- This scenario includes above water table product feed, it does not include below water table or fresh mineralization

- Recoveries assumed at 70% for oxide/transitional material heap leaching based on historic studies by Newmont and others. Opportunity exists to further optimise/increase recoveries and further metallurgical testwork is needed

- Optimised pit shells were applied, not a refined pit design

- Future opportunity exists to increase mine production, as this schedule assumes dayshift only mining to meet the planned material movement requirements

- Revenue from silver production is included in this model, however, there has been little to no work on modeling of silver grade/tonnage recovery due to lack of silver assay data in historical drilling

- Cashflow model includes a 1.2% Royalty

Capital Categories

- Contingency of 30% added to all capital to cover unknown/ unrecognized categories

- Working capital is sufficient to cover 2 months of operating costs

- All Capital estimates are based on previous projects (within the past two years) and inflated to 2022 levels

- Engineering Procurement Construction Management (EPCM)

- Earthworks – roads, stockpiles and yard construction

- Crushing/stacking equipment, single stage crushing for 6-8Kt per day, cost estimate includes installation and commissioning, entire system to be mobile and follow mining from pit to pit

- Leach pad and ponds, 5-8Kt per day, cost estimate includes installation and commissioning. Initial pad built near North Hill and Silica Ridge will handle 63% of planned tonnage with a second smaller pad build near Southeast Pediment and Abel Knoll in year 3.

- Carbon columns, cost estimate includes installation and commissioning. One set of columns for the initial leach pad and second set to be constructed for the second leach pad

- Sustaining capital includes temporary construction facilities, construction services, supplies, quality control, survey support, construction equipment and safety

- Sample preparation conducted on site with off site gold analysis

- Infrastructure includes portable office, warehouse/parts storage, and a workshop

- Initial purchase or lease of water rights necessary to operate the mine

- Option to purchase additional surface rights included

Operational Categories

- Mining contractor mobilisation for 12-15 equipment units, office space and other resources.

- Contract mining comprises

- Drilling

- Blasting

- In-pit loading

- Waste haulage to near-pit waste rock stockpile

- Product feed haulage to near-pit stockpile location (for feed to crusher)

- Loader feed into a portable (movable) crusher

- Loading of crushed material into trucks

- Truck haulage to heap leach pad

- Roads/dumps/stockpile maintenance

- Company shall maintain small workforce for project management, administration, SHE permitting-training-compliance, general labor, crushing/heap leach operations, supply chain etc.

- Contractor demobilisation at the end of the project life

- Centralised location for diesel, gasoline, lubes and oils

- Power Generation and Distribution with mobile generators for crushing, pumping and other infrastructure requirements, includes a back-up generator, power poles, transformers for on-site distribution

- Further studies for alternative power solutions are needed as this scenario uses diesel generators

- Water supply and distribution, water well construction and extraction, pumping and piping to supply water for the project. Water usage 3,900 gallons per minute with make-up water consumption rate of 285 gallons per minute

- Additional environmental and hydrogeological baseline studies are required

- Initial purchase or lease of water rights necessary to operate the mine

- Indirect owners’ costs include temporary construction facilities, construction services, supplies, quality control, survey support, construction equipment, safety etc.

Operating Costs

An operating cost estimate has been calculated at US$15.99 per tonne of mineralized material mined and processed for the project. The estimate relates to all costs to allow production of gold doré, capturing the processing plant facilities, contractor mining, product refining and general and administration (G&A) costs.

| FunctionalArea |

CostperTonneProcessed

(US$) |

| Mining |

$6.69 |

| Processing |

$5.44 |

| G&A |

$2.52 |

| Other |

$1.34 |

| TotalSiteOperatingCost1 |

$15.99 |

Table 3. Sandman Project operating cost summary.

Basis for Economic calculations (tonnage/grades)

The Company announced its Mineral Resource Estimate February 2, 2021 (refer to table 6) with combined Indicated and Inferred ounces totaling 494K ounces of gold.

- Indicated Resource of 18,550kt @ 0.73g/t gold for 433kozs of gold

- Inferred Resource of 3,246kt @ 0.58g/t gold for 61kozs of gold

Table 4 summarises the tonnes and grade applied to the Scoping Study for above water table oxide mineralization.

The Scoping Study is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the Scoping Study will be realized.

A further grade model was created for the Scoping Study to include the 2021 and 2022 drill results and estimate an above water table tonnage and grade model. This was applied to the Scoping Study pit optimisation work and the resulting tonnes and grade are summarised in Table 4. The water table surface was conservatively defined by first intercept of water in the exploration drill holes. Detailed hydrogeological studies accurately defining the water table are yet to be conducted.

Table 4. Scoping Study tonnes and grade depicting 250K oz contained gold within the pit optimisation and above the estimated water table depth

Mining Methods

The Sandman Project is planned to be mined using conventional open pit mining methods on the four (4) separate deposits in the order listed in Table 4. The mining operation schedule is dayshift only with a roster of two production crews on a 4-days on and 4-days off, 12 hours per day.

Pre-production stripping is minimal as mineralized material is located at or near surface where mining is anticipated to begin at the North Hill and Silica Ridge deposits. The pit areas have small shrubs and grasses that can be easily cleared with planned mining equipment.

Open pit mining is currently envisaged to be by diesel-powered equipment, utilizing a combination of one rotary blasthole rig drilling 170mm diameter blastholes, one 8m3 front-end loader (or similar size excavator), and five, 70-tonne capacity trucks to handle mineralized material and waste. The mining fleet has sufficient capacity to move up to approximately 5.5Mtpa of total material on a dayshift-only schedule. Support equipment comprising a grader, track dozer(s) and water truck will aid in the mining. Mineralized material will be hauled to the crushing area for stockpiling before being rehandled later for primary crushing. Initially, waste rock will be stored in the waste rock dumps close to the pit to reduce haulage costs. As space and design allows, waste will be backfilled into the pit to reduce haulage costs and surface disturbance.

Haul roads are contemplated to be 9-10m widths for one-way traffic and 18-20m widths for two-way traffic. The final location of the ramps will be optimized to reduce the overall pit slopes and to aid in efficient haulage to various stockpile locations. The pit is considered dry.

The mine plan was designed to deliver ~2,000,000 tonnes of mineralized material per year to the processing facility. The mine plan was based on efficient extraction of mineralized material above the water table and started at the North Hill deposit (predicted higher-grade and low strip ratio) and then working the deposits in a southerly direction without regard to Indicated and Inferred Mineral Resource categories.

Total estimated mining workforce is 45-50 people, comprising a team of 15 Gold Bull personnel and 30-35 mining contractors (20 production operators, 8 maintenance techs, 5 supervisory staff).

Table 5 summarizes the five-year annual mining production schedule for above water table product, it is not a life of mine schedule.

| Period |

Product |

Gold

Grade |

Contained

Gold |

Total

Waste |

Total

Material |

Strip

Ratio |

|

tonnes |

g/t |

ounces |

tonnes |

tonnes |

w:o |

| Year 1 |

1,623,598 |

0.82 |

42,857 |

3,102,181 |

4,725,780 |

1.9 |

| Year 2 |

2,291,882 |

0.78 |

57,143 |

3,825,925 |

6,117,807 |

1.7 |

| Year 3 |

2,702,106 |

0.66 |

57,143 |

2,824,233 |

5,526,339 |

1.0 |

| Year 4 |

2,211,842 |

0.80 |

57,143 |

2,971,717 |

5,183,559 |

1.3 |

| Year 5 |

1,776,498 |

0.66 |

37,563 |

4,521,774 |

6,298,272 |

2.5 |

| Totals |

10,605,927 |

0.74 |

251,848 |

17,245,830 |

27,851,756 |

1.6 |

Table 5. Sandman Project annual mining production schedule for 5 years of the four Sandman deposits. Mining is for above water table mining only.

Mineral Processing and Recovery Methods

Precious metal recovery from this Scoping Study is through conventional heap leaching and adsorption, desorption, regeneration (ADR) technology for metal extraction from crushed product using industry standard equipment. Processing will involve mineralized material passing through a single stage of crushing, which will allow for haulage transport and end-dump stacking of the mineralized material onto a heap leach pad. The processing facilities accommodate a leachable tonnage of approximately 11Mt of product at a gold grade of 0.74g/t and a process rate of 5,000tpd or 2.1Mtpa. The heap leach pad facilities have been located and designed with expandability for a LOM production increase.

Mineralized material will be delivered to the heap leach pad from the open pit and placed in the stockpile adjacent to the crushing plant. The mineralized material will be fed to the crushing plant using a front-end loader and will be crushed and then transported to the heap leach pad via haul trucks. The mineralized material will be stacked onto the heap using industry standard end-dumping and dozer pushing and then leached with a weak cyanide solution to extract the precious metal values. The gold will then be recovered from the pregnant solution in the carbon columns by adsorbing the dissolved gold onto activated carbon, which will be bagged and transported off-site to an external facility to extract gold from the loaded carbon. The stripped carbon will be returned from the external treatment facility to site for continuous reuse in the process plant. The doré will be sent to a contract refiner for final refining.

Sensitivity Analysis

High level sensitivity analysis of the Sandman Project economics was conducted, indicating the project is most sensitive towards gold price and less sensitive towards operating cost and least sensitive to capital cost.

Figure 4. Sandman sensitivity analysis evaluating gold price, capital costs and operating costs.

Table 6. January 2021 NI 43-101 Sandman Gold Resource Estimate. Full report available: Sandman-NI-43-101_2021-01-20.pdf (goldbull.ca) Please note that the Sandman 2021 NI 43-101 Resource Estimate does not include drilling conducted by Gold Bull in 2021 and 2022.

NEXT STEPS

Further metallurgical and hydrogeological studies are required for inclusion in a Feasibility Study. Baseline hydrogeological, cultural and biological surveys have previously been conducted at Sandman, however, may need to be updated for mine permitting.

CAUTIONARY STATEMENT

This Scoping Study is a preliminary technical and economic study investigating the potential viability of commissioning and running a gold mine at the Sandman Project. The Scoping Study includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the Scoping Study will be realized.

The Scoping Study in this announcement is based on technical and economic assumptions and assessments which could be further refined and evaluated in a prefeasibility and feasibility study. If the Company were to attempt to bring the Sandman Project into production without established mineral reserves on the project supported by a full feasibility study, the Company cautions that this could result in a higher risk of economic or technical failure of the operation than if a full feasibility study had been prepared demonstrating economic and technical viability.

The Scoping Study is based on material assumptions outlined in this announcement. These include assumptions about the availability of funding and other parameters. While the Company considers all the material assumptions are based on reasonable grounds, there is no certainty they will prove to be correct or that the range of outcomes indicated in this Scoping Study announcement can be achieved or realised. There are no assurances that the Sandman Project will be found to be economic.

To achieve the potential mine development outcomes indicated in the Scoping Study, significant funding is required as well as further metallurgical, hydrogeological, and environmental assessments and permits received prior to confirming mining can take place. The Study has focussed only on initial oxide mining of mineralized material above the water table using conventional heap leach processing. Investors should note there is no certainty that the Company will be able to raise the required funding when needed, however the Company has concluded that it has a reasonable basis for providing the forward-looking statements included in this announcement and believes that it has a “reasonable basis” to expect it will be able to fund the gold development project upon receiving satisfactory and favourable results for further metallurgical, hydrogeological and environmental studies and permits enabling economic ore extraction. Further studies are required to confirm the proposed mine scenario and confirm assumptions made in this Scoping Study.

It is also possible that such funding may only be available on terms that may be dilutive, or otherwise affect the value of the Company’s existing shares. It is also possible that the Company could pursue other strategies to provide alternative funding options including project finance.

Given the uncertainties involved for the metallurgical, hydrogeological and environmental assessments and permits, investors should not make any investment decision based solely on the results of the Scoping Study and assume a mine will be developed, however every effort will be made by the Company to progress towards mine development.

ABOUT SANDMAN

In December 2020, Gold Bull purchased the Sandman Project from Newmont. Gold mineralization was first discovered at Sandman in 1987 by Kennecott and the project has been intermittently explored since then. There are four known pit constrained gold resources located within the Sandman Project, consisting of 21.8Mt at 0.7g/t gold for 494,000 ounces of gold; comprising of an Indicated Resource of 18,550kt at 0.73g/t gold for 433kozs of gold plus an Inferred Resource of 3,246kt at 0.58g/t gold for 61kozs of gold. Several of the resources remain open in multiple directions and the bulk of the historical drilling has been conducted to a depth of less than 100m. Sandman is conveniently located circa 25-30 km northwest of the mining town of Winnemucca, Nevada.

QUALIFIED PERSON

The technical information in this news release has been reviewed and approved by Mr. Jerod Eastman, a Qualified Person under National Instrument 43-101. Mr. Eastman is a Registered Member (#00885850) of the Society for Mining, Metallurgy and Exploration, Inc. and is completely independent of Gold Bull Resources Corp. The information in this news release that relates to mining and cost estimation is based on, and fairly reflects, information compiled by Mr. Eastman.

ABOUT GOLD BULL RESOURCES CORP.

Gold Bull’s mission is to grow into a US focused mid-tier gold development Company via rapidly discovering and acquiring additional ounces. The Company’s exploration hub is based in Nevada, USA, a top-tier mineral district that contains significant historical production, existing mining infrastructure and an established mining culture. Gold Bull is led by a Board and Management team with a track record of exploration and acquisition success.

Gold Bull’s core asset is the Sandman Project, located in Nevada which has a 494,000 oz gold resource as per 2021 43-101 Resource Estimate. Sandman is located 23 km south of the Sleeper Mine and boasts excellent large-scale exploration potential. Drilling at Sandman is currently underway.

Gold Bull is driven by its core values and purpose which includes a commitment to safety, communication & transparency, environmental responsibility, community, and integrity.

Cherie Leeden

President and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull Resources Corp., please visit our website at www.goldbull.ca or email admin@goldbull.ca or phone 778.899.3050.

Cautionary Note Regarding Forward-Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed “forward-looking statements” with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential”, “indicates”, “opportunity”, “possible” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although Gold Bull believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company’s ability to raise sufficient capital to fund its planned activities at the Sandman Project; the timing and costs of future activities on the Company’s properties; maintaining its mineral tenures and concessions in good standing, to explore and develop its projects, to repay its debt and for general working capital purposes; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations, future prices of copper and other metals, changes in general economic conditions, accuracy of mineral resource and reserve estimates, the potential for new discoveries, the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company’s plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.