ENDEAVOUR MAKES MAJOR GREENFIELD DISCOVERY IN CÔTE D’IVOIRE WITH MAIDEN 1.1MOZ INDICATED AND 1.9MOZ INFERRED RESOURCE

TANDA-IGUELA HIGHLIGHTS

- Tanda-Iguela property in Côte d’Ivoire has the potential to be another flagship asset for Endeavour

- Major maiden resource has been outlined in under 15 months on the Assafou target:

- Indicated resource of 14.9Mtat 2.33 g/t for 1.1Moz; Inferred resource of 32.9Mtat 1.80g/t for 1.9oz

- Low discovery cost of under $10 per Indicated ounce discovered

- Thick high grade mineralisationoccurrence withtotal cumulated interceptsofup to 100 m in true thickness with an average grade >3.00 g/t gold

- Significant potential to further expand Assafou as its Indicated resource only covers ~20% of the 3km long identified mineralised system which isopen along strike and at depth

- Assafou’s structural geological trend is highly prospective as it extends over a 15km long stretch with several identified high-quality gold-in-soil anomalies

- At least 10 additional highly prospective targets have been identified on the Tanda-Iguela property

- An aggressive 70,000 m drill programme is planned for 2023 to both delineate further resources at Assafou and test new targets

- Preliminary metallurgical tests indicate high gold recovery rates of above 95% with a significant portion recoverable by gravity

|

Abidjan, 21 November 2022 – Endeavour Mining plc (LSE:EDV, TSX:EDV, OTCQX:EDVMF) (“Endeavour”, the “Group” or the “Company”) is pleased to announce that a major discovery has been made at its 100%-owned Tanda-Iguela greenfield exploration property in Côte d’Ivoire. The Tanda-Iguela property has the potential to be another flagship asset for Endeavour, given the size of the maiden resource and its significant exploration potential as 10 additional nearby targets have been identified.

Following highly encouraging initial results obtained in 2021, an intensive drilling programme conducted in 2022 resulted in the rapid delineation of a maiden resource estimate for the Assafou target, as presented in Table 1 below.

Table 1: Tanda-Iguela Mineral Resource Estimate

|

TONNAGE |

GRADE |

CONTENT |

|

(Mt) |

(Au g/t) |

(Au koz) |

| Indicated resources |

14.9 |

2.33 |

1,114 |

| Inferred resources |

32.9 |

1.80 |

1,903 |

Mineral Resource Estimate current as at 31 October 2022. No Measured resources have been estimated. Mineral Resources estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by $1,500/oz gold price MII Pit Shell and based on a cut-off of 0.5 g/t Au.

Significant exploration potential exists at the Assafou deposit since it is open along strike in both directions and at depth. The delineated Indicated resource encompasses only 20% of the identified mineralised system which covers an area three kilometres long by 350 metres wide. As such, an aggressive exploration drilling campaign is scheduled to begin in 2023, with an additional 50,000 metres expected to be conducted on the Assafou deposit, compared to the 58,000 metres of drilling, which formed the basis of the maiden resource calculation. In addition, a drilling programme of 20,000 metres is planned to test the additional nearby targets identified to date. These efforts are expected to yield an updated resource estimate in 2023 and increase the overall geological understanding of the area.

Sébastien de Montessus, President and CEO commented: “We are thrilled with the maiden resource at our Tanda-Iguela greenfield property in Côte d’Ivoire.It ranks as one of the most significant discoveries made in West Africa over the last decade and shows potential to be another flagship asset for the company.

This discovery builds on our recent success discovering the Lafigué project, where construction was recently launched, and reinforces our ability to organically source our project pipeline through ongoing exploration success. Additionally, this discovery showcases West Africa’s geological potential, which is a key reason behind its rapid growth into the largest gold producing region globally.As the largest gold producer in West Africa, we have developed a strong competitive advantage in the region, strategically positioning us to continue to unlock value over the long term.

With this new important discovery and exploration success across our portfolio, we are well on track to achieve our target of discovering between 15 to 20 million ounces for the 5-year period ending in 2025.”

Patrick Bouisset, Executive Vice President Exploration and Growth said: “After securing long mine lives at our flagship mines through brownfield exploration, we were excited to significantly increaseour focus on greenfield exploration this year, with the goal of feeding our project pipeline following the commencement of construction at Lafigué.

Following promising drill results late last year, Tanda-Iguela quickly becamea stronger strategic focus in 2022, and we were able to quickly shift our efforts to accelerate its drilling by leveraging our presence and competitive advantage in the region. As such, we are thrilled to have quickly delineated a maiden resource of 1.1Moz at Indicated status and a further 1.9Moz at Inferred status, following our first significant drilling campaign on the asset, at an industrylow discovery cost of less than $10 per Indicated ounce.

Significant exploration potential exists on the Tanda-Iguela property with the Assafou deposit located over a structural trend extending over 15 kilometresand remaining open in all directions with at least 10 additional exploration targets identified nearby. To both delineate further resources at Assafou and test new targets, we are preparing to launch an aggressive 70,000-metre drilling programme next year.

Based on the initial analysis of the ore characteristics and orebody shape, we believe it should be amenable to open pit mining as mineralisation starts at surface, whilst preliminary metallurgical test work done to date suggests the potential for very high gold recovery rates. The geological context, coupled with the occurrence ofgreater than 30-metre thick high grade intercepts at depth,also suggests the possibility for future underground mining potential.”

ABOUT THE TANDA-IGUELA PROPERTY

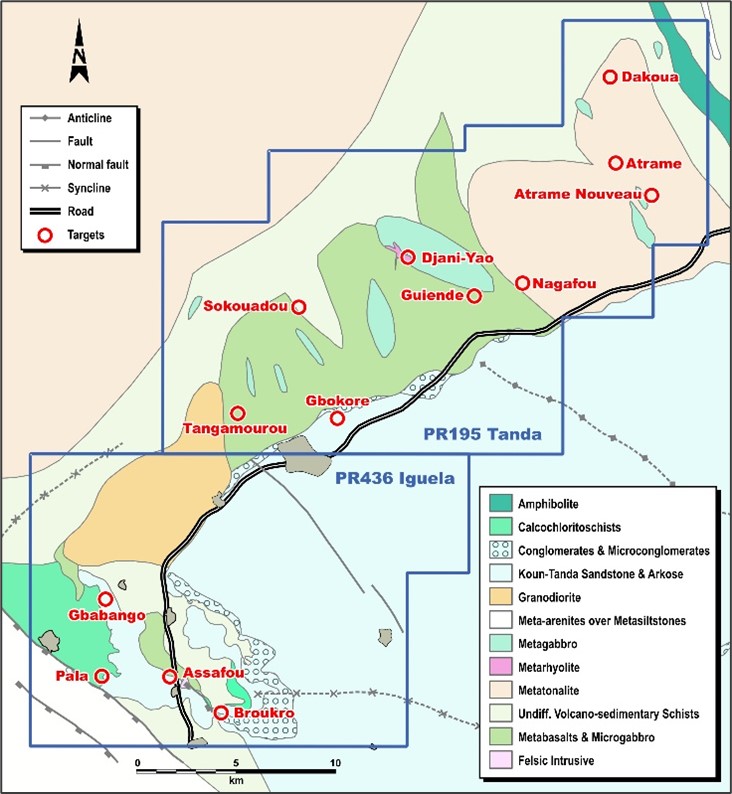

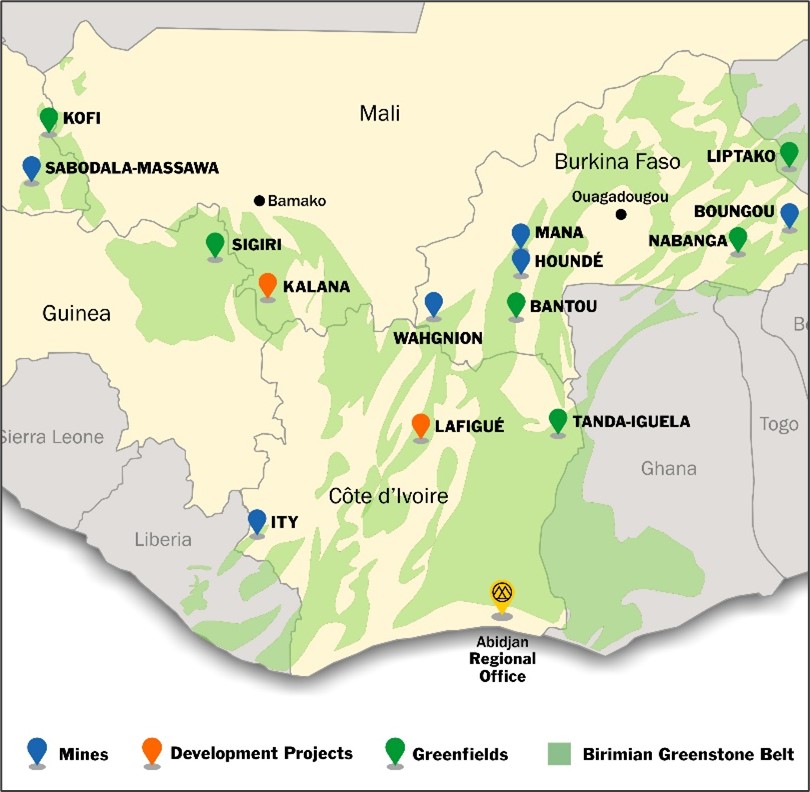

The Tanda-Iguela property is located in the Eastern part of Côte d’Ivoire within the Boundounkou Birimian greenstone belt, approximately 400 kilometres to the Northeast of Abidjan and 30 kilometres from the border with Ghana. The property is composed of two exploration permits, as shown in Figure 1 below.

Figure 1: Tanda-Iguela Maps

The Tanda permit, covering 395 km2, was introduced into Endeavour’s portfolio in late 2015 following the transaction with La Mancha. The first exploration work was initiated in the early 2000s, by the previous owner, resulting in the identification of several targets through the geochemical campaigns (9,056 samples collected) and following a sparse drilling campaign which comprised 1,346 metres of Auger drilling over 136 holes, 7,410 metres of Reverse Circulation (“RC”) drilling over 79 holes and 1,627 metres Diamond Drilling (“DD”) over 19 holes.

Endeavour conducted an initial small drilling campaign in early 2016 with 5,324 metres of RC drilling over 76 holes on the Tanda permit. This programme yielded strong results and the grounds adjacent to the Tanda permit were quickly identified as being highly prospective with the possibility to delineate a resource of critical size to justify a standalone operation.

As such, Endeavour consolidated the area in May 2017 by being awarded the Iguela permit, covering 298 km2, through the permitting application process. Shortly after, during 2018 and 2019 an initial geochemical campaign, comprised of 3,436 samples, was conducted over the Iguela permit. This campaign coupled with considerable fieldwork and mapping outlined a series of significant potential gold occurrences and exploration targets over the tenement package, as shown in Figure 1 above, with the most attractive anomalies located right over the structural contact, extending over more than 15 kilometres, and separating the Birimian volcanics and the Tarkwaian sediments.

Due to the exciting positive initial assay results from the Assafou target, including multiple thick high-grade gold intercepts, most of the drilling was quickly focused on the target to define a maiden resource which is based on a total of 303 drillholes amounting to 58,388 metres.

In addition, ten other exploration targets have been identified within the Tanda-Iguela exploration licenses, and at least two (Broukro and Gbabango) are directly on trend with the prolific Assafou mineralised system, as shown in Figure 1 above.

ABOUT THE ASSAFOU DISCOVERY

The delineated resource for the Assafou deposit is very robust, due to its relative high-grade and continuous mineralisation, as demonstrated with the sensitivity analysis performed at various gold prices, presented in Table 2 below.

Table 2: Assafou Mineral Resource Estimate Sensitivity

|

TONNAGE |

GRADE |

CONTENT |

|

(Mt) |

(Au g/t) |

(Au koz) |

| INDICATED RESOURCE |

|

|

|

| Based on a gold price of $1,300/oz |

14.8 |

2.33 |

1,109 |

| Based on a gold price of $1,500/oz |

14.9 |

2.33 |

1,114 |

| Based on a gold price of $1,700/oz |

14.9 |

2.33 |

1,115 |

| Based on a gold price of $1,900/oz |

14.9 |

2.33 |

1,116 |

|

|

|

|

| INFERRED RESOURCE |

|

|

|

| Based on a gold price of $1,300/oz |

30.1 |

1.84 |

1,780 |

| Based on a gold price of $1,500/oz |

32.9 |

1.80 |

1,903 |

| Based on a gold price of $1,700/oz |

33.8 |

1.79 |

1,942 |

| Based on a gold price of $1,900/oz |

35.0 |

1.77 |

1,990 |

Mineral Resource Estimate current as at 31 October 2022. No Measured resources have been estimated. Mineral Resources estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII $1,500/oz Pit Shell and for sensitivity purpose by MII $1,300/oz, $1,700/oz and $1,900/oz pit shells and based on a cut-off of 0.5 g/t Au.

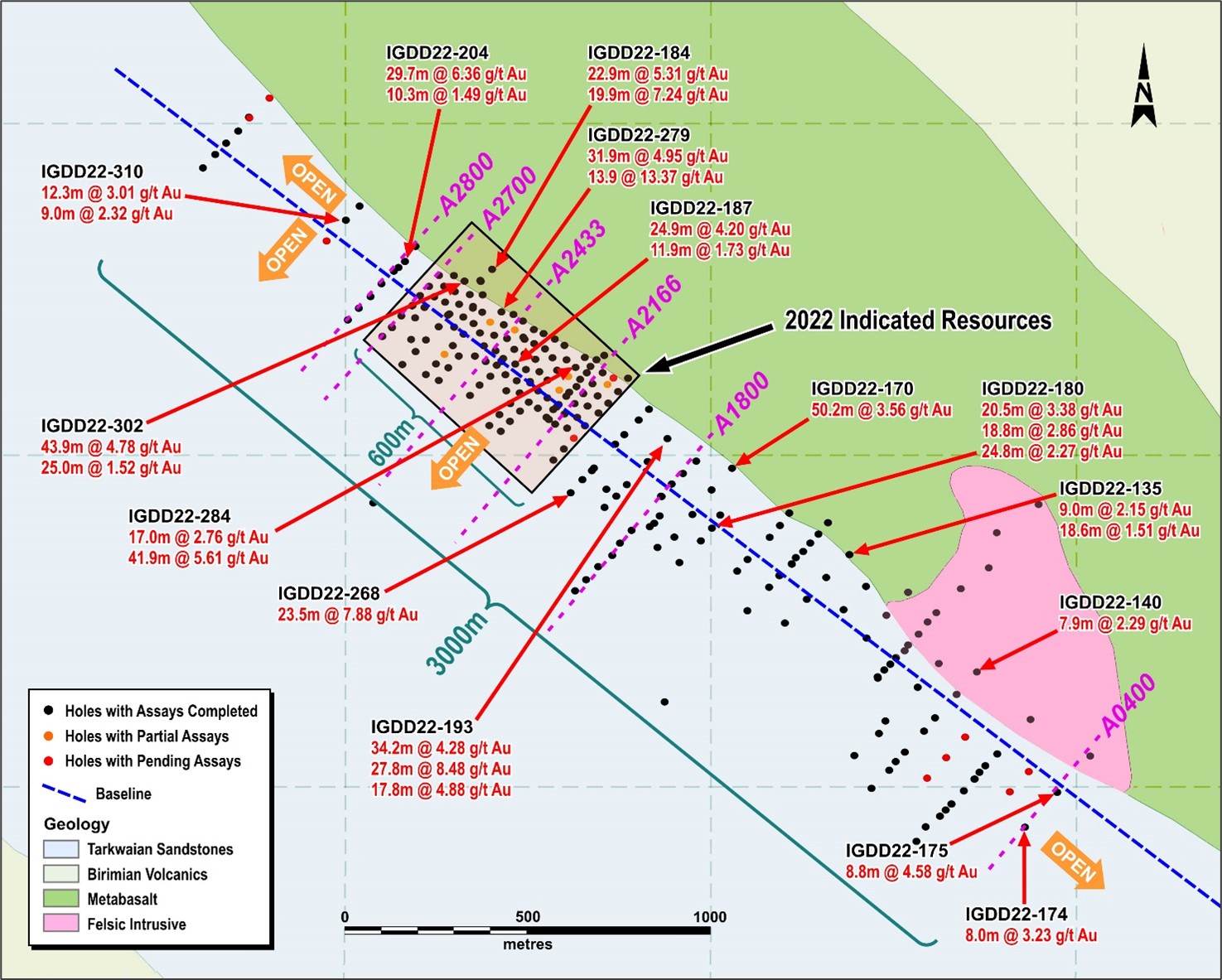

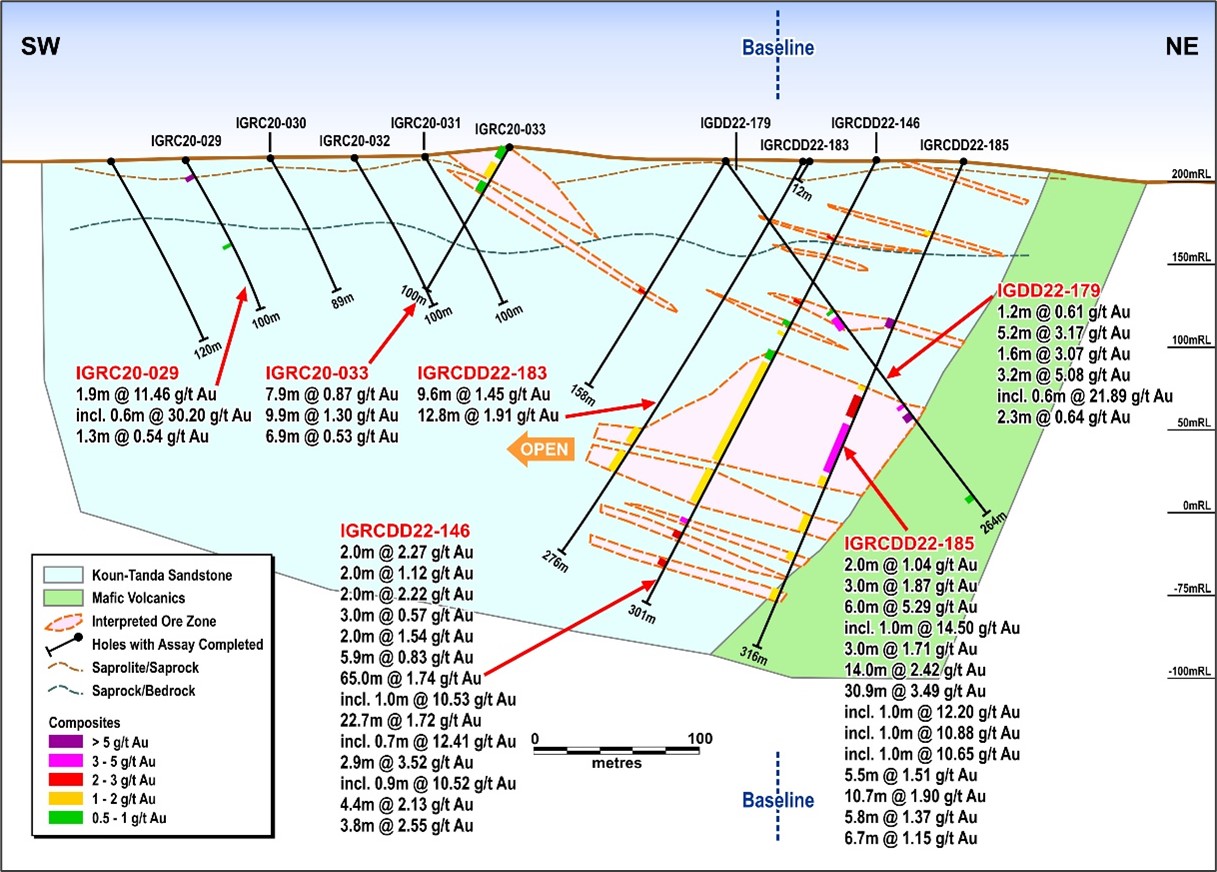

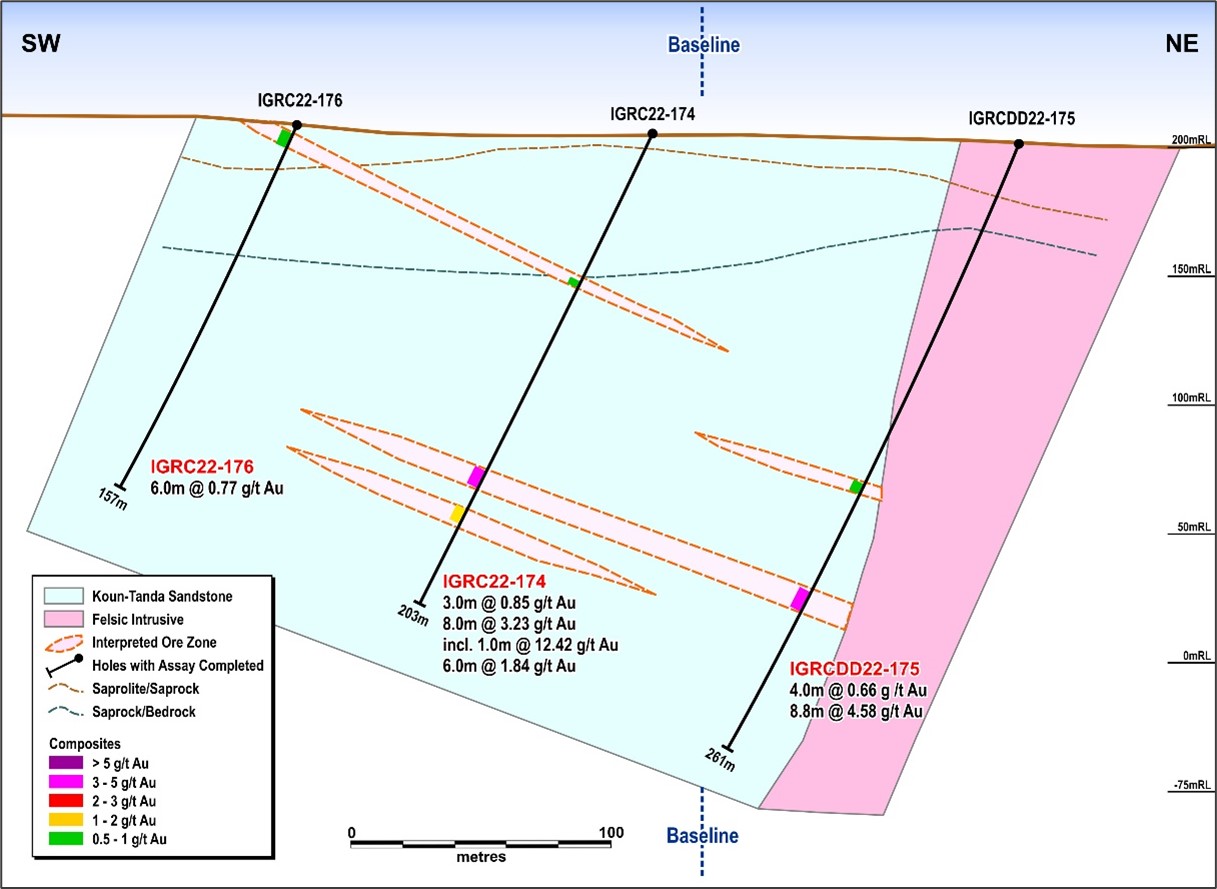

As shown in Figure 2 below, the Assafou mineralised system has now been defined over an area which is approximately three kilometres in length and 350 metres in width, extending from surface to depths exceeding 300 metres. The 2022 delineated Indicated resource covers only 600 metres of the defined mineralised area with the deposit remaining open along strike in both directions, as well as at depth.

Figure 2: Assafou Geological Context with Best Selected Intercepts Map

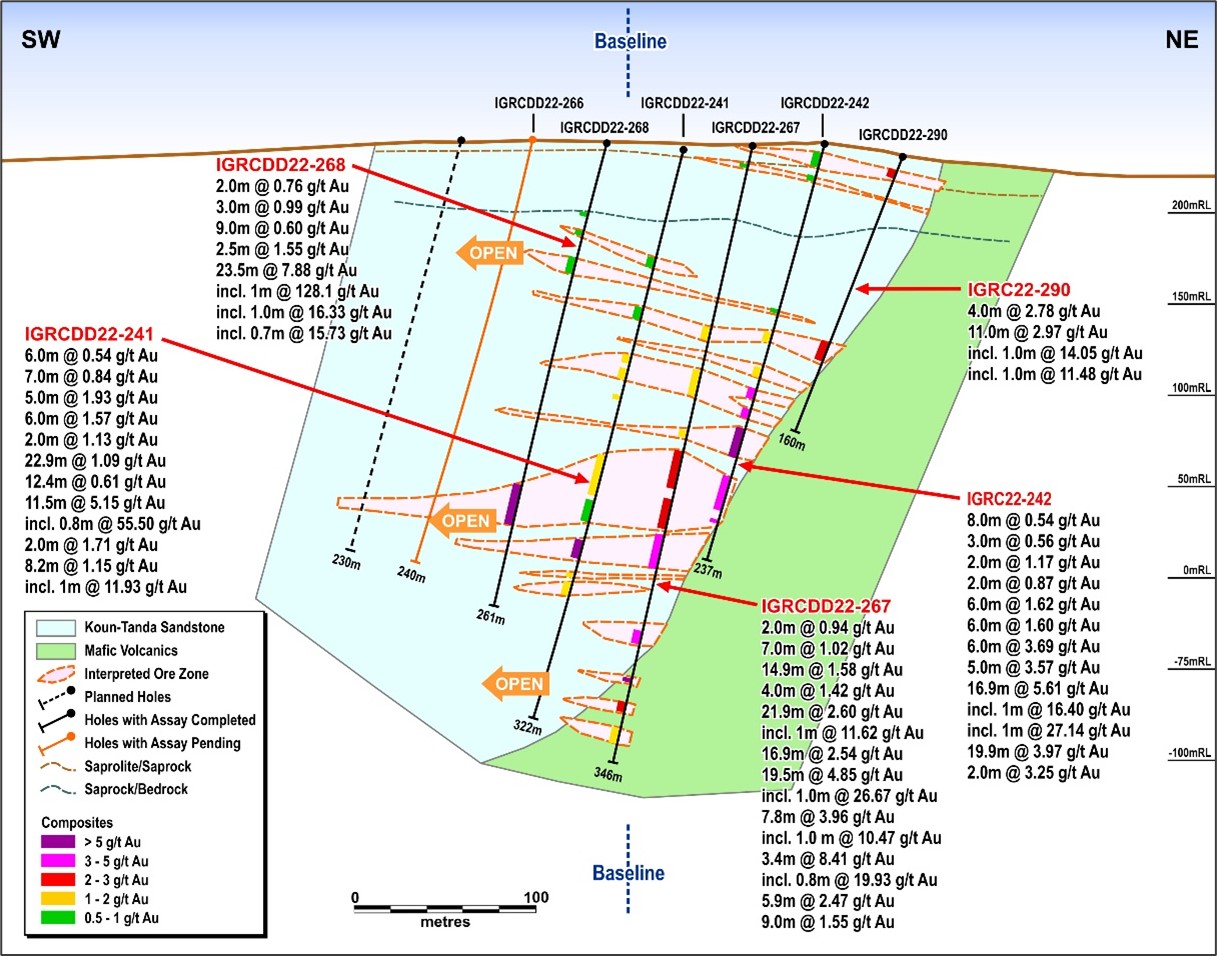

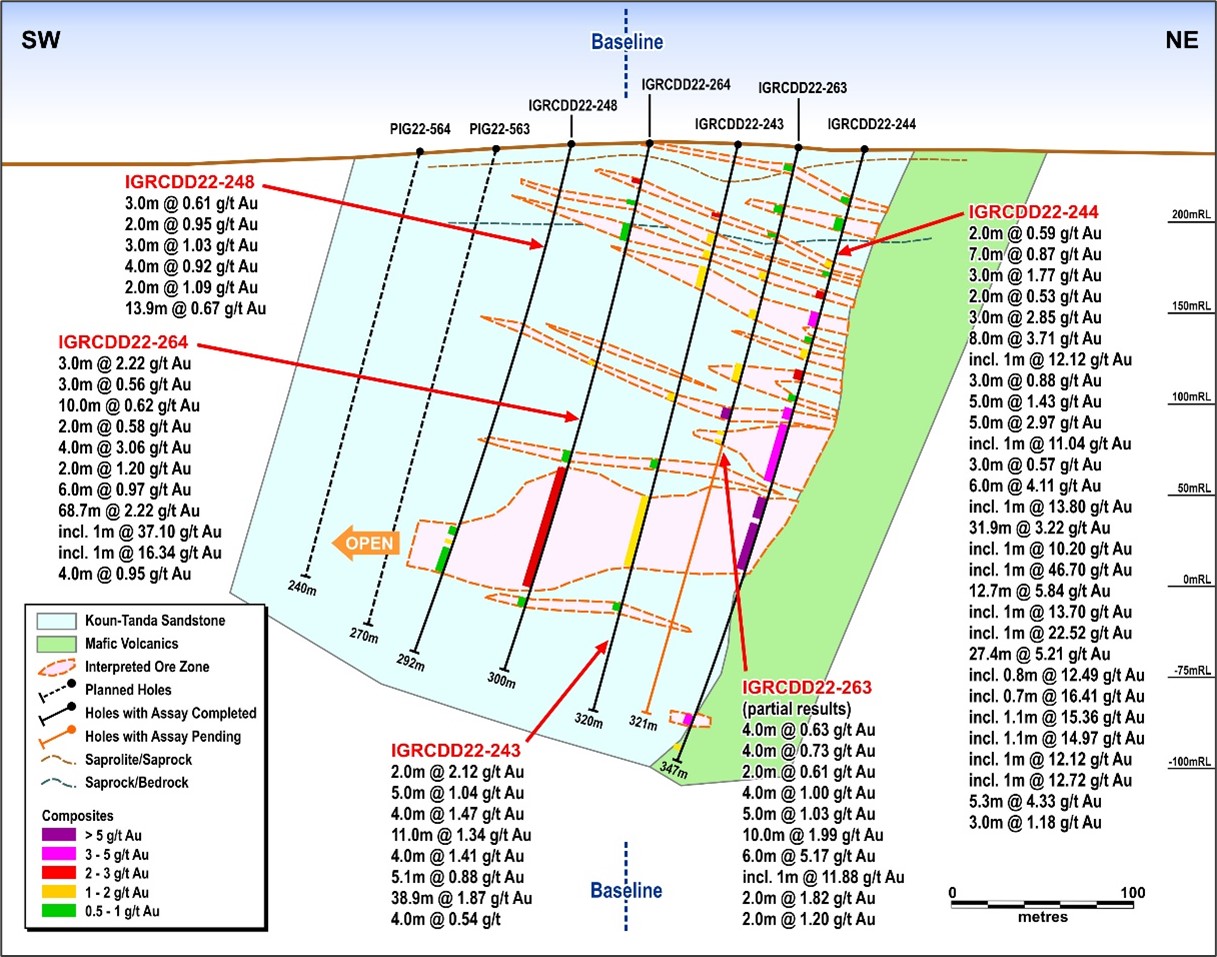

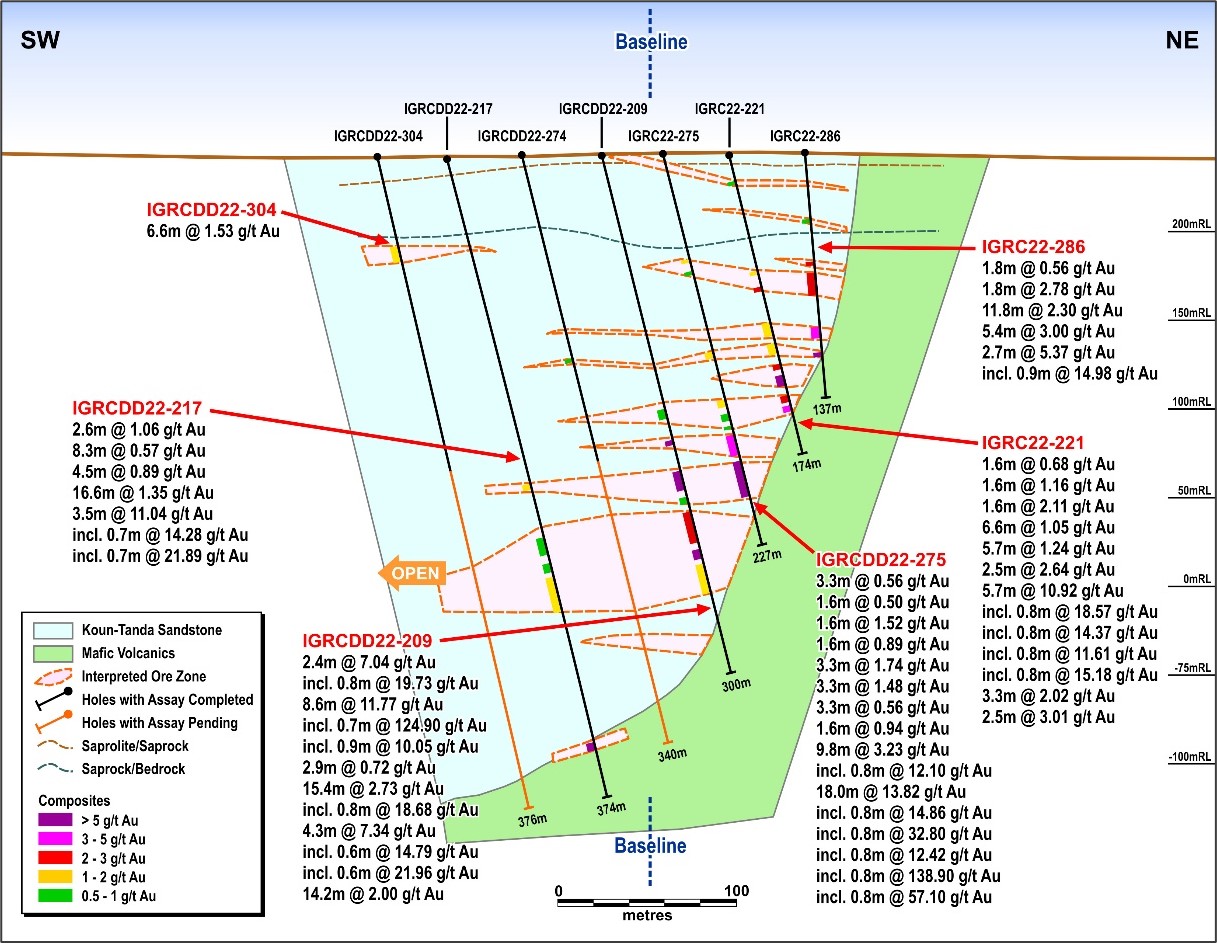

The Assafou deposit is hosted within Tarkwaian Sediments (sandstones) at or immediately in the vicinity of a major structural contact with mafic Birimian rocks. As shown in Figures 3, 4 and 5 below, the deposit comprises a main thick (up to 60 metres) continuous lense, appearing to be low angle to flat-lying, overlaid by a series of stacked low angle dipping lenses, that are distributed from the surface (in the saprolite) down to over 200 metres depth, recognised so far. Some of the best holes drilled in the thicker part of the mineralisation delivered total cumulative intercepts exceeding 90 to 100 metres in true thickness with an average grade above 3.00g/t gold.

Figure 3: Section 2166 within the central part of the indicated resource

(True Width Uncapped)

Figure 4: Assafou Section 2433 within the central part of the indicated resource

(True Width Uncapped)

Figure 5: Assafou Section A2700 at the Northwest limit of the indicated resource boundary

(True Width Uncapped)

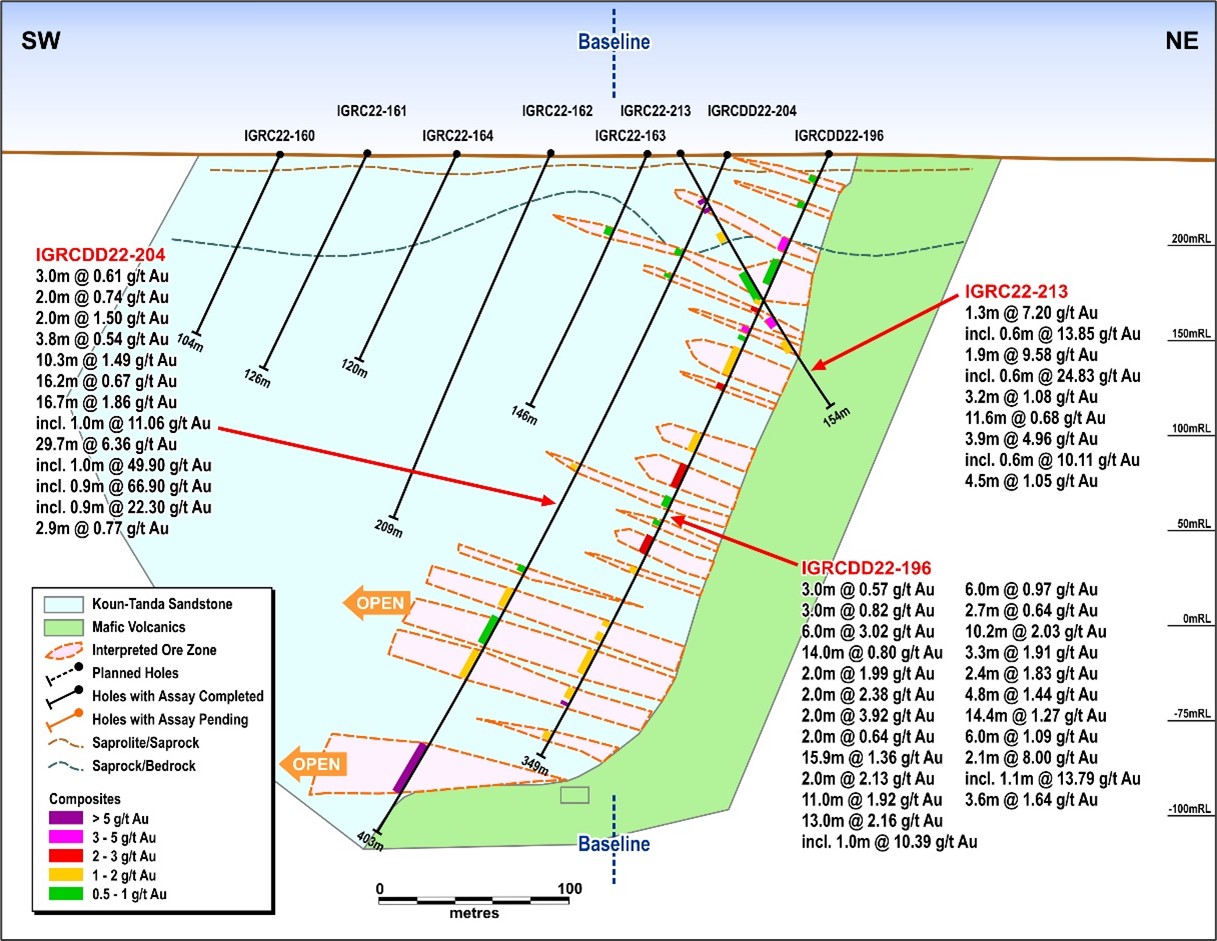

As shown in Figure 6 below, step back drilling returned high-grade intercepts, very close to the structural contact, outside of the current resource boundary, confirming that mineralisation is still open towards the Northwest. Some high grade mineralised intercepts were also encountered in this area at great depth (> 300-metre vertical) close to the main structural contact, as demonstrated by Hole IGRCDD22-204 with intercepts of 29.7 metres at 6.36 g/t gold.

Figure 6: Section A2800showing high grade intercepts outsidethe indicated resource boundary towards Northwest

(True Width Uncapped)

As shown in Figures 7 and 8 below, the mineralised system was also identified to continue over two kilometres away from the delineated Indicated resource area, towards the southeast. Ground geophysical surveys (including magnetic, IP-Resistivity and gravity) are currently on-going over the Assafou target with the goal of outlining the contact between the sandstones and the mafic rocks, and to better identify the extensions of the deposit.

Figure 7: Section A1800 showing inferred resource high grade intercepts 200mto SE of the Indicated resource boundary

(True Width Uncapped)

Figure 8: Section A0400 showing intercepts 2km outside of the indicated resource boundary towards Southeast

(True Width Uncapped)

In the above Figures, the parameters used to calculate the composites are: a cut-off sample of 0.3 g/t gold, a minimum value composite of 0.5 g/t gold, a dilution of two metres, a minimum composite length of two metres, and the including is based on a > 10g/t gold filter. Composite interval represent calculated downhole (true) thickness.

PRELIMINARY METALLURGY

Preliminary metallurgical tests, completed at Endeavour’s Ity mine, included five Assafou variability samples representative of the so far identified ore resource facies: (1) perched lens – medium grade, (2) perched lens – high grade, (3) thick lens - medium grade, (4) thick lens - high grade, and (5) saprock. Testwork focussed on gravity gold recovery with cyanidation of the gravity tail. Gold recoveries were high from all facies with high gravity gold recovery of between 55% to 75%, and high overall gold extractions of above 95%.

The Assafou deposit appears to be monometallic containing no potentially penalising elements associated with the gold.

NEXT STEPS

- Comprehensive ground and airborne geophysical surveys (including magnetic, IP-Resistivity and gravity) are being designed and will be executed in 2023.

- An aggressive drilling delineation campaign is planned for 2023 over the Assafou target, with at least 50,000 metres of RC and DD expected to be conducted.

- In addition, 20,000 metres of drilling is planned for 2023 to test some of the 10 additional targets, on which very limited exploration has been conducted to date. Information received is expected to orient a second phase of more systematic exploration on the best identified targets.

TECHNICAL NOTES

AssafouGeology

Within the Assafou deposit, gold mineralisation occurs both within a network of quartz veins and breccia crosscutting the sandstones, and as disseminated occurrences within pervasively altered sandstones. The Tarkwaian sandstones have been subject to several alteration phases comprising early white mica crystallisation (in both barren and mineralised sandstones), often followed by a silicification episode coeval with gold deposition and a later carbonatation (in both barren and mineralised sandstones). Gold is closely associated with pyrite ± chalcopyrite and, very locally, galena. The more intense the silicification (and presence of pyrite), the more mineralised the sandstones tend to be.

The gold-bearing quartz vein network appears to have developed during the reverse reactivation of the initial normal basin border fault separating the sandstones (in the hanging wall) from the Birimian basement. Mineralising hydrothermal fluids filled the open spaces and fractures induced by the fault-related compressive stress regime and mostly invaded the sandstones, which displayed a higher initial remaining porosity/permeability and competency than the mafic rocks.

AssafouResource Modelling

The statistical analysis, geological modelling and resource estimation were prepared by the Endeavour resource team, under the direction of Kevin Harris (CPG) VP Resources for Endeavour as the Qualified Person as defined by NI 43-101.

The Assafou Mineral Resource model was developed in Seequent’s Leapfrog Geo and Maptek Vulcan software. The database used to generate the Mineral Resources comprised some 303 drillholes, with a total drilling meterage of 58,388 metres. The majority of the available drillhole data were drilled in 2022 and supported by industry standard quality assurance and quality control systems, with quality control sampling comprising blanks, coarse blanks, certified reference materials, and field and pulp duplicates. Resource team has reviewed the QAQC data and are confident they are of high standard to be used in resource estimation.

Mineralisation domains were modelled using geology and grade continuity as veins, by selecting intervals which forms part of each mineralisation lenses; a nominal cut-off of 0.5g/t together with presence of Silica Alteration or quartz vein zones were used. The gold assays from the drillholes were composited to 1.0 metre intervals within the modelled veins. Capping varied depending on the mineralised domain, between no cap and 45g/t.

Density measurements from 38 drillholes for total 751 samples and covering each of the material type and major lithologies, were averaged based on the material type. Average density values were applied to the associated portions of the block model as outlined below:

- Laterite: 1.62 g/cm3

- Saprolite: 1.62 g/cm3

- Saprock: 2.38 g/cm3

- Fresh: 2.75 g/cm3

Gold grades were estimated using Inverse Distances Squared for all the modelled mineralisation and estimated in multiple passes to define the higher confidence areas and extend the grade to the interpreted mineralised zone extents. Any block not estimated after the Third pass is left as waste block.

The grade estimation was validated with visual and statistical analysis, and comparison with the drilling data on sections with swath plots comparing the block grades with the composites.

The quality and spatial distribution of the data used and the geological continuity of the mineralisation and the quality of the estimated block model for Assafou is sufficient for the reporting of Indicated and Inferred Mineral Resources, Indicated Mineral Resources have typically been defined in areas with a drillhole spacing of 30-40 metres along sections, and 40-50 metres between sections, where there is a reasonable level of confidence in geological and grade continuity. Inferred Mineral Resources have typically been defined in areas with a drillhole spacing of 50 to 80 metres, and where the continuity is much reduced.

Mineral Resources are reported within a Whittle optimised pit shell using cut-off of grades of 0.5 g/t gold. Optimisation parameters used are as below:

- Ore mining cost: $2.10/t Oxide; $2.40/t Transition; $3.12/t for Fresh

- Waste mining cost: $3.00/t

- Processing cost: Oxide/Transition: $9.30/t; Fresh: $11.00/t

- Selling cost: $80/oz gold

- Mining recovery: 95%

- Mining dilution: 0%

- Strip ratio: 5.9

- Processing recovery: Varies dependent on head grade. Averages 92% for each of the three material types

- Average slope angles: 43°

- G&A cost: $5.60/t processed

Drilling, Assay, Quality Assurance / Quality Control Procedures

Reverse Circulation (“RC”) and Air Core (“AC”) drilling delivers material to the surface via percussion hammer pushing pulverized rock into dule tube rods which evacuate the material to the surface via high pressure compressed air.

The samples are collected from the cyclone at surface at 1-metre intervals. The cyclone is cleaned after every 6-metre rod by flushing the hole. Additional manual cleaning is required in saprolitic or wet ground, closely monitored by the site geologist / geotechnician to ensure no sample to sample contamination occurs.

Samples are split at the drill site using several different riffle splitters, based on bulk sample weight. 2-5kg laboratory and a second 2-5kg reference sample are collected. Bulk and laboratory sample weights, in addition to moisture levels are recorded. Representative samples for each interval were collected with a spear, sieved into chip trays and retained for reference.

Drill core (PQ, HQ and NQ size) samples are selected by Endeavour geologists and sawn in half with a diamond blade at the project site. Half of the core is retained at the site for reference purposes. Sample intervals are generally 1 metre in length.

All samples are transported by road to Bureau Veritas in Abidjan. Each laboratory sample is secured in poly-woven bags ensuring that there is a clear record of the chain of custody. On arrival samples are weighed. Complete samples are crushed to 2 mm (70% passing) with 1 kg split out for pulverization. The entire 1 kg is pulverized 75µm (85% passing). A 50 gram sample is extracted and analysed for gold using standard fire assay technique. An Atomic Absorption (“AA”) finish provides the final gold value.

Blanks, field duplicates and certified reference material (“CRM’s”) are inserted into the sample sequence by Endeavour geologists at a rate of 1 of each samples type per 20 samples. This ensures that there is a 5% Quality Assurance / Quality Control (“QA/QC”) sample insertion rate applied to each fire assay batch. The sampling and assaying are monitored through analysis of these QA/QC samples. This QA/QC program was audited by a consultant, independent from Endeavour Mining and has been verified to follow industry best practices.

In September 2022, 1,758 samples were sent to ALS Ouagadougou for umpire (referee) analysis. Comparison of the Original analysis against the umpire analysis revealed a very strong Correlation Coefficient of 96% suggesting that the original assays provided by Bureau Veritas in Abidjan are accurate. Core sampling and assay data were monitored through a quality assurance/quality control program designed to follow NI 43-101 and industry best practice.

Full drill results are available by clicking here.

QUALIFIED PERSONS

The scientific and technical content of this news release has been reviewed, verified and compiled by Silvia Bottero, Professional Natural Scientist, VP Exploration Côte d’Ivoire for Endeavour Mining. Silvia Bottero has more than 20 years of mineral exploration and mining experience and is a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The resource estimation was completed by Kevin Harris, CPG, VP Resources for Endeavour Mining and "Qualified Person" as defined by National Instrument 43-101.

CONTACT INFORMATION

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is one of the world’s senior gold producers and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso and a strong portfolio of advanced development projects and exploration assets in the highly prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to the principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the London and Toronto Stock Exchanges, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans for further exploration of the Tanda-Iguela property, the extent and timing of Endeavour’s drilling campaign, the timing of the updated mineral resource estimate, the estimation of mineral resources, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business.

APPENDIX: BEST SELECTED INTERCEPTS

| HOLE ID |

|

FROM

(m) |

TO

(m) |

TRUE LENGTH

(m) |

AU GRADE

(g/t) |

| IGRCDD22-154 |

and |

116 |

121 |

5.0 |

2.65 |

|

and |

128 |

134 |

6.0 |

2.77 |

|

and |

167 |

173 |

6.0 |

2.26 |

|

and |

176 |

184 |

8.0 |

2.39 |

|

including |

176 |

177 |

1.0 |

12.86 |

|

and |

192 |

232 |

39.5 |

4.51 |

|

including |

208 |

209 |

1.0 |

10.82 |

|

including |

213 |

214 |

1.0 |

58.30 |

|

including |

220 |

221 |

0.7 |

13.58 |

|

including |

225 |

226 |

1.0 |

26.51 |

| IGRCDD22-185 |

and |

103 |

109 |

6.0 |

5.29 |

|

including |

107 |

108 |

1.0 |

14.50 |

|

and |

154 |

168 |

13.9 |

2.42 |

|

and |

173 |

204 |

30.9 |

3.49 |

|

including |

188 |

189 |

1.0 |

12.20 |

|

including |

195 |

196 |

1.0 |

10.88 |

|

including |

196 |

197 |

1.0 |

10.65 |

| IGRCDD22-188 |

and |

53 |

59 |

6.0 |

2.74 |

|

including |

54 |

55 |

1.0 |

13.86 |

|

and |

78 |

96 |

17.9 |

2.47 |

|

including |

85 |

86 |

1.0 |

13.20 |

|

and |

102 |

108 |

6.0 |

2.88 |

|

and |

146 |

160 |

13.9 |

3.98 |

|

including |

150 |

151 |

1.0 |

14.58 |

|

including |

155 |

156 |

1.0 |

12.89 |

|

and |

191 |

224 |

32.9 |

3.29 |

|

including |

201 |

202 |

1.0 |

12.43 |

|

including |

206 |

207 |

1.0 |

12.33 |

|

and |

235 |

241 |

6.4 |

25.83 |

|

including |

235 |

236 |

1.0 |

16.06 |

|

including |

237 |

237 |

0.6 |

23.80 |

|

including |

238 |

239 |

1.0 |

121.90 |

| IGRCDD22-240 |

and |

200 |

237 |

36.9 |

4.05 |

|

including |

227 |

228 |

1.0 |

27.12 |

|

including |

235 |

236 |

1.0 |

11.33 |

| IGRCDD22-244 |

and |

90 |

98 |

8.0 |

3.71 |

|

including |

92 |

93 |

1.0 |

12.12 |

|

and |

123 |

128 |

5.0 |

2.97 |

|

including |

124 |

125 |

1.0 |

11.04 |

|

and |

145 |

151 |

6.0 |

4.11 |

|

including |

148 |

149 |

1.0 |

13.80 |

|

and |

154 |

186 |

31.9 |

3.22 |

|

including |

174 |

175 |

1.0 |

10.20 |

|

including |

184 |

185 |

1.0 |

46.70 |

|

and |

195 |

208 |

12.7 |

5.84 |

|

including |

195 |

196 |

1.0 |

13.70 |

|

including |

202 |

203 |

1.0 |

22.52 |

|

and |

210 |

238 |

27.4 |

5.21 |

|

including |

211 |

212 |

0.8 |

12.49 |

|

including |

220 |

221 |

0.7 |

16.41 |

|

including |

223 |

224 |

1.1 |

15.36 |

|

including |

225 |

226 |

1.0 |

14.97 |

|

including |

227 |

228 |

1.0 |

12.12 |

|

including |

231 |

232 |

1.0 |

12.72 |

|

and |

322 |

327 |

5.3 |

4.33 |

|

including |

322 |

323 |

0.8 |

16.21 |

| IGRC22-242 |

|

140 |

146 |

6.0 |

3.69 |

|

and |

152 |

157 |

5.0 |

3.57 |

|

and |

162 |

179 |

16.9 |

5.61 |

|

including |

164 |

165 |

1.0 |

16.40 |

|

including |

169 |

170 |

1.0 |

27.14 |

|

and |

190 |

210 |

19.9 |

3.97 |

| IGRCDD22-144 |

and |

124 |

126 |

2.0 |

4.57 |

|

and |

130 |

151 |

20.9 |

2.90 |

|

including |

134 |

135 |

1.0 |

30.60 |

|

and |

162 |

181 |

18.9 |

3.18 |

|

including |

174 |

175 |

1.0 |

40.20 |

| IGRCDD22-190 |

and |

166 |

172 |

6.0 |

15.09 |

|

including |

168 |

169 |

1.0 |

26.03 |

|

including |

170 |

171 |

1.0 |

60.80 |

|

and |

185 |

228 |

42.7 |

2.98 |

|

including |

207 |

208 |

1.0 |

12.14 |

|

including |

227 |

228 |

0.6 |

12.40 |

|

and |

274 |

284 |

9.5 |

2.35 |

Parameters used for the above table: 0.3 g/t Au cut off for samples, 5.0 metre minimum composite length, 2g/t Au minimum composite grade, and 2.0 metre maximum interval dilution length. Composite interval represent calculated downhole (true) thickness. “Including” represents >10 g/t Au.