(TheNewswire)

|

|

|

|

Jervois Global Limited – TheNewswire – October 21, 2022

(ACN:007 626 575)

(ASX/TSXV:JRV)

(OTC:JRVMF)

Corporate Information

1,519.7M Ordinary Shares

93.6M Options

4.4M Performance Rights

Non-Executive Chairman

Peter Johnston

CEO and Executive Director

Bryce Crocker

Non-Executive Directors

Brian Kennedy

Michael Callahan

David Issroff

Company Secretary

Alwyn Davey

Contact Details

Suite 2.03,

1-11 Gordon Street

Cremorne

Victoria 3121

Australia

P: +61 (3) 9583 0498

E: admin@jervoisglobal.com

W: www.jervoisglobal.com

|

Highlights

Idaho Cobalt Operations (“ICO”), United States:

-

ICO officially opened on 7 October 2022 as the only cobalt mine in the U.S.

-

First stage of commissioning commenced at ICO with commercial concentrate production expected in Q4 2022

-

Jervois expects to achieve ICO nameplate capacity production by end of Q1 2023

-

U.S. Government announced Inflation Reduction Act in September 2022 – significant for critical minerals producers

Jervois Finland:

-

Sales of 1,407 metric cobalt tonnes in Q3 representing +23% increase compared to the previous quarter

-

Q3 2022 revenue US$84.6 million (YTD: US$280.9 million)

-

Q3 2022 Adjusted EBITDA for Q3 2022 US$(0.6) million (YTD: US$26.2 million)

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil:

-

SMP acquisition closed on 15 July 2022, shortly after receipt of São Paulo City Hall Permit

-

Restart readiness activities advancing, including detailed engineering and progression of POX Feasibility Study

-

Mr. Carlos Braga appointed as President and Executive General Manager – Jervois Brasil

Corporate:

|

Idaho Cobalt Operations (“ICO”), United States

Jervois celebrated the official opening of ICO on 7 October 2022 with a ceremony attended by its Board of Directors, United States (“U.S.”) and Australian dignitaries including Idaho Governor Mr. Brad Little; the Ambassador of Australia to the U.S., the Hon. Arthur Sinodinos AO; Under Secretary for Science and Innovation, U.S. Department of Energy, Dr. Geri Richmond; and the Deputy Assistant Secretary for Textile, Consumer Goods and Materials, U.S. Department of Commerce, Ms. Jennifer Knight.

The ceremony took place at 8,100 feet, surrounded by the Salmon Challis National Forest, which is managed by Jervois’ regulator, the U.S. Forest Service. Jervois acknowledges that ICO is located within lands traditionally occupied by the Shoshone-Bannock Tribes and Nez Perce Tribe, whose rights are respectively reserved by treaties across the region. This serves to reinforce Jervois’ continued dedication to environmental stewardship and engagement with tribal governments.

ICO is the only primary cobalt mine in the U.S. and will produce a cobalt concentrate, which will be refined into the critical metal necessary for electric vehicles, energy generation and distribution, defense and other industries. Cobalt will play a key role in the transition to a low carbon economy.

Jervois commenced the first stage of plant commissioning at ICO following the opening, with commissioning expected to continue throughout October and November. Commercial concentrate production is expected in Q4 2022. Jervois expects to achieve full nameplate capacity by the end of Q1 2023.

ICO Construction and Mine Development Progress

Ore delivery to the plant on the ICO site is expected to begin during Q4 2022, with multiple ore faces now available for production mining. Underground mine infrastructure, including the underground fuel island, triple clarifying sumps and the main shop, are nearing completion. Mine development continues with a focus on vertical development to support additional production ore faces, reducing risk to ore delivery and increasing optionality for blending.

During September, the ICO mining camp opened and is now operating at 90% capacity. The mining camp consists of 102 individual rooms with ensuites, a dining facility, laundry facilities and recreation facilities. During Q4 2022, the “miners’ dry” is expected to be installed and commissioned. The ICO mining camp will deliver increased safety benefits with reduced travel and improved fatigue management, as well as increased productivity from increased working hours, efficient shift changes and the ability to continue construction activities on a 24 hours / 7 days a week basis.

At the end of Q3 2022, ICO construction was at 95% engineering completion and 71% construction completion. Major equipment installs including the SAG mill, ball mill, jaw crusher, fine ore bin, raw water tank, process water tank, copper and cobalt flotation cells are now complete. Commissioning on key utility systems such as process water delivery has commenced. Concrete work for the project is nearing completion, as construction focus moves to electrical and piping installation with the first installs occurring during the period.

During Q3 2022, expansion of the Tailings and Waste Storage Facility (“TWSF”) commenced with all earthmoving, lining and piping completed, with only the installation of the aggregate overliner remaining for completion in Q4 2022.

At the end of September, Jervois had spent US$91.0 million of the total capital expenditure budget of US$107.5 million, with final project capital expected to fall within this estimate. Capital expenditure in Q3 2022 was US$24.1 million.

Drilling at ICO

During 2022, Jervois commenced a US$4.8 million, or 46,000 feet, drilling campaign at ICO targeting both infill and expansion of the existing known mineral reserve and resource. To date, the Company has completed 28,000 feet of drilling, which has reduced drill hole spacing in the resource that will underpin mining in 2023 and into 2024. With adequate underground access now available, surface drilling (including targeted resource expansion holes) is moving underground, where productivity is expected to improve and can continue through the upcoming winter.

An updated Australian JORC 2012 and Canadian National Instrument (“NI”) 43-101 Mineral Reserve and Resource Estimate is expected to be published in Q2 2023.

Offtake

As there are no cobalt refineries in the U.S., the cobalt concentrate produced at ICO must be sent outside the country for refining. Jervois has an option to refine ICO cobalt concentrate at its 100%-owned São Miguel Paulista (“SMP”) refinery in São Paulo, Brazil, and is continuing its negotiations with third-party processors in countries allied to the U.S..

Jervois will sell copper concentrate from ICO into North American markets.

Operating Costs

ICO construction has taken place across a period of rising inflation in the U.S.. Strong management by Jervois and its U.S. construction partners, led by M3 Engineering, minimised capital expenditure increases for mine development and construction. As the mine enters commissioning, Jervois is working to optimise its business plan for ICO including opportunities to mitigate these same U.S. inflationary pressures on ICO operating costs.

Strategic Importance of ICO

ICO became an economically viable project as cobalt prices increased, and global geopolitical perspectives evolved with governments placing increased importance on critical mineral production in their own countries or in friendly jurisdictions. ICO will be a key contributor to U.S. national security by securing a domestic supply of cobalt, which has been designated a critical mineral by the U.S. Government.

Jervois hopes to progress its engagement with the U.S. Government to preserve and expand these national security benefits, including potential investments into mine expansion and downstream processing, and other strategies to ensure that pricing volatility associated with a commodity supply chain controlled by China does not adversely impact the U.S. national interest.

Jervois is proud of its ESG record to date and plans to continue to demonstrate its ability to operate ICO with strong environmental stewardship. Jervois looks forward to continuing its productive relationship with its regulators, including the U.S. Forest Service, as it examines potential mine expansion within the currently disturbed site footprint.

Jervois may pursue financing options for ICO and / or in other parts of its business with the U.S. Government that could be in addition to or in place of the existing ICO Bonds, in accordance with the Bond Terms. Jervois does not expect to update the market on any such financing options unless a definitive agreement is reached.

Jervois Finland Q3 2022 Results

-

Quarterly revenue: US$84.6 million (Q2 2022: US$91.2 million)

-

Adjusted EBITDA -US$0.6 million (Q2 2022: US$11.9 million)

-

Adjusted EBITDA margin: -0.7% (Q2 2022: 13.0%)

-

Cobalt sales volume: 1,407 metric tonnes (Q2 2022: 1,139 metric tonnes)

-

Production volume: 1,586 metric tonnes (Q2 2022: 1,145 metric tonnes)

Sales and Marketing

The cobalt market has stabilised after the recent downturn where the global macroeconomic situation, along with continuing Covid-related lockdowns, temporarily dampened demand. Risks of disruptions to global supply from the Democratic Republic of Congo are re-emerging. This may trigger re-stocking by downstream users which would favourably impact prices, should this occur. The outlook remains positive for 2023 and beyond. The growth in battery sector demand is poised to accelerate, the consumer electronics sector is expected to recover, while demand in traditional industrial uses is expected to grow broadly in line with global GDP.

Jervois’ outlook for key market segments is summarised below.

Batteries:

-

Lithium cobalt oxide “LCO”) chemistry into China remains weak; whilst electric vehicle demand is growing rapidly, lithium ion battery usage into cell phones, tablets and computers remains a large driver of the cobalt market.

-

Jervois Finland sales to the battery market remain sluggish as producers sit on high levels of inventory and programmes have been delayed. A lack of semiconductors has been cited as the reason for much of the softness.

-

Looking to 2023, Jervois’s customers will carry inventory across the remainder of 2022 and into early 2023, and cobalt sales are expected to begin accelerating across next year as the situation both improves, and electric vehicle penetration rates continue to rise.

-

Jervois’s commercial team are in active negotiations with major European, U.S. and Japanese battery plants regarding a significant uptick in cobalt demand that is steadily projected across 2023, and then aggressively from early 2024.

-

The recent U.S. Inflation Reduction Act 2022 is expected to have a profound impact not only on trade flows but also industry capital allocation, as the economic benefits associated the legislation trigger both new investment decisions into America, and prior announcements to be revisited in light of U.S. incentives.

Chemicals, Catalysts and Ceramics:

-

Catalysts: cobalt carbonate sales to Jervois Finland’s customer base continue to meet expectations, which are currently at the lower end of historical bands particularly in hydrodesulphurization (“HDS”) catalysts. Modest growth is expected in 2023, with gas to liquids (“GTL”) catalysts holding up better than HDS.

-

Chemicals: consumption remains steady, particularly in Asia, of cobalt hydroxide for rubber adhesion promoters and coatings, while Western demand is weakening. Cobalt sulphate usage in copper electrowinning remained steady.

-

Ceramics: high energy costs continue to dampen demand at ceramic tile and pigment producers, particularly in Europe, while Chinese cobalt oxide producers remain active participants in global markets as a result of their country’s continued ‘zero Covid’ policy and consequential impact on their domestic economy.

Powder Metallurgy:

-

Jervois has relatively limited direct sales, but aerospace (the second largest consumer of cobalt after batteries) has picked up substantially post Covid, with a strong outlook for 2023. Rising demand in aerospace is being supported by increases across both civilian and defense industry sectors. Cobalt metal (of which aerospace consumes) has the most pronounced impact on Western pricing, published by Fastmarkets Metal Bulletin.

-

Jervois Finland cobalt powder sales have softened, as recession concerns have hard metal and diamond tool customers reducing inventories and forecasting limited growth in 2023.

-

European customers are expressing concern that lack of natural gas supplies could impact business activity levels, depending on the harshness of the winter and geopolitical situation following Russia’s invasion of Ukraine.

Jervois Finland achieved production of 1,586 metric tonnes and sales of 1,407 metric tonnes in the quarter, an increase over the prior quarter of +38.5% (which was affected by a scheduled annual maintenance shutdown) and +23.5%, respectively. Quarterly sales volumes were restored to historic average levels as market demand stabilised. Jervois continues to pursue new market development initiatives, with a focus on expanding and deepening relationships in the high-growth battery segment, to underpin future growth.

The business is pursuing a disciplined approach to managing its cobalt inventories. Inventories continue to be above target levels at 30 September. The pace of inventory reduction is being optimised for market conditions. Working capital is discussed further below.

Financial Performance2

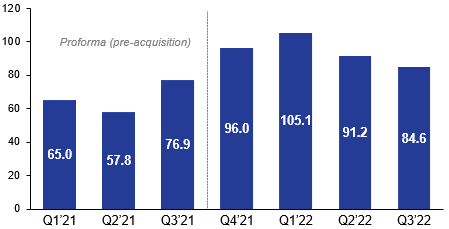

Jervois Finland achieved revenue of US$84.6 million in Q3 2022 (Figure 1).

Figure 1: Jervois Finland Revenue (US$M, unaudited)

Jervois Finland revenue was 8% lower than the prior quarter. Sales volumes were 23% higher, offset by the impact of a 32% decline in the average cobalt price.

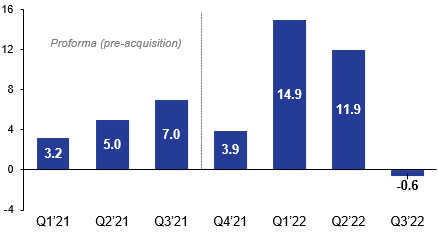

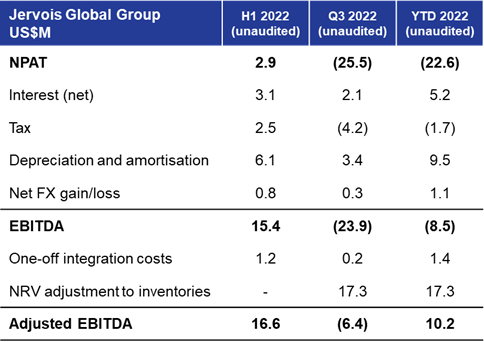

Adjusted Jervois Finland EBITDA for Q3 2022 of (US$0.6 million) compares to US$11.9 million in the prior quarter (Figure 2 and Figure 3).

Figure 2: Jervois Finland Adjusted EBITDA (US$M, unaudited)

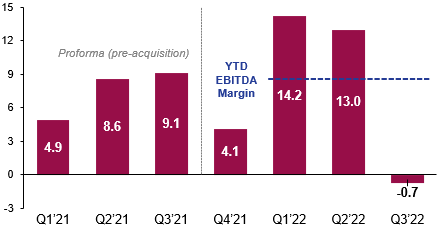

Figure 3: Jervois Finland Adjusted EBITDA Margin (%, unaudited)

Year-to-date Adjusted EBITDA is US$26.2 million, and year-to-date Adjusted EBITDA margins are 9%. The key impact on Q3 2022 performance is the higher realised feed costs in the profit and loss account. This resulted from the sharp downward movement in the cobalt price in Q2 2022 and early in Q3 2022. Costs are realised in the profit and loss account based on the average cost of inventory at the time when finished goods are sold. For the current period, costs realised in the profit and loss account included raw materials costs linked to purchases settled in the periods prior to the recent price declines. Jervois expects feed costs realised in the profit and loss account and margins to start to normalise in Q4 2022.

Sales volume guidance for the full year is 5,400 to 5,600 mt. Adjusted EBITDA guidance for the full year is US$27.5 million to US$32.5 million based on actual results for the year to date and a US$25.00/lb cobalt price assumption for Q4 2022, down from US$27.50 for 1H 2022 at the last results. Jervois is revising its guidance methodology for 2023, which will focus on communicating key physical metrics and operating cost guidance for its operating assets.

Working Capital

Net working capital was stable relative to the prior quarter. Cobalt inventories were 2,687 mt at 30 September, compared to 2,491 mt at 30 June. Total inventory volume at ~160 days remains in excess of target levels (90 to 110 days). A key driver is the cobalt hydroxide supply catch-up that occurred in Q2 2022 following significant interruptions to logistics over the prior 12 months. Jervois has elected to stage the inventory unwind into 2023 with the aim of preserving value in periods where the market has been relatively illiquid and supporting management of near-term risks around raw materials supply. Jervois anticipates that cash progressively released from working capital reductions will be used to meet partial repayment of the Mercuria working capital facility.

The Net Realisable Value (“NRV”) of cobalt inventories as at 30 September 2022 was lower than historic cost, and therefore a US$17.3 million non-cash accounting adjustment has been recorded in the period. The NRV write-down is a non-cash adjustment to the book value of inventory and does not impact the economic gain or loss associated with the inventory position. The economic gain or loss is expected to be realised in future cash flows according to market conditions and other circumstances in the future period when the inventory is sold. The cost has been excluded from Adjusted EBITDA.3

São Miguel Paulista (“SMP”) Nickel and Cobalt Refinery, Brazil

In September, Jervois received an Environmental Installation License (the “LPI”) for its São Miguel Paulista (“SMP”) nickel cobalt refinery in São Paulo. This license from the State environmental regulator, Companhia Ambiental do Estado de São Paulo (“CETESB”), represents São Paulo State approval for construction of the Stage 1 SMP restart, another important milestone for the project.

Activities in support of the restart of the refinery are advancing. Detailed engineering and execution planning are advancing in partnership with Ausenco. Commercial activities are advancing with increased confidence in an ability to achieve future supply of nickel intermediate feed products on more attractive terms than assumed in the published Bankable Feasibility Study (“BFS”) (see announcement on 29 April 2022). The POX BFS now expected end Q4 2022, with the scope linked with third party concentrate sale negotiations, which remain ongoing.

Jervois forecasts production of 10,000 metric tonnes per annum (“mtpa”) and 2,000 mtpa of refined nickel and cobalt metal cathode respectively for the Stage 1 SMP refinery restart. Final investment decision expected in Q4 2022.

Nico Young Nickel-Cobalt Project, New South Wales, Australia

Jervois’ 100%-owned Nico Young nickel and cobalt project envisages heap leaching nickel and cobalt laterite ore to produce either an intermediate MHP or refining through to battery grade nickel sulphate and cobalt in refined sulphide.

Planning for Jervois’s drilling campaign at Nico Young is well underway, with an initial focus on converting inferred resources into the indicated category. An inspection will be undertaken in late October to assess the local conditions following significant local rainfall, and review key activities for the planned drilling program expected to commence in January 2023.

Corporate Activities

Liquidity

Jervois closed the quarter with US$52.3 million cash and US$157.6 million in physical cobalt inventories. Debt drawn down at the balance sheet date was US$200.0 million.

Investor Relations

In August, Jervois’ Chief Executive Officer, Mr. Bryce Crocker, presented at the Diggers & Dealers Mining Forum in Kalgoorlie, Australia.

Environmental, Social, Governance and Compliance

Responsible Supply Chains

Jervois established a Responsible Supply Chain Working Group in the quarter to strengthen internal capacity. The working group will harmonise approaches to meeting requirements under OECD and the Responsible Minerals Initiative (“RMI”) guidelines and establish due diligence requirements for both mineral and non-mineral supply chains related to emerging legislation in the U.S., European Union (“E.U.”) and elsewhere.

Jervois is well positioned to leverage the expertise, policies and processes in place at Jervois Finland, the first cobalt chemical and metal powder producer conformant to RMI’s Downstream Assessment Program. In conjunction, Jervois’ Group Manager – ESG and Jervois Finland’s Director of Plant Support and Administration conducted a 10-day visit to a number of supplier sites in order to assess Jervois’ upstream ESG compliance. All supplier sites visited were observed to be aligned with international standards, including through having well-established risk management frameworks.

Climate Action

A series of near-term, carbon emission reduction measures are already underway at Jervois Finland, including the securing of access to long term (10 year) renewable electricity representing approximately two thirds of its total annual current (prior to expansion) power consumption commencing in 2024 and 2025 as announced on 20 October 2022, with additional strategies identified through to 2035 and beyond. These largely relate to a continued focus on energy and resource efficiency, including through introduction of low carbon technology, equipment and inputs; improvements in water and waste management; and continued engagement in Towards Carbon Neutral Metals (“TOCANEM”), a consortium of metal industry companies and universities in Finland. TOCANEM is focused on new product opportunities, technology innovations, process efficiencies and the circular economy to reach carbon neutral targets.

Diversity and Inclusion

Jervois recognises that, by developing inclusive working conditions and fostering a diverse workforce, we can create a pipeline for promotion from within while creating conditions to attract talent from outside. Benefits in terms of productivity, innovation, decision-making, employee satisfaction and other factors are well-established. A Diversity and Inclusion Roadmap is being prepared, led by the Diversity and Inclusion Working Group.

Jervois Whistleblower and Grievance Process

Reinforcement of Jervois’ whistleblower and operations-level grievance processes is essential to compliance with acceptable standards of practice under industry ESG standards while helping to strengthen community relations, create inclusive working conditions, support responsible supply chains, and foster continuous improvement. Jervois has engaged People InTouch to provide organisational support, including training, to improve existing whistleblower and grievance mechanisms and establish a “Speak Up” culture at all levels of the organisation.

Engaging the Global Community

During the quarter, Jervois continued to engage in the Cobalt Institute Responsible Sourcing and Sustainability Committee, including through participation in online training aimed to enhance capacity to meet requirements of E.U. legislation concerning human rights and environmental justice expectations.

Jervois also continued to engage with the U.S. Critical Materials Initiative during the quarter, which aims to advance greener technology via cutting edge research, and the U.S.’ National Mining Association, including through participation in training related to the Rights of Indigenous Peoples and Free, Prior and Informed Consent.

Management Updates

Post quarter-end in October, Jervois appointed Mr. Carlos Braga as Executive General Manager – Brazil.

Mr. Braga joins Jervois from Brazilian private fertilizer group, Morro Verde Fertilizer, where he was Chief Executive Officer since 2021 and successfully transitioned the company into operation, selling phosrock into the Brazilian domestic market. Prior to Morro Verde Fertilizer, Mr. Braga spent three years at McKinsey in São Paulo where he advised clients on operational transformation and optimisation across a range of industries including fertilizers, rare earths, and base metals.

Mr. Braga has previous experience with SMP, when early in his career in 2001 he collaborated in the implementation of a US$20 million expansion at SMP through his role at the engineering firm Progen.

Mr. Braga is a graduate of São Paulo University with an MBA from Cornell University in the United States.

Acting EGM Brazil, Mr. Valdecir Botassini (refer to announcement dated 26 January 2021) will continue in his current role as SMP Project Director, where he and Jervois Brasil’s local operating team in São Paulo are coordinating detailed engineering and advanced procurement by Ausenco to underpin restarting the facility, ahead of anticipated final investment decision by the Jervois Board before the end of 2022.

Exploration and Development Expenditure

No material cash expenditure on exploration and development was incurred during the quarter.

Insider Compensation Reporting

During the quarter, US$0.05 million was paid to Non-Executive Directors and US$0.1 million was paid to the CEO (Executive Director).

Non-Core Assets

Jervois’ non-core assets are summarised on the Company’s website.

ASX Waiver Information

On 6 June 2019, the ASX granted a waiver to Jervois in respect of extending the period to 8 November 2023 in which it may issue new Jervois shares to the eCobalt option holders as part of the eCobalt transaction. As at 30 September 2022, the following Jervois shares were issued in the quarter on exercise of eCobalt options and the following eCobalt options remain outstanding:

|

Jervois shares issued in the quarter on exercise of eCobalt options:

|

Nil

|

|

eCobalt options remaining4

|

|

1,179,750

1,980,000

|

eCobalt options exercisable until 28 June 2023 at C$0.61 each

eCobalt options exercisable until 1 October 2023 at C$0.53 each

|

|

3,159,750

|

|

By Order of the Board

Bryce Crocker

Chief Executive Officer, Jervois Global Limited

For further information, please contact:

Forward-Looking Statements

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to future EBITDA for the group, operations at Jervois Finland, construction work undertaken at ICO, timing of production at ICO, preparation of studies on the SMP refinery, timing of restart of SMP refinery and the reliability of third party information, and certain other factors or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Basis of Preparation of Financial Information

Historical and forecast financial information

Historical financial information for Jervois Finland prior to acquisition by Jervois Global Limited on 1 September 2021 is based on unaudited financial statements that have been prepared in accordance with US GAAP and accounting principles applied under its ownership by Freeport McMoRan Inc. Financial information presented for the period prior to acquisition by Jervois Global Limited on 1 September 2021 is presented on a proforma basis for illustrative purposes only.

Financial information presented for periods after the acquisition on 1 September 2021 is prepared under Jervois Global Group accounting policies, which conform with Australian Accounting Standards (“AASBs”) and International Financial Reporting Standards (“IFRS”). The Jervois Finland financial results for the period post-acquisition are consolidated into the Jervois Global Group consolidated financial statements. Information presented is unaudited.

EBITDA for historical periods is presented as net income after adding back tax, interest, depreciation and extraordinary items and is a non-IFRS/non-GAAP measure.

The Jervois Finland 2022 guidance consists of actual results for January to September and forecast results for October to December. The forecast period includes an assumption of a Q4 2022 forecast Fastmarkets Metal Bulletin Standard Grade Low quoted cobalt price of US$25.00/lb and cobalt hydroxide index price of 32% . Other forecast assumptions, including production, sales plans, costs and exchange rates are based on Jervois’ internal estimates.

Reconciliation of NPAT to EBITDA and Adjusted EBITDA

EBITDA is a non-IFRS financial measure. EBITDA is presented as net income after adding back interest, tax, depreciation and amortisation, and extraordinary items. Adjusted EBITDA represents EBITDA adjusted to exclude items which do not reflect the underlying performance of the company’s operations. Exclusions from adjusted EBITDA are items that require exclusion in order to maximise insight and consistency on the financial performance of the company’s operations.

Exclusions include gains/losses on disposals, impairment charges (or reversals), certain derivative items, NRV adjustments to inventories*, and one-off costs related to post-acquisition integration.

*NRV is excluded from Adjusted EBITDA given the adjustment occurs in times of extreme and rapid cobalt price movements. This approach is consistent with the scope of exclusions previously disclosed by Jervois, which includes impairments and reversals, and the 2019 proforma financials disclosed as part of the July 2021 equity raise. The adjustment in 2019 was made in similar circumstances of extreme cobalt price volatility.

Tenements

Australian Tenements

|

Description

|

|

Tenement number

|

Interest owned %

|

|

Ardnaree (NSW)

|

|

EL 5527

|

100.0

|

|

Thuddungra (NSW)

|

|

EL 5571

|

100.0

|

|

Nico Young (NSW)

|

|

EL 8698

|

100.0

|

|

West Arunta (WA)

|

|

E80 4820

|

17.9

|

|

West Arunta (WA)

|

|

E80 4986

|

17.9

|

|

West Arunta (WA)

|

|

E80 4987

|

17.9

|

|

Uganda Exploration Licences

|

|

Description

|

|

Exploration Licence number

|

Interest owned %

|

|

Kilembe Area

|

|

EL0292

|

100.0

|

|

Kilembe Area

|

|

EL0012

|

100.0

|

|

Idaho Cobalt Operations – 100% Interest owned

|

|

Claim Name

|

County #

|

IMC #

|

|

SUN 1

|

222991

|

174156

|

|

SUN 2

|

222992

|

174157

|

|

SUN 3 Amended

|

245690

|

174158

|

|

SUN 4

|

222994

|

174159

|

|

SUN 5

|

222995

|

174160

|

|

SUN 6

|

222996

|

174161

|

|

SUN 7

|

224162

|

174628

|

|

SUN 8

|

224163

|

174629

|

|

SUN 9

|

224164

|

174630

|

|

SUN 16 Amended

|

245691

|

177247

|

|

SUN 18 Amended

|

245692

|

177249

|

|

Sun 19

|

277457

|

196394

|

|

SUN FRAC 1

|

228059

|

176755

|

|

SUN FRAC 2

|

228060

|

176756

|

|

TOGO 1

|

228049

|

176769

|

|

TOGO 2

|

228050

|

176770

|

|

TOGO 3

|

228051

|

176771

|

|

DEWEY FRAC Amended

|

248739

|

177253

|

|

Powder 1

|

269506

|

190491

|

|

Powder 2

|

269505

|

190492

|

|

LDC-1

|

224140

|

174579

|

|

LDC-2

|

224141

|

174580

|

|

LDC-3

|

224142

|

174581

|

|

LDC-5

|

224144

|

174583

|

|

LDC-6

|

224145

|

174584

|

|

LDC-7

|

224146

|

174585

|

|

LDC-8

|

224147

|

174586

|

|

LDC-9

|

224148

|

174587

|

|

LDC-10

|

224149

|

174588

|

|

LDC-11

|

224150

|

174589

|

|

LDC-12

|

224151

|

174590

|

|

LDC-13 Amended

|

248718

|

174591

|

|

LDC-14 Amended

|

248719

|

174592

|

|

LDC-16

|

224155

|

174594

|

|

LDC-18

|

224157

|

174596

|

|

LDC-20

|

224159

|

174598

|

|

LDC-22

|

224161

|

174600

|

|

LDC FRAC 1 Amended

|

248720

|

175880

|

|

LDC FRAC 2 Amended

|

248721

|

175881

|

|

LDC FRAC 3 Amended

|

248722

|

175882

|

|

LDC FRAC 4 Amended

|

248723

|

175883

|

|

LDC FRAC 5 Amended

|

248724

|

175884

|

|

RAM 1

|

228501

|

176757

|

|

RAM 2

|

228502

|

176758

|

|

RAM 3

|

228503

|

176759

|

|

RAM 4

|

228504

|

176760

|

|

RAM 5

|

228505

|

176761

|

|

RAM 6

|

228506

|

176762

|

|

RAM 7

|

228507

|

176763

|

|

RAM 8

|

228508

|

176764

|

|

RAM 9

|

228509

|

176765

|

|

RAM 10

|

228510

|

176766

|

|

RAM 11

|

228511

|

176767

|

|

RAM 12

|

228512

|

176768

|

|

RAM 13 Amended

|

245700

|

181276

|

|

RAM 14 Amended

|

245699

|

181277

|

|

RAM 15 Amended

|

245698

|

181278

|

|

RAM 16 Amended

|

245697

|

181279

|

|

Ram Frac 1 Amended

|

245696

|

178081

|

|

Ram Frac 2 Amended

|

245695

|

178082

|

|

Ram Frac 3 Amended

|

245694

|

178083

|

|

Ram Frac 4 Amended

|

245693

|

178084

|

|

HZ 1

|

224173

|

174639

|

|

HZ 2

|

224174

|

174640

|

|

HZ 3

|

224175

|

174641

|

|

HZ 4

|

224176

|

174642

|

|

HZ 5

|

224413

|

174643

|

|

HZ 6

|

224414

|

174644

|

|

HZ 7

|

224415

|

174645

|

|

HZ 8

|

224416

|

174646

|

|

HZ 9

|

224417

|

174647

|

|

HZ 10

|

224418

|

174648

|

|

HZ 11

|

224419

|

174649

|

|

HZ 12

|

224420

|

174650

|

|

HZ 13

|

224421

|

174651

|

|

HZ 14

|

224422

|

174652

|

|

HZ 15

|

231338

|

178085

|

|

HZ 16

|

231339

|

178086

|

|

HZ 18

|

231340

|

178087

|

|

HZ 19

|

224427

|

174657

|

|

Z 20

|

224428

|

174658

|

|

HZ 21

|

224193

|

174659

|

|

HZ 22

|

224194

|

174660

|

|

HZ 23

|

224195

|

174661

|

|

HZ 24

|

224196

|

174662

|

|

HZ 25

|

224197

|

174663

|

|

HZ 26

|

224198

|

174664

|

|

HZ 27

|

224199

|

174665

|

|

HZ 28

|

224200

|

174666

|

|

HZ 29

|

224201

|

174667

|

|

HZ 30

|

224202

|

174668

|

|

HZ 31

|

224203

|

174669

|

|

HZ 32

|

224204

|

174670

|

|

HZ FRAC

|

228967

|

177254

|

|

JC 1

|

224165

|

174631

|

|

JC 2

|

224166

|

174632

|

|

JC 3

|

224167

|

174633

|

|

JC 4

|

224168

|

174634

|

|

JC 5 Amended

|

245689

|

174635

|

|

JC 6

|

224170

|

174636

|

|

JC FR 7

|

224171

|

174637

|

|

JC FR 8

|

224172

|

174638

|

|

JC 9

|

228054

|

176750

|

|

JC 10

|

228055

|

176751

|

|

JC 11

|

228056

|

176752

|

|

JC-12

|

228057

|

176753

|

|

JC-13

|

228058

|

176754

|

|

JC 14

|

228971

|

177250

|

|

JC 15

|

228970

|

177251

|

|

JC 16

|

228969

|

177252

|

|

JC 17

|

259006

|

187091

|

|

JC 18

|

259007

|

187092

|

|

JC 19

|

259008

|

187093

|

|

JC 20

|

259009

|

187094

|

|

JC 21

|

259010

|

187095

|

|

JC 22

|

259011

|

187096

|

|

CHELAN NO. 1 Amended

|

248345

|

175861

|

|

GOOSE 2 Amended

|

259554

|

175863

|

|

GOOSE 3

|

227285

|

175864

|

|

GOOSE 4 Amended

|

259553

|

175865

|

|

GOOSE 6

|

227282

|

175867

|

|

GOOSE 7 Amended

|

259552

|

175868

|

|

GOOSE 8 Amended

|

259551

|

175869

|

|

GOOSE 10 Amended

|

259550

|

175871

|

|

GOOSE 11 Amended

|

259549

|

175872

|

|

GOOSE 12 Amended

|

259548

|

175873

|

|

GOOSE 13

|

228028

|

176729

|

|

GOOSE 14 Amended

|

259547

|

176730

|

|

GOOSE 15

|

228030

|

176731

|

|

GOOSE 16

|

228031

|

176732

|

|

GOOSE 17

|

228032

|

176733

|

|

GOOSE 18 Amended

|

259546

|

176734

|

|

GOOSE 19 Amended

|

259545

|

176735

|

|

GOOSE 20

|

228035

|

176736

|

|

GOOSE 21

|

228036

|

176737

|

|

GOOSE 22

|

228037

|

176738

|

|

GOOSE 23

|

228038

|

176739

|

|

GOOSE 24

|

228039

|

176740

|

|

GOOSE 25

|

228040

|

176741

|

|

SOUTH ID 1 Amended

|

248725

|

175874

|

|

SOUTH ID 2 Amended

|

248726

|

175875

|

|

SOUTH ID 3 Amended

|

248727

|

175876

|

|

SOUTH ID 4 Amended

|

248717

|

175877

|

|

SOUTH ID 5 Amended

|

248715

|

176743

|

|

SOUTH ID 6 Amended

|

248716

|

176744

|

|

South ID 7

|

306433

|

218216

|

|

South ID 8

|

306434

|

218217

|

|

South ID 9

|

306435

|

218218

|

|

South ID 10

|

306436

|

218219

|

|

South ID 11

|

306437

|

218220

|

|

South ID 12

|

306438

|

218221

|

|

South ID 13

|

306439

|

218222

|

|

South ID 14

|

306440

|

218223

|

|

OMS-1

|

307477

|

218904

|

|

Chip 1

|

248956

|

184883

|

|

Chip 2

|

248957

|

184884

|

|

Chip 3 Amended

|

277465

|

196402

|

|

Chip 4 Amended

|

277466

|

196403

|

|

Chip 5 Amended

|

277467

|

196404

|

|

Chip 6 Amended

|

277468

|

196405

|

|

Chip 7 Amended

|

277469

|

196406

|

|

Chip 8 Amended

|

277470

|

196407

|

|

Chip 9 Amended

|

277471

|

196408

|

|

Chip 10 Amended

|

277472

|

196409

|

|

Chip 11 Amended

|

277473

|

196410

|

|

Chip 12 Amended

|

277474

|

196411

|

|

Chip 13 Amended

|

277475

|

196412

|

|

Chip 14 Amended

|

277476

|

196413

|

|

Chip 15 Amended

|

277477

|

196414

|

|

Chip 16 Amended

|

277478

|

196415

|

|

Chip 17 Amended

|

277479

|

196416

|

|

Chip 18 Amended

|

277480

|

196417

|

|

Sun 20

|

306042

|

218133

|

|

Sun 21

|

306043

|

218134

|

|

Sun 22

|

306044

|

218135

|

|

Sun 23

|

306045

|

218136

|

|

Sun 24

|

306046

|

218137

|

|

Sun 25

|

306047

|

218138

|

|

Sun 26

|

306048

|

218139

|

|

Sun 27

|

306049

|

218140

|

|

Sun 28

|

306050

|

218141

|

|

Sun 29

|

306051

|

218142

|

|

Sun 30

|

306052

|

218143

|

|

Sun 31

|

306053

|

218144

|

|

Sun 32

|

306054

|

218145

|

|

Sun 33

|

306055

|

218146

|

|

Sun 34

|

306056

|

218147

|

|

Sun 35

|

306057

|

218148

|

|

Sun 36

|

306058

|

218149

|

|

Chip 21 Fraction

|

306059

|

218113

|

|

Chip 22 Fraction

|

306060

|

218114

|

|

Chip 23

|

306025

|

218115

|

|

Chip 24

|

306026

|

218116

|

|

Chip 25

|

306027

|

218117

|

|

Chip 26

|

306028

|

218118

|

|

Chip 27

|

306029

|

218119

|

|

Chip 28

|

306030

|

218120

|

|

Chip 29

|

306031

|

218121

|

|

Chip 30

|

306032

|

218122

|

|

Chip 31

|

306033

|

218123

|

|

Chip 32

|

306034

|

218124

|

|

Chip 33

|

306035

|

218125

|

|

Chip 34

|

306036

|

218126

|

|

Chip 35

|

306037

|

218127

|

|

Chip 36

|

306038

|

218128

|

|

Chip 37

|

306039

|

218129

|

|

Chip 38

|

306040

|

218130

|

|

Chip 39

|

306041

|

218131

|

|

Chip 40

|

307491

|

218895

|

|

DRC NW 1

|

307492

|

218847

|

|

DRC NW 2

|

307493

|

218848

|

|

DRC NW 3

|

307494

|

218849

|

|

DRC NW 4

|

307495

|

218850

|

|

DRC NW 5

|

307496

|

218851

|

|

DRC NW 6

|

307497

|

218852

|

|

DRC NW 7

|

307498

|

218853

|

|

DRC NW 8

|

307499

|

218854

|

|

DRC NW 9

|

307500

|

218855

|

|

DRC NW 10

|

307501

|

218856

|

|

DRC NW 11

|

307502

|

218857

|

|

DRC NW 12

|

307503

|

218858

|

|

DRC NW 13

|

307504

|

218859

|

|

DRC NW 14

|

307505

|

218860

|

|

DRC NW 15

|

307506

|

218861

|

|

DRC NW 16

|

307507

|

218862

|

|

DRC NW 17

|

307508

|

218863

|

|

DRC NW 18

|

307509

|

218864

|

|

DRC NW 19

|

307510

|

218865

|

|

DRC NW 20

|

307511

|

218866

|

|

DRC NW 21

|

307512

|

218867

|

|

DRC NW 22

|

307513

|

218868

|

|

DRC NW 23

|

307514

|

218869

|

|

DRC NW 24

|

307515

|

218870

|

|

DRC NW 25

|

307516

|

218871

|

|

DRC NW 26

|

307517

|

218872

|

|

DRC NW 27

|

307518

|

218873

|

|

DRC NW 28

|

307519

|

218874

|

|

DRC NW 29

|

307520

|

218875

|

|

DRC NW 30

|

307521

|

218876

|

|

DRC NW 31

|

307522

|

218877

|

|

DRC NW 32

|

307523

|

218878

|

|

DRC NW 33

|

307524

|

218879

|

|

DRC NW 34

|

307525

|

218880

|

|

DRC NW 35

|

307526

|

218881

|

|

DRC NW 36

|

307527

|

218882

|

|

DRC NW 37

|

307528

|

218883

|

|

DRC NW 38

|

307529

|

218884

|

|

DRC NW 39

|

307530

|

218885

|

|

DRC NW 40

|

307531

|

218886

|

|

DRC NW 41

|

307532

|

218887

|

|

DRC NW 42

|

307533

|

218888

|

|

DRC NW 43

|

307534

|

218889

|

|

DRC NW 44

|

307535

|

218890

|

|

DRC NW 45

|

307536

|

218891

|

|

DRC NW 46

|

307537

|

218892

|

|

DRC NW 47

|

307538

|

218893

|

|

DRC NW 48

|

307539

|

218894

|

|

EBatt 1

|

307483

|

218896

|

|

EBatt 2

|

307484

|

218897

|

|

EBatt 3

|

307485

|

218898

|

|

EBatt 4

|

307486

|

218899

|

|

EBatt 5

|

307487

|

218900

|

|

EBatt 6

|

307488

|

218901

|

|

EBatt 7

|

307489

|

218902

|

|

EBatt 8

|

307490

|

218903

|

|

OMM-1

|

307478

|

218905

|

|

OMM-2

|

307479

|

218906

|

|

OMN-2

|

307481

|

218908

|

|

OMN-3

|

307482

|

218909

|

|

BTG-1

|

307471

|

218910

|

|

BTG-2

|

307472

|

218911

|

|

BTG-3

|

307473

|

218912

|

|

BTG-4

|

307474

|

218913

|

|

BTG-5

|

307475

|

218914

|

|

BTG-6

|

307476

|

218915

|

|

NFX 17

|

307230

|

218685

|

|

NFX 18

|

307231

|

218686

|

|

NFX 19

|

307232

|

218687

|

|

NFX 20

|

307233

|

218688

|

|

NFX 21

|

307234

|

218689

|

|

NFX 22

|

307235

|

218690

|

|

NFX 23

|

307236

|

218691

|

|

NFX 24

|

307237

|

218692

|

|

NFX 25

|

307238

|

218693

|

|

NFX 30

|

307243

|

218698

|

|

NFX 31

|

307244

|

218699

|

|

NFX 32

|

307245

|

218700

|

|

NFX 33

|

307246

|

218701

|

|

NFX 34

|

307247

|

218702

|

|

NFX 35

|

307248

|

218703

|

|

NFX 36

|

307249

|

218704

|

|

NFX 37

|

307250

|

218705

|

|

NFX 38

|

307251

|

218706

|

|

NFX 42

|

307255

|

218710

|

|

NFX 43

|

307256

|

218711

|

|

NFX 44

|

307257

|

218712

|

|

NFX 45

|

307258

|

218713

|

|

NFX 46

|

307259

|

218714

|

|

NFX 47

|

307260

|

218715

|

|

NFX 48

|

307261

|

218716

|

|

NFX 49

|

307262

|

218717

|

|

NFX 50

|

307263

|

218718

|

|

NFX 56

|

307269

|

218724

|

|

NFX 57

|

307270

|

218725

|

|

NFX 58

|

307271

|

218726

|

|

NFX 59

|

307272

|

218727

|

|

NFX 60 Amended

|

307558

|

218728

|

|

NFX 61

|

307274

|

218729

|

|

NFX 62

|

307275

|

218730

|

|

NFX 63

|

307276

|

218731

|

|

NFX 64

|

307277

|

218732

|

|

|

|

|

OMN-1 revised

|

315879

|

228322

|

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

|

Name of entity

|

|

Jervois Global Limited

|

|

ABN

|

|

Quarter ended (“current quarter”)

|

|

52 007 626 575

|

|

30 September 2022

|

|

Consolidated statement of cash flows

|

Current quarter

$US’000

|

Year to date

(9 months)

$US’000

|

|

1.

|

Cash flows from operating activities

|

83,776

|

277,884

|

|

1.1

|

Receipts from customers

|

|

1.2

|

Payments for

|

-

|

-

|

|

-

(a)exploration evaluation

|

|

-

(b)development

|

-

|

-

|

|

-

(c)production

|

(96,141)

|

(310,140)

|

|

-

(d)staff costs

|

(1,669)

|

(4,988)

|

|

-

(e)administration and corporate costs

|

(1,519)

|

(4,329)

|

|

1.3

|

Dividends received (see note 3)

|

-

|

-

|

|

1.4

|

Interest received

|

87

|

94

|

|

1.5

|

Interest and other costs of finance paid

|

(8,160)

|

(16,789)

|

|

1.6

|

Income taxes paid

|

(1,646)

|

(5,771)

|

|

1.7

|

Government grants and tax incentives

|

-

|

-

|

|

1.8

|

Other – incl. business development costs and SMP BFS costs

|

(1,245)

|

(3,814)

|

|

1.9

|

Net cash from / (used in) operating activities

|

(26,517)

|

(67,853)

|

|

|

2.

|

Cash flows from investing activities

|

-

|

-

|

|

2.1

|

Payments to acquire or for:

|

|

-

(a)entities

|

|

-

(b)tenements

|

-

|

-

|

|

-

(c)property, plant and equipment – incl. assets under construction

|

(35,053)

|

(84,110)

|

|

-

(d)exploration evaluation

|

(35)

|

(85)

|

|

-

(e)acquisition of subsidiaries

|

-

|

-

|

|

-

(f)transfer tax on acquisition

|

-

|

-

|

|

-

(g)other non-current assets

|

-

|

-

|

|

2.2

|

Proceeds from the disposal of:

|

-

|

-

|

|

-

(a)entities

|

|

-

(b)tenements

|

-

|

-

|

|

-

(c)property, plant and equipment

|

20

|

1,250

|

|

-

(d)investments

|

-

|

-

|

|

-

(e)other non-current assets

|

186

|

186

|

|

2.3

|

Cash flows from loans to other entities

|

-

|

-

|

|

2.4

|

Dividends received (see note 3)

|

-

|

-

|

|

2.5

|

Other – SMP Refinery Purchase: lease payment

|

-

|

-

|

|

2.6

|

Net cash from / (used in) investing activities

|

(34,882)

|

(82,759)

|

|

|

3.

|

Cash flows from financing activities

|

-

|

-

|

|

3.1

|

Proceeds from issues of equity securities (excluding convertible debt securities)

|

|

3.2

|

Proceeds from issue of convertible debt securities

|

-

|

-

|

|

3.3

|

Proceeds from exercise of options

|

-

|

221

|

|

3.4

|

Transaction costs related to issues of equity securities or convertible debt securities

|

-

|

(847)

|

|

3.5

|

Proceeds from borrowings

|

57,250

|

156,000

|

|

3.6

|

Repayment of borrowings

|

-

|

-

|

|

3.7

|

Transaction costs related to loans and borrowings

|

-

|

-

|

|

3.8

|

Dividends paid

|

-

|

-

|

|

3.9

|

Other – incl. lease liabilities

|

(1,100)

|

(1,318)

|

|

3.10

|

Net cash from / (used in) financing activities

|

56,150

|

154,056

|

|

|

4.

|

Net increase / (decrease) in cash and cash equivalents for the period

|

|

|

|

4.1

|

Cash and cash equivalents at beginning of period

|

57,560

|

49,181

|

|

4.2

|

Net cash from / (used in) operating activities (item 1.9 above)

|

(26,517)

|

(67,853)

|

|

4.3

|

Net cash from / (used in) investing activities (item 2.6 above)

|

(34,882)

|

(82,759)

|

|

4.4

|

Net cash from / (used in) financing activities (item 3.10 above)

|

56,150

|

154,056

|

|

4.5

|

Effect of movement in exchange rates on cash held

|

8

|

(306)

|

|

4.6

|

Cash and cash equivalents at end of period

|

52,319

|

52,319

|

|

5.

|

Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts

|

Current quarter

$US’000

|

Previous quarter

$US’000

|

|

5.1

|

Bank balances

|

52,319

|

57,560

|

|

5.2

|

Call deposits

|

-

|

-

|

|

5.3

|

Bank overdrafts

|

-

|

-

|

|

5.4

|

Other (provide details)

|

-

|

-

|

|

5.5

|

Cash and cash equivalents at end of quarter (should equal item 4.6 above)

|

52,319

|

57,560

|

|

6.

|

Payments to related parties of the entity and their associates

|

Current quarter

$US’000

|

|

6.1

|

Aggregate amount of payments to related parties and their associates included in item 1

|

156

|

|

6.2

|

Aggregate amount of payments to related parties and their associates included in item 2

|

-

|

|

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments.

|

|

7.

|

Financing facilities

Note: the term “facility’ includes all forms of financing arrangements available to the entity.

Add notes as necessary for an understanding of the sources of finance available to the entity.

|

Total facility amount at quarter end

$US’000

|

Amount drawn at quarter end

$US’000

|

|

7.1

|

Bond Facility1

|

100,000

|

100,000

|

|

7.2

|

Secured Revolving Credit Facility2

|

150,000

|

100,000

|

|

7.3

|

Other

|

-

|

-

|

|

7.4

|

Total financing facilities

|

250,000

|

200,000

|

|

|

|

|

7.5

|

Unused financing facilities available at quarter end ($US’000)

|

50,000

|

|

7.6

|

Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well.

|

-

Bond Facility – US$100.0 million:

On 20 July 2021 the Company completed settlement of a US$100.0 million senior secured bond facility. The bonds were issued by the Company’s wholly owned subsidiary, Jervois Mining USA Limited, and are administered by the bond trustee, Nordic Trustee AS. In February 2022, Jervois Mining USA Limited completed the first US$50.0 million drawdown on the bonds, and in July 2022 the second, and final, US$50.0 million drawdown was completed.

Key terms:

-

Issuer: Jervois Mining USA Limited (wholly owned subsidiary of the Company).

-

Maturity: 5-year tenor with a maturity date of 20 July 2026.

-

Original issue discount of 2%.

-

Coupon rate: 12.5% per annum with interest payable bi-annually.

-

No amortisation – bullet payment on maturity.

-

Non-callable for 3 years, after which callable at par plus 62.5% of coupon, declining rateably to par in year 5.

-

Transaction security: First priority security over all material assets of the Issuer, pledge of all the shares of the Issuer, intercompany loans.

-

Secured Revolving Credit Facility – US$150.0 million:

On 28 October 2021 the Company’s wholly owned subsidiaries, Jervois Suomi Holding Oy and Jervois Finland Oy (together, “the Borrowers”), entered into a secured loan facility with Mercuria Energy Trading SA, a wholly owned subsidiary of Mercuria Energy Group Limited, to borrow up to US$75 million. The facility was fully drawn as of 31 March 2022. On 3 June 2022, the Borrowers increased the facility to US$150 million through the execution of the Accordion Increase (as contemplated in the facility agreement entered into on 28 October 2021).

Key terms:

-

Borrowers: Jervois Suomi Holding Oy and Jervois Finland Oy (wholly owned subsidiaries of the Company).

-

Maturity: rolling facility to 31 December 2024.

-

Interest rate: SOFR + 5.0% per annum.

-

Transaction security: First priority security over all material assets of Jervois Finland, including inventory, receivables, collection account, and shares in Jervois Finland.

|

|

8.

|

Estimated cash available for future operating activities

|

$US’000

|

|

8.1

|

Net cash from / (used in) operating activities (item 1.9)

|

(26,517)

|

|

8.2

|

(Payments for exploration & evaluation classified as investing activities) (item 2.1(d))

|

(35)

|

|

8.3

|

Total relevant outgoings (item 8.1 + item 8.2)

|

(26,552)

|

|

8.4

|

Cash and cash equivalents at quarter end (item 4.6)

|

52,319

|

|

8.5

|

Unused finance facilities available at quarter end (item 7.5)

|

50,000

|

|

8.6

|

Total available funding (item 8.4 + item 8.5)

|

102,319

|

|

|

|

|

8.7

|

Estimated quarters of funding available (item 8.6 divided by item 8.3)

|

3.85

|

|

Note: if the entity has reported positive relevant outgoings (i.e., a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7.

|

|

8.8

|

If item 8.7 is less than 2 quarters, please provide answers to the following questions:

|

|

8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not?

|

|

Answer: N/A

|

|

8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful?

|

|

Answer: N/A

|

|

8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis?

|

|

Answer: N/A

|

|

Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

|

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 21 October 2022

Authorised by: Disclosure Committee

(Name of body or officer authorising release – see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – e.g., Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

1 Debt drawn down represents the aggregate of amounts drawn under the US$150 million working capital facility and amounts drawn from Escrow Account under the terms of the US$100 million Senior Secured Bonds. Amounts represent the nominal loan amounts; balances recorded in the Company’s financial statements under International Financial Reporting Standards will differ.

2 Information on the basis of preparation for the financial information included in this Quarterly Activities report is set out on page 13 below.

3See basis of preparation of financial information on p13.

4The number of options represent the number of Jervois shares that will be issued on exercise. The exercise price represents the price to be paid for the Jervois shares when issued.

Copyright (c) 2022 TheNewswire - All rights reserved.